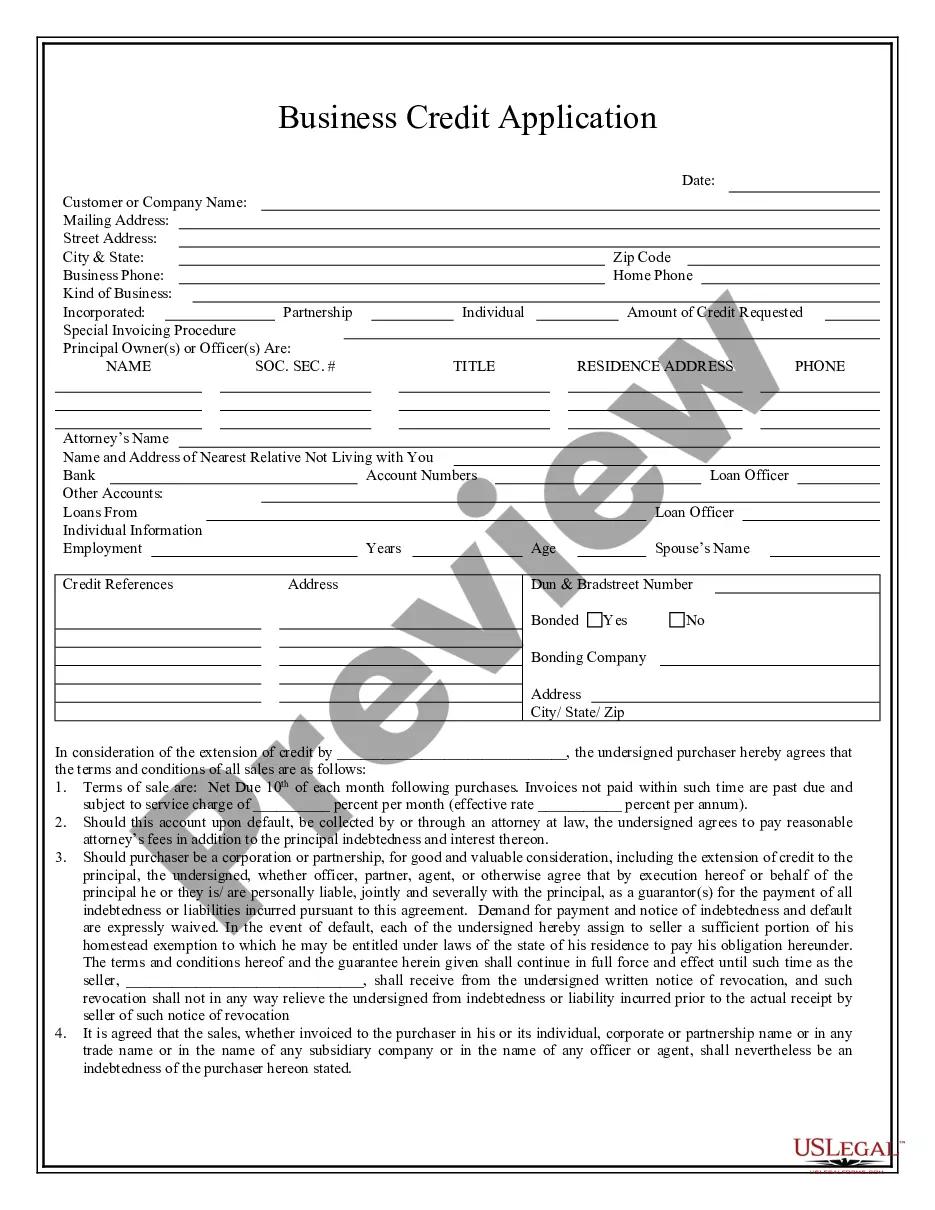

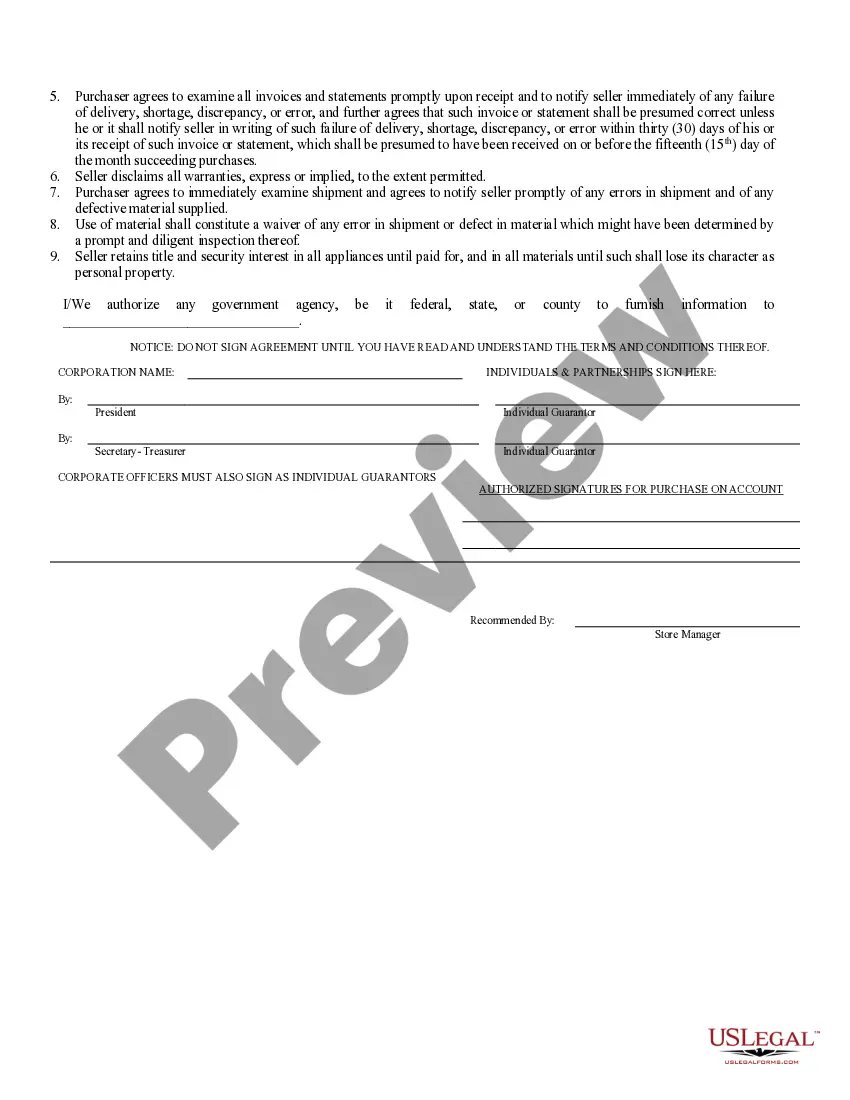

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Fargo North Dakota Business Credit Application is a comprehensive application form that businesses in Fargo, North Dakota can submit to apply for credit from financial institutions and lenders. This application is specifically designed to gather all the necessary information needed for lenders to evaluate the creditworthiness of businesses seeking financial assistance. Keywords: Fargo North Dakota, Business Credit Application, financial institutions, lenders, creditworthiness, businesses, financial assistance. There are a few different types of Fargo North Dakota Business Credit Applications available, each tailored to suit the specific needs of different types of businesses: 1. Small Business Credit Application: This type of credit application is designed for small businesses, including startups and sole proprietorship, seeking credit for their day-to-day operations, such as purchasing inventory or financing equipment. 2. Commercial Credit Application: This type of credit application is suitable for larger businesses, corporations, or partnerships looking for substantial credit for expansion, capital investment, or funding major projects. 3. Vendor Credit Application: Some businesses often require credit from their suppliers or vendors for purchasing goods or services. This application is used specifically for establishing credit terms with vendors. 4. Credit Line Increase Application: If a business already has an existing line of credit with a financial institution but needs to increase the credit limit, this type of application is used. It allows businesses to request an extension of their credit limit based on their changing needs. 5. Joint Credit Application: In some cases, multiple businesses may want to apply for credit jointly. This application gathers information from all the businesses involved to evaluate their combined creditworthiness. Regardless of the type, Fargo North Dakota Business Credit Application generally includes sections requiring essential information such as the business's legal name, physical address, tax identification number, contact information, years in business, annual revenue, number of employees, and financial statements (e.g., income statements, balance sheets). The application may also inquire about the purpose of credit, intended loan amount, desired repayment terms, and any collateral that can be offered. Fargo North Dakota Business Credit Application serves as a critical tool for businesses to access the financial resources needed for growth and development. It enables financial institutions and lenders to assess the creditworthiness of businesses