Fargo North Dakota Financial Account Transfer to Living Trust: A Comprehensive Guide If you are a resident of Fargo, North Dakota, and looking to secure your financial assets for the future, considering a financial account transfer to a living trust can be a wise decision. In this detailed description, we will explore the various aspects of this process, including its benefits, requirements, and different types available to residents of Fargo, North Dakota. Key Terms: Fargo, North Dakota financial account transfer, living trust, estate planning, assets, beneficiaries, probate, trustee, revocable living trust, irrevocable living trust, testamentary trust. Overview: A financial account transfer to a living trust essentially involves transferring ownership of your financial accounts from individual ownership to the name of your living trust. By doing so, you create a legal mechanism to manage and distribute your assets in accordance with your wishes, even after your passing. It serves as a part of comprehensive estate planning. Benefits of Financial Account Transfer to Living Trust in Fargo, North Dakota: 1. Avoiding Probate: One of the main benefits of transferring your financial accounts to a living trust is to bypass the potentially lengthy and expensive probate process. This allows for a smoother transfer of assets to your beneficiaries upon your passing. 2. Privacy and Control: Choosing a living trust allows you to maintain privacy over your financial matters and exercise greater control over the distribution of your assets. Unlike a will, a living trust does not become public record, ensuring your financial affairs remain confidential. 3. Incapacity Planning: A living trust offers an effective way to plan for the possibility of incapacity. By appointing a successor trustee to manage your financial affairs in the event you become unable to do so, you can ensure your assets are in trusted hands. Types of Fargo North Dakota Financial Account Transfers to Living Trust: 1. Revocable Living Trust: This type of living trust allows you to retain control over your assets during your lifetime. You have the flexibility to make changes, amendments, or even revoke the trust completely if your circumstances or wishes change. 2. Irrevocable Living Trust: An irrevocable living trust, once established, cannot be altered or revoked. It offers added protection against potential creditors and can be an effective tool for tax planning or asset protection purposes. 3. Testamentary Trust: While not a living trust in the traditional sense, a testamentary trust is established through a will and comes into effect after the testator's passing. Financial accounts can be transferred to this trust upon the completion of probate. In conclusion, a financial account transfer to a living trust in Fargo, North Dakota, provides numerous benefits such as probate avoidance, increased control, privacy, and incapacity planning. Residents have the option to choose between revocable living trusts, irrevocable living trusts, or testamentary trusts based on their specific needs and goals. Seeking guidance from a qualified estate planning attorney is essential to ensure a smooth and legally sound transfer of your financial accounts to a living trust.

