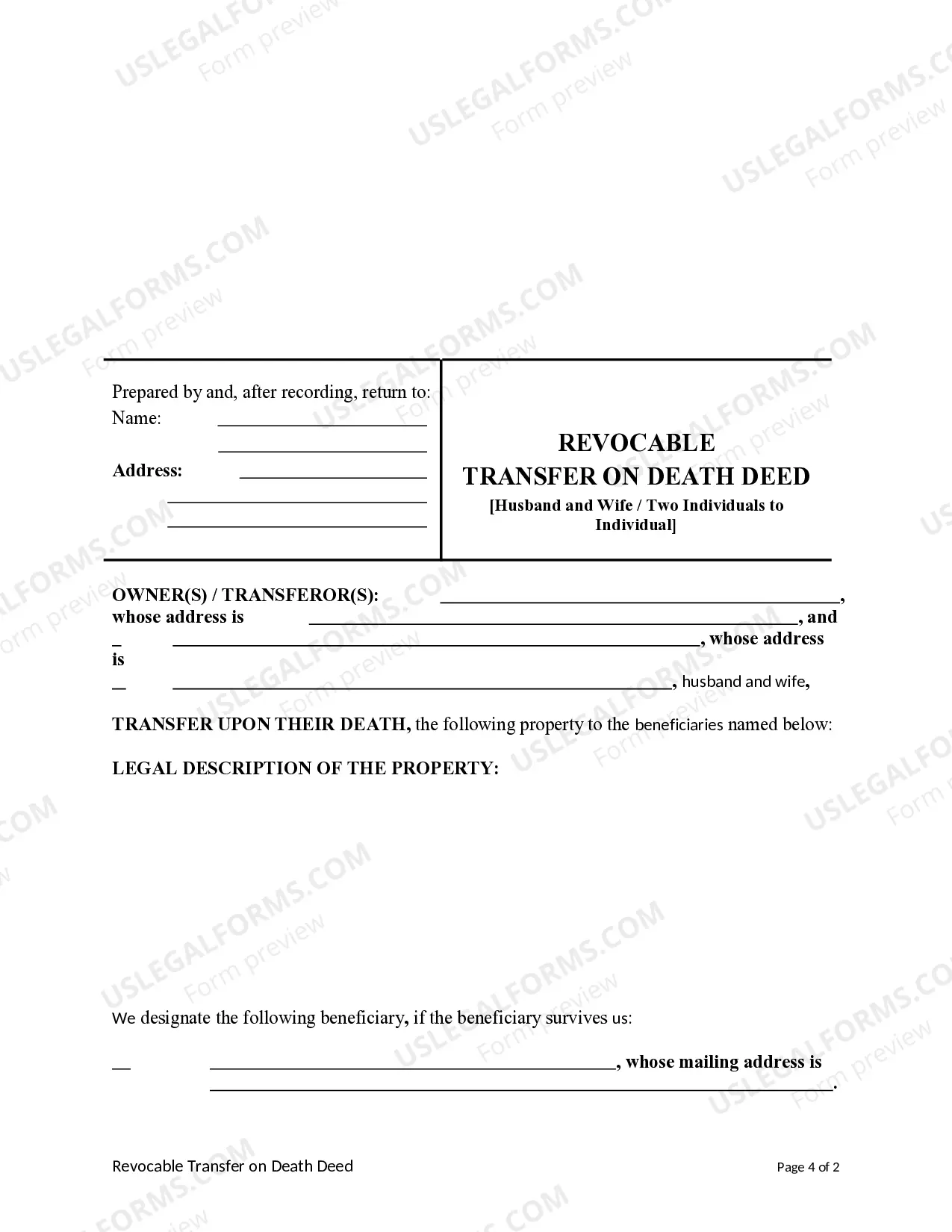

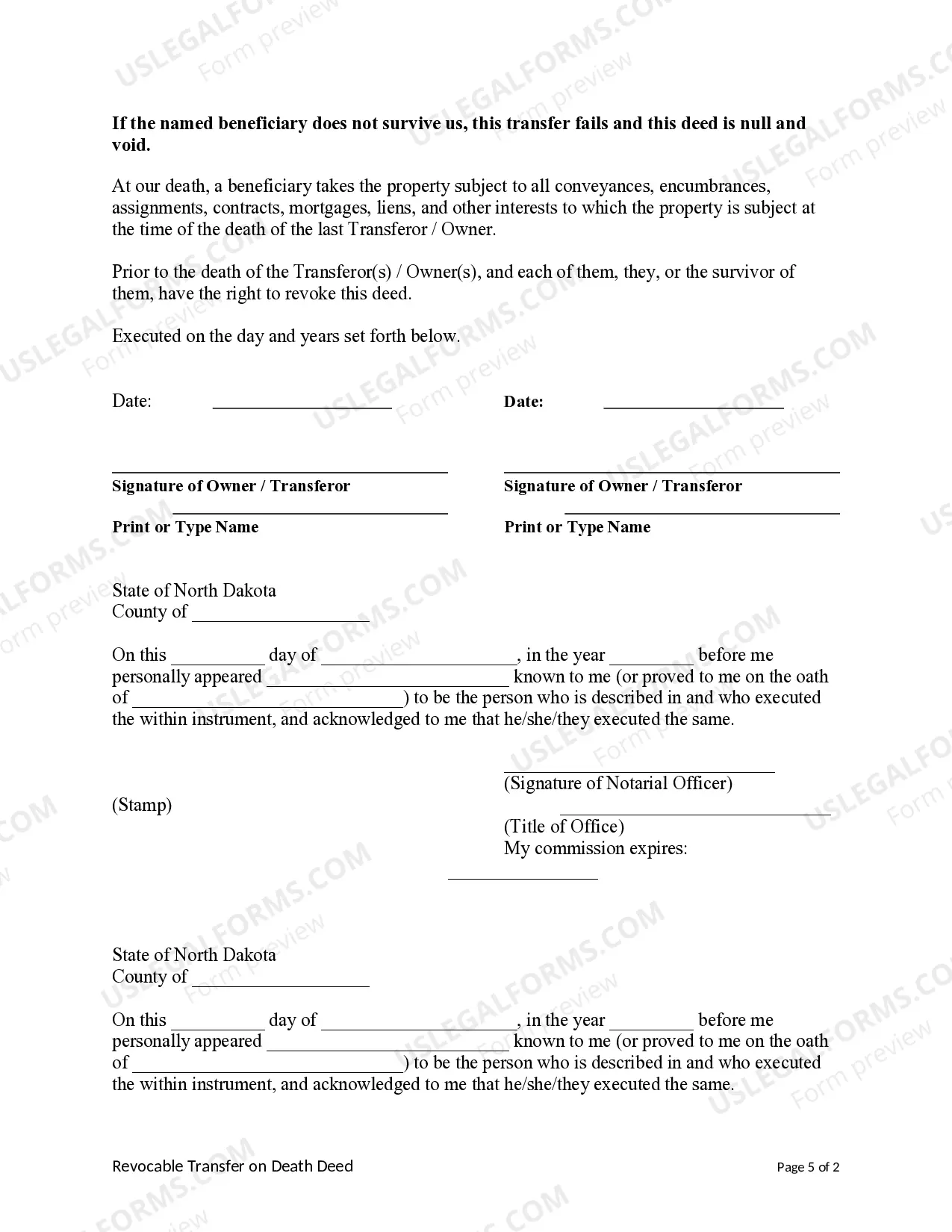

Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual is a legal document that allows property owners in Fargo, North Dakota, to designate a specific individual as the beneficiary of their property upon their death. This type of deed is often used by married couples or two individuals who jointly own property and wish to ensure that it passes to a designated individual without going through the probate process. The Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed offers several benefits for property owners. First, it provides a straightforward mechanism to transfer property rights upon the owner's death, bypassing the need for probate court intervention. This can help to save time, money, and stress for both the property owner and their loved ones. Second, this type of deed grants the property owner complete control over their property during their lifetime. They can continue to use, sell, or mortgage the property as they see fit. The beneficiary named in the deed only gains ownership rights after the owner's death. There are different types of Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual, which include: 1. Fargo North Dakota Joint Transfer on Death Deed for Husband and Wife: This type of deed is specifically designed for married couples who jointly own property in Fargo, North Dakota. It allows both spouses to designate a specific individual as the beneficiary of their share of the property. 2. Fargo North Dakota Individual Transfer on Death Deed for Two Individuals: This deed is suitable for two individuals who jointly own property but are not married. It enables each owner to designate their preferred beneficiary to inherit their respective share of the property. In conclusion, the Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual is a valuable legal instrument that provides property owners with a convenient way to transfer their property to a chosen beneficiary without going through probate. It offers flexibility and control during the owner's lifetime and peace of mind knowing that their property will be passed on to their intended beneficiary.

Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual is a legal document that allows property owners in Fargo, North Dakota, to designate a specific individual as the beneficiary of their property upon their death. This type of deed is often used by married couples or two individuals who jointly own property and wish to ensure that it passes to a designated individual without going through the probate process. The Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed offers several benefits for property owners. First, it provides a straightforward mechanism to transfer property rights upon the owner's death, bypassing the need for probate court intervention. This can help to save time, money, and stress for both the property owner and their loved ones. Second, this type of deed grants the property owner complete control over their property during their lifetime. They can continue to use, sell, or mortgage the property as they see fit. The beneficiary named in the deed only gains ownership rights after the owner's death. There are different types of Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual, which include: 1. Fargo North Dakota Joint Transfer on Death Deed for Husband and Wife: This type of deed is specifically designed for married couples who jointly own property in Fargo, North Dakota. It allows both spouses to designate a specific individual as the beneficiary of their share of the property. 2. Fargo North Dakota Individual Transfer on Death Deed for Two Individuals: This deed is suitable for two individuals who jointly own property but are not married. It enables each owner to designate their preferred beneficiary to inherit their respective share of the property. In conclusion, the Fargo North Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife / Two Individuals to Individual is a valuable legal instrument that provides property owners with a convenient way to transfer their property to a chosen beneficiary without going through probate. It offers flexibility and control during the owner's lifetime and peace of mind knowing that their property will be passed on to their intended beneficiary.