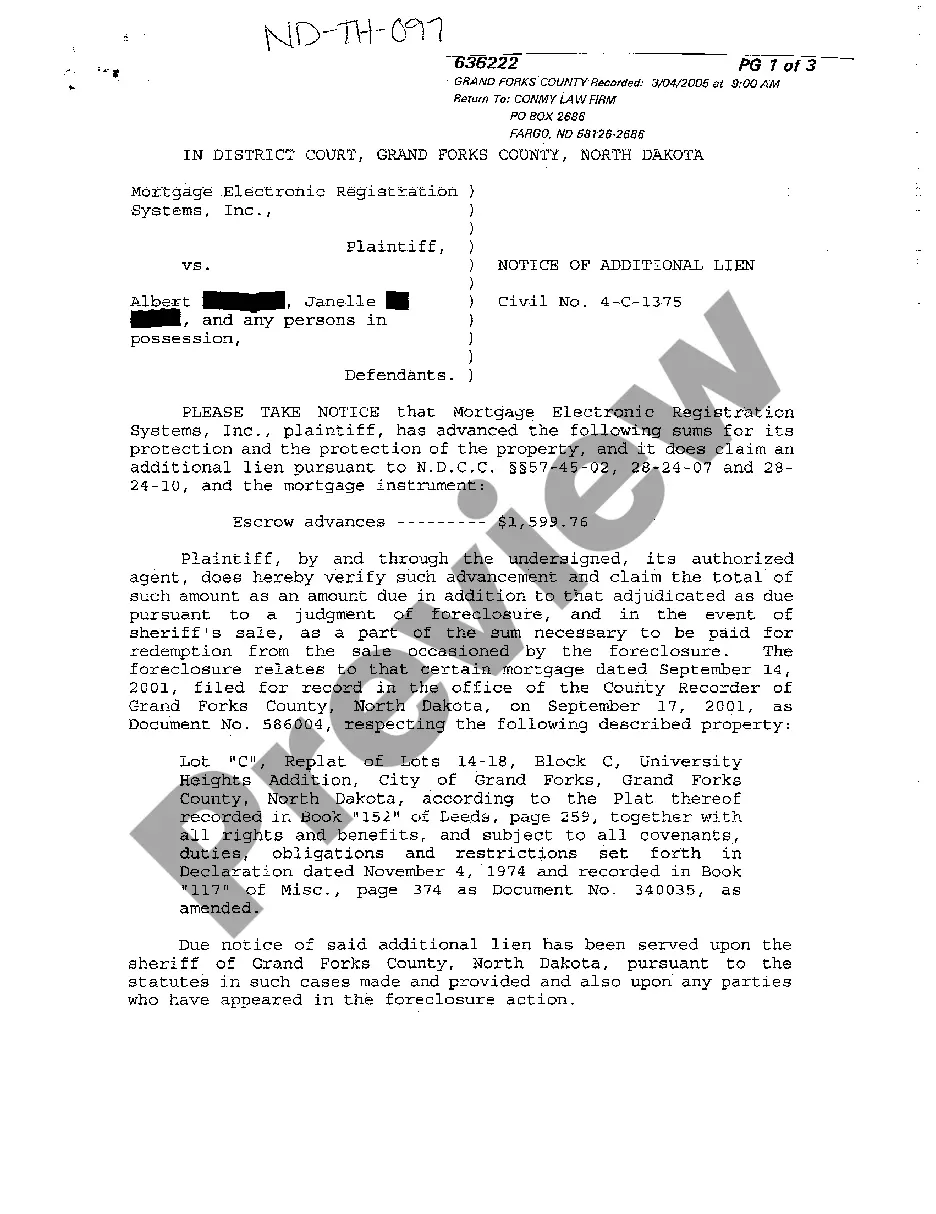

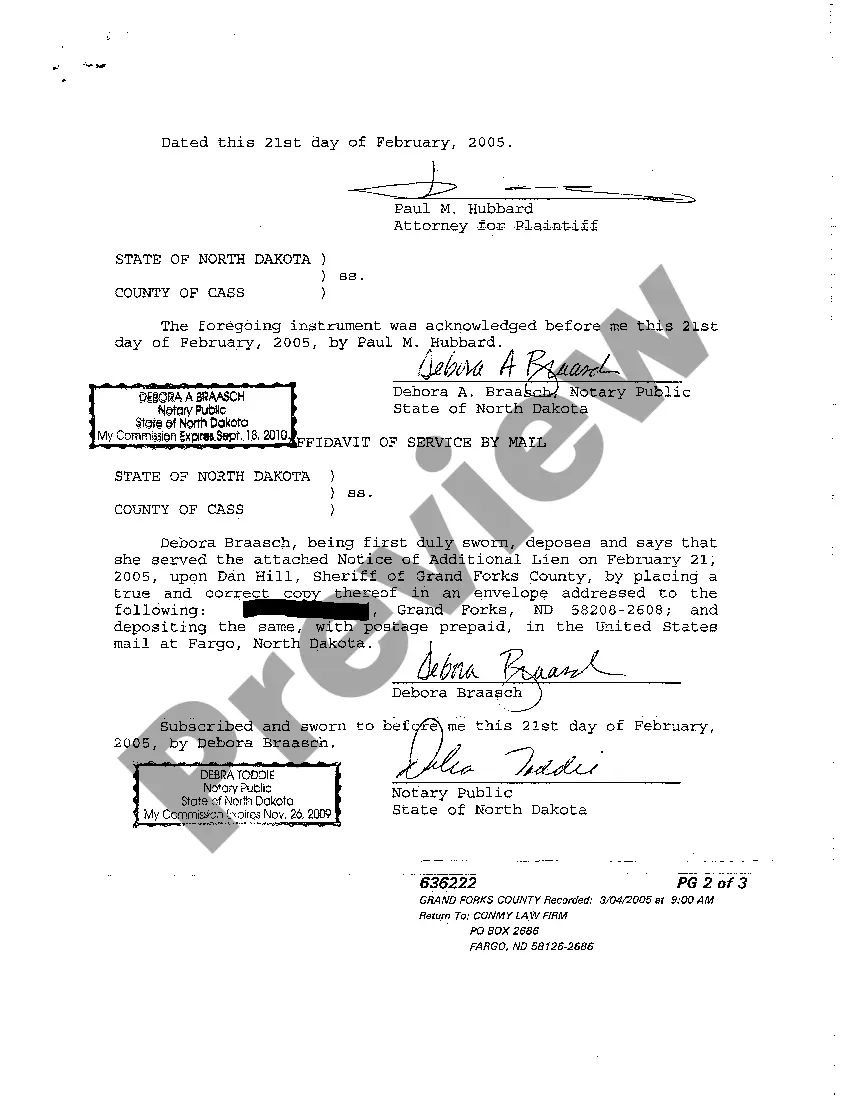

Fargo, North Dakota Notice of Additional Lien: Understanding the Process and Types In Fargo, North Dakota, a Notice of Additional Lien refers to a legal document filed to indicate the existence of an additional lien on a property or property owner's assets. This notice serves as a crucial step in securing the rights of creditors who wish to collect debts owed to them by the property owner. By filing a Notice of Additional Lien, creditors aim to protect their interests and increase the likelihood of receiving payment. Different Types of Fargo, North Dakota Notice of Additional Lien: 1. Mortgage Lien: When a borrower secures a loan to purchase a property or refinance an existing mortgage, the lender typically files a mortgage lien. This type of lien enables the lender to claim ownership rights to the property if the borrower fails to fulfill their repayment obligations. 2. Mechanics Lien: Construction contractors, subcontractors, or suppliers who have provided labor, materials, or services for improvements or repairs on a property, may file a mechanics lien. This type of lien secures the contractor's right to payment for work completed, acting as a protection against non-payment. 3. Tax Lien: In certain cases, homeowners may fail to pay their property taxes to the local government. As a result, the government may file a tax lien against the property. This lien grants the government the right to collect outstanding tax debts by either selling the property or applying legal measures. 4. Judgment Lien: If an individual or an entity obtains a judgment against a property owner through a court ruling, they can file a judgment lien. This type of lien ensures that the creditor receives their owed payment from the proceeds of the sale of the property. It is essential to note that the filing process for a Notice of Additional Lien may differ depending on the specific type of lien and the applicable laws of Fargo, North Dakota. Typically, a creditor will need to gather the necessary documentation, such as invoices, contracts, or court judgments, before submitting the notice with the appropriate governmental authority or county recorder's office. Once filed, a Notice of Additional Lien becomes public knowledge, alerting potential buyers, lenders, or other creditors about the existence of debt or liens associated with the property. It serves as an important source of information allowing interested parties to assess the property's financial obligations and determine their options accordingly. In summary, a Fargo, North Dakota Notice of Additional Lien refers to a legal document that acknowledges the presence of a lien on a property. Common types of liens include mortgage liens, mechanics liens, tax liens, and judgment liens. Filing a Notice of Additional Lien is a crucial step for creditors to protect their interests and improve the chances of recovering owed payments.

