Fargo North Dakota Trust Registration is a legal process through which individuals or businesses establish trusts in the city of Fargo, North Dakota, and ensure compliance with state laws and regulations. Trust registration is a critical step in safeguarding assets and ensuring the smooth transfer and management of wealth for future generations. One type of Fargo North Dakota Trust Registration is a revocable living trust. This popular form of trust allows individuals to retain control over their assets during their lifetime while also avoiding probate and ensuring a seamless transition of wealth to designated beneficiaries upon their death. Another type of trust registration in Fargo, North Dakota, is an irrevocable trust. Irrevocable trusts are often used for estate planning purposes, as they provide additional asset protection and potential tax benefits. Once assets are transferred to an irrevocable trust, they no longer belong to the granter and are safeguarded against potential creditors or legal claims. In addition, Fargo North Dakota Trust Registration may also include registration of special needs trusts, charitable trusts, and dynasty trusts. Special needs trusts are designed to provide financial support to individuals with disabilities without jeopardizing their eligibility for government benefits. Charitable trusts are established for the purpose of supporting charitable organizations or causes. Dynasty trusts, on the other hand, are created to benefit multiple generations of a family, allowing wealth to be preserved and protected for years to come. The process of Fargo North Dakota Trust Registration involves several steps. First, individuals or businesses must consult with an attorney specializing in trust law to determine the most appropriate type of trust for their specific circumstances. The attorney will then help draft the necessary legal documents, including the trust agreement, and ensure compliance with all applicable laws. Once the trust documents are prepared, they must be signed, witnessed, and notarized. Following the signing of the trust documents, it is essential to transfer the ownership of assets to the trust. This typically involves changing the titles or registrations of properties, such as real estate, vehicles, or financial accounts, to reflect the trust as the new owner. It is crucial to keep meticulous records of all asset transfers to maintain a clear and organized trust structure. After the trust is registered and assets are properly designated, it is necessary to regularly review and update the trust as circumstances change. Life events such as births, deaths, marriages, divorces, or changes in financial status may require amendments or modifications to the trust agreement. By engaging in Fargo North Dakota Trust Registration, individuals and businesses can protect their assets, ensure their wishes are carried out, and provide financial security for their loved ones. Trust registration affords individuals the peace of mind that comes with knowing their assets will be distributed according to their desires, while also often offering tax benefits and asset protection.

