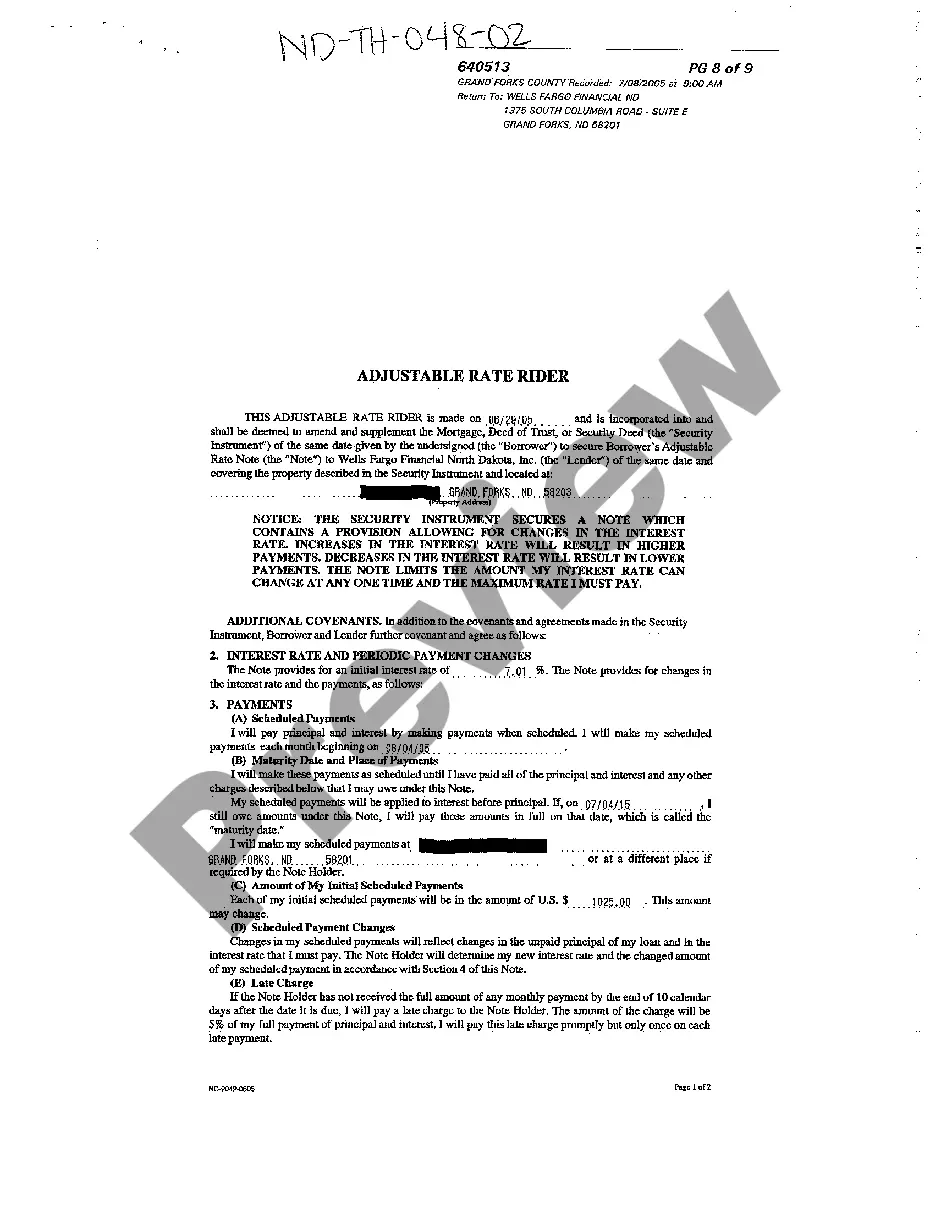

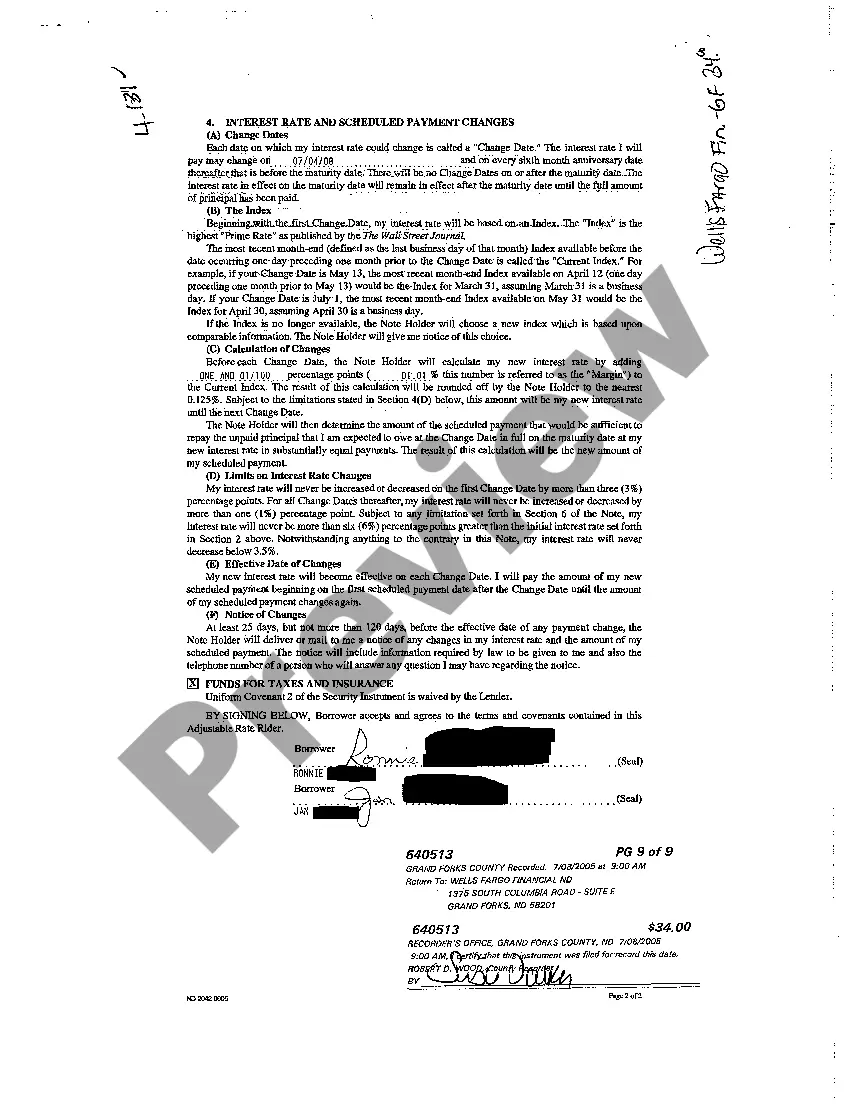

Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption refers to a specific agreement that can be attached to short-term mortgages in Fargo, North Dakota. This unique rider allows borrowers to have an adjustable interest rate on their mortgage for a predetermined period of time before transitioning to a fixed rate. This provides some flexibility for borrowers, especially if they anticipate changes in the interest rate market. The Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption offers several benefits, making it popular among homebuyers and investors. Firstly, it helps to manage cash flow and budgeting by offering lower initial interest rates compared to traditional fixed-rate mortgages. This can be advantageous for borrowers who intend to sell the property or refinance before the adjustable rate period ends. Secondly, the rider offers the potential to take advantage of favorable market conditions in Fargo. If interest rates decrease during the adjustable rate period, borrowers can enjoy lower monthly payments and potentially save money. On the other hand, if rates increase, borrowers may benefit from refinancing or selling their property before the rates become too burdensome. It's important to note that there are various types of Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption, each with its own specifications. These variations depend on factors such as the length of the adjustable rate period, the frequency of interest rate adjustments, and any rate caps or limits in place. Some common types include: 1. Fargo North Dakota 3/1 Adjustable Rate Rider: This rider offers a fixed interest rate for the first three years of the mortgage, followed by annual adjustments based on market conditions. 2. Fargo North Dakota 5/1 Adjustable Rate Rider: With this type, borrowers enjoy a fixed interest rate for the initial five years before annual adjustments kick in. 3. Fargo North Dakota 7/1 Adjustable Rate Rider: This rider provides a fixed interest rate for seven years, after which adjustments occur annually. 4. Fargo North Dakota 10/1 Adjustable Rate Rider: Borrowers receive a fixed interest rate for ten years before transitioning to annual adjustments. These are just a few examples of the Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption options available. It's essential for borrowers to carefully review the terms and conditions associated with these riders, as they can significantly impact the overall cost and feasibility of the mortgage. Seeking advice from a reputable mortgage professional is advisable to ensure borrowers are fully informed and make informed decisions when considering this type of mortgage arrangement in Fargo, North Dakota.

Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption

Description

How to fill out Fargo North Dakota Adjustable Rate Rider Attached To Short-Term Mortgage Redemption?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Fargo North Dakota Adjustable Rate Rider Attached to Short-Term Mortgage Redemption. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!