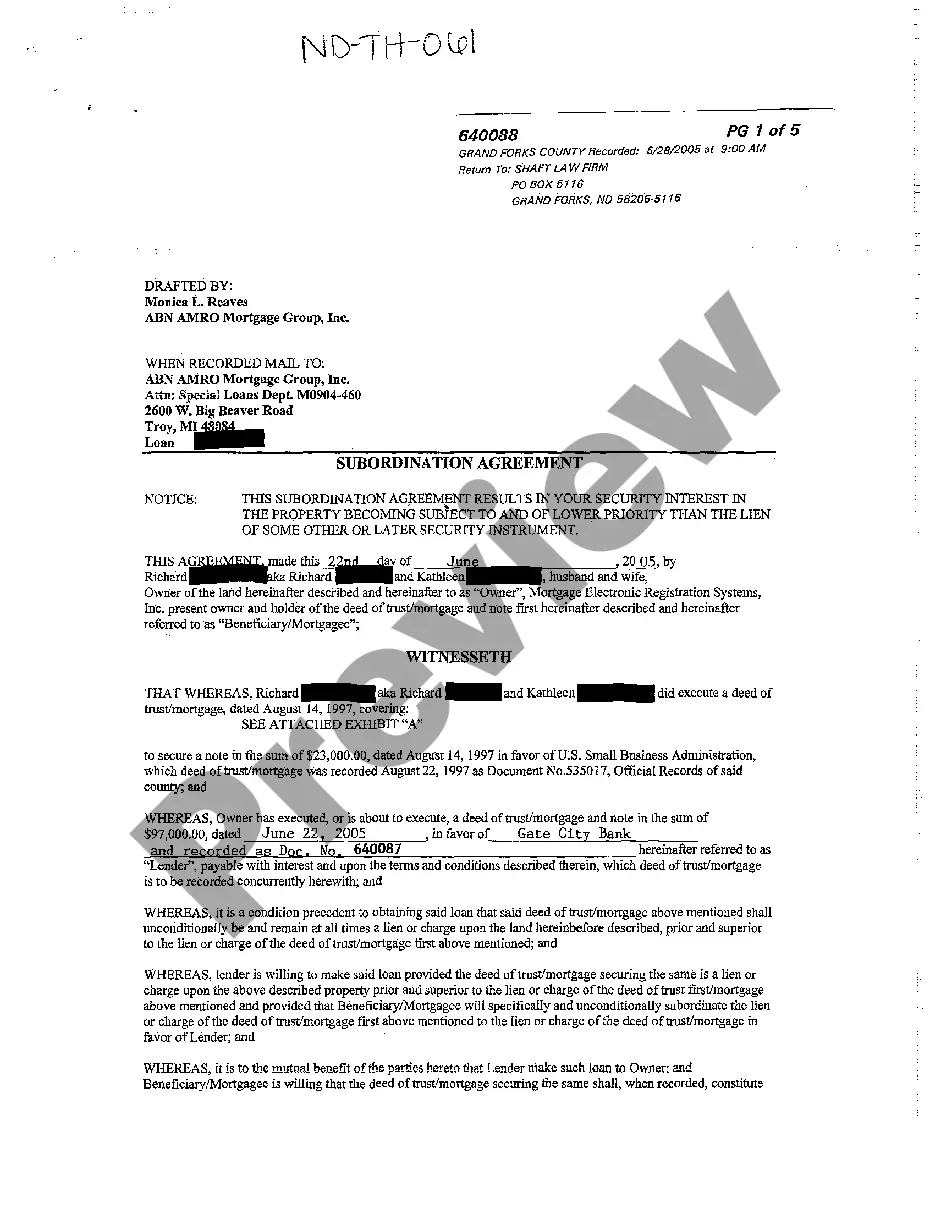

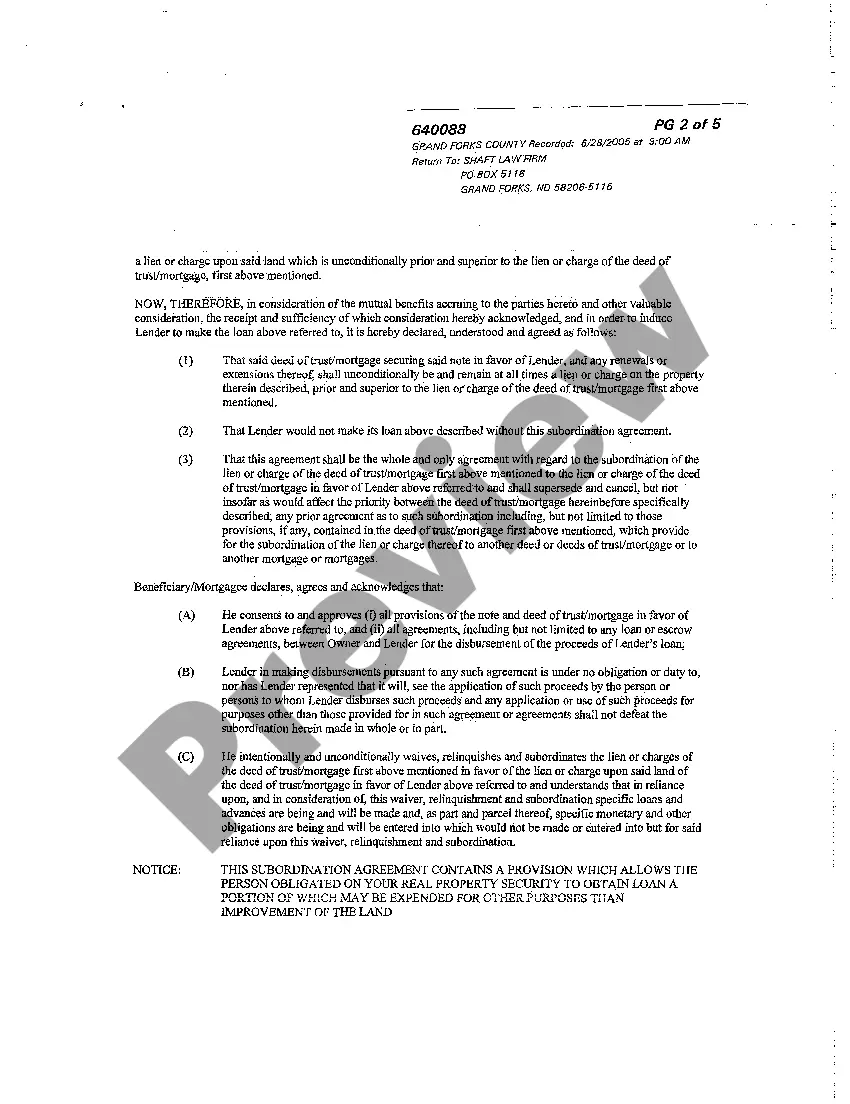

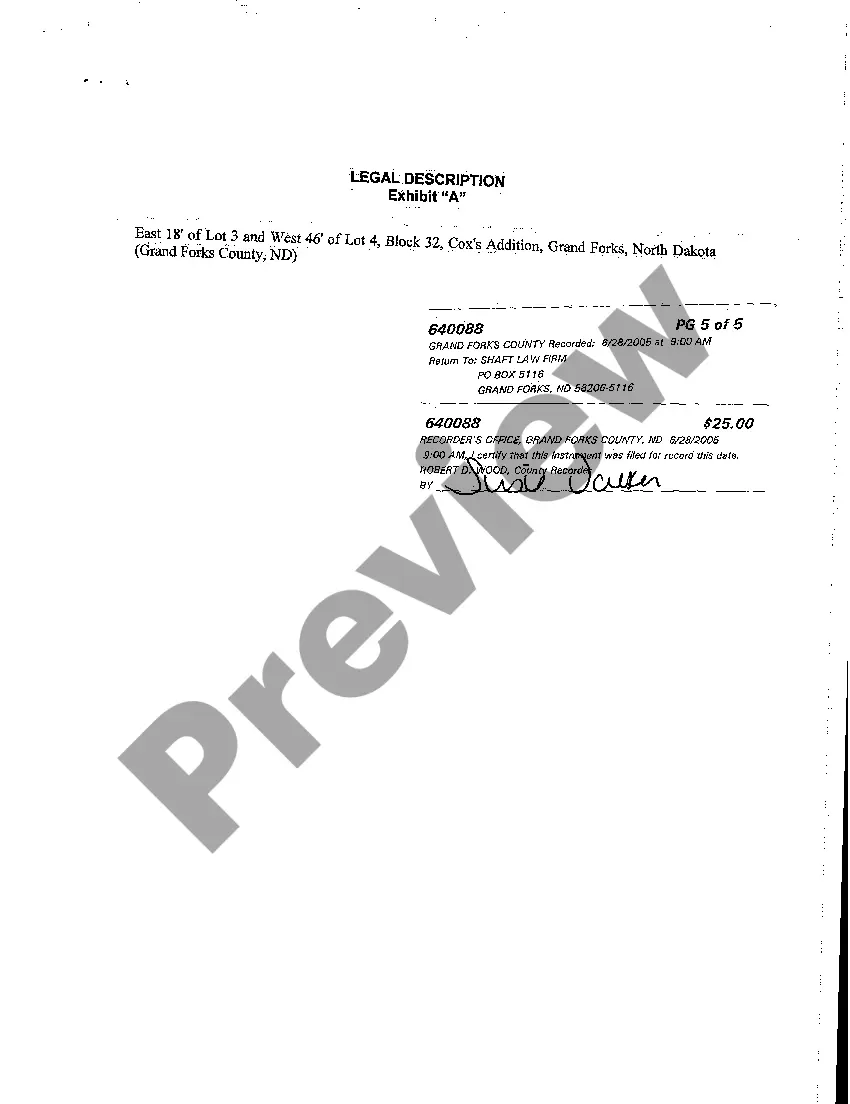

A Fargo North Dakota Subordination Agreement is a legal document that outlines the relationship between multiple parties involved in a real estate transaction, typically in the context of a mortgage loan. This agreement is often used when a borrower seeks additional financing or refinancing on a property that is already encumbered by an existing mortgage. In essence, the subordination agreement is an agreement by which the existing mortgage lender agrees to subordinate their mortgage lien position to a new lender. By doing so, the new lender's lien takes priority over the existing mortgage, allowing them to have the first claim on the property in the event of default or foreclosure. This agreement is crucial in situations where the borrower needs to secure additional funds or take advantage of better loan terms offered by a new lender. However, the existing lender may not be willing to release their first lien position, as it poses a higher risk to their interest in the property. By signing a subordination agreement, the existing lender agrees to put their lien in a secondary position, known as a subordinate lien. Keywords: Fargo North Dakota, subordination agreement, real estate transaction, mortgage loan, refinancing, additional financing, lien position, encumbered, borrower, priority, default, foreclosure, mortgage lender, lien, subordinate lien. There