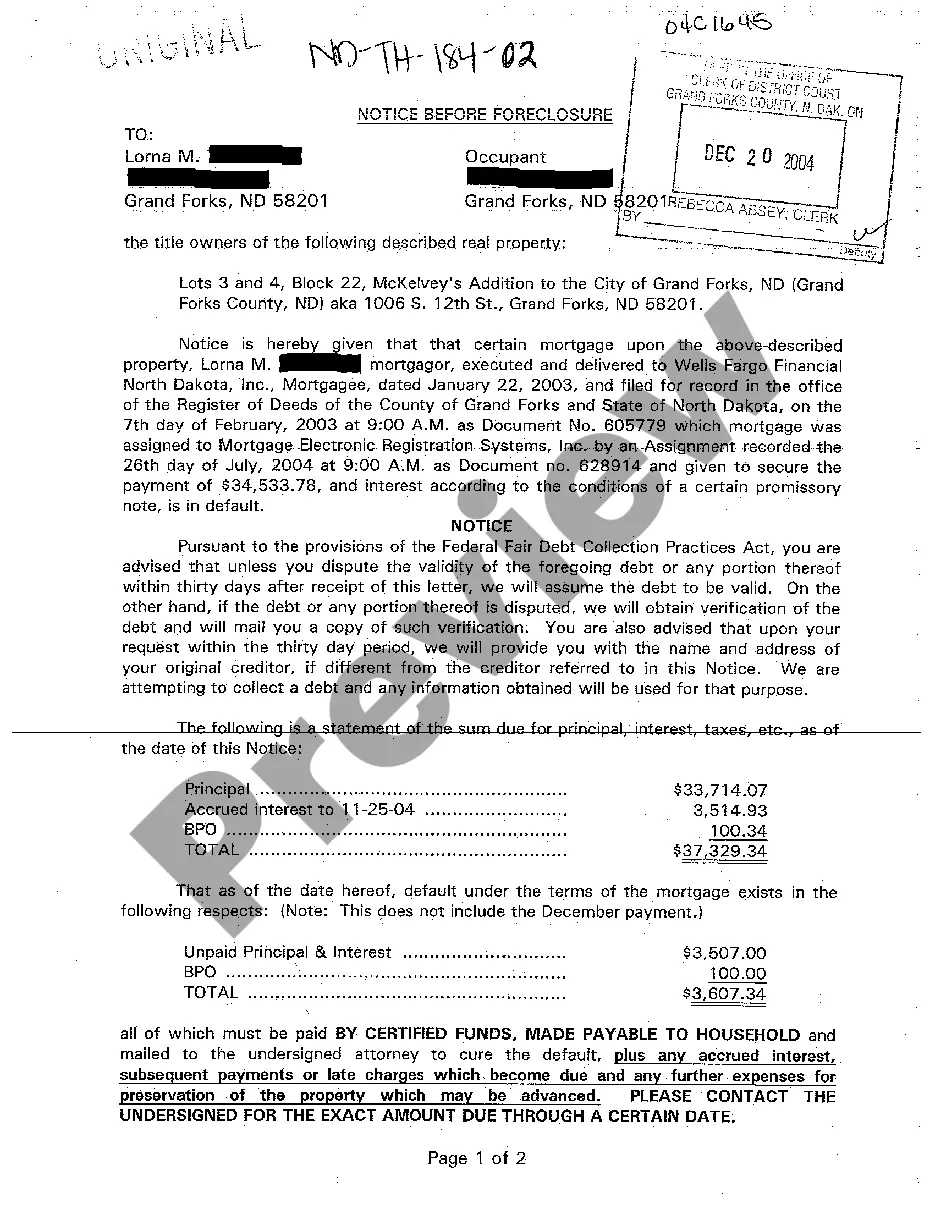

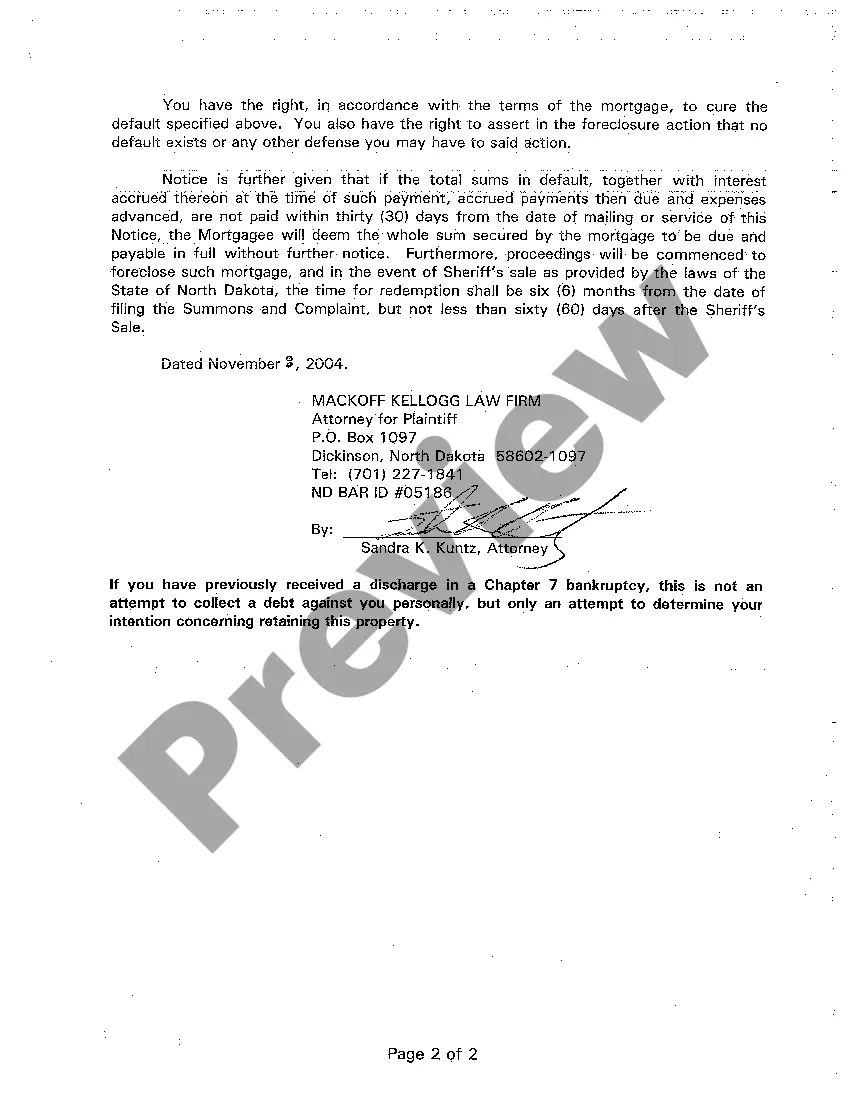

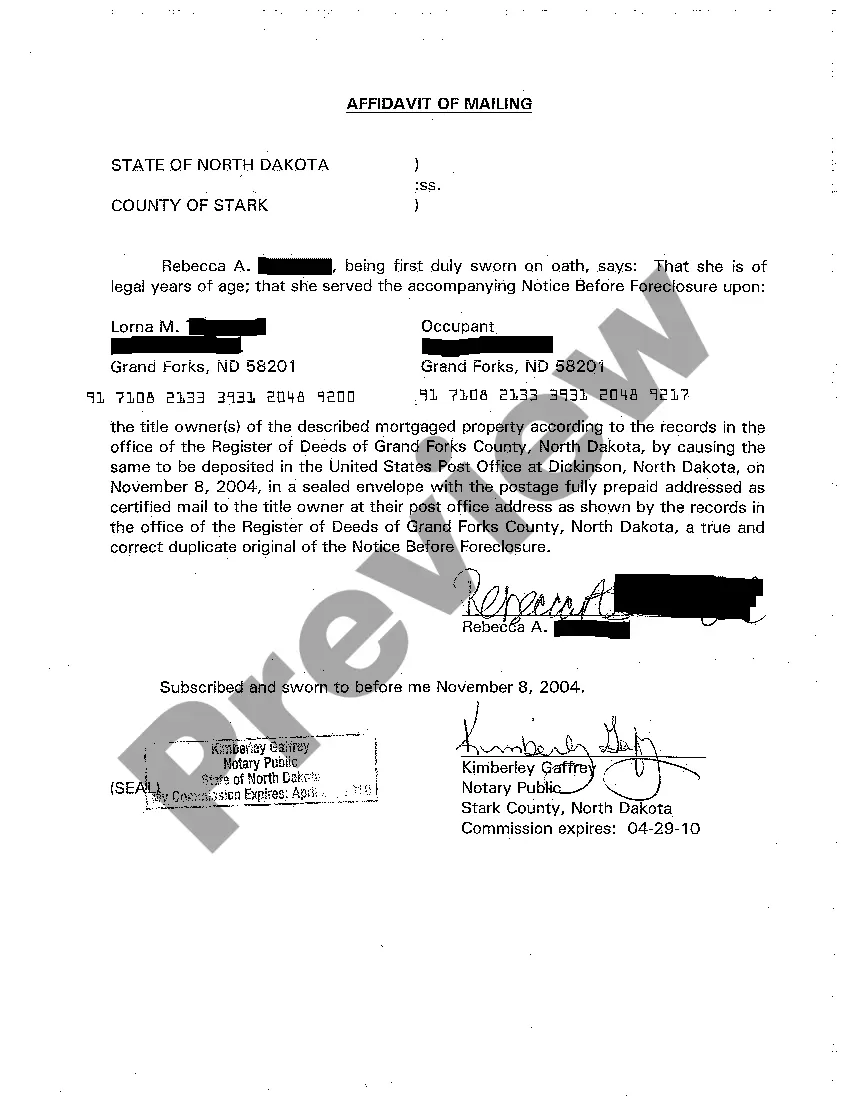

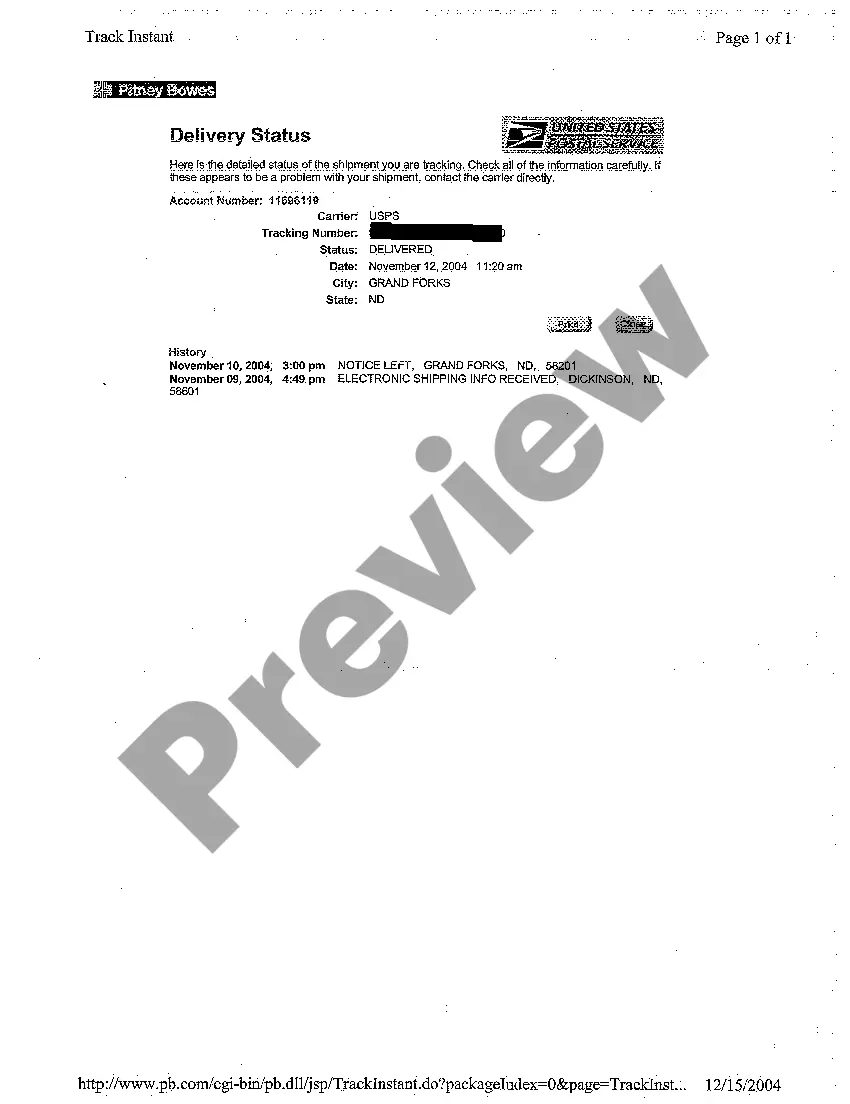

Fargo, North Dakota Notice Before Foreclosure: A Complete Guide Foreclosure is a legal process through which a lender seeks to take ownership of a property when the borrower fails to make timely mortgage payments. In Fargo, North Dakota, before a foreclosure is initiated, the lender must provide the borrower with a notice detailing key information related to the upcoming foreclosure proceedings. This notice, known as the "Fargo North Dakota Notice Before Foreclosure," serves as an essential component of the foreclosure process and provides the borrower with crucial options and rights. The Fargo North Dakota Notice Before Foreclosure typically includes the following information: 1. Identification of Parties: The notice will identify the lender, their contact information, and the borrower(s) involved in the mortgage agreement. It is crucial for borrowers to carefully review this information to ensure accuracy. 2. Property Description: The notice provides a detailed description of the property being foreclosed, including its address, legal description, and any related parcel numbers. This information helps borrowers confirm that their property is correctly identified in the foreclosure process. 3. Unpaid Amount: The notice clearly states the total unpaid amount, including the delinquent principal, interest, late fees, and other charges. This section allows borrowers to understand the exact amount required to bring the loan up to date. 4. Right to Cure: Fargo, North Dakota law grants borrowers a specific period, usually 30 days, to "cure" the loan default by paying the overdue amount. The notice details the deadline for payment, which allows borrowers the opportunity to rectify the defaulted loan before the foreclosure process begins. 