Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

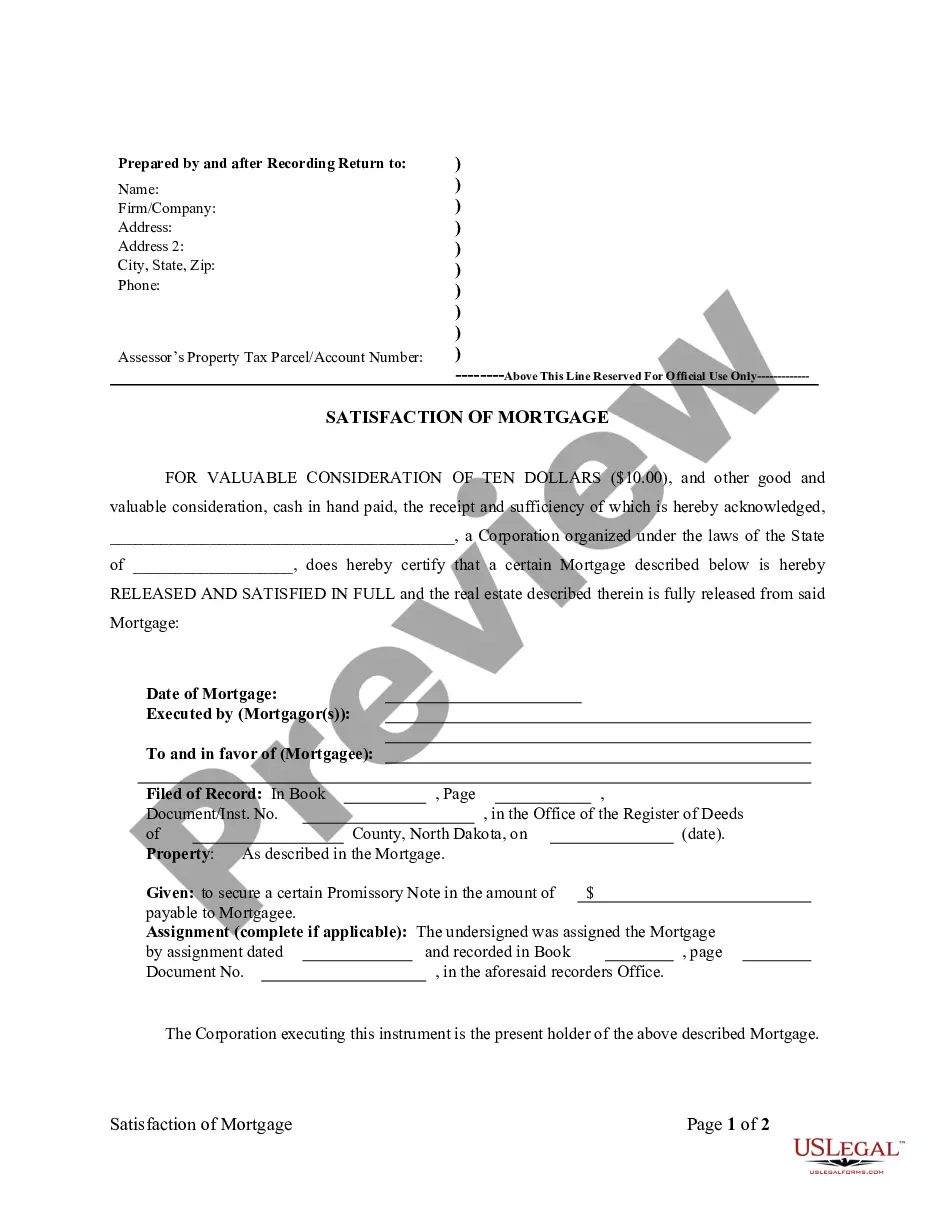

How to fill out North Dakota Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Locating authenticated templates relevant to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It's a digital repository of over 85,000 legal documents catering to personal and professional requirements as well as various real-life circumstances.

All papers are accurately categorized by usage area and jurisdiction, making it as straightforward as ABC to find the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Corporation.

Maintaining documentation organized and in compliance with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily accessible for any requirements!

- Examine the Preview mode and document description. Ensure you've selected the correct one that fulfills your requirements and aligns perfectly with your local jurisdiction standards.

- Search for an alternative template, if necessary. If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your needs, proceed to the following step.

- Acquire the document. Click on the Buy Now button and choose your preferred subscription plan. You need to create an account to gain access to the library’s materials.

- Complete your purchase. Provide your credit card information or use your PayPal account to finalize the subscription payment.

- Download the Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Corporation. Store the template on your device to continue with its completion and gain access to it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

Discharging a mortgage means officially removing the lien from your property after paying off the mortgage. You initiate this by obtaining a Satisfaction of Mortgage letter from your lender, stating that the debt is settled. Once you have this document, file it with the relevant county clerk or recorder's office. If you need guidance, US Legal Forms provides valuable tools to facilitate a smooth process for a Fargo North Dakota Satisfaction, Release or Cancellation of Mortgage by Corporation.