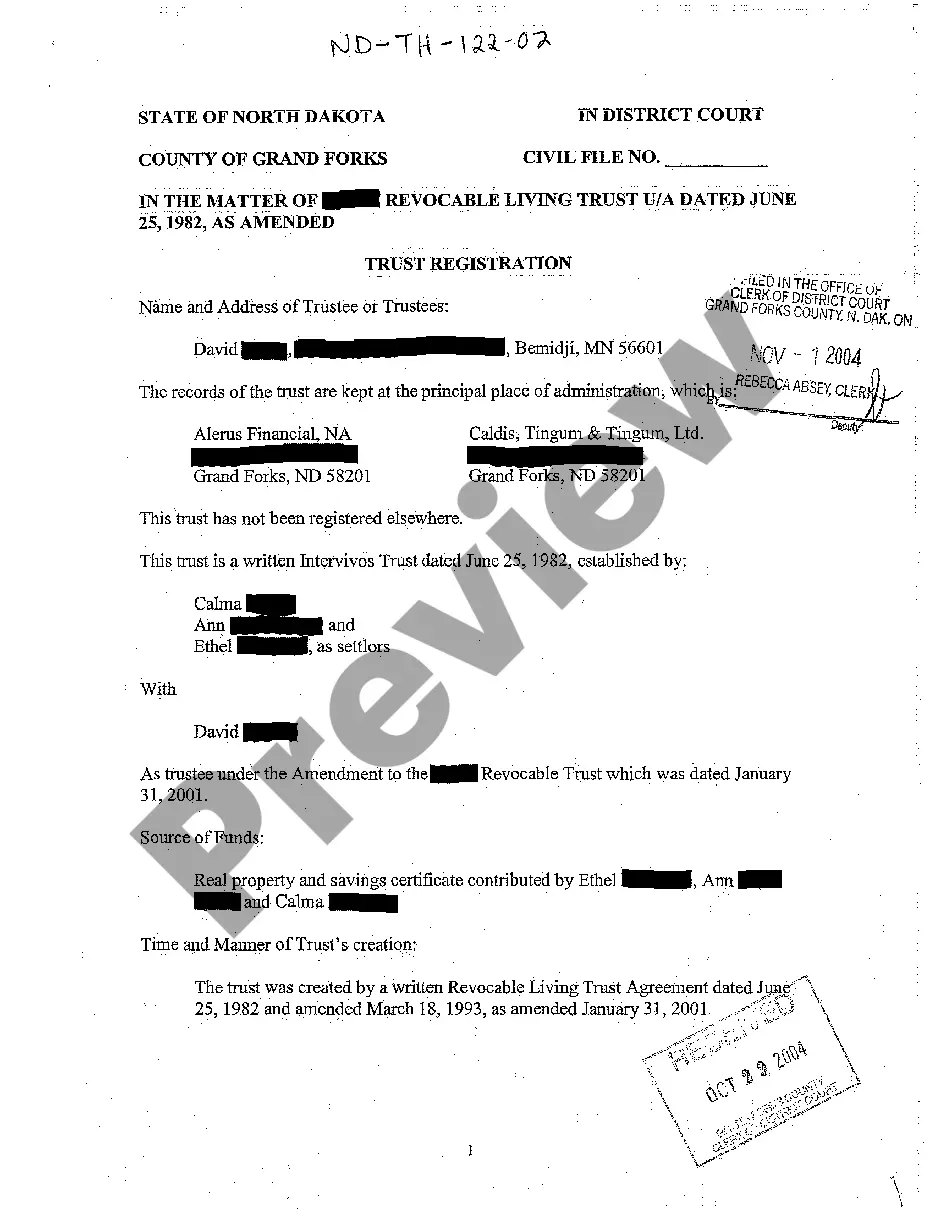

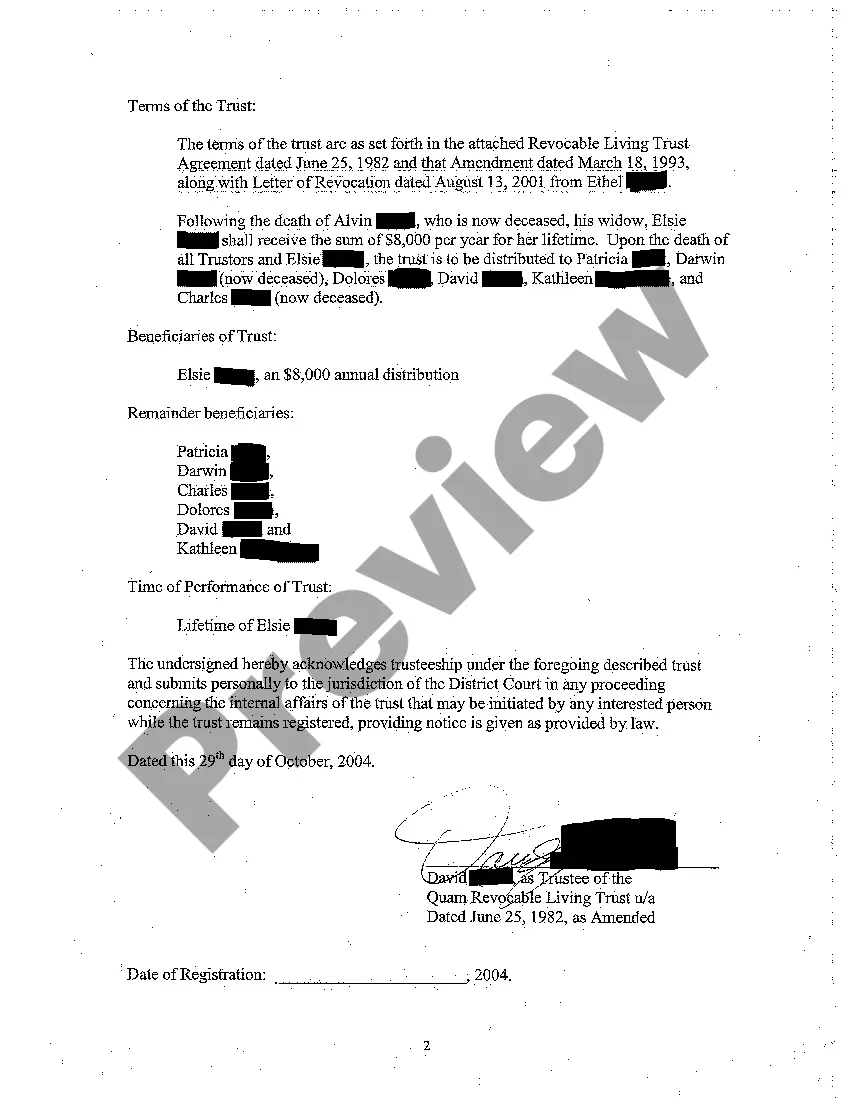

Fargo North Dakota Trust Registration

Description

How to fill out Fargo North Dakota Trust Registration?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Fargo North Dakota Trust Registration becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Fargo North Dakota Trust Registration takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Fargo North Dakota Trust Registration. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!