5. Intent to Foreclose: The notice includes a statement that indicates the lender's intent to foreclose on the property if the borrower fails to cure the default within the specified time frame. Understanding the lender's intentions is crucial for borrowers to take appropriate actions and explore alternative options. 6. Mediation Information: Fargo, North Dakota provides borrowers with the option to pursue foreclosure mediation. This process aims to facilitate communication between the borrower and lender, potentially leading to a mutually acceptable foreclosure alternative. The notice will contain specific instructions on how to request mediation if interested. 7. Consequences of Foreclosure: The notice highlights the potential consequences of foreclosure, including the loss of ownership rights, eviction, damage to credit scores, and legal expenses. It is vital for borrowers to comprehend the long-term effects of foreclosure to make informed decisions. Different Types of Fargo North Dakota Notice Before Foreclosure: 1. Notice of Default: This initial notice is sent when a borrower becomes delinquent on their mortgage payments, typically after 3-6 missed payments, informing them that they are in default and must cure the default within a specific timeframe. 2. Notice of Intent to Foreclose: If the borrower fails to cure the default, the lender sends a notice of intent to foreclose, clearly stating their intention to initiate foreclosure proceedings if the outstanding amount is not paid within a specified period. 3. Notice of Sale: If the borrower fails to cure the default or reach an agreement with the lender, a notice of sale is issued. This notice confirms the date and time of the foreclosure sale, where the property will be auctioned off to the highest bidder. In conclusion, the Fargo North Dakota Notice Before Foreclosure is a comprehensive document that provides borrowers with critical information regarding their defaulted mortgage. By understanding the implications, available options, and rights outlined in the notice, borrowers can make informed decisions and take necessary steps to prevent foreclosure or explore alternatives.

