Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate

Description

How to fill out North Dakota Warranty Deed For Parents To Child With Reservation Of Life Estate?

Are you seeking a trustworthy and cost-effective legal forms provider to purchase the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate? US Legal Forms is your top choice.

Whether you require a simple contract to establish rules for living with your partner or a collection of forms to facilitate your divorce proceedings through the court, we have you covered. Our site features over 85,000 current legal document templates for individual and business purposes. All templates that we provide are not generic but customized according to the regulations of specific states and counties.

To obtain the document, you need to Log In to your account, find the desired template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My documents section.

Are you new to our platform? No problem. You can easily set up an account, but first, ensure you do the following.

Now you can create your account. Next, select the subscription plan and complete the payment. Once the payment is processed, download the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate in any available file format. You can revisit the website at any time and redownload the document at no additional charge.

Obtaining the latest legal forms has never been easier. Try US Legal Forms today, and stop wasting your precious time learning about legal documents online once and for all.

- Verify if the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate complies with the laws of your state and locality.

- Read the form’s details (if available) to understand who and what the document is intended for.

- Restart the search if the template does not suit your particular needs.

Form popularity

FAQ

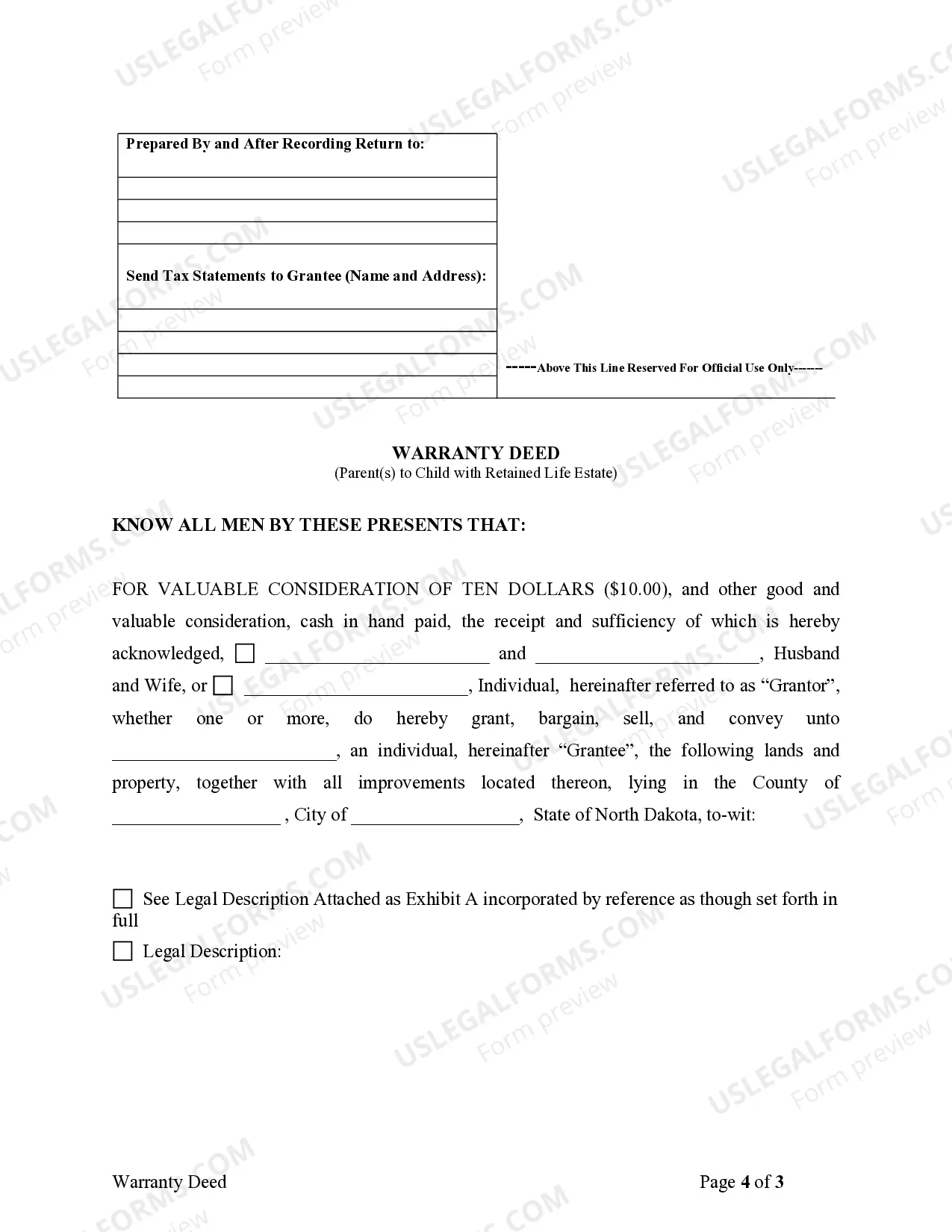

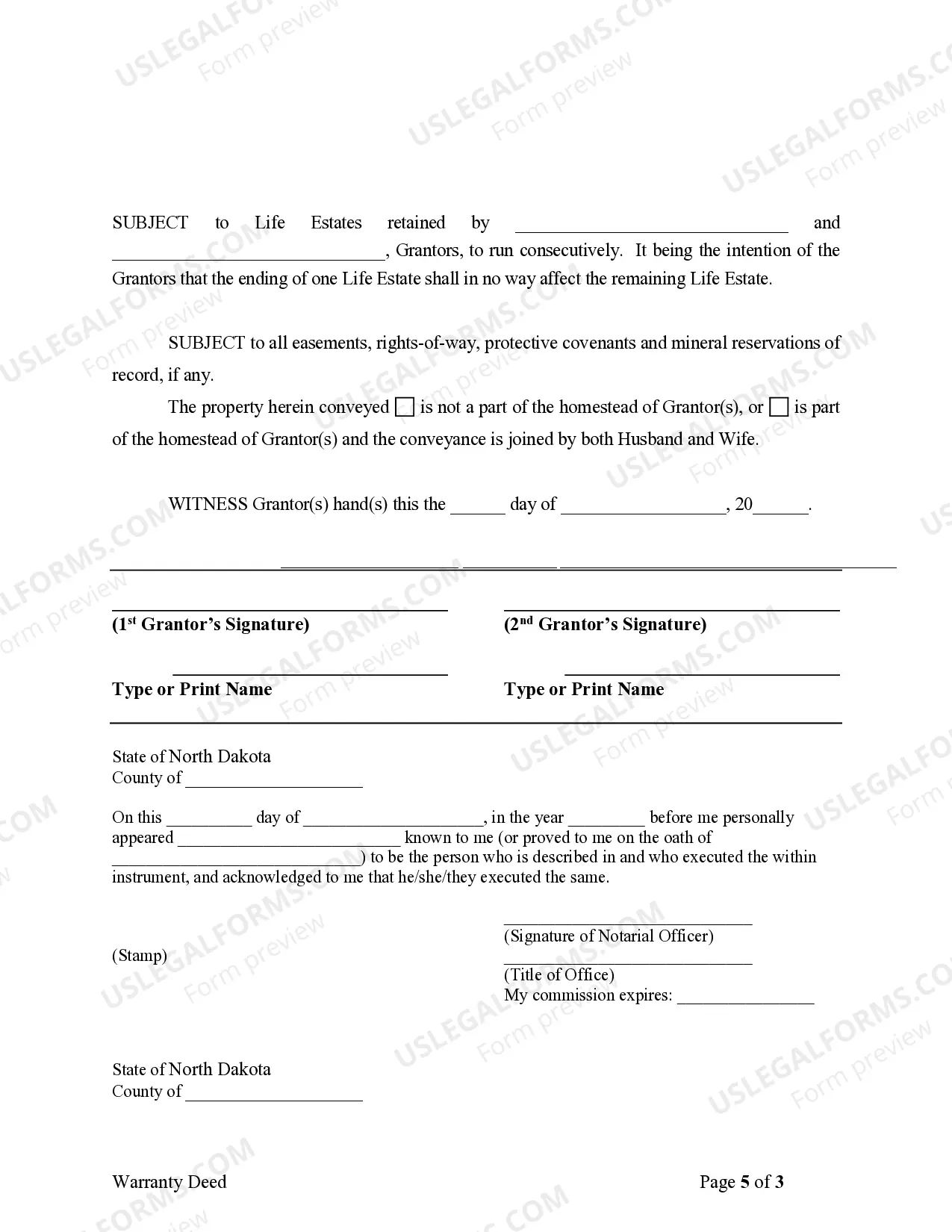

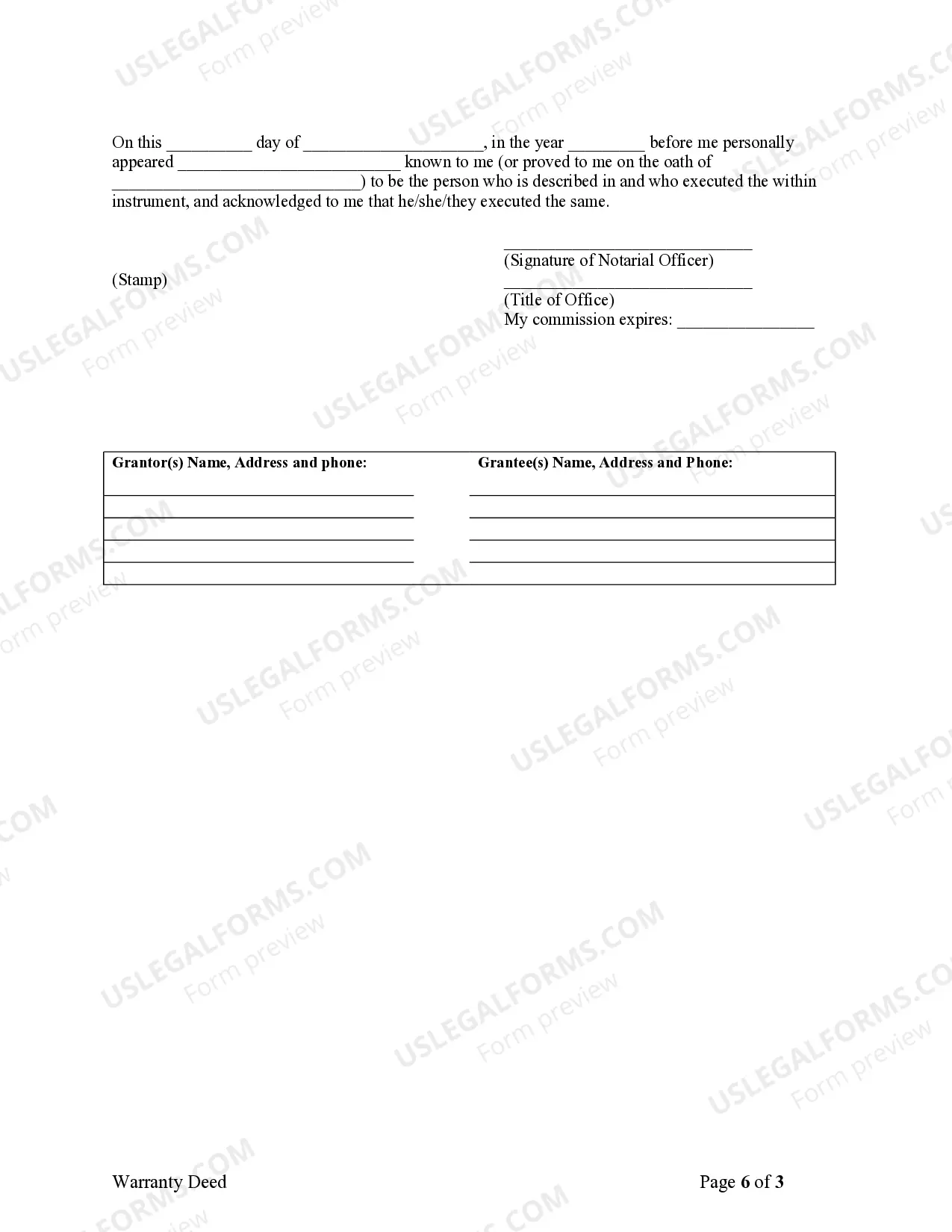

