Title: Fargo North Dakota Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: Creating a Living Trust in Fargo, North Dakota, is a wise decision for couples with one child who want to protect and distribute their assets according to their wishes. A Living Trust offers numerous benefits such as avoiding probate, minimizing estate taxes, and providing directives for asset management during incapacity. This article will outline the various types of Living Trusts available for couples with one child in Fargo, North Dakota, highlighting their key features and advantages. 1. Revocable Living Trust: A revocable living trust is the most common type of trust for spouses with one child in Fargo, North Dakota. It allows the couple (as the granters) to retain control over their assets during their lifetime while providing flexibility to make changes or amendments as needed. In the event of incapacity or death, a successor trustee, usually a trusted family member or friend, manages the trust assets for the benefit of the surviving spouse and child. 2. Testamentary Living Trust: A testamentary living trust is established through a will. It becomes effective upon the death of the first spouse, leaving specific instructions on how the assets should be managed and distributed for the surviving spouse's benefit and, ultimately, for the child. This type of trust ensures that the surviving spouse maintains financial security while preserving assets for the child's future. 3. Irrevocable Living Trust: An irrevocable living trust is designed to take assets out of the granter's estate for tax planning purposes. Once created, the trust cannot be modified or revoked without the consent of all beneficiaries. By transferring assets to an irrevocable trust, spouses can reduce their taxable estate and potentially minimize estate taxes upon their passing, benefiting the surviving spouse and child. Key Elements of Fargo North Dakota Living Trusts: a. Asset Protection: Fargo North Dakota Living Trusts offer safeguards against creditors and potential legal claims, ensuring that the assets are protected for the beneficiaries, including the surviving spouse and the child. b. Minimize Probate: Living Trusts bypass probate, saving time, money, and maintaining privacy. This allows for the efficient transfer of assets to the spouse and child without court interference. c. Incapacity Planning: Living Trusts contain provisions for managing the assets and providing for the family in the event of the granters' incapacity, sparing loved ones from the burden of expensive and time-consuming guardianship proceedings. d. Preservation of Government Benefits: Properly structured Living Trusts can help preserve eligibility for government assistance programs by providing a framework to distribute assets without affecting the child's eligibility for benefits like Medicaid. Conclusion: Fargo North Dakota Living Trusts for Husband and Wife with One Child provide a comprehensive estate planning tool that ensures the preservation and efficient distribution of assets for the benefit of the surviving spouse and child. Whether choosing a revocable, testamentary, or irrevocable trust, consulting an experienced estate planning attorney in Fargo is essential to tailor the trust to meet individual needs and objectives. Take the proactive step today to secure your family's financial future by establishing a Living Trust.

Fargo North Dakota Living Trust for Husband and Wife with One Child

Category:

State:

North Dakota

City:

Fargo

Control #:

ND-E0177

Format:

Word;

