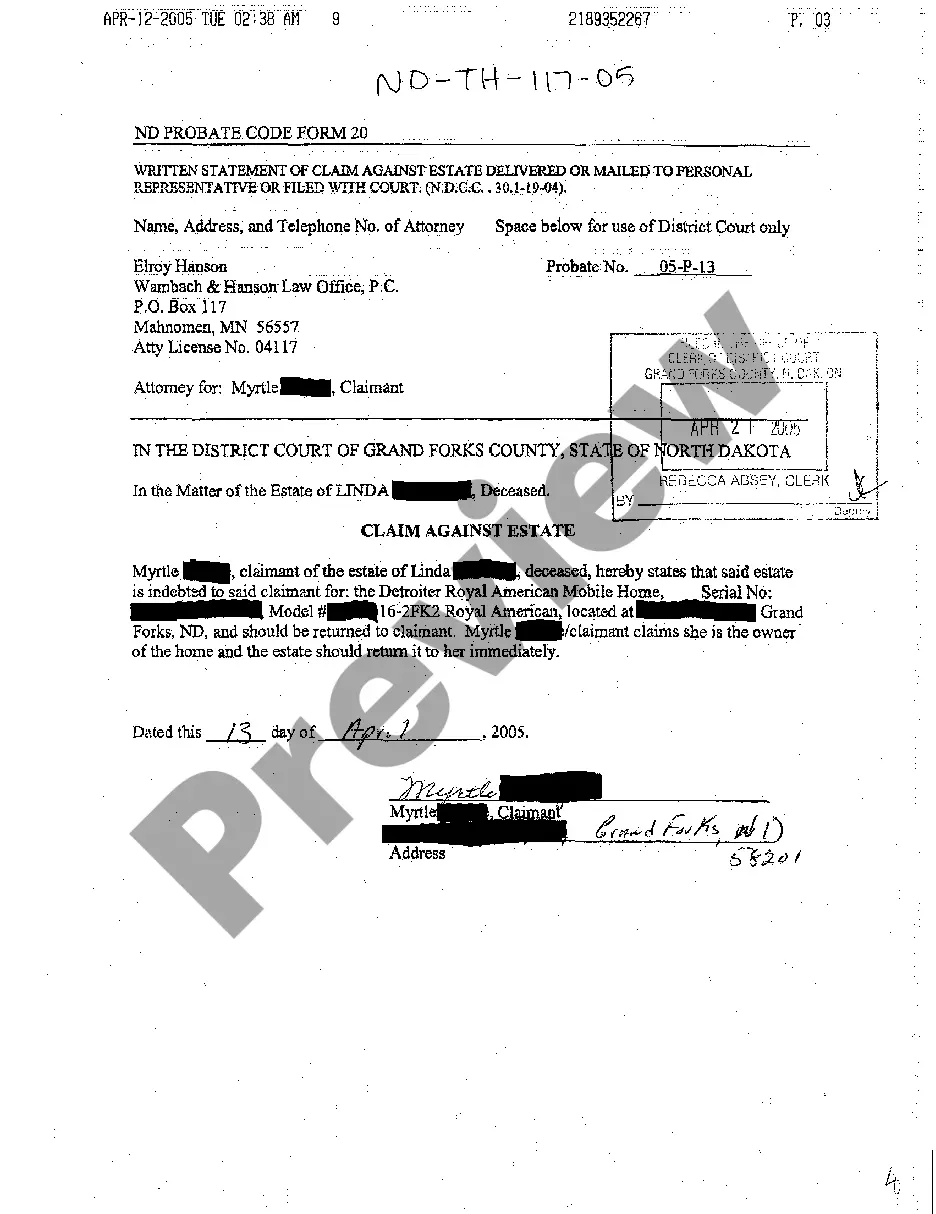

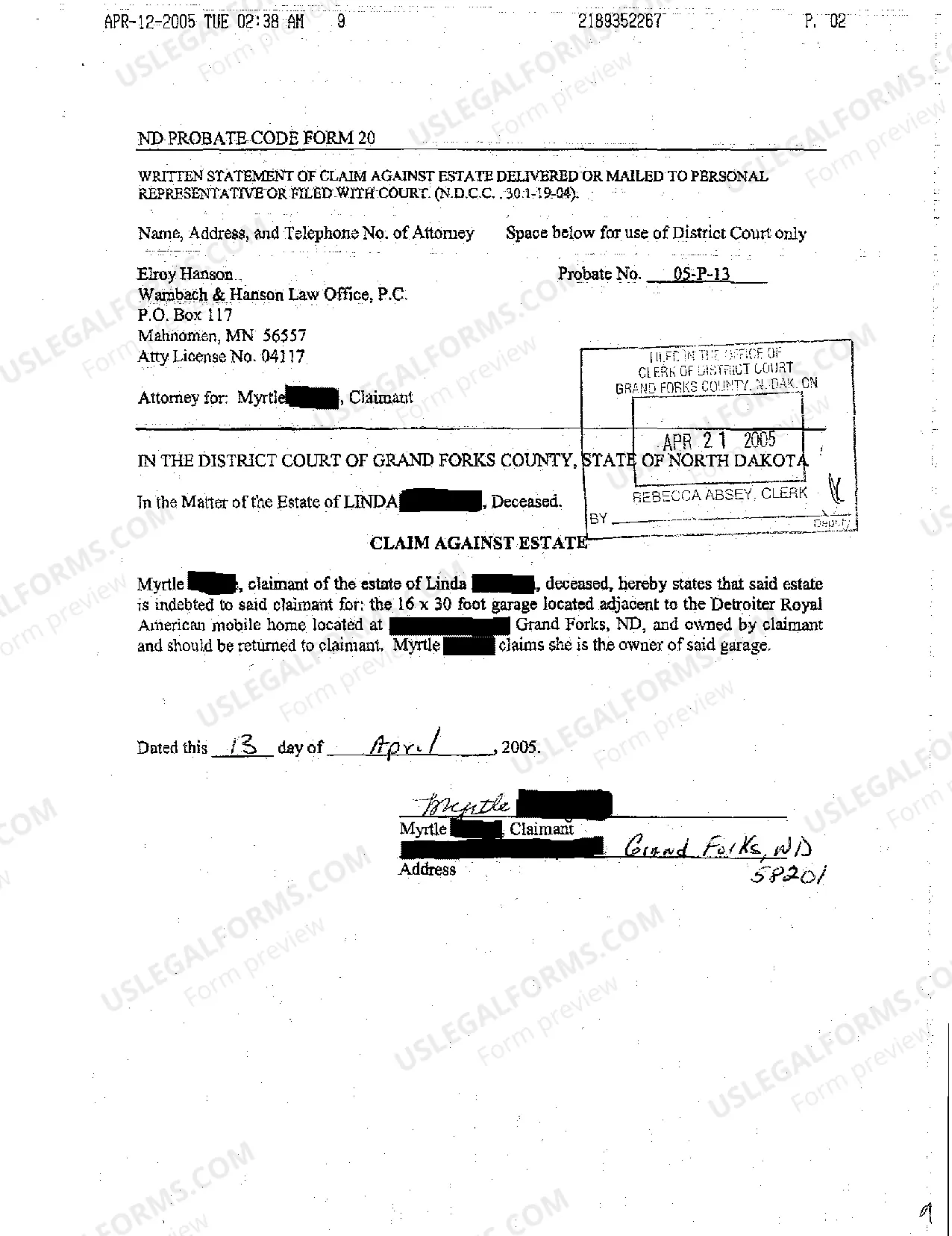

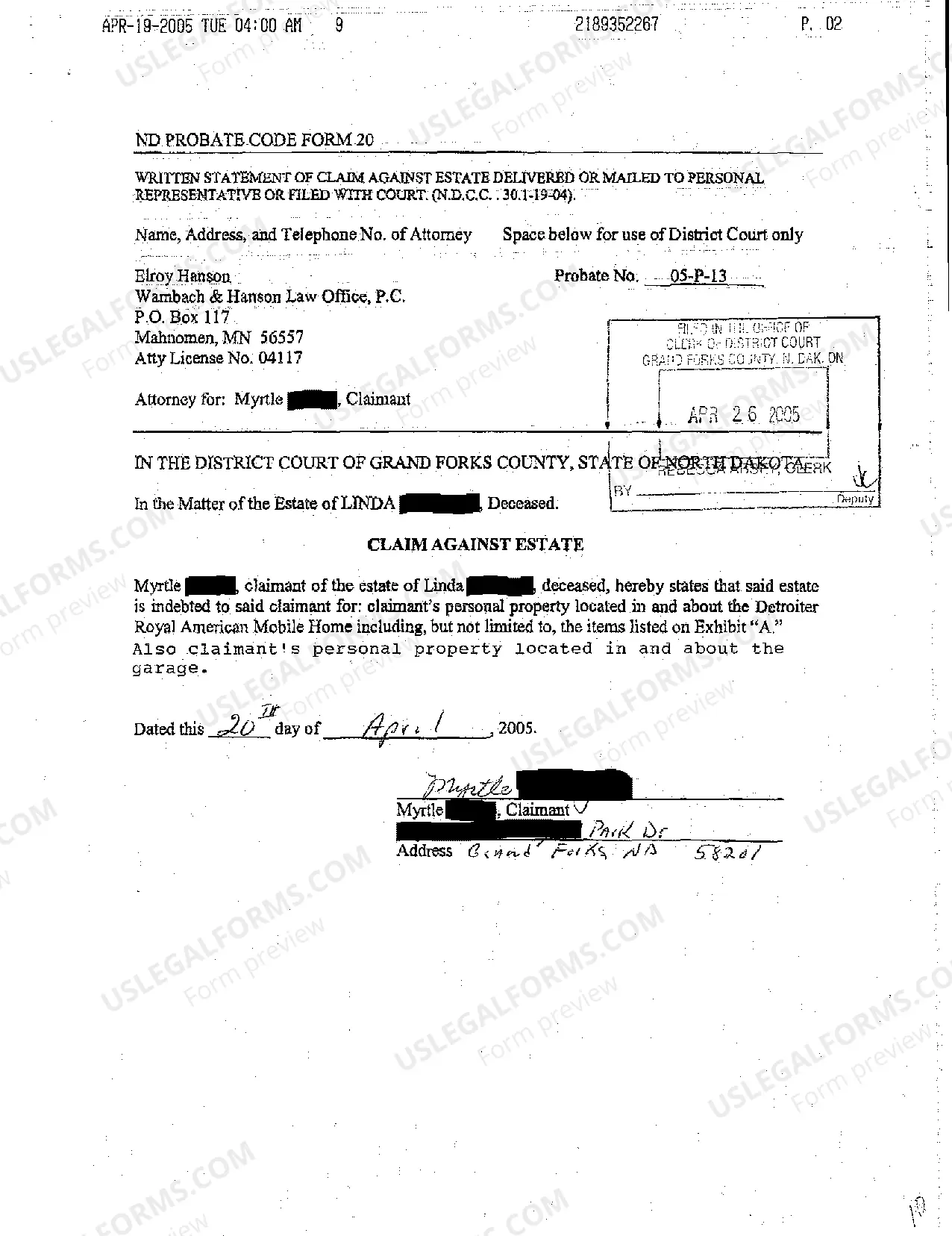

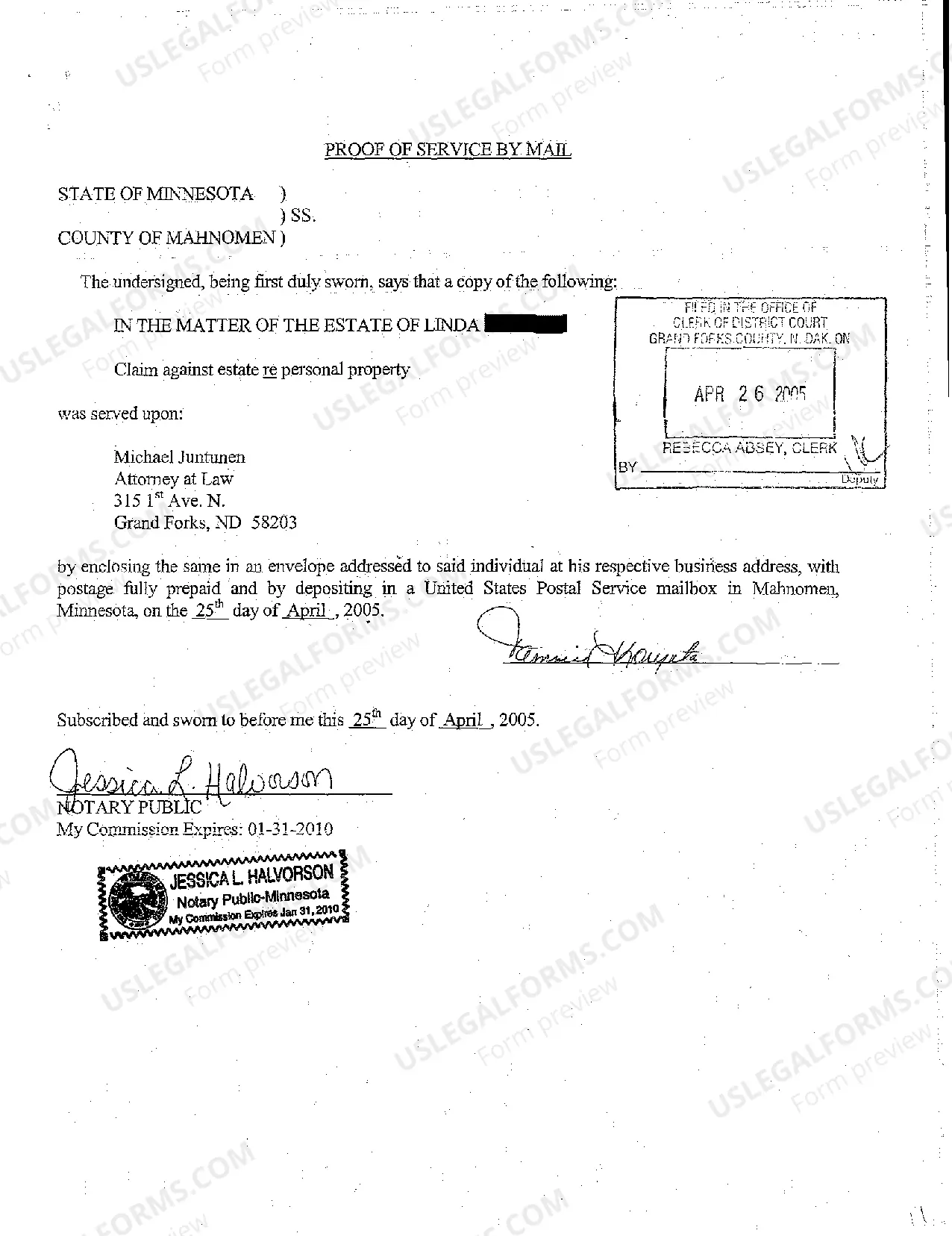

Title: Understanding Fargo North Dakota Claim Against Estate: Types and Overview Introduction: In Fargo, North Dakota, a claim against an estate refers to a legal process through which a creditor, beneficiary, or interested party seeks to assert their right to receive a share of the deceased person's assets. Various situations can arise that could prompt someone to file a claim against an estate in Fargo, North Dakota. This article provides a comprehensive overview of the different types of claim against an estate in the region. 