Fargo North Dakota Financial Account Transfer to Living Trust

Description

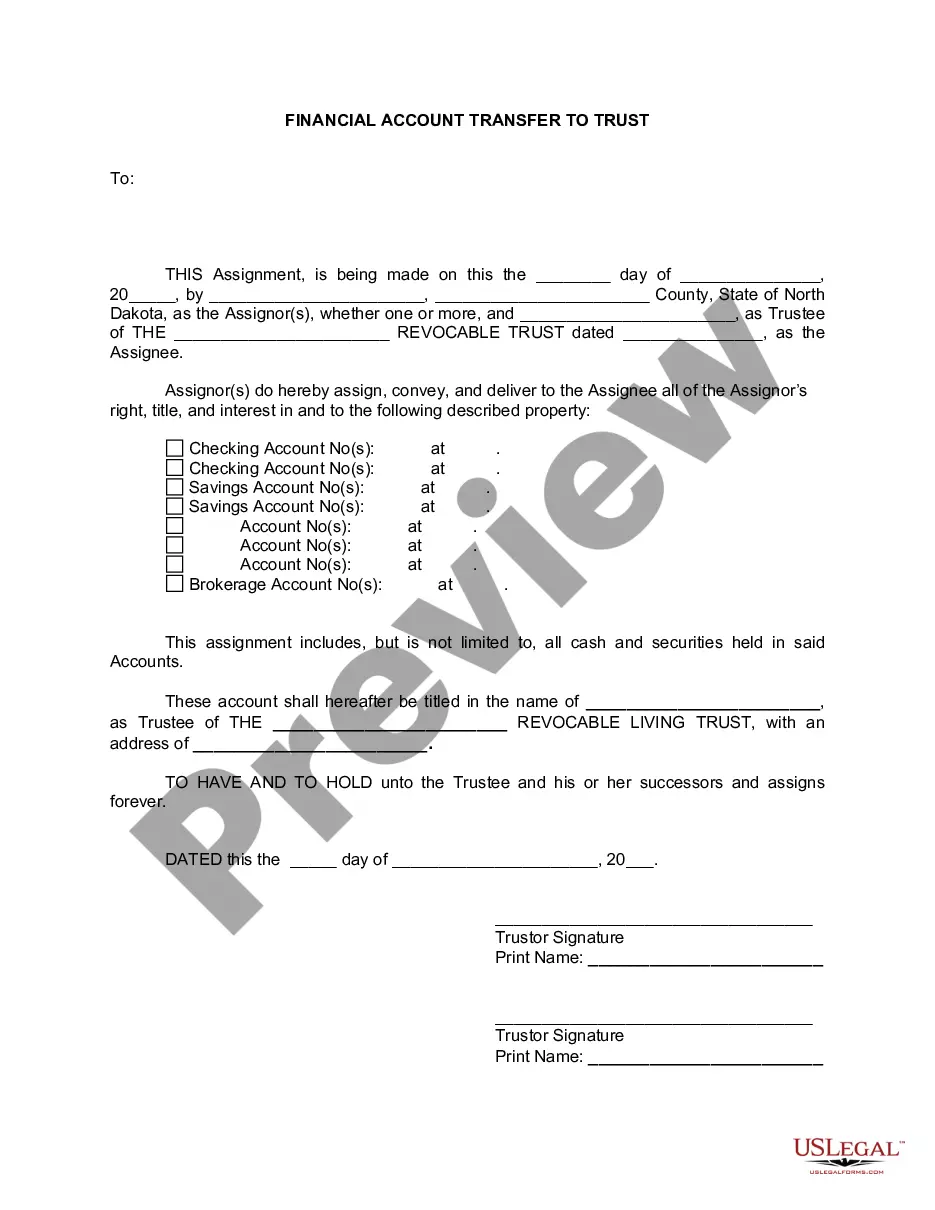

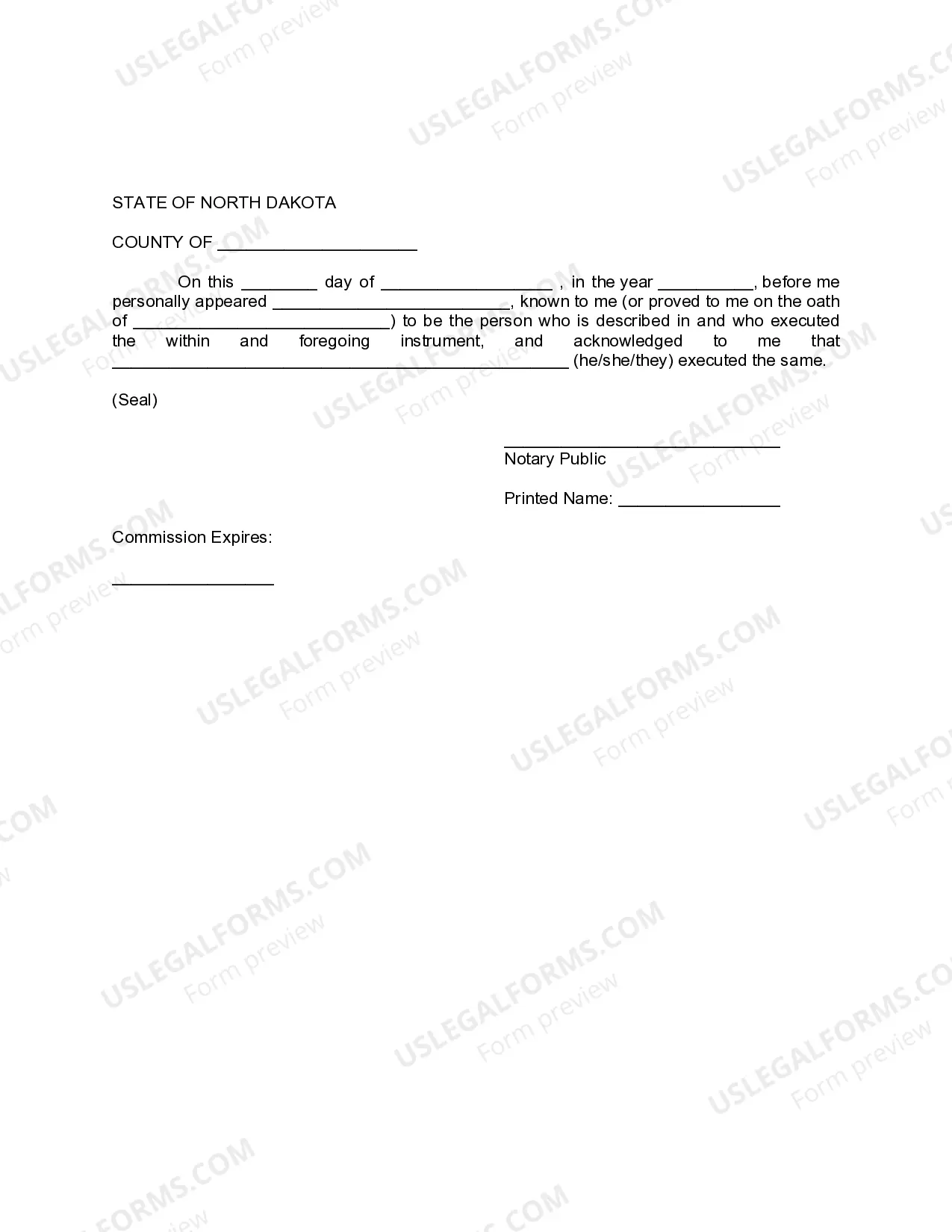

How to fill out Fargo North Dakota Financial Account Transfer To Living Trust?

If you are searching for a valid form, it’s extremely hard to find a better platform than the US Legal Forms site – one of the most comprehensive online libraries. With this library, you can find a huge number of form samples for organization and individual purposes by categories and regions, or key phrases. With the high-quality search feature, getting the newest Fargo North Dakota Financial Account Transfer to Living Trust is as elementary as 1-2-3. Additionally, the relevance of each and every file is verified by a team of skilled attorneys that on a regular basis check the templates on our website and revise them according to the newest state and county requirements.

If you already know about our platform and have an account, all you need to get the Fargo North Dakota Financial Account Transfer to Living Trust is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the sample you require. Look at its explanation and make use of the Preview function to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the appropriate document.

- Affirm your selection. Choose the Buy now button. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Pick the file format and download it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Fargo North Dakota Financial Account Transfer to Living Trust.

Every single form you add to your account does not have an expiry date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to have an extra duplicate for enhancing or printing, you may come back and export it again whenever you want.

Make use of the US Legal Forms professional library to get access to the Fargo North Dakota Financial Account Transfer to Living Trust you were seeking and a huge number of other professional and state-specific templates in a single place!