Fargo North Dakota Short-Term Mortgage Redemption is a process that allows borrowers to repay their home loans within a shorter timeframe than the standard mortgage term. This type of mortgage redemption is particularly beneficial for those looking to minimize their total interest payments or for borrowers who anticipate a change in their financial situation in the near future. One type of short-term mortgage redemption available in Fargo, North Dakota is the 15-year fixed-rate mortgage. This mortgage enables borrowers to pay off their loans within 15 years by making consistent monthly payments. The shorter term allows borrowers to build equity in their homes at a faster rate and save significantly on interest compared to longer-term loans. Another type of short-term mortgage redemption in Fargo, North Dakota is the adjustable-rate mortgage (ARM). With an ARM, borrowers have a fixed interest rate initially for a specific period, commonly 5, 7, or 10 years, after which the rate adjusts periodically based on market conditions. These mortgages are ideal for borrowers who plan to sell or refinance their homes within a few years, as they offer lower initial rates compared to fixed-rate options. Fargo North Dakota also offers short-term bridge loans, which are temporary loans used to cover the gap between the purchase of a new home and the sale of an existing one. Bridge loans are especially useful for homeowners who are looking to move to a new property while their current home is still on the market. These loans typically have higher interest rates due to the short repayment period and can be refinanced or paid off once the old property is sold. Moreover, FHA (Federal Housing Administration) loans are another short-term mortgage redemption option available in Fargo, North Dakota. These loans are insured by the FHA and allow borrowers with lower credit scores or limited down payment funds to qualify for financing. FHA loans typically come with shorter terms, such as 10 or 15 years, making them suitable for those looking for short-term repayment options while benefiting from the FHA's favorable terms and conditions. In conclusion, Fargo North Dakota Short-Term Mortgage Redemption provides borrowers with various options, including the 15-year fixed-rate mortgage, adjustable-rate mortgage (ARM), bridge loans, and FHA loans. These customized alternatives cater to different financial situations, enabling borrowers to repay their loans quickly, save on interest, and adapt to their changing housing needs.

Fargo North Dakota Short-Term Mortgage Redemption

Description

How to fill out Fargo North Dakota Short-Term Mortgage Redemption?

Take advantage of the US Legal Forms and have instant access to any form template you need. Our helpful website with thousands of document templates allows you to find and get almost any document sample you require. It is possible to download, complete, and sign the Fargo North Dakota Short-Term Mortgage Redemption in just a few minutes instead of surfing the Net for hours attempting to find a proper template.

Utilizing our catalog is a wonderful strategy to raise the safety of your record submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you get the Fargo North Dakota Short-Term Mortgage Redemption? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the tips listed below:

- Open the page with the form you require. Make sure that it is the template you were seeking: examine its title and description, and use the Preview function if it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Pick the format to get the Fargo North Dakota Short-Term Mortgage Redemption and revise and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the web. We are always happy to assist you in any legal procedure, even if it is just downloading the Fargo North Dakota Short-Term Mortgage Redemption.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

The foreclosure process in North Dakota generally takes several months, usually between 2 to 6 months. Once served with papers, a homeowner can anticipate a timeline before the property is sold at auction. Knowing your rights is essential during this period, especially the potential for Fargo North Dakota Short-Term Mortgage Redemption options that could keep you in your home longer.

In North Dakota, debts are typically considered uncollectible after six years. This timeframe allows creditors to pursue collections within a reasonable period. If you find yourself facing unmanageable debts, consider options like Fargo North Dakota Short-Term Mortgage Redemption. This approach might offer a path toward regaining financial stability.

In North Dakota, once you reach 65 years of age, you may qualify for a property tax exemption. This exemption can alleviate some financial burden associated with property taxes. It’s important to check with your local authorities for specific eligibility criteria. If you face challenges, exploring Fargo North Dakota Short-Term Mortgage Redemption options may provide additional financial relief.