1. Probate Claims: Probate claims are perhaps the most common type of claim against an estate in Fargo, North Dakota. These claims typically arise when a creditor believes they are owed money by the deceased individual. Claims may include unpaid debts, outstanding loans, unpaid bills, or pending lawsuits that the deceased owed money on. 2. Medicaid Estate Recovery Claims: Medicaid estate recovery claims are specifically related to the reimbursement of Medicaid benefits provided to the deceased. If the individual received Medicaid benefits during their lifetime, the state or government agency may have the right to recover those expenses from the estate after their passing. 3. Family Maintenance Claims: Family maintenance claims can be filed by individuals in significant financial need who were financially dependent on the deceased person. These claims aim to ensure that adequate provision is made for the maintenance and support of the person making the claim, whether they are a spouse, child, or other dependent. 4. Contesting a Will: In certain circumstances, interested parties might contest the validity of the deceased person's will. This occurs when there are concerns about the legality of the document, including claims of fraud, undue influence, or lack of mental capacity during its creation. Contesting a will can lead to legal proceedings, resulting in changes to the distribution of the estate. 5. Inheritance Tax Claims: Inheritance tax claims relate to the payment of taxes on the estate left behind by the deceased person. When the estate's assets exceed a specific threshold, it becomes subject to inheritance tax, and various parties involved may have a claim against the estate to ensure proper tax payments are made. Conclusion: Understanding the different types of claims against an estate in Fargo, North Dakota is crucial for individuals involved in the estate administration process or considering filing a claim. While the most common claim relates to unpaid debts (probate claims), one should also be aware of Medicaid recovery claims, family maintenance claims, will contest, and inheritance tax claims. Seeking professional legal advice and assistance is recommended to navigate the complexities and ensure appropriate outcomes during the claim process.

