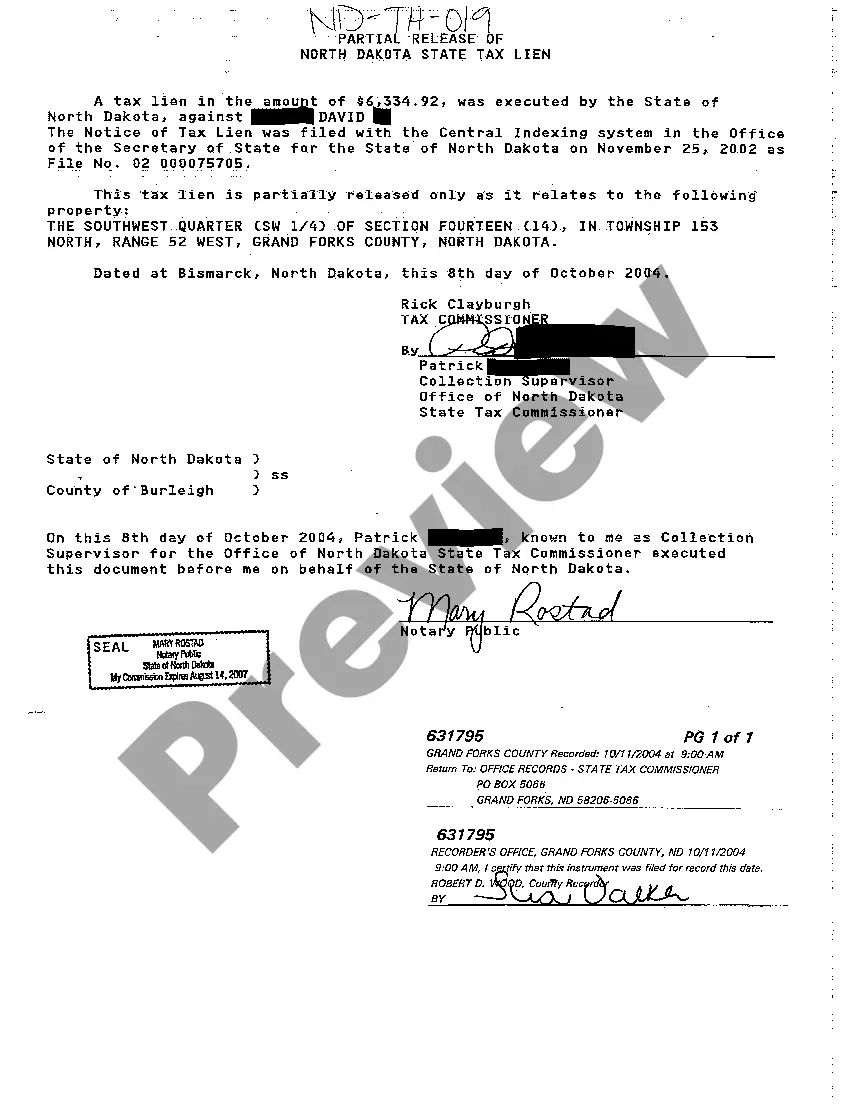

A Fargo North Dakota Partial Release of State Tax Lien is a legal document that signifies the release of a portion of a state tax lien on a property located in Fargo, North Dakota. This release indicates that the property owner has fulfilled their tax obligations relating to a specific portion of the total amount owed to the state government. A partial release of a state tax lien is granted when the property owner has made a partial payment towards their outstanding tax debt. This payment could be a lump sum or a series of installments, reducing the overall amount owed. By obtaining this release, the property owner gains some freedom from the encumbrance caused by the tax lien and retains the ability to transfer or refinance the property without the full lien amount jeopardizing the transaction. Keywords: Fargo North Dakota, Partial Release, State Tax Lien, legal document, property owner, tax obligations, state government, fulfilled, outstanding tax debt, payment, lump sum, installments, reduction, encumbrance, transfer, refinance, transaction. Different types of Fargo North Dakota Partial Release of State Tax Lien may include: 1. Full Payment Partial Release — When the property owner pays the full amount owed for a particular tax lien, the state government grants a full payment partial release, thereby releasing the entire lien from the property. 2. Installment Payment Partial Release — In this case, the property owner enters into an agreement with the state government to pay the outstanding tax debt in installments. As the property owner makes regular payments according to the agreed upon plan, the state may grant a partial release for each payment made, allowing the property owner to gradually remove the lien. 3. Strategic Lien Release — Property owners who have multiple tax liens may strategically prioritize the repayment of certain liens to obtain partial releases on specific properties. By focusing on paying off certain liens, they can release those properties from the encumbrance while still working towards resolving the remainder of their tax debt. Keywords: Full Payment Partial Release, Installment Payment Partial Release, Strategic Lien Release, agreement, regular payments, multiple tax liens, prioritize, repayment, specific properties, encumbrance, resolving tax debt.