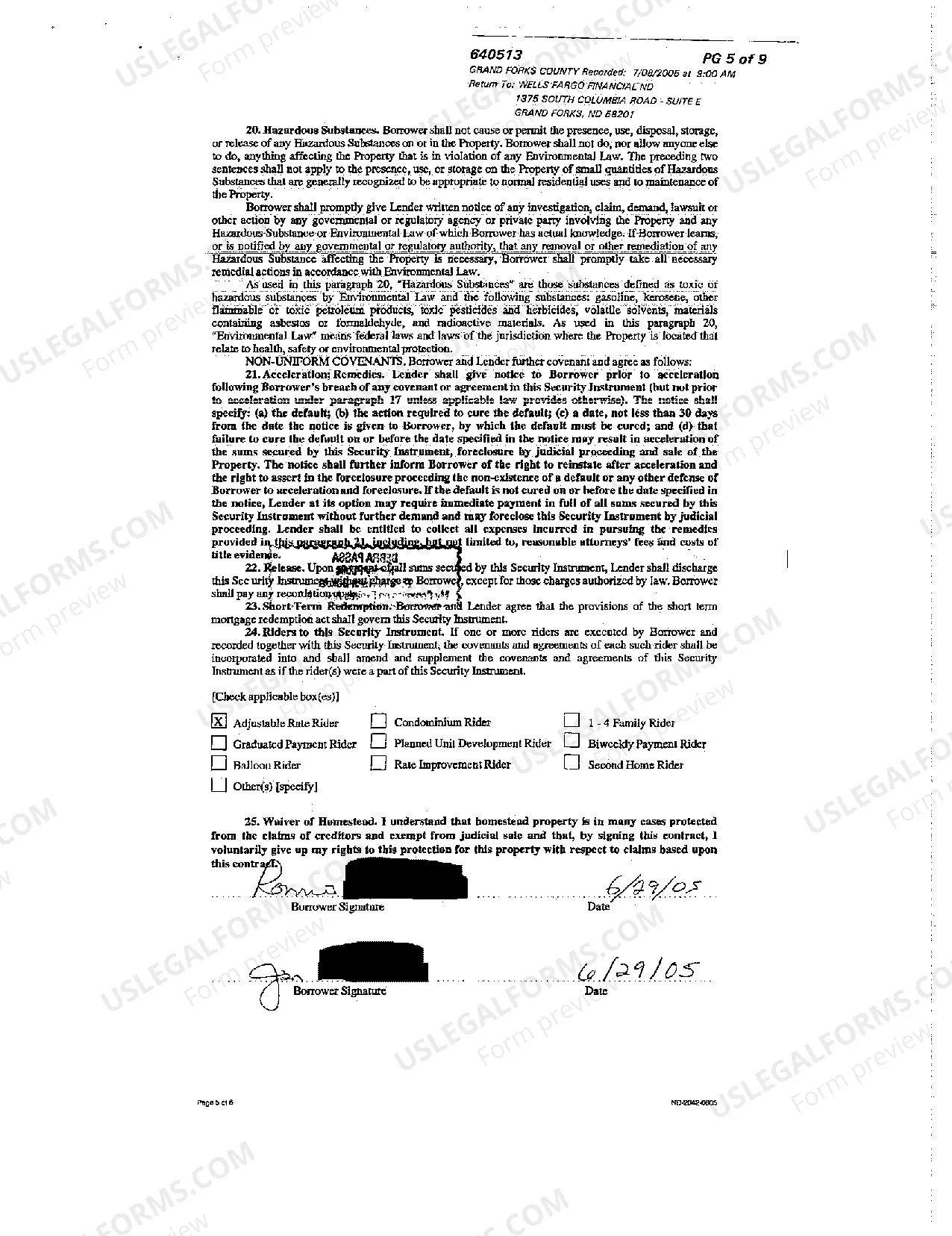

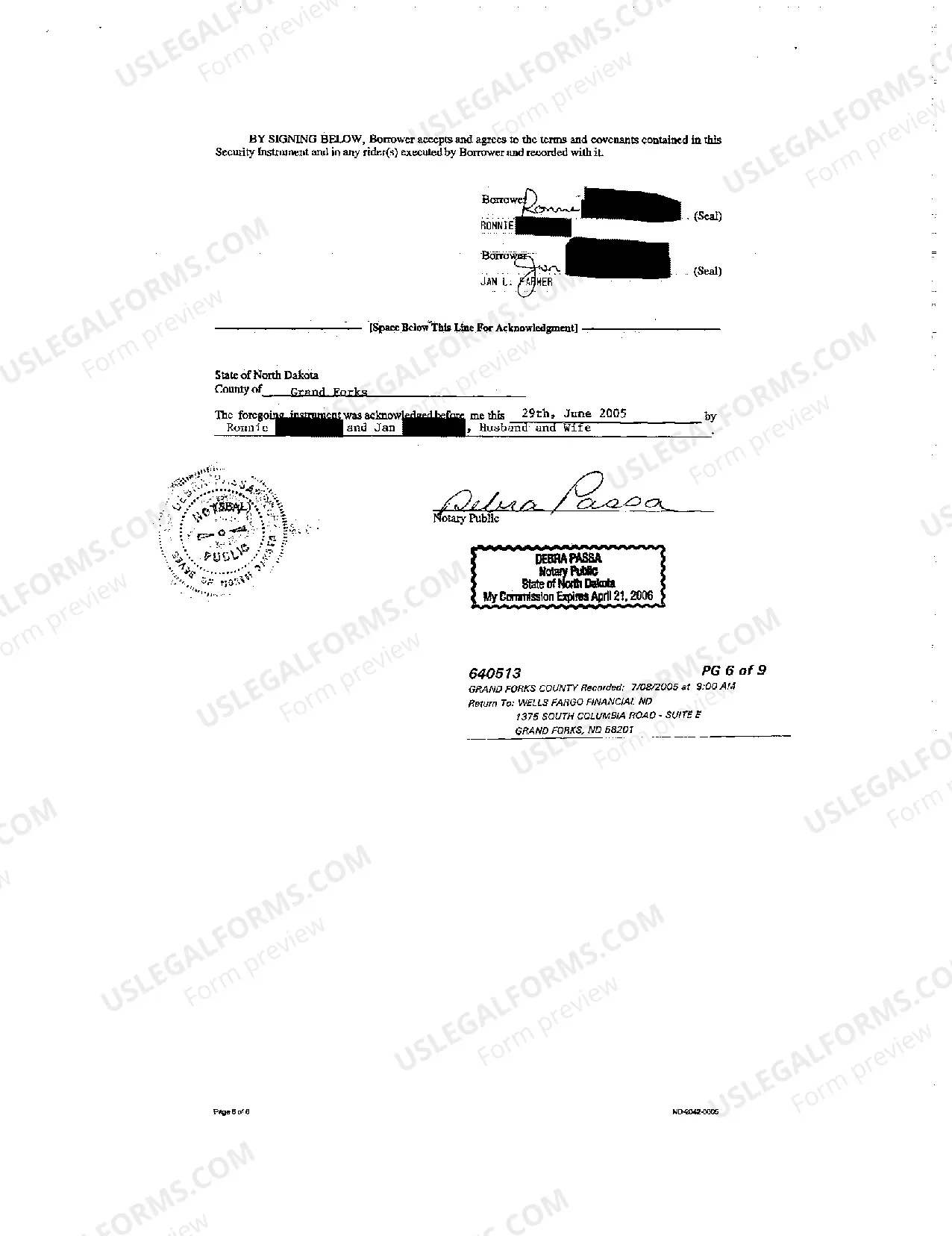

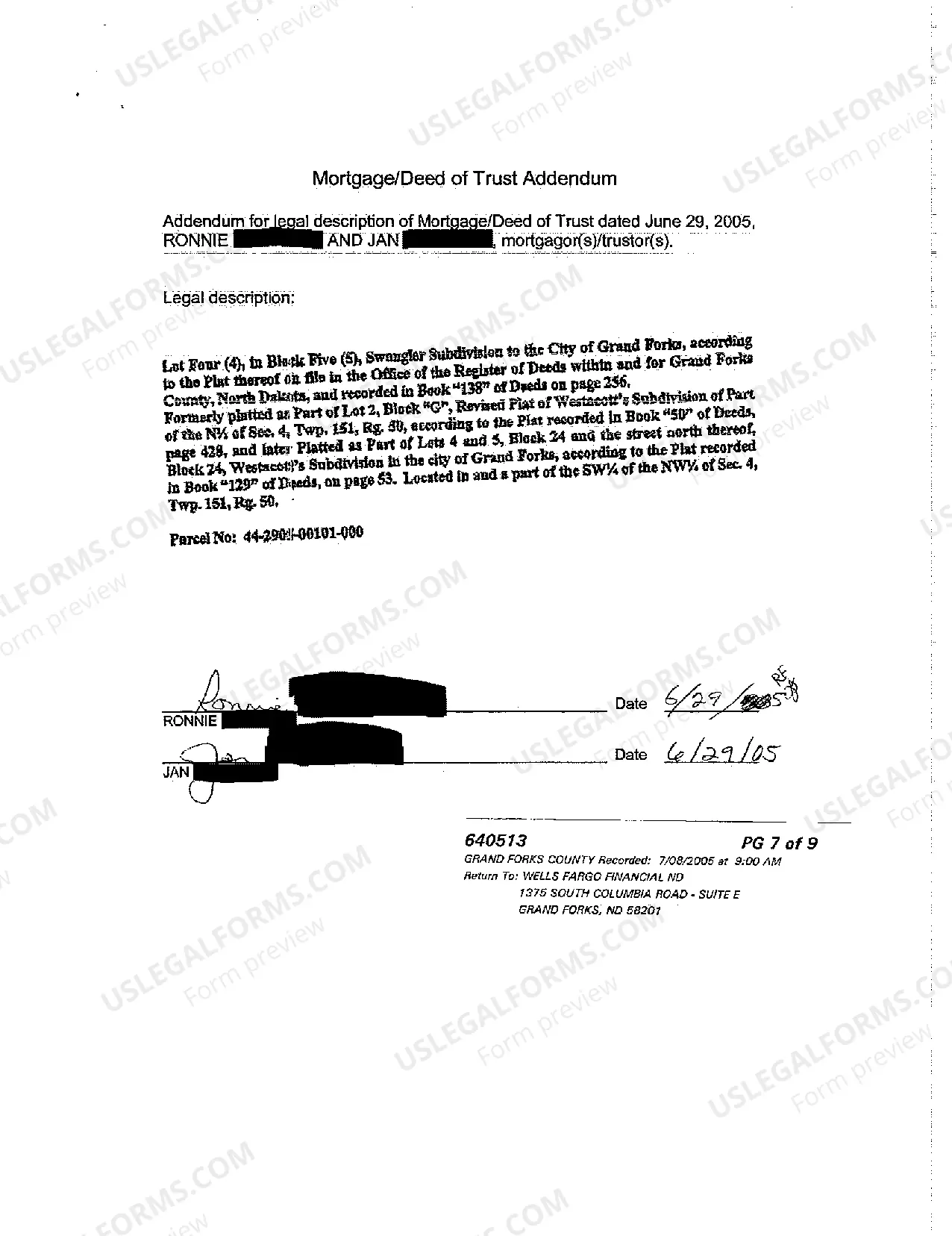

Redemption in a foreclosure allows homeowners to recover their property by paying off their mortgage debt, including any fees or penalties. In Fargo, North Dakota, during the redemption period, you can regain ownership even after a foreclosure sale has occurred. This process underscores the importance of knowing your rights and the options available to you, especially regarding Fargo North Dakota Short-Term Mortgage Redemption. For support and resources, consider using platforms like US Legal Forms to navigate the redemption process efficiently.

In Fargo, North Dakota, the redemption period timeline typically lasts for one year following a foreclosure sale. This period allows you to reclaim your property by paying the total amount of the mortgage debt. It’s essential to understand this timeline so you can act promptly if you wish to utilize Fargo North Dakota Short-Term Mortgage Redemption. You should consult resources like US Legal Forms for detailed guidance on this process.