Fargo North Dakota Claim Against Estate

Description

How to fill out Fargo North Dakota Claim Against Estate?

If you are looking for a legitimate form template, it’s incredibly difficult to discover a more user-friendly service than the US Legal Forms website – likely one of the most comprehensive collections on the web.

With this collection, you can locate a vast array of templates for both business and personal needs categorized by types and regions, or by keywords.

Using the advanced search feature, obtaining the latest Fargo North Dakota Claim Against Estate is as simple as 1-2-3.

Complete the financial transaction. Utilize your credit card or PayPal account to finish the registration process.

Obtain the template. Select the file format and download it to your device.

- Additionally, the accuracy of each document is validated by a team of skilled attorneys who routinely review the templates on our site and update them in line with the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to access the Fargo North Dakota Claim Against Estate is to Log Into your profile and click the Download button.

- If you’re visiting US Legal Forms for the first time, just follow the instructions listed below.

- Ensure you have opened the sample you require. Review its details and use the Preview option to inspect its content. If it does not fulfill your requirements, use the Search feature at the top of the page to find the appropriate document.

- Confirm your choice. Select the Buy now button. Then, choose the desired pricing plan and provide your information to create an account.

Form popularity

FAQ

No, North Dakota does not impose an estate or inheritance tax. This absence of taxes can benefit heirs by allowing them to inherit the decedent's assets without state tax deductions. Understanding this aspect can simplify the process of settling a Fargo North Dakota claim against an estate, making it easier for beneficiaries to receive their inheritances without additional financial burdens.

When a creditor files a claim against an estate, the executor must review the claim to verify its validity. If the claim is legitimate, the executor will prioritize settling it using the estate's assets. This process helps maintain fairness in the distribution of remaining assets to beneficiaries and is an important part of managing a Fargo North Dakota claim against the estate, allowing it to be resolved smoothly.

