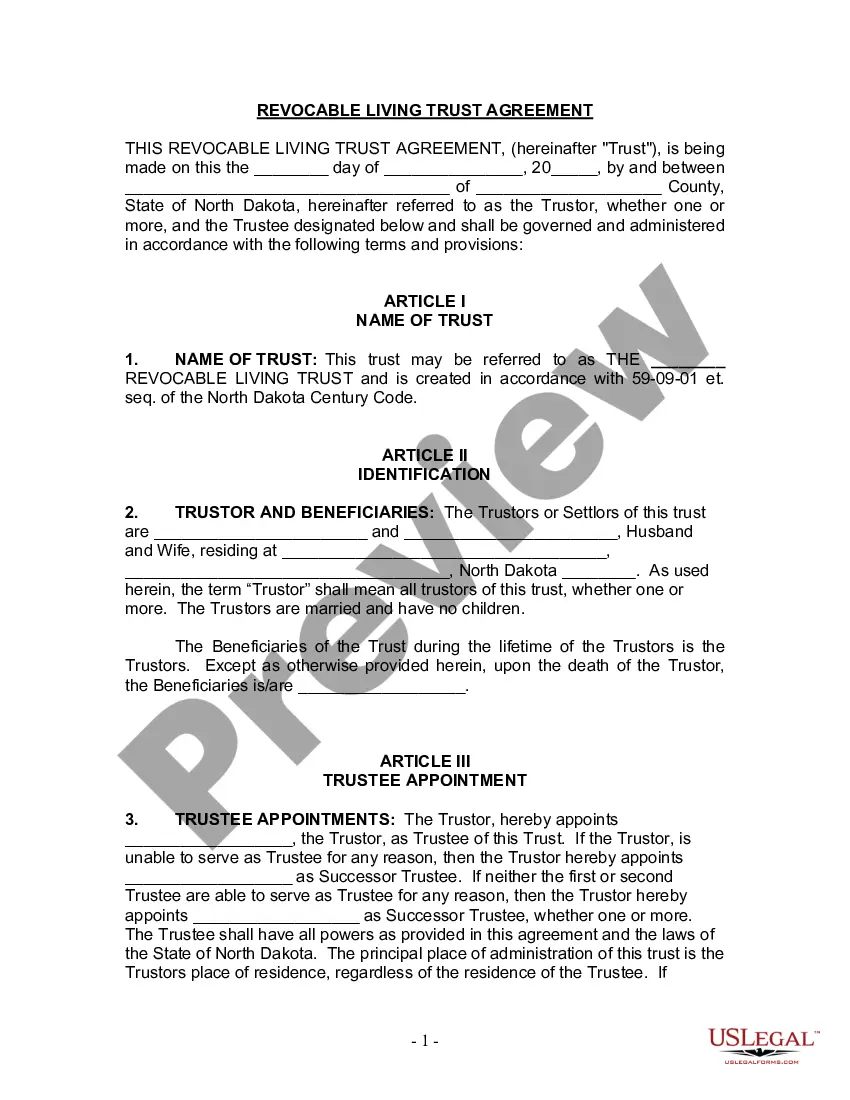

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fargo North Dakota Living Trust for Husband and Wife with No Children: A Comprehensive Guide In Fargo, North Dakota, a living trust is a legal document that allows a husband and wife with no children to protect and manage their assets during their lifetime and ensures smooth asset distribution upon their passing. This type of trust offers various benefits, including privacy, flexibility, and the avoidance of probate. 1. Revocable Living Trust: A revocable living trust in Fargo, North Dakota, is the most common type of living trust for married couples without children. It allows the couple to maintain control over their assets and make changes or revoke the trust at any time. 2. Irrevocable Living Trust: An irrevocable living trust, although less common, offers distinct advantages. This type of trust cannot be modified or terminated without the consent of both the husband and wife. It provides additional protection against creditors and may offer tax benefits. 3. Joint Living Trust: A joint living trust is specifically designed for married couples. It combines the assets of both spouses into a single trust, allowing them to manage their assets together during their lifetime. This type of trust ensures efficient asset distribution upon the death of the first spouse and offers easier management of assets for the surviving spouse. 4. Testamentary Trust: While not solely designated for married couples, a testamentary trust can be included in their living trust plan. This trust is created within a will and becomes effective only upon the death of the person establishing it. It allows the surviving spouse to manage and distribute the assets according to their wishes. Creating a Fargo North Dakota Living Trust for Husband and Wife with No Children involves several key steps. First, the couple needs to determine their goals and the assets they wish to place in the trust. They should seek professional guidance from an experienced estate planning attorney to ensure they follow all legal requirements and maximize the benefits of the living trust. Once the assets are identified, the couple should appoint a trustee who will manage and distribute the trust's assets according to their instructions. It is crucial to name successor trustees who will take over the responsibility if the initial trustee becomes incapacitated or passes away. During the couple's lifetime, they can modify or revoke their living trust as circumstances change. They retain complete control of the assets placed in the trust and can use them for their benefit. Upon the death of the first spouse, the living trust ensures that the surviving spouse retains control and can access the assets without the need for probate court involvement. This guarantees a smoother transition and may help avoid potential conflicts. In conclusion, a Fargo North Dakota Living Trust for Husband and Wife with No Children provides married couples with a secure and efficient way to manage and protect their assets. It offers benefits such as privacy, flexibility, and avoiding probate. By consulting with an estate planning attorney, couples can create a customized living trust plan that best fits their needs and goals, ensuring their wishes are fulfilled for generations to come.Fargo North Dakota Living Trust for Husband and Wife with No Children: A Comprehensive Guide In Fargo, North Dakota, a living trust is a legal document that allows a husband and wife with no children to protect and manage their assets during their lifetime and ensures smooth asset distribution upon their passing. This type of trust offers various benefits, including privacy, flexibility, and the avoidance of probate. 