effectively and make informed decisions regarding extending credit.Fargo North Dakota Business Credit Application is a comprehensive application form that businesses in Fargo, North Dakota can submit to apply for credit from financial institutions and lenders. This application is specifically designed to gather all the necessary information needed for lenders to evaluate the creditworthiness of businesses seeking financial assistance. Keywords: Fargo North Dakota, Business Credit Application, financial institutions, lenders, creditworthiness, businesses, financial assistance. There are a few different types of Fargo North Dakota Business Credit Applications available, each tailored to suit the specific needs of different types of businesses: 1. Small Business Credit Application: This type of credit application is designed for small businesses, including startups and sole proprietorship, seeking credit for their day-to-day operations, such as purchasing inventory or financing equipment. 2. Commercial Credit Application: This type of credit application is suitable for larger businesses, corporations, or partnerships looking for substantial credit for expansion, capital investment, or funding major projects. 3. Vendor Credit Application: Some businesses often require credit from their suppliers or vendors for purchasing goods or services. This application is used specifically for establishing credit terms with vendors. 4. Credit Line Increase Application: If a business already has an existing line of credit with a financial institution but needs to increase the credit limit, this type of application is used. It allows businesses to request an extension of their credit limit based on their changing needs. 5. Joint Credit Application: In some cases, multiple businesses may want to apply for credit jointly. This application gathers information from all the businesses involved to evaluate their combined creditworthiness. Regardless of the type, Fargo North Dakota Business Credit Application generally includes sections requiring essential information such as the business's legal name, physical address, tax identification number, contact information, years in business, annual revenue, number of employees, and financial statements (e.g., income statements, balance sheets). The application may also inquire about the purpose of credit, intended loan amount, desired repayment terms, and any collateral that can be offered. Fargo North Dakota Business Credit Application serves as a critical tool for businesses to access the financial resources needed for growth and development. It enables financial institutions and lenders to assess the creditworthiness of businesses effectively and make informed decisions regarding extending credit.