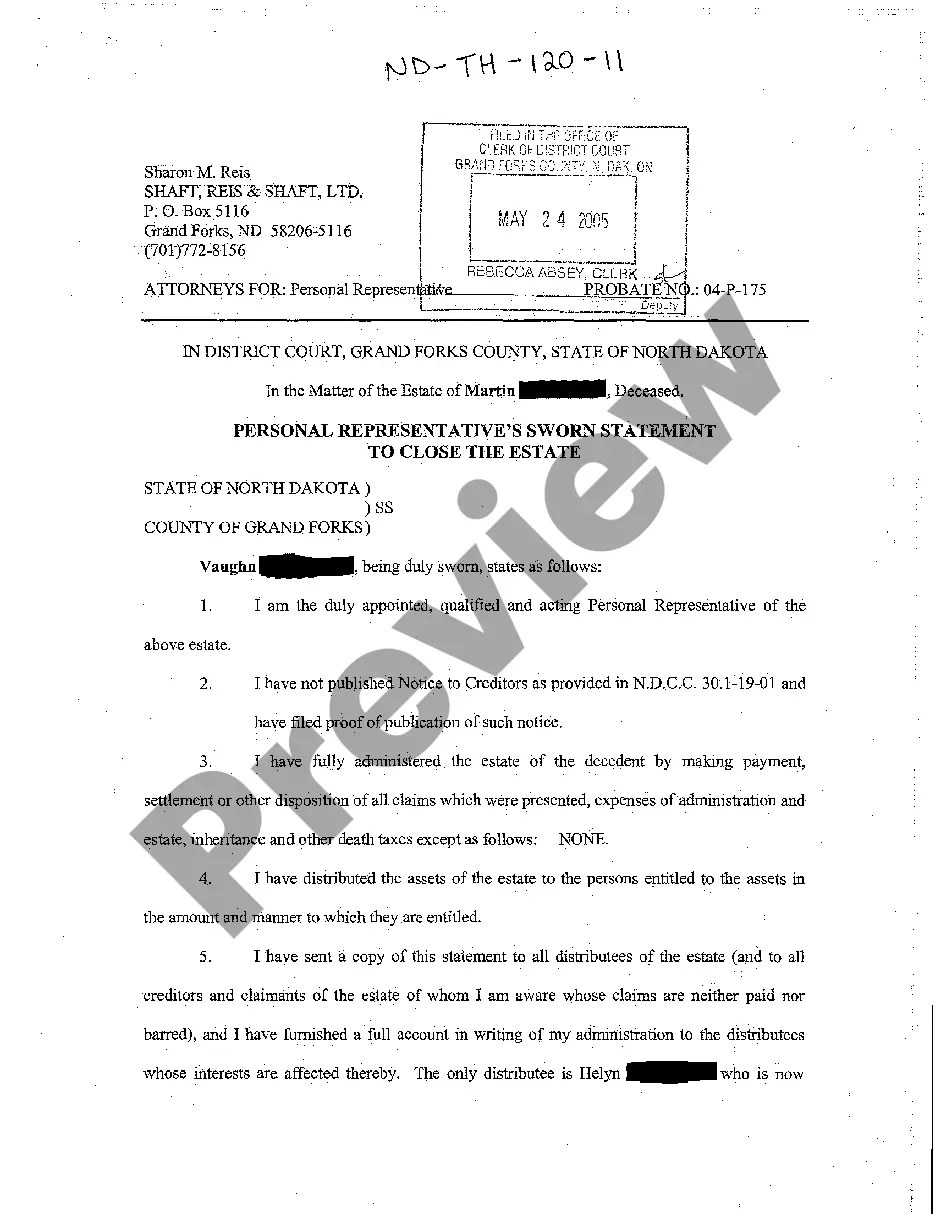

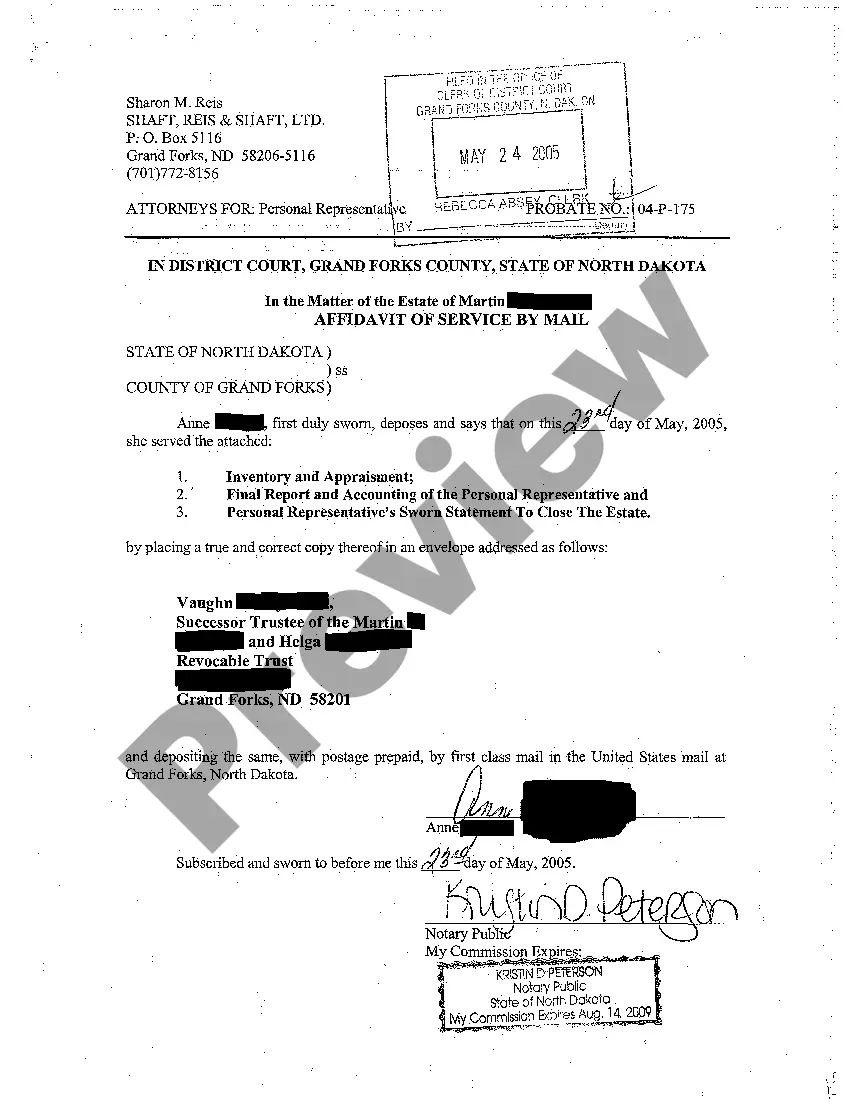

The Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate is an essential legal document that outlines the necessary steps and requirements for closing an estate in Fargo, North Dakota. This detailed description will provide valuable insights into the purpose, content, and types of statements associated with closing an estate. The purpose of the Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate is to provide an official declaration from the personal representative (also known as an executor or administrator) of the deceased's estate, verifying that all necessary tasks and obligations have been completed to finalize the estate administration process. Keywords: Fargo North Dakota, Personal Representative's Sworn Statement, Close the Estate, estate administration, legal document, executor, administrator. The content of a typical Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate includes the following elements: 1. Identification details: The name, contact information, and role of the personal representative are provided at the beginning of the statement. Keywords: personal representative, identification details. 2. Deceased information: Essential information about the deceased, such as their full legal name, date of death, and last known address, is included in the statement. Keywords: deceased information. 3. Assets and liabilities listing: The statement includes a comprehensive list of all the assets, properties, investments, debts, and liabilities associated with the estate, along with their estimated values and relevant details. Keywords: assets, liabilities, properties, debts. 4. Beneficiaries and inheritance details: The personal representative provides information about the identified beneficiaries of the estate and the distribution of inheritance as outlined in the deceased's will or state law if there is no will. Keywords: beneficiaries, inheritance, will, state law. 5. Confirmation of creditor payments: The personal representative confirms that all outstanding debts, taxes, and other financial obligations of the deceased and the estate have been duly settled. Keywords: creditor payments, outstanding debts, taxes, financial obligations. 