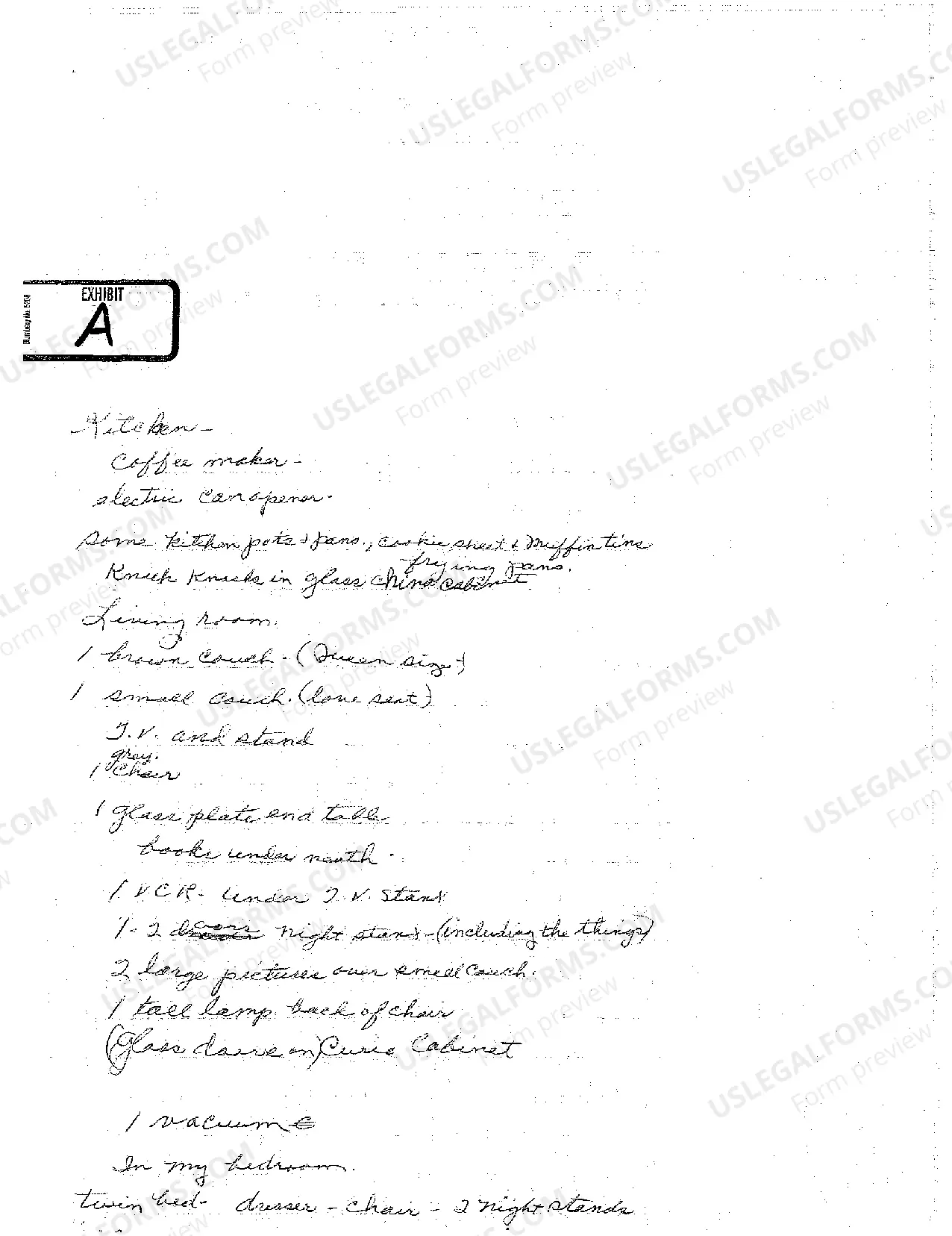

Probate in North Dakota is triggered when a person passes away, leaving assets that need to be distributed according to their will or state law if no will exists. If an estate includes real property, significant financial accounts, or personal belongings, probate provides a legal framework to manage and transfer these assets. Executors play a vital role in this process, ensuring that all claims against the estate are addressed appropriately.