1. Revocable Living Trust: A revocable living trust in Fargo, North Dakota, is the most common type of living trust for married couples without children. It allows the couple to maintain control over their assets and make changes or revoke the trust at any time. 2. Irrevocable Living Trust: An irrevocable living trust, although less common, offers distinct advantages. This type of trust cannot be modified or terminated without the consent of both the husband and wife. It provides additional protection against creditors and may offer tax benefits. 3. Joint Living Trust: A joint living trust is specifically designed for married couples. It combines the assets of both spouses into a single trust, allowing them to manage their assets together during their lifetime. This type of trust ensures efficient asset distribution upon the death of the first spouse and offers easier management of assets for the surviving spouse. 4. Testamentary Trust: While not solely designated for married couples, a testamentary trust can be included in their living trust plan. This trust is created within a will and becomes effective only upon the death of the person establishing it. It allows the surviving spouse to manage and distribute the assets according to their wishes. Creating a Fargo North Dakota Living Trust for Husband and Wife with No Children involves several key steps. First, the couple needs to determine their goals and the assets they wish to place in the trust. They should seek professional guidance from an experienced estate planning attorney to ensure they follow all legal requirements and maximize the benefits of the living trust. Once the assets are identified, the couple should appoint a trustee who will manage and distribute the trust's assets according to their instructions. It is crucial to name successor trustees who will take over the responsibility if the initial trustee becomes incapacitated or passes away. During the couple's lifetime, they can modify or revoke their living trust as circumstances change. They retain complete control of the assets placed in the trust and can use them for their benefit. Upon the death of the first spouse, the living trust ensures that the surviving spouse retains control and can access the assets without the need for probate court involvement. This guarantees a smoother transition and may help avoid potential conflicts. In conclusion, a Fargo North Dakota Living Trust for Husband and Wife with No Children provides married couples with a secure and efficient way to manage and protect their assets. It offers benefits such as privacy, flexibility, and avoiding probate. By consulting with an estate planning attorney, couples can create a customized living trust plan that best fits their needs and goals, ensuring their wishes are fulfilled for generations to come.