Fargo North Dakota Partial Release of State Tax Lien

Description

How to fill out Fargo North Dakota Partial Release Of State Tax Lien?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our practical website featuring thousands of document templates makes it simple to locate and acquire nearly any document sample you may require.

You can save, complete, and validate the Fargo North Dakota Partial Release of State Tax Lien in a few minutes instead of scouring the internet for hours trying to find a suitable template.

Employing our catalog is an excellent method to enhance the security of your form submission.

If you haven’t yet created an account, follow the instructions below.

Access the page containing the form you need. Ensure it is the template you intended to find: confirm its title and description, and use the Preview feature if it's available. If not, use the Search box to locate the correct one.

- Our experienced attorneys routinely assess all documents to ensure that the templates are applicable for a specific state and compliant with current laws and regulations.

- How can you access the Fargo North Dakota Partial Release of State Tax Lien.

- If you have an account, simply Log In to your profile.

- The Download button will show on all the samples you view.

- Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

Yes, the IRS typically forgives tax debt after 10 years from the date of assessment due to the statute of limitations. This means that any outstanding liens will expire, and the government cannot collect the debt. However, this does not apply to state tax liens, which may have different rules. In Fargo, North Dakota, understanding how a Partial Release of State Tax Lien works can provide clarity on your financial obligations.

Removing a tax lien can take anywhere from a few weeks to several months, depending on the circumstances surrounding your tax situation. After resolving the tax debt, you will need to wait for the IRS or state to process the necessary paperwork. If you are in Fargo, North Dakota, using the right legal forms and guidance can significantly streamline this process, especially regarding a Partial Release of State Tax Lien.

The speed at which a tax lien can be removed depends on several factors, including the resolution of the debt and compliance with tax regulations. Once you settle the tax debt, it usually takes the IRS or state tax authority a few weeks to process the release. For individuals seeking a quicker solution, exploring the Fargo North Dakota Partial Release of State Tax Lien may offer an immediate benefit while you work on resolving the underlying debt.

A certificate of release of tax lien is a document issued by the IRS or state tax authority that officially cancels a recorded tax lien against a property. This certificate indicates that the tax debt has been settled, either through payment or an accepted Offer in Compromise. For residents in Fargo, North Dakota, obtaining this document is crucial for restoring clear title to your property. It can also pave the way for a Partial Release of State Tax Lien.

The statute of limitations for an IRS tax lien is generally 10 years from the date the tax debt was assessed. This means the IRS can collect the tax debt for a decade, after which the lien expires automatically. It’s important to note that circumstances, such as bankruptcy or an Offer in Compromise, can extend or suspend this period. If you are in Fargo, North Dakota, understanding this timeline can help you manage your financial situation more effectively, especially if you are considering a Partial Release of State Tax Lien.

No, North Dakota is not classified as a tax lien state. Instead, it operates under a deed system for tax collections. This distinction can impact your approach to property investments, especially if you're interested in a Fargo North Dakota Partial Release of State Tax Lien. For further assistance and insights on understanding these regulations, our platform, US Legal Forms, can be a valuable resource.

When a UCC lien is filed, the creditor declares a legal interest in the debtor's assets. This action protects the creditor by establishing priority over the debtor’s property in case of default. In the context of a Fargo North Dakota Partial Release of State Tax Lien, such filings can influence how creditors collect debts. Knowledge about these liens can empower you to make informed decisions.

North Dakota is primarily a deed state rather than a tax lien state. This means that when property taxes go unpaid, the county typically sells the property itself to recover owed taxes rather than issuing a lien. Understanding these differences is essential, especially when dealing with a Fargo North Dakota Partial Release of State Tax Lien. To navigate these terms effectively, consider our resources for clarity.

When a tax lien is released, it signifies that the debt tied to the lien has been satisfied, and the legal claim on the property is removed. This release allows you to regain clear ownership of your property and facilitates future transactions. For a practical guide on achieving a Fargo North Dakota Partial Release of State Tax Lien, consider using resources available through USLegalForms.

In North Dakota, property taxes can go unpaid for up to three years before the government may initiate a tax lien sale. During this time, the property owner can work towards settling the debts to avoid further action. Staying informed about these timelines is crucial for those looking to manage their Fargo North Dakota Partial Release of State Tax Lien efficiently.