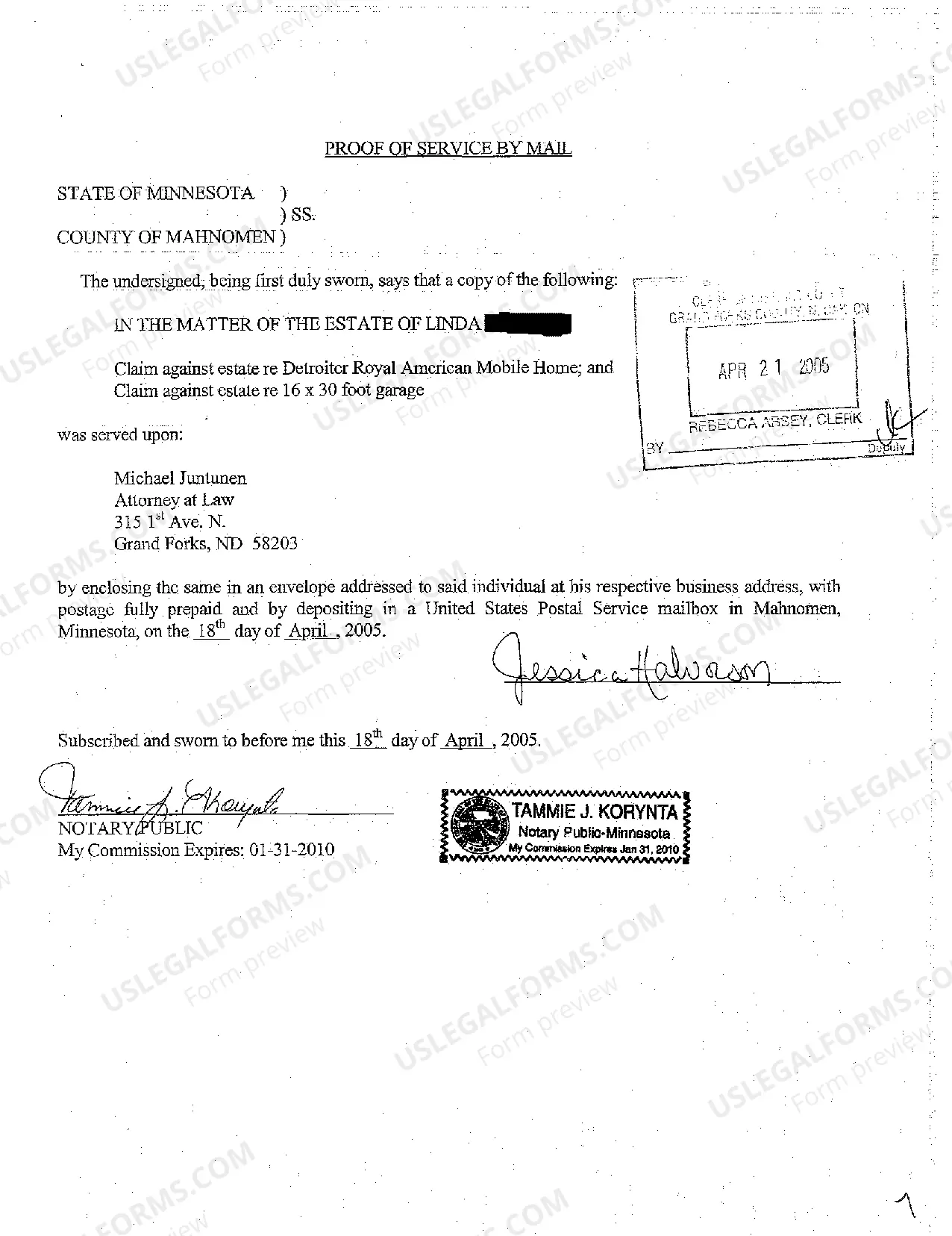

Executors discover claims against a decedent's estate through various means, such as reviewing financial records, bank statements, and outstanding invoices. Public notices may also alert creditors to file claims within a specified timeframe. By actively investigating these claims, executors fulfill their responsibility and ensure that valid demands are settled, protecting the estate's integrity in Fargo, North Dakota.

A claim against the estate refers to any demand for payment from the estate's assets. This may include debts owed by the deceased, outstanding taxes, or financial obligations to creditors. In Fargo, North Dakota, recognizing and addressing these claims is essential for the fair distribution of an estate's assets to beneficiaries while protecting their interests.

In Fargo, North Dakota, a personal representative typically has up to one year to settle an estate. However, certain circumstances may extend this timeline, such as the complexity of the estate or delays in probate proceedings. It's crucial for the personal representative to act diligently, as timely settlement helps in addressing claims against the estate and ensuring beneficiaries receive their inheritances promptly.

To avoid probate in North Dakota, you can consider various estate planning strategies like establishing a living trust, transferring assets to joint ownership, or designating beneficiaries on accounts and insurance policies. These methods can streamline the distribution of your estate without the need for probate, which can be particularly beneficial when dealing with a Fargo North Dakota Claim Against Estate. Utilizing services from uslegalforms can provide you with the necessary tools and resources to implement these options effectively.

The minimum value for probate in North Dakota is set at $50,000. If the estate's assets are below this figure, you may not need to go through the probate process. This can significantly simplify the management of a Fargo North Dakota Claim Against Estate, enabling faster resolution and reduced legal complexities. Consulting with professionals can help you make informed decisions about your situation.

In North Dakota, the probate threshold refers to the minimum value of a deceased person's assets that require probate administration. Currently, if the total value exceeds $50,000, a probate process is typically necessary. Understanding this threshold is essential when considering a Fargo North Dakota Claim Against Estate, as it determines how the estate's assets will be distributed. You can seek assistance to navigate this process through platforms like uslegalforms.

Making a claim against an estate in Fargo, North Dakota, involves submitting a written claim to the probate court. Ensure you include details about your relationship to the deceased, the nature of your claim, and supporting documentation. Meeting state deadlines is essential, as claims often must be filed within specific timeframes. If you need guidance, USLegalForms can provide the necessary tools and information to help streamline your claim process.