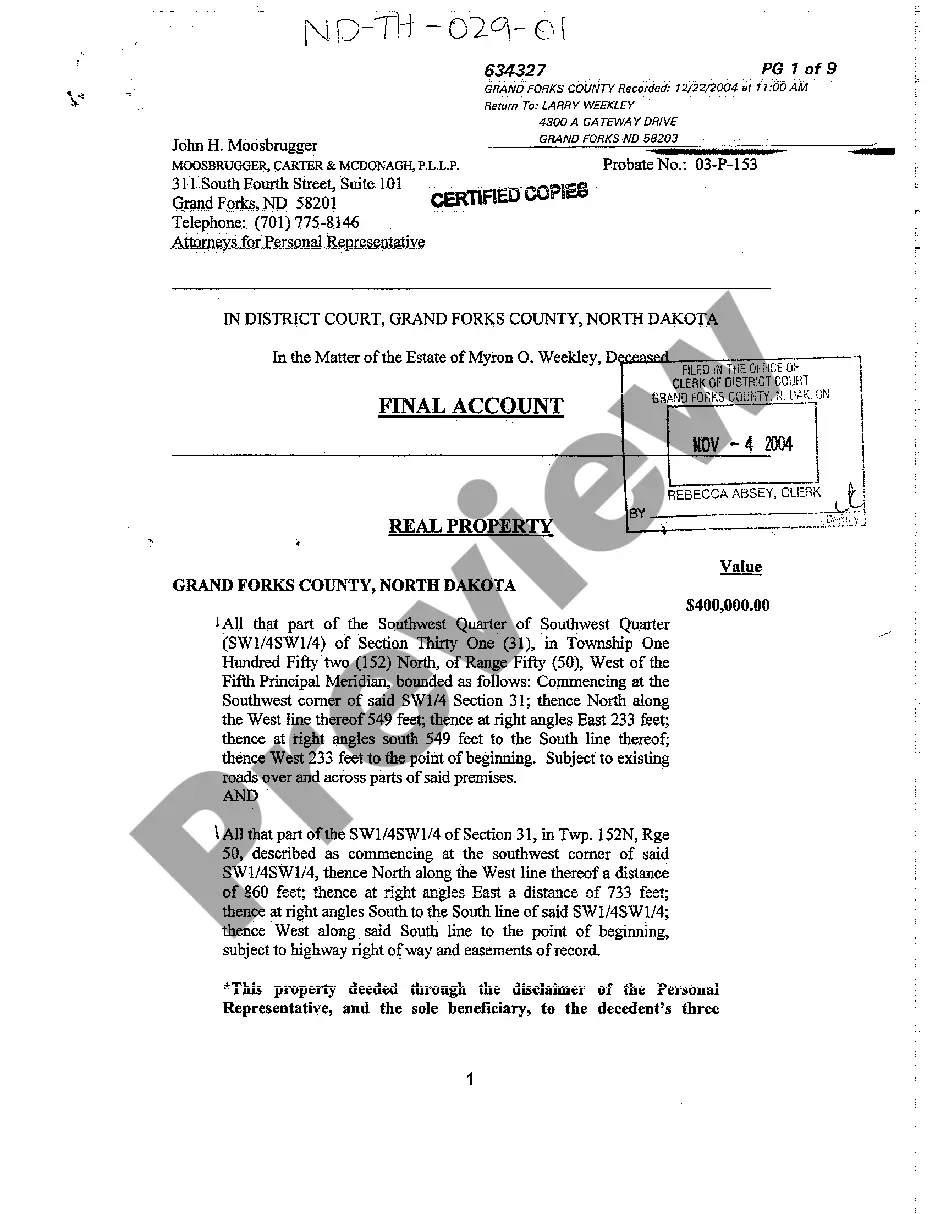

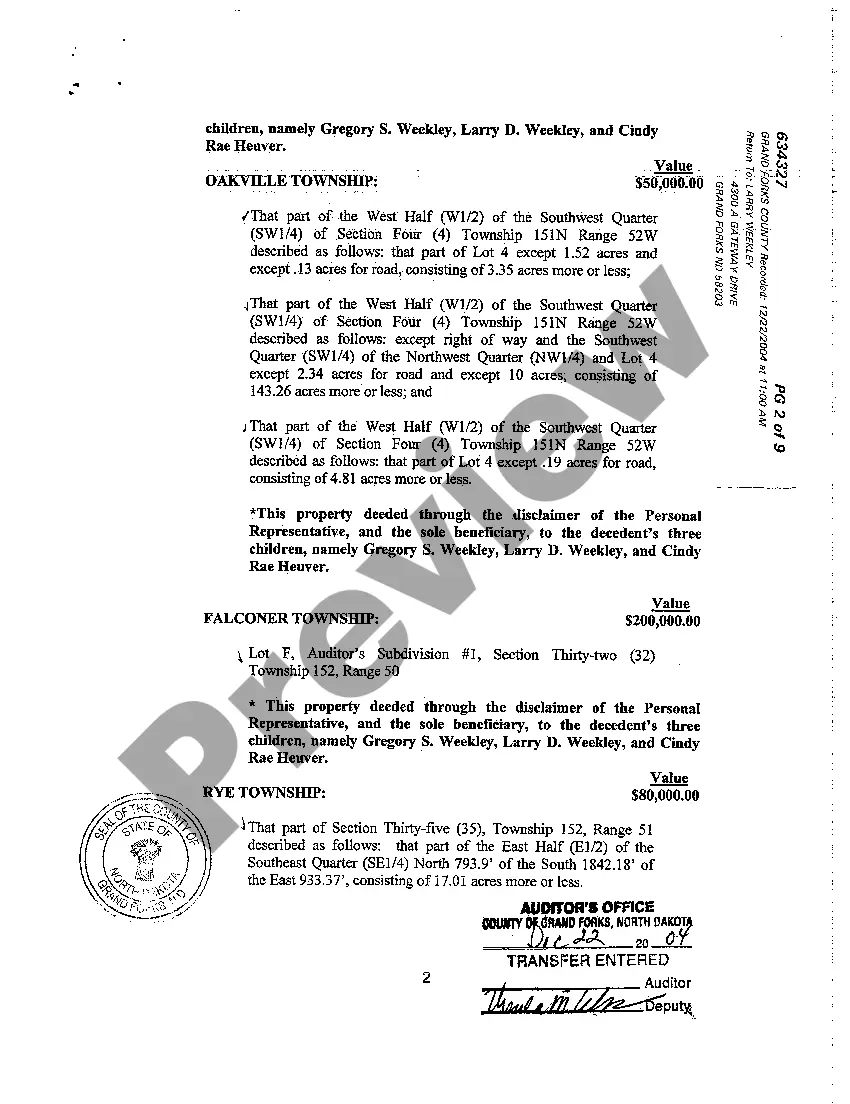

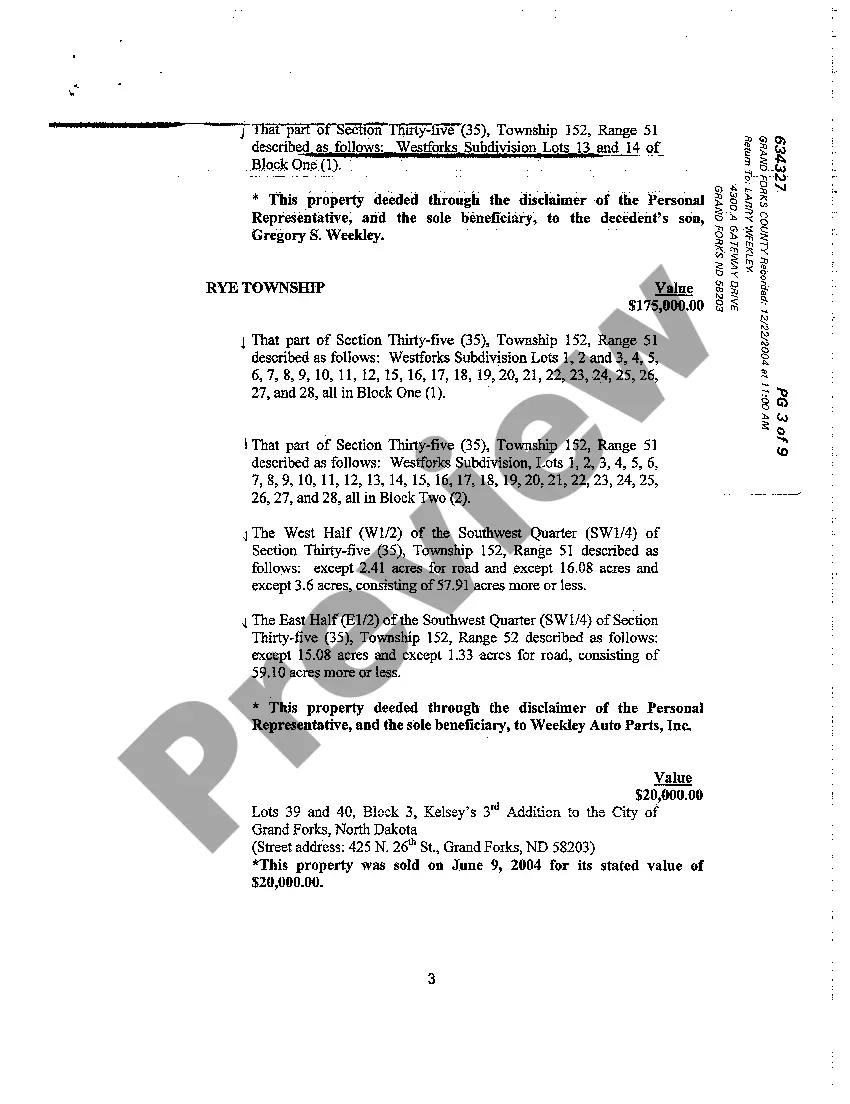

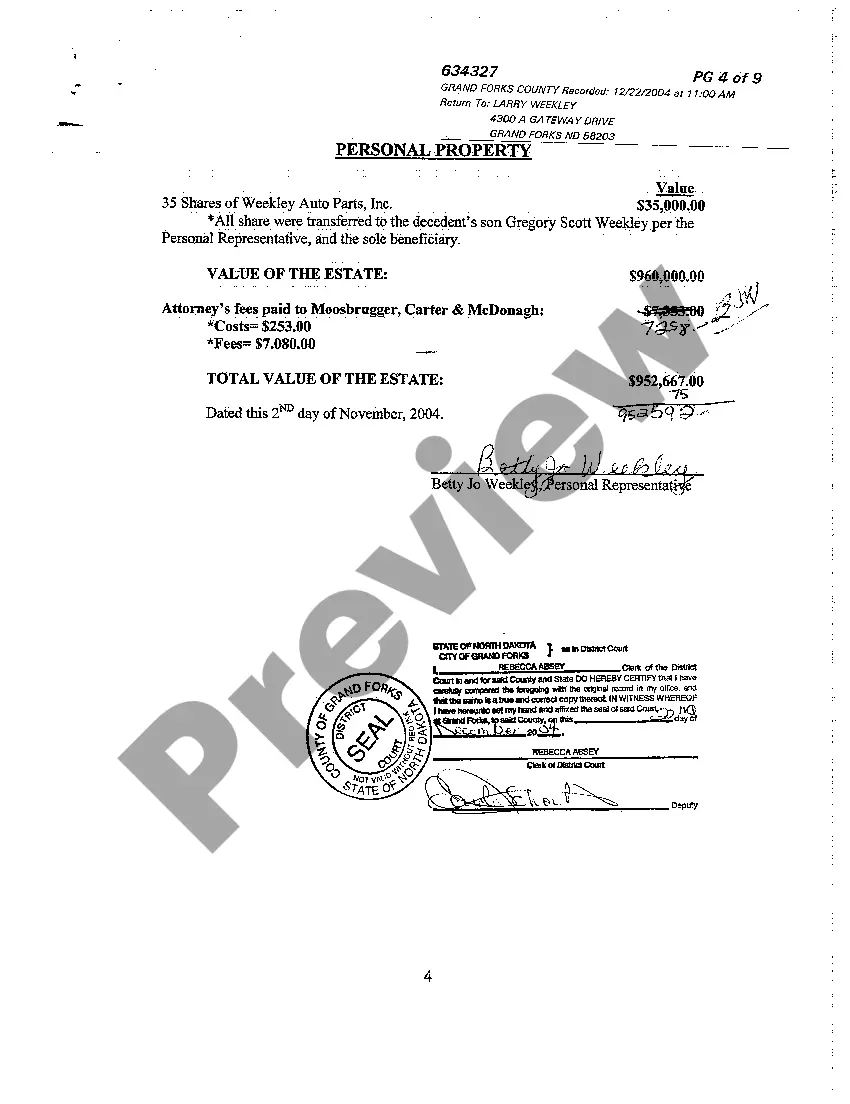

Fargo North Dakota Final Account Appraisal of Decedent's Property is a crucial process that involves the evaluation and assessment of a deceased individual's assets and liabilities to establish the final value of their estate. This appraisal provides an accurate representation of the property's worth, which is a necessary step for legal purposes, such as probate proceedings, estate distribution, or tax assessments. In Fargo, North Dakota, there are various types of final account appraisals of decedent's property, each serving a specific purpose: 1. Real Estate Appraisal: This type of appraisal focuses on determining the fair market value of any land, residential, or commercial property owned by the decedent. It includes evaluating factors like location, size, condition, comparable sales, and current market trends. 2. Personal Property Appraisal: This appraisal encompasses the valuation of movable assets owned by the deceased, including furniture, vehicles, jewelry, artwork, antiques, collectibles, and other personal possessions. Expert appraisers consider factors like condition, rarity, age, artistic value, and market demand to establish an accurate value. 