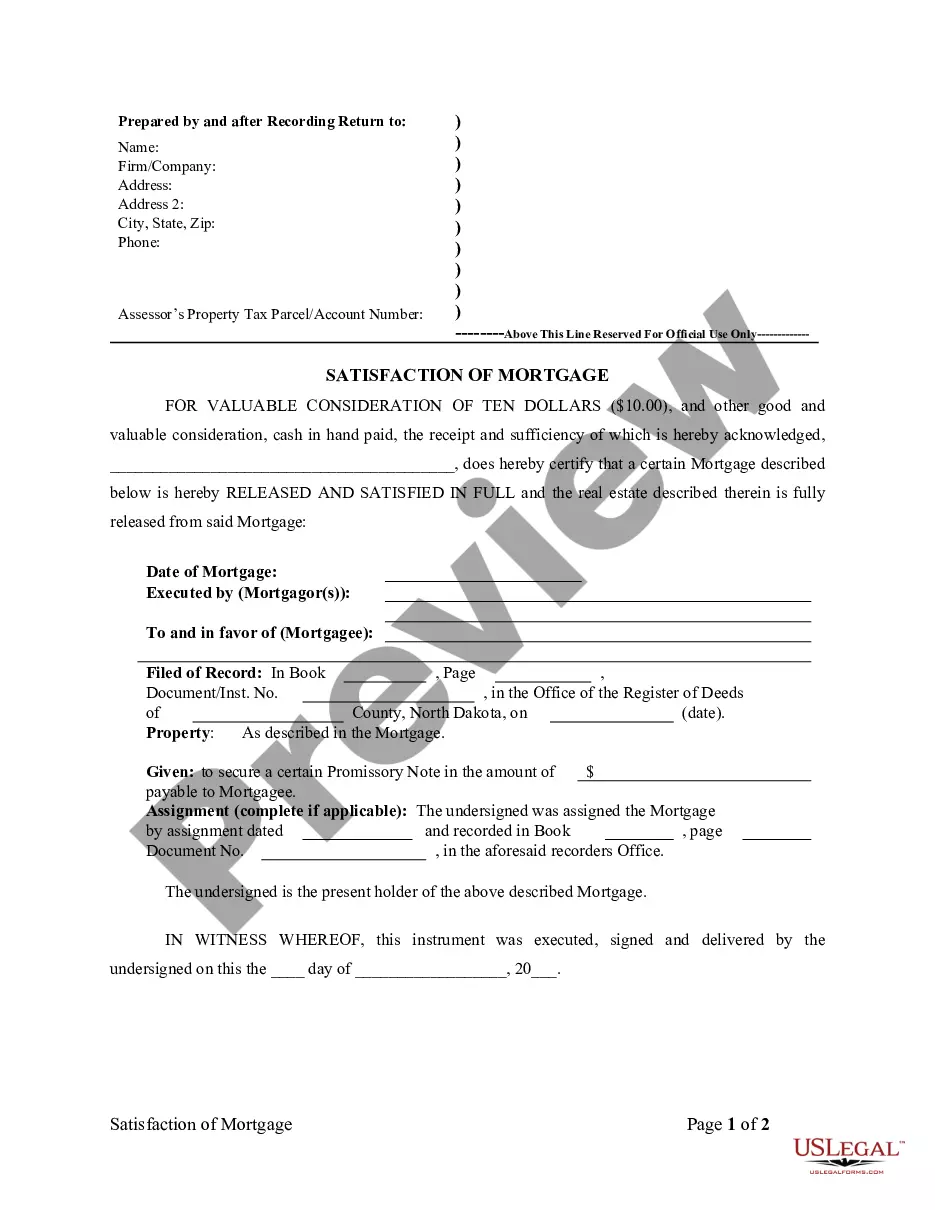

Title: Fargo North Dakota Satisfaction, Release, or Cancellation of Mortgage by Individual: A Detailed Overview Introduction: In Fargo, North Dakota, satisfying, releasing, or canceling a mortgage by an individual involves an important legal process. This detailed description will provide valuable information, steps, and relevant keywords to understand this process and enable homeowners to navigate it successfully. Additionally, this article will mention different types of release or cancellation processes related to mortgage in Fargo, North Dakota. Keywords: Fargo, North Dakota, satisfaction of mortgage, release of mortgage, cancellation of mortgage, satisfaction by individual, release by individual, cancellation by individual 1. Understanding the Fargo North Dakota Satisfaction, Release, or Cancellation of Mortgage: When a homeowner in Fargo, North Dakota fulfills the obligations of their mortgage, they can proceed with satisfying, releasing, or canceling it. This process allows them to clear the title of their property from any liens or encumbrances. 2. Types of Fargo North Dakota Satisfaction, Release, or Cancellation of Mortgage by Individual: a. Satisfaction of Mortgage by Individual: — This process occurs when the homeowner has fully paid off their mortgage debt, fulfilling all terms and conditions agreed upon in the mortgage agreement. — The lender provides the homeowner with a satisfaction or release of mortgage document. b. Release of Mortgage by Individual: — This process can occur when the homeowner wants to sell or transfer the property but hasn't fully paid off the mortgage. — The homeowner and the lender agree to release a particular portion of the property title for sale or transfer. c. Cancellation of Mortgage by Individual: — In certain cases, the homeowner might want to voluntarily cancel their mortgage due to refinancing with a different lender or other legal agreements. — This requires legal proceedings to terminate the existing mortgage and create a new one under different terms. 3. Steps Involved in Fargo North Dakota Satisfaction, Release, or Cancellation of Mortgage by Individual: a. Gather Required Documentation: — Obtain a copy of the original mortgage agreement, including any amendments or modifications. — Collect relevant proof of mortgage payments and current outstanding balance. b. Notify the Lender: — Inform the lender of your intentions to satisfy, release, or cancel the mortgage by an individual. — Request specific instructions or forms required from the lender's side. c. Complete and Sign Release/Cancellation Documents: — Prepare the necessary satisfaction, release, or cancellation documents as required by North Dakota state laws. — Properly fill out the forms, ensuring accuracy and providing necessary supporting information. d. Notarization and Witnessing: — Depending on state laws, the satisfaction, release, or cancellation documents may require notarization or witnessing to validate their authenticity. e. Recording: — Submit the signed and notarized satisfaction, release, or cancellation documents to the appropriate office in Fargo, North Dakota for recording. — Pay any applicable fees associated with recording the documents. Conclusion: The Fargo North Dakota Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial process that homeowners may go through. Understanding the different types of releases or cancellations, gathering the required documentation, notifying the lender, completing and signing the necessary documents, and finally recording them are the fundamental steps involved in this process. Proper execution of these steps ensures a smooth transition towards a mortgage-free title and paves the way for a hassle-free property transfer or refinancing.

Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Fargo North Dakota Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Regardless of one’s social or occupational standing, filling out legal paperwork is an unfortunate requirement in the modern professional landscape.

It is frequently nearly impossible for individuals lacking legal education to draft such documents from the beginning, primarily due to the complex terminology and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Ensure the template you have located is pertinent to your area, as the regulations of one state or locality do not apply to another.

Examine the document and read a brief description (if available) of the situations the document can be utilized for.

- Our platform offers a vast assortment with over 85,000 ready-to-use state-specific templates suitable for nearly every legal situation.

- US Legal Forms also serves as an excellent resource for associates or legal professionals looking to save time by using our DIY forms.

- Whether you require the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual or any other document applicable in your state or region, US Legal Forms has it all.

- Here’s how to efficiently obtain the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual using our dependable platform.

- If you are currently an existing customer, you can simply Log In to your account to download the necessary form.

- However, if you are new to our platform, make sure to follow these steps before downloading the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual.

Form popularity

FAQ

When no satisfaction of a mortgage is recorded in Fargo, North Dakota, the mortgage remains active. This means the lender retains a legal claim against the property until the satisfaction is officially documented. As a homeowner, you may face difficulties when selling the property or obtaining future financing. To resolve this, consider utilizing USLegalForms to assist you with the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Individual process efficiently.

The time frame for receiving a lien satisfaction letter in Fargo North Dakota largely depends on the lender's processing times. Generally, once the lien is released, you should receive the letter within a few weeks. It's advisable to keep detailed records of your payments and follow up to expedite the process.

The duration to obtain a mortgage letter in Fargo North Dakota can depend on various factors, including the lender's policies and the status of your mortgage. Typically, after submitting your request, you should expect to wait between a few days to a couple of weeks for processing. If you encounter delays, don't hesitate to reach out directly to your lender for assistance.

The time it takes to receive a satisfaction of mortgage in Fargo North Dakota can vary, but it usually occurs within a few weeks after your final payment. Factors such as lender processing times and local regulations can influence the duration. For a smoother experience, use a reliable service like USLegalForms to expedite your request.

To obtain a mortgage satisfaction letter in Fargo North Dakota, contact your lender after fulfilling your mortgage payments. They will typically send this letter to confirm that your mortgage is satisfied. If you encounter difficulties, solutions from platforms like USLegalForms can assist you in obtaining this critical document.

In Fargo North Dakota, a lien release and a satisfaction convey the termination of a mortgage but may not mean the same thing. A lien release is a formal process by which a lender confirms the mortgage obligation is ended, while a satisfaction indicates the debt was fully repaid. Knowing these distinctions can help you manage your financial records effectively.

Yes, in Fargo North Dakota, a satisfaction of mortgage should be notarized to ensure its validity. This notarization makes the document official and helps avoid any future disputes regarding the mortgage. If you are unsure about the process, seeking help from a legal platform like USLegalForms can provide the guidance you need.

A mortgage discharge usually refers to the complete cancellation of a mortgage, indicating that no further obligations remain. It is often used interchangeably with a mortgage release, although some jurisdictions may differentiate between the two. Knowing these terms can assist you in managing your responsibilities concerning a Satisfaction, Release, or Cancellation of Mortgage by Individual in Fargo, North Dakota.

Filling out a satisfaction of mortgage form involves providing your information, the lender's details, and the specifics of the mortgage being satisfied. You will need to include any required signatures and dates, ensuring all information is accurate. Using a reliable resource like USLegalForms can help simplify this process, guiding you through the necessary steps.

The time it takes to process a mortgage lien release can vary, but in Fargo, North Dakota, it typically ranges from a few days to a couple of weeks. After correctly filing the required documentation with the county recorder's office, you will wait for processing. Ensuring proper filing will expedite the process and safeguard your credit record.