are different types of Fargo North Dakota Subordination Agreements, including: 1. First Lien Subordination: In this type of subordination agreement, the existing first mortgage holder agrees to subordinate their lien to a new lender's lien, allowing the new lender to take the first position. 2. Second Lien Subordination: This type of agreement occurs when there is an existing second mortgage on the property and the lender agrees to subordinate their lien to a new lender's lien. This enables the new lender to have a higher claim on the property in case of default. 3. Intercreditor Agreement: This type of subordination agreement is commonly used in commercial real estate transactions. It establishes the priority of competing lenders' liens and outlines the rights and obligations of each lender in relation to the property. 4. Partial Subordination: In some cases, the existing lender may agree to subordinate only a portion of their lien to the new lender. This can arise when the borrower needs additional funds but wants to maintain the terms and conditions of the existing mortgage for a certain portion of the loan. 5. Subordination to Future Advances: This agreement is used when a lender agrees to subordinate their lien to future advances made by the borrower. It allows the borrower to access additional funds in the future without affecting the priority of the existing lien. It is crucial for all parties involved in a real estate transaction in Fargo, North Dakota to understand the implications and terms of a subordination agreement. Seeking legal advice is highly recommended ensuring compliance with applicable laws and to protect the interests of all parties involved.

Fargo North Dakota Subordination Agreement

Description

How to fill out Fargo North Dakota Subordination Agreement?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you want. Our useful platform with a huge number of templates makes it simple to find and get almost any document sample you will need. You are able to export, fill, and certify the Fargo North Dakota Subordination Agreement in a couple of minutes instead of browsing the web for many hours attempting to find the right template.

Utilizing our library is a great way to increase the safety of your record filing. Our experienced lawyers regularly check all the records to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Fargo North Dakota Subordination Agreement? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Open the page with the template you need. Make certain that it is the form you were looking for: check its title and description, and use the Preview option if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Pick the format to get the Fargo North Dakota Subordination Agreement and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable document libraries on the internet. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Fargo North Dakota Subordination Agreement.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!