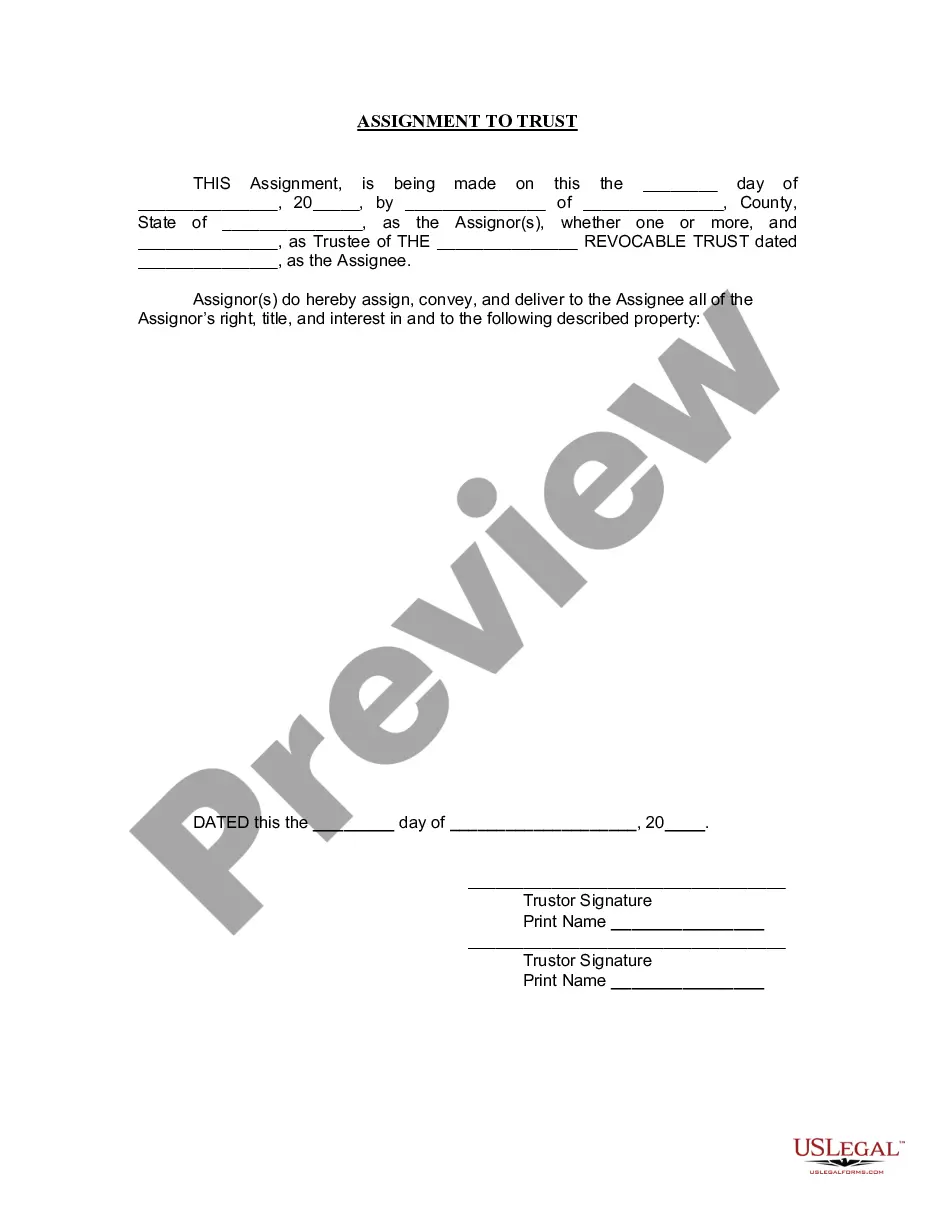

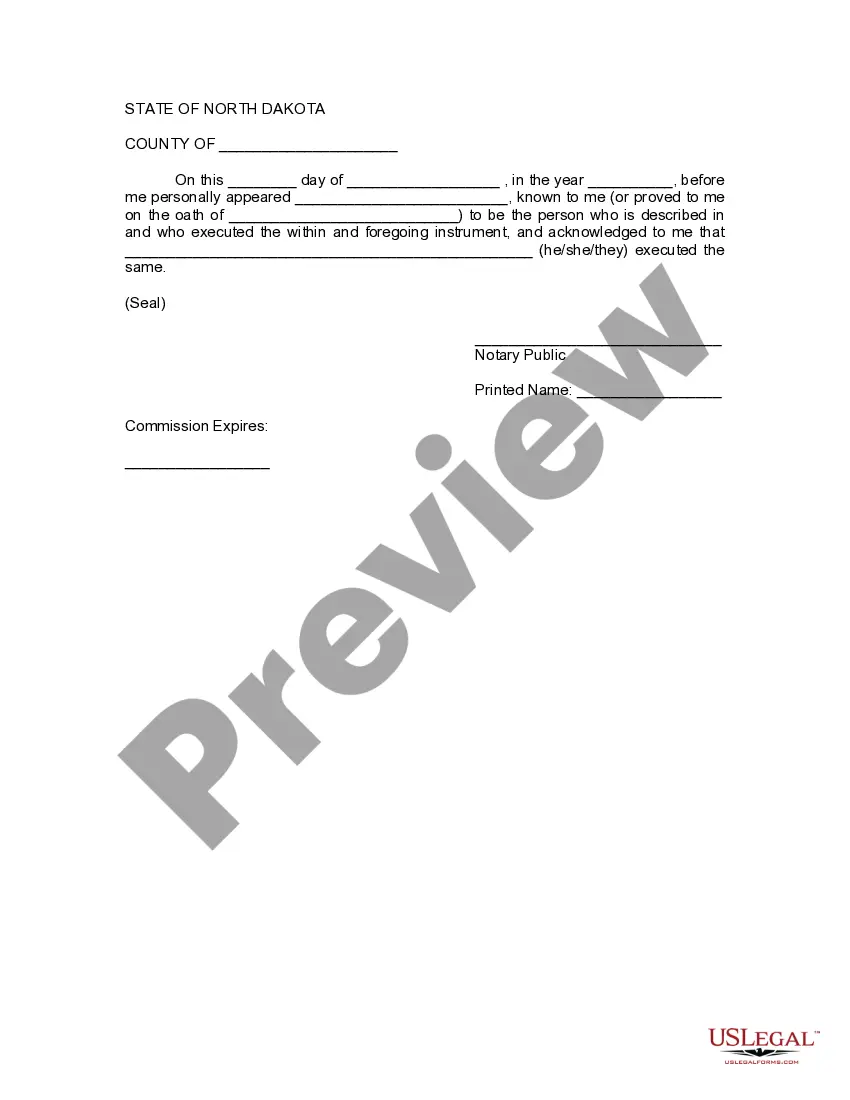

Fargo North Dakota Assignment to Living Trust is a legal document that transfers ownership of property and assets in Fargo, North Dakota to a trust. This assignment ensures that the property will be managed and distributed according to the wishes of the granter while avoiding the need for probate. In Fargo, North Dakota, there are primarily two types of living trusts: revocable living trusts and irrevocable living trusts. 1. Revocable Living Trust: This type of living trust allows the granter to retain full control over the assets and property assigned to the trust during their lifetime. They have the power to modify, amend, or terminate the trust as per their wishes. In case of the granter's incapacitation or death, a successor trustee takes over the management and distribution of the assets, avoiding probate court proceedings. 2. Irrevocable Living Trust: Unlike the revocable living trust, an irrevocable living trust cannot be altered or terminated once established, except under limited circumstances. This type of trust provides additional asset protection and may offer tax advantages, but it requires the granter to relinquish control and ownership of the assigned property. In Fargo, North Dakota, irrevocable living trusts are often used for Medicaid planning and estate tax planning. The Fargo North Dakota Assignment to Living Trust process involves several steps. First, the granter, who is the person creating the trust, must draft a detailed trust agreement outlining their intentions including the trust assets, beneficiaries, and appointed trustee(s). The granter then assigns ownership of the selected property and assets to the trust according to the agreement. The assignment must be recorded with the appropriate government agency in Fargo, North Dakota, such as the county recorder's office. Once the assignment is completed, the trustee assumes responsibility for managing the trust assets and distributing them to the specified beneficiaries at the appropriate time. Assigning assets to a living trust in Fargo, North Dakota can provide several benefits. It allows for privacy as the assignment remains confidential, unlike the public probate process. Additionally, it helps to avoid the cost and delays associated with probate court proceedings. Living trusts also provide flexibility for the granter to plan for incapacity and ensure the smooth transfer of assets to beneficiaries after their passing. It's important to consult with an experienced estate planning attorney in Fargo, North Dakota when considering an assignment to a living trust. They can provide personalized guidance based on individual circumstances and assist in creating a comprehensive estate plan.

Fargo North Dakota Assignment to Living Trust

Description

How to fill out Fargo North Dakota Assignment To Living Trust?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Fargo North Dakota Assignment to Living Trust gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Fargo North Dakota Assignment to Living Trust takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Fargo North Dakota Assignment to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!