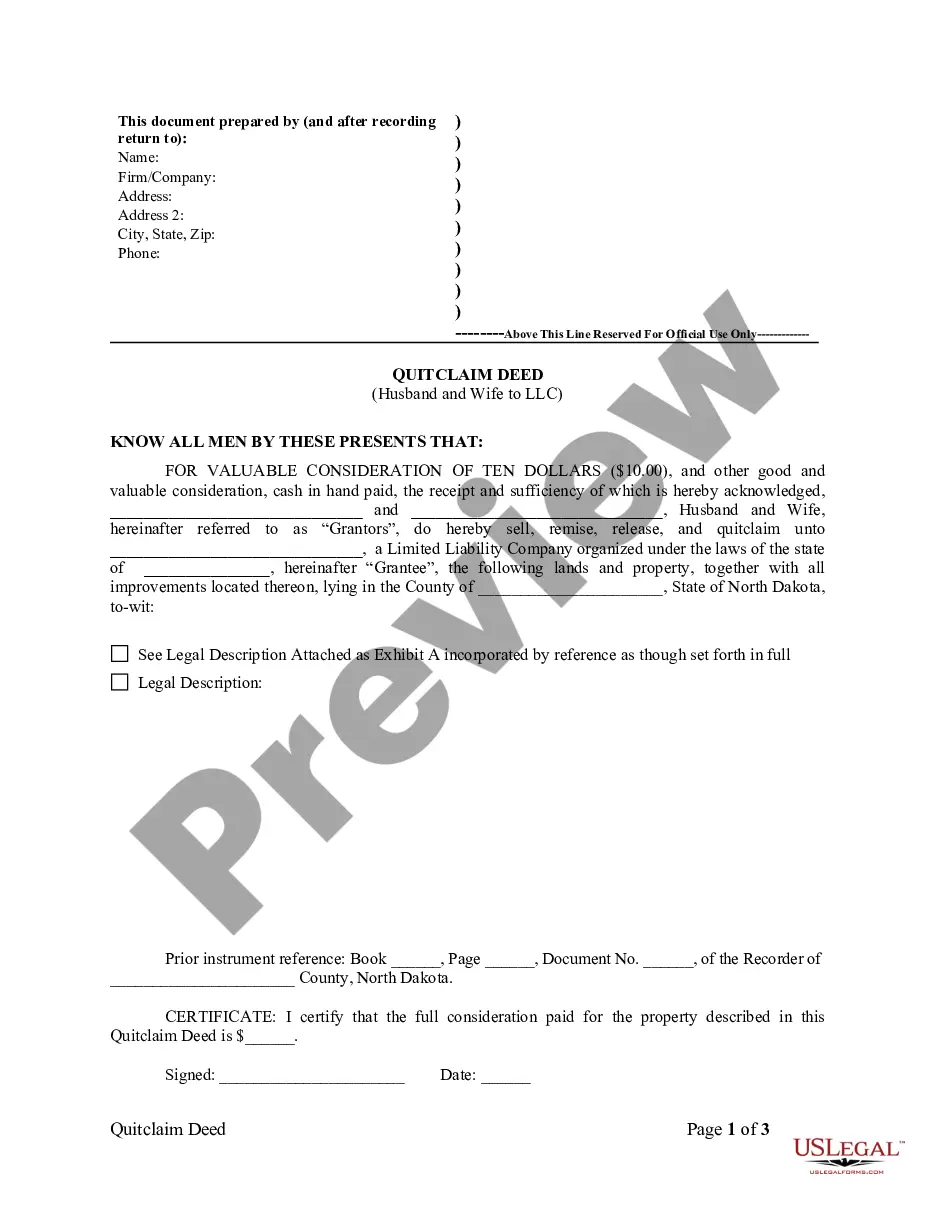

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Fargo North Dakota Quitclaim Deed from Husband and Wife to LLC is a legally binding document that transfers the ownership of a property from a husband and wife to a limited liability company (LLC). This type of deed is commonly used when a couple decides to transfer the ownership of their property to an LLC for various reasons, such as asset protection or business purposes. When drafting a Fargo North Dakota Quitclaim Deed from Husband and Wife to LLC, it is essential to include important details to ensure its validity and accuracy. These details may include the full legal names of the husband and wife, the name of the LLC, a clear legal description of the property being transferred, and the date of the transfer. To make the document more comprehensive, additional information can be included, such as the property's address, parcel number, and any existing encumbrances or liens. Keywords: Fargo North Dakota, Quitclaim Deed, Husband and Wife, LLC, property transfer, legal description, asset protection, business purposes, legal names, property address, parcel number, encumbrances, liens. Different types of Fargo North Dakota Quitclaim Deed from Husband and Wife to LLC may include variations based on the specific circumstances or requirements of the parties involved. Here are a few notable examples: 1. Fargo North Dakota Quitclaim Deed from Husband and Wife to Single-Member LLC: This type of deed involves transferring the property to an LLC with only one owner (a single member), instead of multiple members. 2. Fargo North Dakota Quitclaim Deed from Husband and Wife to Multi-Member LLC: This deed transfers the property to an LLC with multiple owners (multiple members). It may require additional clauses or provisions to address ownership interests and management responsibilities among the members. 3. Fargo North Dakota Quitclaim Deed from Husband and Wife to Family LLC: In some cases, couples may create an LLC specifically for family-owned properties. This type of deed allows for the seamless transfer of ownership within the family while providing liability protection and potential tax benefits. It is important to consult with a qualified real estate attorney or legal professional to ensure that the specific requirements and regulations of Fargo North Dakota are followed when creating and executing a Quitclaim Deed from Husband and Wife to LLC.