3. Financial Asset Appraisal: This appraisal concentrates on assessing financial holdings, such as bank accounts, stocks, bonds, mutual funds, retirement accounts, and other investments held by the decedent. A detailed analysis is conducted to determine their market value at the time of the individual's passing. 4. Business Appraisal: In cases where the decedent owned a business or had ownership interests in a company, a business appraisal is conducted to ascertain the enterprise's value. This involves examining financial statements, assets, liabilities, market conditions, and other crucial factors to establish a fair market value. 5. Specialized Asset Appraisal: In some situations, specialized assets require a unique appraisal approach. These may include intellectual property, patents, copyrights, trademarks, royalties, mineral rights, or any other non-conventional assets owned by the decedent. The Fargo North Dakota Final Account Appraisal of Decedent's Property serves the purpose of providing an accurate evaluation of the deceased person's estate. The appraisal process ensures a fair distribution of assets, helps settle any outstanding liabilities, and provides a clear record for tax purposes. It is essential to hire qualified appraisers and work closely with attorneys or estate administrators to ensure a smooth final account appraisal process in Fargo, North Dakota.

Fargo North Dakota Final Account Appraisal of Decedent's Property is a crucial process that involves the evaluation and assessment of a deceased individual's assets and liabilities to establish the final value of their estate. This appraisal provides an accurate representation of the property's worth, which is a necessary step for legal purposes, such as probate proceedings, estate distribution, or tax assessments. In Fargo, North Dakota, there are various types of final account appraisals of decedent's property, each serving a specific purpose: 1. Real Estate Appraisal: This type of appraisal focuses on determining the fair market value of any land, residential, or commercial property owned by the decedent. It includes evaluating factors like location, size, condition, comparable sales, and current market trends. 2. Personal Property Appraisal: This appraisal encompasses the valuation of movable assets owned by the deceased, including furniture, vehicles, jewelry, artwork, antiques, collectibles, and other personal possessions. Expert appraisers consider factors like condition, rarity, age, artistic value, and market demand to establish an accurate value. 3. Financial Asset Appraisal: This appraisal concentrates on assessing financial holdings, such as bank accounts, stocks, bonds, mutual funds, retirement accounts, and other investments held by the decedent. A detailed analysis is conducted to determine their market value at the time of the individual's passing. 4. Business Appraisal: In cases where the decedent owned a business or had ownership interests in a company, a business appraisal is conducted to ascertain the enterprise's value. This involves examining financial statements, assets, liabilities, market conditions, and other crucial factors to establish a fair market value. 5. Specialized Asset Appraisal: In some situations, specialized assets require a unique appraisal approach. These may include intellectual property, patents, copyrights, trademarks, royalties, mineral rights, or any other non-conventional assets owned by the decedent. The Fargo North Dakota Final Account Appraisal of Decedent's Property serves the purpose of providing an accurate evaluation of the deceased person's estate. The appraisal process ensures a fair distribution of assets, helps settle any outstanding liabilities, and provides a clear record for tax purposes. It is essential to hire qualified appraisers and work closely with attorneys or estate administrators to ensure a smooth final account appraisal process in Fargo, North Dakota.