Fargo North Dakota Notice Before Foreclosure

State:

North Dakota

City:

Fargo

Control #:

ND-TH-184-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Notice Before Foreclosure

Fargo, North Dakota Notice Before Foreclosure: A Complete Guide Foreclosure is a legal process through which a lender seeks to take ownership of a property when the borrower fails to make timely mortgage payments. In Fargo, North Dakota, before a foreclosure is initiated, the lender must provide the borrower with a notice detailing key information related to the upcoming foreclosure proceedings. This notice, known as the "Fargo North Dakota Notice Before Foreclosure," serves as an essential component of the foreclosure process and provides the borrower with crucial options and rights. The Fargo North Dakota Notice Before Foreclosure typically includes the following information: 1. Identification of Parties: The notice will identify the lender, their contact information, and the borrower(s) involved in the mortgage agreement. It is crucial for borrowers to carefully review this information to ensure accuracy. 2. Property Description: The notice provides a detailed description of the property being foreclosed, including its address, legal description, and any related parcel numbers. This information helps borrowers confirm that their property is correctly identified in the foreclosure process. 3. Unpaid Amount: The notice clearly states the total unpaid amount, including the delinquent principal, interest, late fees, and other charges. This section allows borrowers to understand the exact amount required to bring the loan up to date. 4. Right to Cure: Fargo, North Dakota law grants borrowers a specific period, usually 30 days, to "cure" the loan default by paying the overdue amount. The notice details the deadline for payment, which allows borrowers the opportunity to rectify the defaulted loan before the foreclosure process begins. 