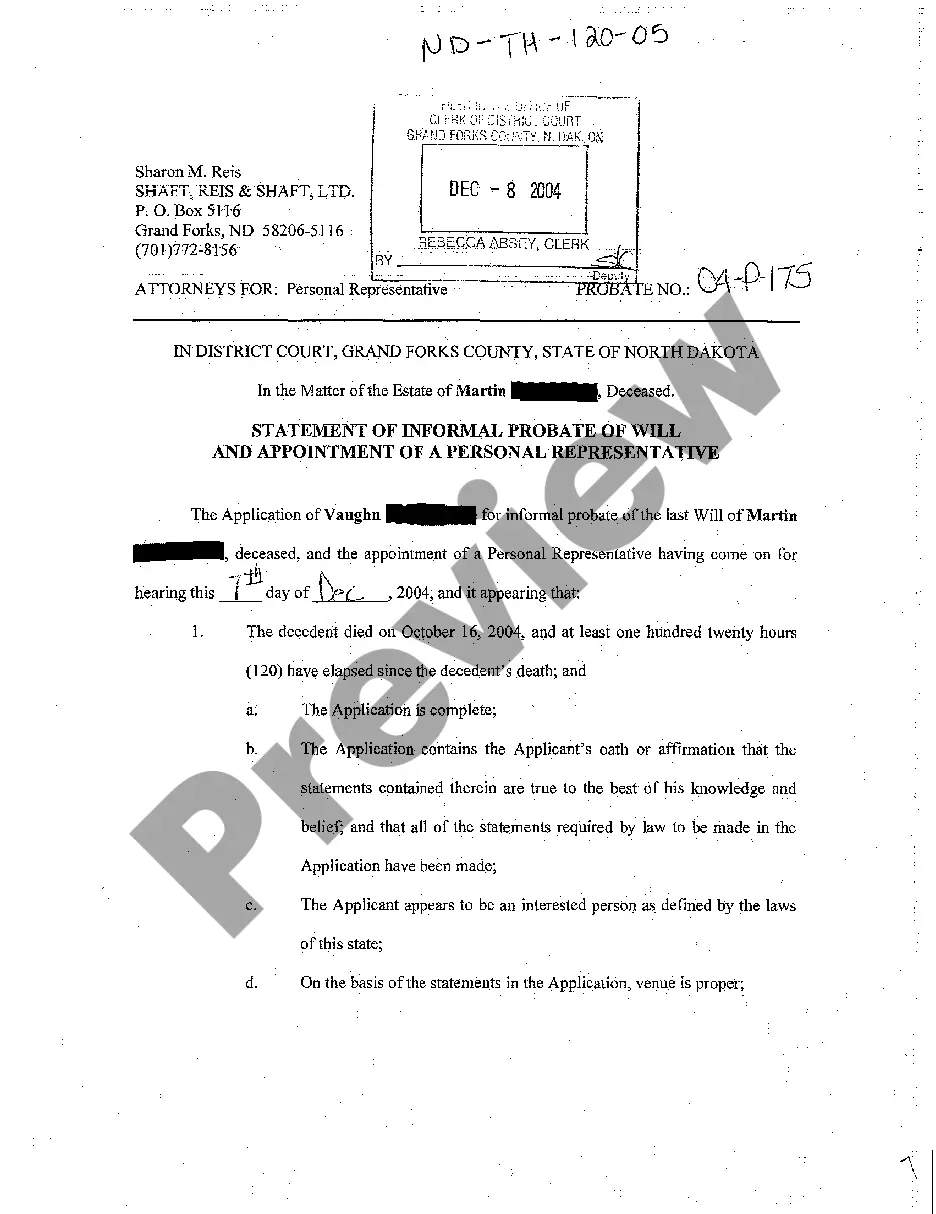

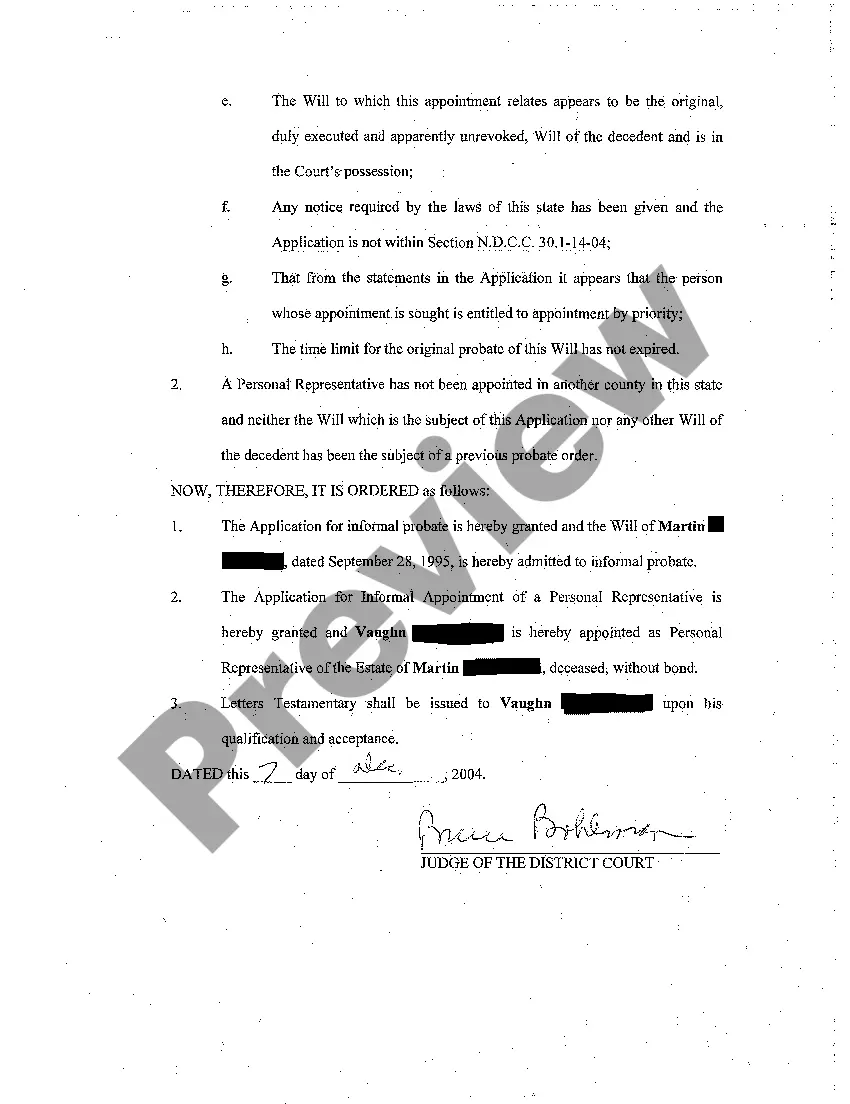

The Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative is a legal document that is used in the probate process to establish the validity of a deceased person's will and appoint a personal representative to handle the administration of their estate. This statement serves as a formal declaration of the court's recognition of the will and the authority of the appointed representative. When someone passes away in Fargo, North Dakota, their will needs to go through the probate process, which involves validating the will and distributing the deceased person's assets according to their wishes. The statement of informal probate of will and appointment of a personal representative is an essential step in this process. By using this statement, the court confirms the authenticity of the will and recognizes its legal effect. It also authorizes the appointed personal representative, who is typically mentioned in the will, to act in the deceased person's best interests and carry out their final wishes. The personal representative is responsible for managing the estate, paying any outstanding debts or taxes, and distributing assets to the beneficiaries as outlined in the will. Different types or scenarios of the Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative may include: 1. Testate Probate: In cases where the deceased individual has left behind a valid will, this statement ensures that the provisions of the will are followed and that the named personal representative is authorized to act on their behalf. 2. Intestate Probate: If a person dies without a valid will or their will is deemed invalid, intestate probate comes into play. The court will appoint a personal representative based on the state's intestate succession laws, which determine who inherits the deceased person's assets. 3. Appointment of Alternate Personal Representative: Sometimes, the named personal representative in a will may be unable or unwilling to fulfill their duties. In such cases, an alternate personal representative may be appointed to take on the responsibilities outlined in the will. 4. Temporary Personal Representative: In situations where immediate action is required, such as securing and preserving assets or filing necessary tax returns, a temporary personal representative may be appointed until a permanent personal representative is chosen. It is important to note that the specific requirements and processes for probate may vary depending on the state and local laws. Additionally, seeking legal advice from an attorney experienced in probate law is highly advisable to ensure compliance with all necessary procedures and documentation.

Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative

Description

How to fill out Fargo North Dakota Statement Of Informal Probate Of Will And Appointment Of A Personal Representative?

Do you need a reliable and inexpensive legal forms provider to get the Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Fargo North Dakota Statement of Informal Probate of Will and Appointment of a Personal Representative in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online for good.