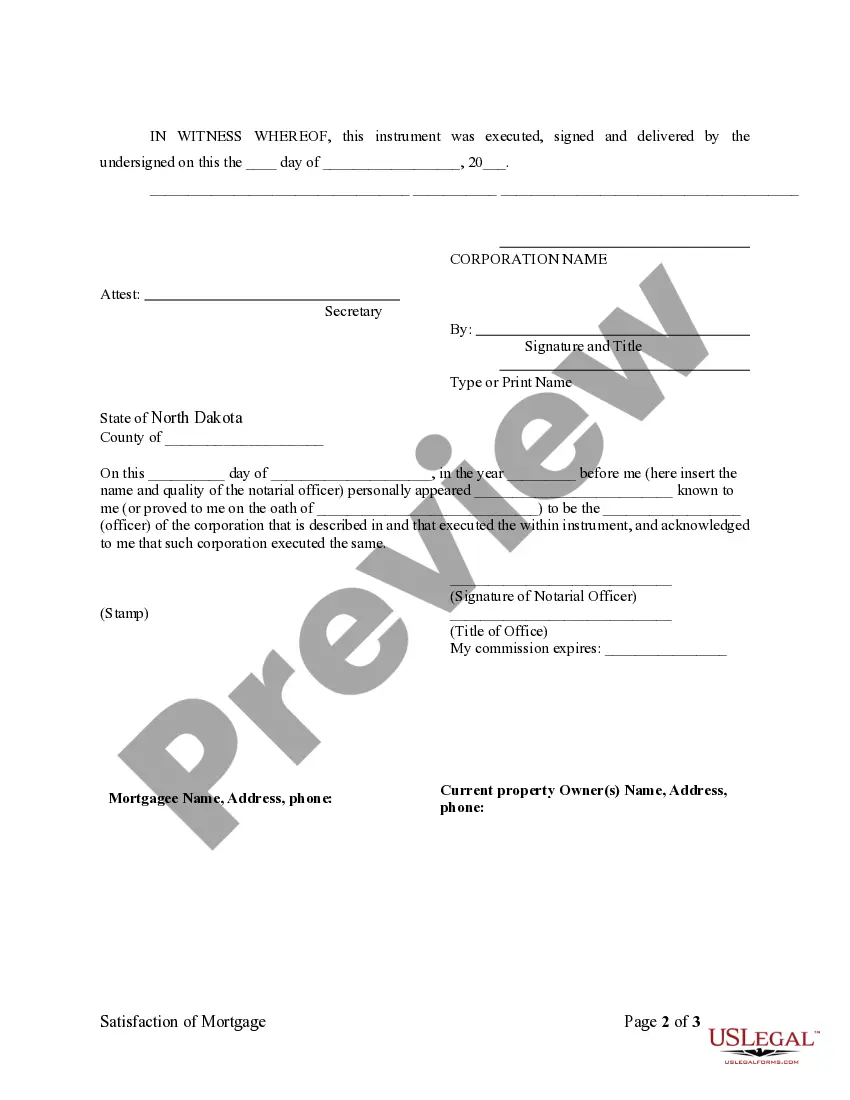

Yes, in many cases, a satisfaction of mortgage must be notarized to be valid. This process ensures the document’s authenticity and compliance with state requirements. After notarization, the satisfaction can then be filed with the appropriate county office. If you're navigating this in Fargo, North Dakota, US Legal Forms provides resources to help manage this process efficiently.

To record a satisfaction of your mortgage, start by obtaining the necessary satisfaction document, ensuring it is notarized. Next, visit the local county recorder’s office in Fargo, North Dakota, where you will submit the document along with any applicable fees. This action solidifies the cancellation of the mortgage and protects your interest in the property.

To record a mortgage satisfaction in Fargo, North Dakota, you need to submit the notarized satisfaction document to the county recorder’s office. Make sure to include any required fees and comply with local guidelines for filing. Recording this document is crucial as it provides public notice that the mortgage has been satisfied, supporting the release or cancellation process.

In Fargo, North Dakota, a satisfaction of mortgage typically requires notarization. Notarization helps ensure the document's authenticity and provides an official record, which can be important during the release or cancellation of a mortgage by a corporation. When dealing with financial institutions, having a notarized document may also expedite the process of officially releasing the mortgage.

If a mortgage doesn’t get recorded, it might create potential challenges when proving ownership and financial obligations. Unrecorded mortgages could complicate sales or refinancing efforts. Recording your mortgage ensures it is officially recognized, protecting your rights as a homeowner.

Typically, obtaining a satisfaction of a mortgage in Fargo, North Dakota, can take anywhere from a few weeks to several months, depending on several factors. Once the lender processes the request, they must notify the appropriate parties. Recording the satisfaction also takes additional time.

When no satisfaction of mortgage is recorded, the mortgage remains on the public record. This can create issues when selling the property or obtaining new financing. It's essential to ensure that the satisfaction is properly recorded to clear the title and avoid complications.