Fargo North Dakota Notice of Assignment to Living Trust

Description

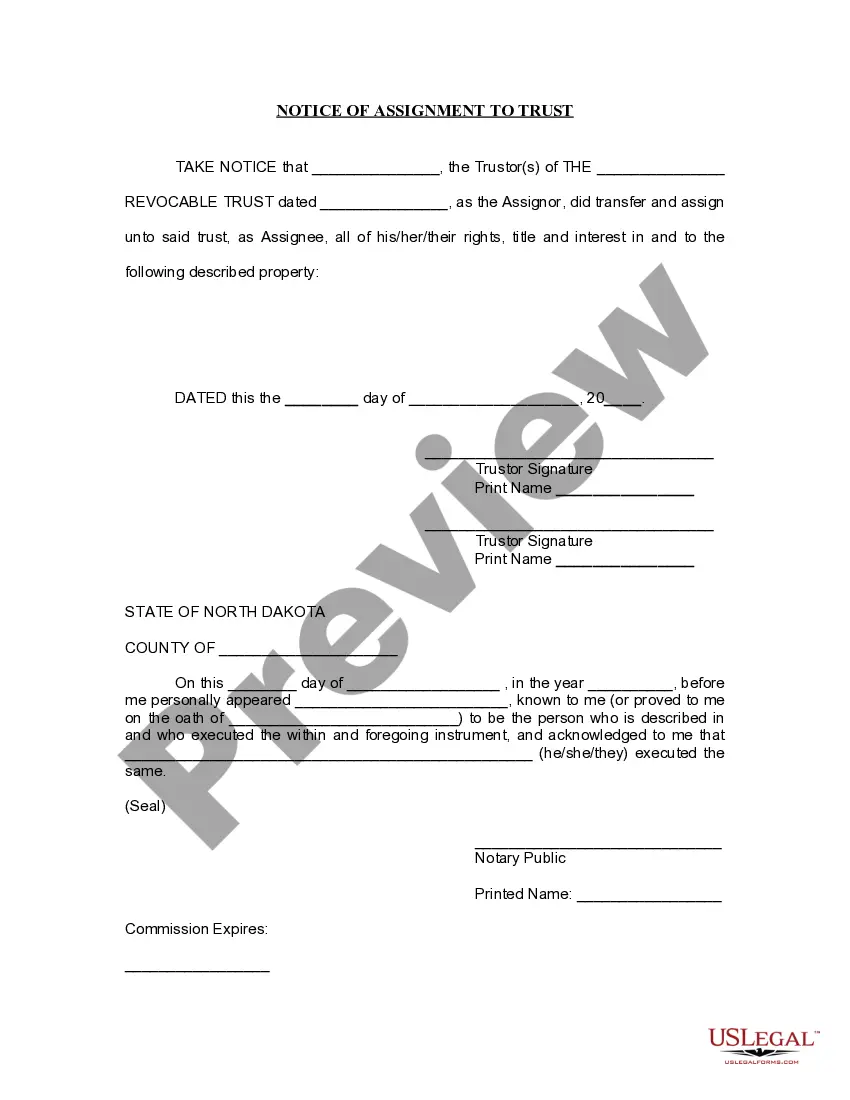

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out North Dakota Notice Of Assignment To Living Trust?

Irrespective of societal or occupational rank, filling out legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for an individual lacking legal knowledge to draft such documents from scratch, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms proves useful.

Ensure the document you have located is appropriate for your region as the laws of one state do not apply to another.

Examine the document and review a brief overview (if available) of the scenarios the paper may be utilized for.

- Our service offers a vast assortment of over 85,000 ready-to-use state-specific documents suitable for nearly every legal scenario.

- US Legal Forms also acts as an excellent tool for associates or legal advisors looking to conserve time by utilizing our DIY forms.

- Whether you require the Fargo North Dakota Notice of Assignment to Living Trust or any other document applicable in your region, with US Legal Forms, all is readily available.

- Here’s how you can obtain the Fargo North Dakota Notice of Assignment to Living Trust in moments using our reliable service.

- If you are currently a member, you can simply Log In to your account to download the desired document.

- However, if you are new to our platform, make sure to follow these instructions before acquiring the Fargo North Dakota Notice of Assignment to Living Trust.

Form popularity

FAQ

Yes, putting bank accounts in a living trust can streamline estate planning and avoid probate. When you include your bank accounts in a living trust, it allows for more straightforward management and transfer of assets upon your passing. This step is crucial for those creating a Fargo North Dakota Notice of Assignment to Living Trust, as it ensures your financial wishes are honored without delay. Leverage tools and resources from USLegalForms to help you navigate this process seamlessly.

To place your bank account in a living trust, first, you need to establish the trust, which will involve drafting a trust document. Next, you will update the title of your bank account to reflect the name of the trust. This process typically requires providing your bank with the trust document to verify the trust's existence. By following these steps, you ensure your bank account is included in your Fargo North Dakota Notice of Assignment to Living Trust.

To transfer your checking account to your living trust, begin by establishing a living trust if you haven't already done so. Next, contact your bank to request their specific requirements for this transfer. Typically, you will need to provide documentation of your living trust, including the Fargo North Dakota Notice of Assignment to Living Trust. Once the bank processes your request, your checking account will be managed by the trust, ensuring your assets are protected and distributed according to your wishes.

A living trust's downside includes the initial expense and effort required to create and fund the trust properly. It may also require ongoing management, which some individuals may find burdensome over time. Additionally, a living trust does not provide asset protection from creditors in the same way as some other structures can. Understanding these limitations, especially through the Fargo North Dakota Notice of Assignment to Living Trust, may help you decide the best route for your estate plan.

An assignment to a trust is the transfer of property or assets into the trust's ownership, making them part of the trust estate. This process allows a trustee to manage and distribute the assets according to the terms outlined in the trust document. By following the Fargo North Dakota Notice of Assignment to Living Trust, you can ensure that your assets are properly assigned and will be handled as you intend. Using USLegalForms can simplify this assignment process.

One downside of having a trust is the complexity of setup and management, which can be overwhelming for some individuals. Additionally, certain types of trusts may have associated costs, including legal fees and ongoing maintenance. However, understanding these aspects through informed resources, such as the Fargo North Dakota Notice of Assignment to Living Trust, can ease these concerns. Evaluate whether a trust aligns with your long-term goals.

In North Dakota, a trust must comply with state laws that ensure its validity. A trust requires a trustee, a definite beneficiary, and identifiable trust property. Furthermore, for a living trust to be valid, it should follow the guidelines stipulated in the Fargo North Dakota Notice of Assignment to Living Trust. Consulting resources from USLegalForms can help clarify these requirements.

To set up a trust in North Dakota, start by deciding what type of trust you need. You can create a living trust or other forms depending on your goals. Next, you can use the services provided by platforms like USLegalForms, which offer templates and guidance specific to the Fargo North Dakota Notice of Assignment to Living Trust. Finally, fund your trust with assets to make it effective.

Deciding whether to put assets into a trust is a significant choice. Trusts can protect assets, facilitate estate planning, and provide for beneficiaries without the need for probate. However, your parents should carefully consider their unique situation and financial goals. Engaging with resources like the Fargo North Dakota Notice of Assignment to Living Trust can help them make an informed decision.

One noted downfall of having a trust is the potential for increased costs and complexities. Establishing and maintaining a trust usually involves legal fees, management tasks, and possibly taxes on the assets held within it. Additionally, trusts require thorough documentation and precise administration, which can be overwhelming for some individuals. Therefore, understanding the Fargo North Dakota Notice of Assignment to Living Trust is crucial to mitigate these issues.