5. Intent to Foreclose: The notice includes a statement that indicates the lender's intent to foreclose on the property if the borrower fails to cure the default within the specified time frame. Understanding the lender's intentions is crucial for borrowers to take appropriate actions and explore alternative options. 6. Mediation Information: Fargo, North Dakota provides borrowers with the option to pursue foreclosure mediation. This process aims to facilitate communication between the borrower and lender, potentially leading to a mutually acceptable foreclosure alternative. The notice will contain specific instructions on how to request mediation if interested. 7. Consequences of Foreclosure: The notice highlights the potential consequences of foreclosure, including the loss of ownership rights, eviction, damage to credit scores, and legal expenses. It is vital for borrowers to comprehend the long-term effects of foreclosure to make informed decisions. Different Types of Fargo North Dakota Notice Before Foreclosure: 1. Notice of Default: This initial notice is sent when a borrower becomes delinquent on their mortgage payments, typically after 3-6 missed payments, informing them that they are in default and must cure the default within a specific timeframe. 2. Notice of Intent to Foreclose: If the borrower fails to cure the default, the lender sends a notice of intent to foreclose, clearly stating their intention to initiate foreclosure proceedings if the outstanding amount is not paid within a specified period. 3. Notice of Sale: If the borrower fails to cure the default or reach an agreement with the lender, a notice of sale is issued. This notice confirms the date and time of the foreclosure sale, where the property will be auctioned off to the highest bidder. In conclusion, the Fargo North Dakota Notice Before Foreclosure is a comprehensive document that provides borrowers with critical information regarding their defaulted mortgage. By understanding the implications, available options, and rights outlined in the notice, borrowers can make informed decisions and take necessary steps to prevent foreclosure or explore alternatives.