The parties to a warranty deed typically include the grantor, who is the property owner, and the grantee, who is the individual receiving the property. In the case of the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate, the parents act as grantors and the child as the grantee. Understanding these roles is vital for a clear and legal transfer of ownership.

To fill out a warranty deed form, start by entering the names of both the grantor and the grantee, along with a complete description of the property. You will also need to state any reservation of life estate or other interests. It's crucial to check out US Legal Forms, which can provide sample forms and explanations, ensuring your completion aligns with the requirements of the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

A warranty deed can be filled out by anyone, including the property owner or a designated representative. If you choose to do it yourself, using tools from US Legal Forms can guide you through the process. Additionally, a lawyer can fill it out for you, which could provide you peace of mind regarding compliance with local laws related to the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

Filling out a warranty deed involves providing specific information such as the names of the grantor and grantee, the legal description of the property, and any reservations of rights. Resources like US Legal Forms offer detailed instructions and templates, making it simpler to fill out. Always ensure that the information is accurate and legible to uphold the legal integrity of the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

Yes, anyone can prepare a warranty deed, but it's wise to consult a legal professional to ensure all requirements are met. While it is possible for individuals to do it themselves using resources like US Legal Forms, guidance from a lawyer can help avoid errors or misunderstandings. The correct preparation is vital for seamless transfer under the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