Fargo, North Dakota Notice of Additional Lien: Understanding the Process and Types In Fargo, North Dakota, a Notice of Additional Lien refers to a legal document filed to indicate the existence of an additional lien on a property or property owner's assets. This notice serves as a crucial step in securing the rights of creditors who wish to collect debts owed to them by the property owner. By filing a Notice of Additional Lien, creditors aim to protect their interests and increase the likelihood of receiving payment. Different Types of Fargo, North Dakota Notice of Additional Lien: 1. Mortgage Lien: When a borrower secures a loan to purchase a property or refinance an existing mortgage, the lender typically files a mortgage lien. This type of lien enables the lender to claim ownership rights to the property if the borrower fails to fulfill their repayment obligations. 2. Mechanics Lien: Construction contractors, subcontractors, or suppliers who have provided labor, materials, or services for improvements or repairs on a property, may file a mechanics lien. This type of lien secures the contractor's right to payment for work completed, acting as a protection against non-payment. 3. Tax Lien: In certain cases, homeowners may fail to pay their property taxes to the local government. As a result, the government may file a tax lien against the property. This lien grants the government the right to collect outstanding tax debts by either selling the property or applying legal measures. 4. Judgment Lien: If an individual or an entity obtains a judgment against a property owner through a court ruling, they can file a judgment lien. This type of lien ensures that the creditor receives their owed payment from the proceeds of the sale of the property. It is essential to note that the filing process for a Notice of Additional Lien may differ depending on the specific type of lien and the applicable laws of Fargo, North Dakota. Typically, a creditor will need to gather the necessary documentation, such as invoices, contracts, or court judgments, before submitting the notice with the appropriate governmental authority or county recorder's office. Once filed, a Notice of Additional Lien becomes public knowledge, alerting potential buyers, lenders, or other creditors about the existence of debt or liens associated with the property. It serves as an important source of information allowing interested parties to assess the property's financial obligations and determine their options accordingly. In summary, a Fargo, North Dakota Notice of Additional Lien refers to a legal document that acknowledges the presence of a lien on a property. Common types of liens include mortgage liens, mechanics liens, tax liens, and judgment liens. Filing a Notice of Additional Lien is a crucial step for creditors to protect their interests and improve the chances of recovering owed payments.