In North Dakota, homeowners have six months from the date of the foreclosure sale to redeem their property. This redemption period offers a crucial opportunity to recover ownership by showcasing financial stability and negotiating terms with the lender. Utilizing services like USLegalForms can help in navigating the Fargo North Dakota Short-Term Mortgage Redemption process efficiently.

The 120-day rule in North Dakota states that lenders must wait at least 120 days from the date of default before initiating foreclosure proceedings. This period allows homeowners a chance to address their financial issues or negotiate alternatives, such as refinancing or pursuing Fargo North Dakota Short-Term Mortgage Redemption options. Knowing this rule can empower borrowers to take timely action.

In North Dakota, a bank can foreclose on your home relatively quickly, often within a few months, once the process begins. The timeline largely depends on how fast the lender files for foreclosure and whether the borrower takes steps to address the default. This urgency highlights the importance of exploring Fargo North Dakota Short-Term Mortgage Redemption options as soon as financial difficulties arise.

The six phases of foreclosure include pre-foreclosure, notice of default, public auction, redemption period, eviction, and post-foreclosure. Each phase represents a critical point in the process where specific actions occur, either to resolve the default or progress toward foreclosure. Being aware of these phases can help borrowers make informed decisions during Fargo North Dakota Short-Term Mortgage Redemption.

Foreclosure timelines in North Dakota can vary, but typically the process may take several months. After defaulting on a mortgage, the lender can initiate foreclosure proceedings that can last anywhere from a few months to over a year. Understanding these timelines is important for anyone considering their options in Fargo North Dakota Short-Term Mortgage Redemption.