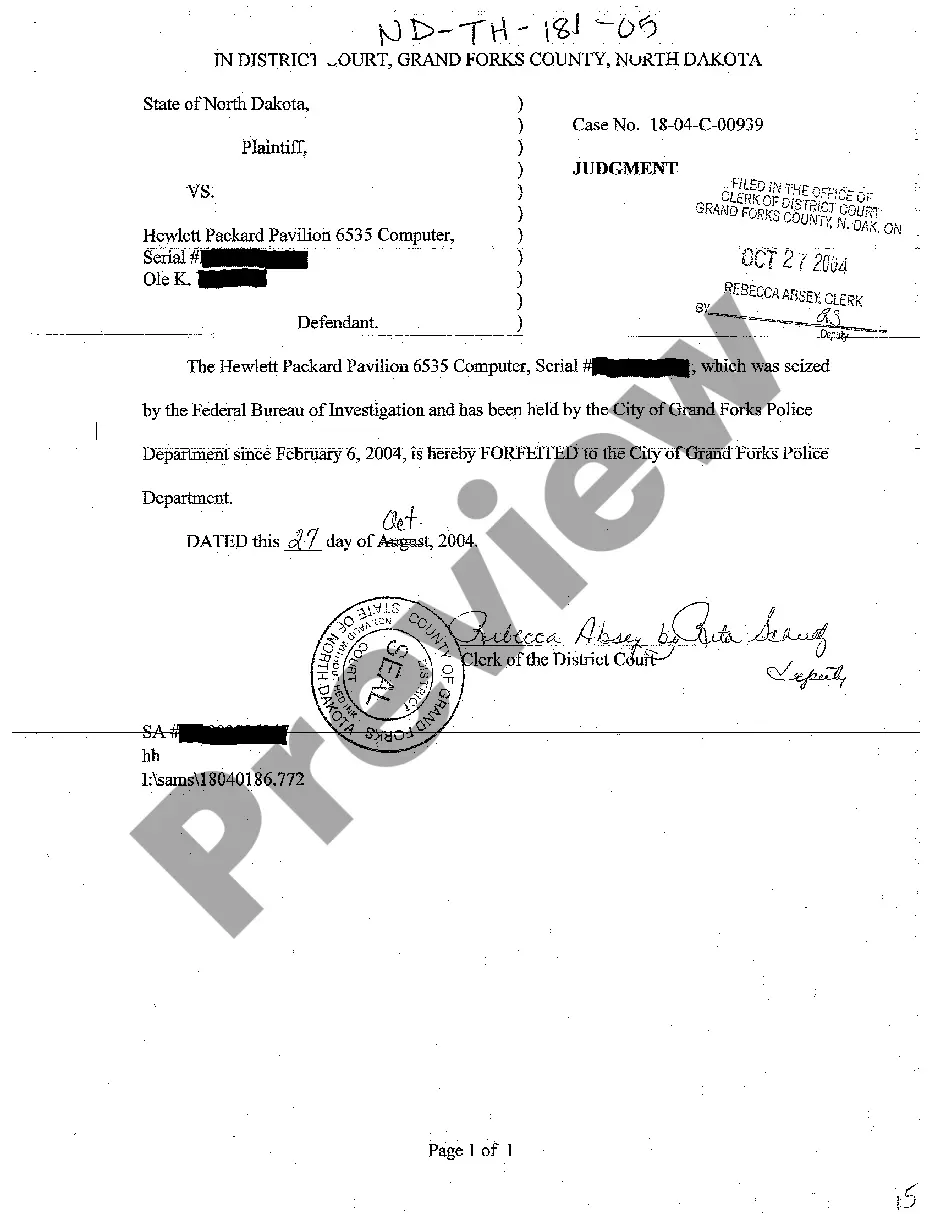

Fargo North Dakota Judgment

Description

How to fill out North Dakota Judgment?

We consistently aim to reduce or evade legal complications when engaging with delicate law-related or financial matters.

To achieve this, we seek attorney services that are generally very expensive.

Nevertheless, not all legal matters are equally intricate.

Most can be handled by ourselves.

Make use of US Legal Forms whenever you need to obtain and download the Fargo North Dakota Judgment or any other document quickly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection enables you to manage your affairs independently without resorting to a lawyer.

- We provide access to legal form templates that aren't always publicly accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

The interest rate for a settlement often depends on the terms negotiated between parties, but it should align with the prevailing judgment rate of 6% in North Dakota. If you're involved in a Fargo North Dakota Judgment settlement, understanding this rate can help you anticipate future costs. Make sure to consult with legal professionals to clarify these terms and secure the best outcome.

Judgments in North Dakota are enforceable for ten years from the date they are entered. After this period, they may become void unless renewed. This means if you have a Fargo North Dakota Judgment, it is important to stay aware of the expiration date. Using US Legal Forms can help navigate renewal processes effectively, ensuring you remain informed.

To calculate the judgment interest rate, multiply the principal amount by the interest rate, then divide that by 100 to find the annual interest. For immediate applications like a Fargo North Dakota Judgment, take into account the length of time the judgment has been outstanding to determine the total interest accrued. Maintaining accurate records is crucial to ensure proper calculations. Tools and forms from US Legal Forms can simplify this process.

The maximum interest rate in North Dakota is set at 6% per year on judgments. However, if a different rate is stipulated in a contract, that rate will apply. Understanding the implications of these rates is vital if you are handling a Fargo North Dakota Judgment. Knowing your legal rights and obligations can significantly benefit you in managing debts.

To verify a judgment, you can start by searching court records for filed judgments in North Dakota. You may find information on a Fargo North Dakota Judgment through online legal resources or by contacting the court directly. Cross-referencing the judgment with public records ensures you have accurate and up-to-date information. Consider using platforms like US Legal Forms to aid your investigation process.

Yes, court records in North Dakota are generally public, meaning anyone can access them. This transparency allows you to review details surrounding a Fargo North Dakota Judgment if needed. Check with local court offices or online databases for access to these records. This openness promotes accountability and provides important information for both individuals and legal professionals.

In North Dakota, a debt typically becomes uncollectible after ten years from the date of the judgment. This timeframe is critical for managing your financial obligations effectively. If you’re dealing with a Fargo North Dakota Judgment, it's essential to understand this timeline. Utilizing resources like US Legal Forms can help you track your obligations and know when debts can no longer be enforced.

The judgment rate in North Dakota is usually the same as the legal interest rate, which is set at 5% per year. This rate applies to judgments made in court, including those issued in Fargo. Understanding the judgment rate is important for managing debts and payments over time. By tracking these rates, you can effectively handle any Fargo North Dakota Judgment.

In North Dakota, a debt generally becomes uncollectible after six years. This timeline starts from the last payment date or the date the account was last active. However, this does not mean the debt disappears; creditors can pursue collections until this period expires. Keeping an eye on the timeline is essential, especially if facing a Fargo North Dakota Judgment.

The interest rate on judgments in North Dakota is set at 5% per annum. This rate applies to most judgments, including those in Fargo. Knowing this interest rate is crucial, as it affects the total amount owed over time. Keeping up with interest can help you manage a Fargo North Dakota Judgment more effectively.