To add your name to your parents' deed, they must execute a new warranty deed that includes both their names and yours. This process typically requires filling out the correct form, which can be found on platforms like US Legal Forms. Ensure both your parents are in agreement and sign the new document, which will then need to be recorded in the appropriate county office. This action ensures that you receive property rights under the Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

To obtain a Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate, you should start by visiting your local county clerk's office, where property records are maintained. Alternatively, you can use platforms like US Legal Forms, which simplify the process by offering pre-drafted forms that cater to your specific needs. Once you have the appropriate form, complete it carefully and take it to the county office for recording. This ensures that your property transfer is legally recognized and protects your interests.

A life estate deed usually supersedes a will regarding the ownership of the property involved. The life tenant’s right to use the property remains intact even if a will states otherwise. This legal arrangement ensures that the designated remainderman inherits the property upon the death of the life tenant. For a clear understanding and guidance, considering a Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate through USLegalForms can be beneficial.

Generally, a will cannot override a life estate deed. Once a life estate is established, it typically remains valid until the life tenant passes away, regardless of any later wills. However, if the will specifically revokes the life estate in accordance with legal requirements, it may have an effect. Be sure to consult a legal professional when dealing with the nuances of a Fargo North Dakota Warranty Deed for Parents to Child with Reservation of Life Estate.

Yes, a life estate can be challenged in court under certain circumstances. If you believe there was coercion, fraud, or mistake in creating the life estate, you can dispute its validity. Legal challenges often involve gathering evidence to support your claim. Exploring platforms like USLegalForms can help you navigate this complex process effectively.