6. Disposition of estate assets: The statement describes how the estate assets have been distributed, sold, or transferred to the beneficiaries or other involved parties, including any necessary legal documents. Keywords: estate assets, distribution, sale, transfer, legal documents. 7. Final accounting: A detailed accounting of all financial transactions, including income, expenses, and disbursements related to the estate administration, is included in the statement. Keywords: final accounting, financial transactions, income, expenses, disbursements. 8. Consent of beneficiaries: The personal representative may need to include signed consent forms from the beneficiaries, acknowledging that they have received their respective shares of the estate. Keywords: consent forms, beneficiaries, estate shares. Types of Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate: 1. Summary Administration Statement: This statement is used when the value of the estate is relatively small, allowing for a simplified probate process in accordance with North Dakota law. Keywords: summary administration, small estate, simplified probate. 2. Formal Administration Statement: This statement is required when the estate's value exceeds the defined threshold for summary administration or when the complexity of the estate warrants a more comprehensive review by the court. Keywords: formal administration, large estate, complex estate, court review. In conclusion, the Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate is a crucial document that demonstrates the completion of all necessary tasks and obligations in the estate administration process. It encompasses various details, including identification information, assets and liabilities, beneficiary details, creditor payments, disposition of assets, final accounting, and consent forms. Additionally, there are different types of statements, such as summary administration and formal administration, based on the estate's value and complexity.

Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate

Description

How to fill out Fargo North Dakota Personal Representative's Sworn Statement To Close The Estate?

If you are searching for a relevant form, it’s difficult to find a better platform than the US Legal Forms site – one of the most extensive libraries on the web. With this library, you can get a large number of form samples for business and individual purposes by types and regions, or keywords. With the advanced search function, discovering the most recent Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate is as easy as 1-2-3. Additionally, the relevance of each record is verified by a team of professional lawyers that regularly review the templates on our website and update them in accordance with the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you want. Look at its description and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to discover the proper record.

- Confirm your selection. Select the Buy now option. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate.

Every form you add to your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for enhancing or printing, you can return and export it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Fargo North Dakota Personal Representative's Sworn Statement to Close the Estate you were seeking and a large number of other professional and state-specific templates in a single place!

Form popularity

FAQ

Maryland offers a simplified probate procedure for smaller estates. The simplified procedure is available if the property subject to probate has a value of $50,000 or less. If the surviving spouse is the only beneficiary, the cap goes up to $100,000 or less.

When someone dies without a will they are said to have died 'intestate' and no one has immediate authority to act as their personal representative. Instead, one of their relatives needs to apply to the Probate Registry for a grant of letters of administration.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

The short answer is: you can't, because that person, as a legal entity, no longer exists. However, you can sue that person's estate through the estate's representative. Generally, the estate representative, more commonly known as an estate trustee, is named in the deceased person's Will, and appointed by the Court.

So, how long do you have to file probate after death? If a Will nominates an Executor, then the Executor has 30 days from the date of the Testator's death. They must present the Will to the Court and ask to file a Petition to open probate.

Like the compensation laws in many other states, Alaska's executor compensation laws stipulate that an executor must be paid fairly for services provided. Many people think $25-$35/hour is reasonable, but a personal representative can also suggest different forms of payment in Alaska.

There's no probate for life insurance or registered accounts with named beneficiaries such as: registered retirement savings plans (RRSPs) or. tax-free savings accounts (TFSAs).

North Dakota has adopted the Uniform Probate Code, which allows a person to informally probate a Will and have a personal representative appointed without the necessity of a court appearance or a court hearing, as long as the proper forms are filed and the correct procedures followed.

There is a strict time limit within which an eligible individual can make a claim on the estate. This is six months from the date that the grant of probate was issued. For this reason, executors are advised to wait until this period has lapsed before distributing any of the estate to the beneficiaries.

Over 18 years of age and ? The surviving spouse of the decedent, ? An adult child of the decedent, ? A parent of the decedent, ? A brother or sister of the decedent, ? A person entitled to property of the decedent, ? A person who was named as personal representative by will, or ? You are a creditor and 45 days have

Interesting Questions

More info

If a witness refuses to answer a question they have been asked in court and then fails to appear, you can be charged with contempt of court for not complying with a court order. If you take possession of a home, whether it has been sold, donated, or rented, you sign a deed and the real owner of the property agrees to give you the title. That is legal. You cannot take the title to the property from an unpaid tax bill or from a bank statement in which you fail to have the right to pay. Even if you sell a home, your deed to the real owner is recorded in the county register, and you need that title. You need to do a title search even if it is only part of the home -- for example, a basement that will still belong to you even if it is only the outer wall of the house; or a stairway that goes up to the attic floor, which you may want to restore.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.