Rich Text

Instant download

Description

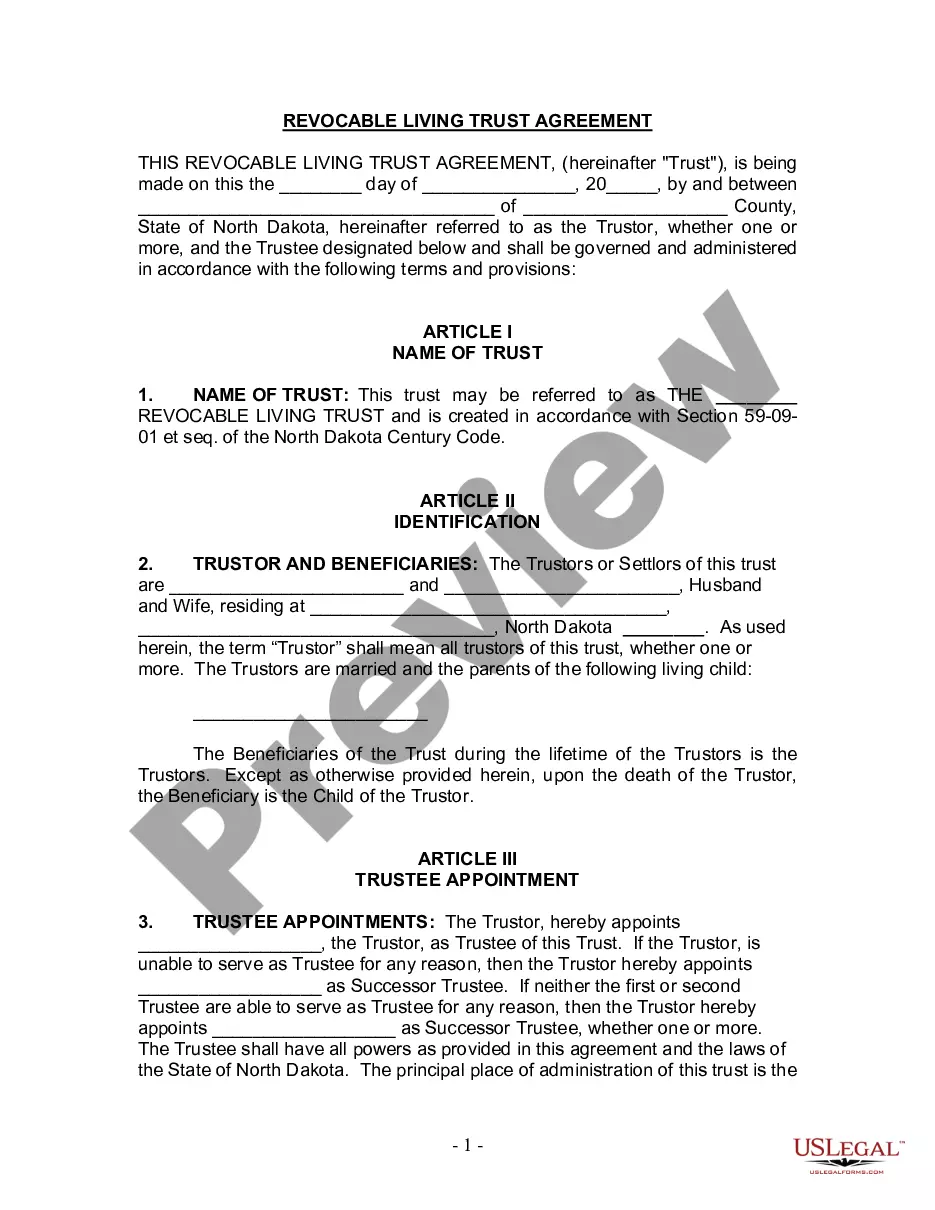

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: Fargo North Dakota Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: Creating a Living Trust in Fargo, North Dakota, is a wise decision for couples with one child who want to protect and distribute their assets according to their wishes. A Living Trust offers numerous benefits such as avoiding probate, minimizing estate taxes, and providing directives for asset management during incapacity. This article will outline the various types of Living Trusts available for couples with one child in Fargo, North Dakota, highlighting their key features and advantages. 1. Revocable Living Trust: A revocable living trust is the most common type of trust for spouses with one child in Fargo, North Dakota. It allows the couple (as the granters) to retain control over their assets during their lifetime while providing flexibility to make changes or amendments as needed. In the event of incapacity or death, a successor trustee, usually a trusted family member or friend, manages the trust assets for the benefit of the surviving spouse and child. 2. Testamentary Living Trust: A testamentary living trust is established through a will. It becomes effective upon the death of the first spouse, leaving specific instructions on how the assets should be managed and distributed for the surviving spouse's benefit and, ultimately, for the child. This type of trust ensures that the surviving spouse maintains financial security while preserving assets for the child's future. 3. Irrevocable Living Trust: An irrevocable living trust is designed to take assets out of the granter's estate for tax planning purposes. Once created, the trust cannot be modified or revoked without the consent of all beneficiaries. By transferring assets to an irrevocable trust, spouses can reduce their taxable estate and potentially minimize estate taxes upon their passing, benefiting the surviving spouse and child. Key Elements of Fargo North Dakota Living Trusts: a. Asset Protection: Fargo North Dakota Living Trusts offer safeguards against creditors and potential legal claims, ensuring that the assets are protected for the beneficiaries, including the surviving spouse and the child. b. Minimize Probate: Living Trusts bypass probate, saving time, money, and maintaining privacy. This allows for the efficient transfer of assets to the spouse and child without court interference. c. Incapacity Planning: Living Trusts contain provisions for managing the assets and providing for the family in the event of the granters' incapacity, sparing loved ones from the burden of expensive and time-consuming guardianship proceedings. d. Preservation of Government Benefits: Properly structured Living Trusts can help preserve eligibility for government assistance programs by providing a framework to distribute assets without affecting the child's eligibility for benefits like Medicaid. Conclusion: Fargo North Dakota Living Trusts for Husband and Wife with One Child provide a comprehensive estate planning tool that ensures the preservation and efficient distribution of assets for the benefit of the surviving spouse and child. Whether choosing a revocable, testamentary, or irrevocable trust, consulting an experienced estate planning attorney in Fargo is essential to tailor the trust to meet individual needs and objectives. Take the proactive step today to secure your family's financial future by establishing a Living Trust.

Free preview

How to fill out Fargo North Dakota Living Trust For Husband And Wife With One Child?

If you’ve already utilized our service before, log in to your account and save the Fargo North Dakota Living Trust for Husband and Wife with One Child on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Fargo North Dakota Living Trust for Husband and Wife with One Child. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!