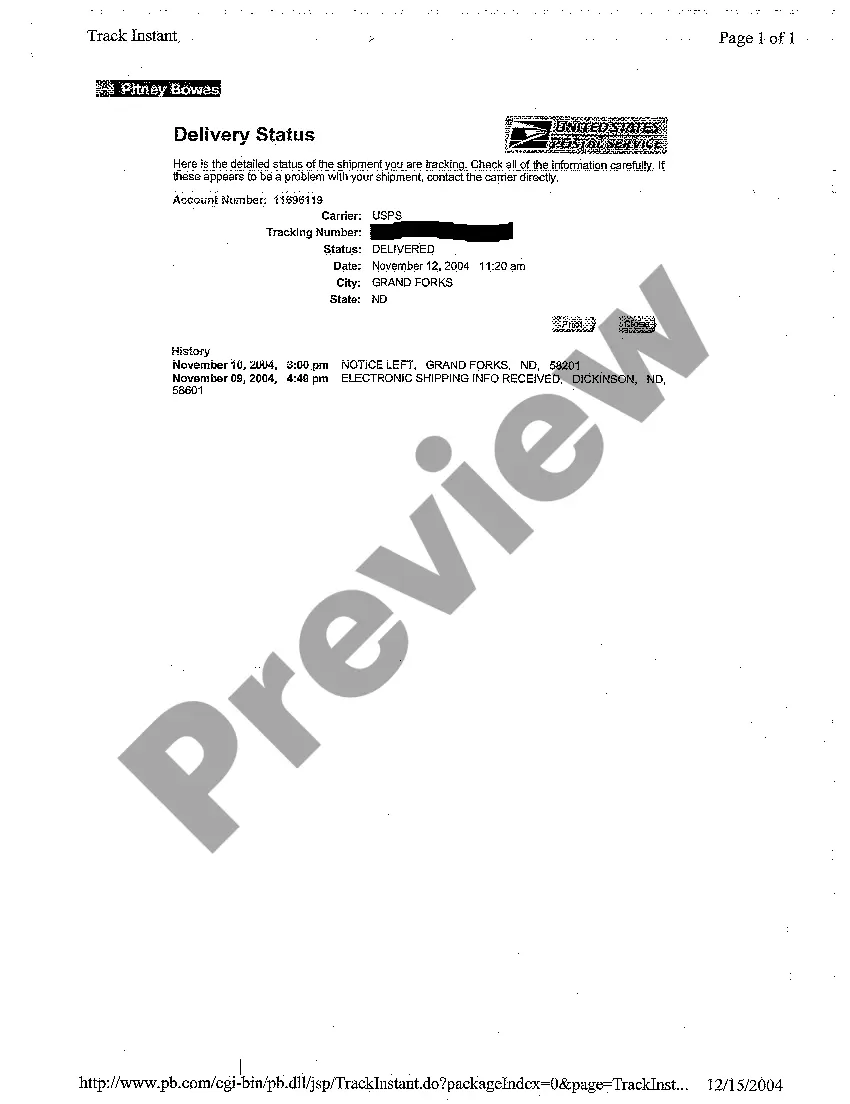

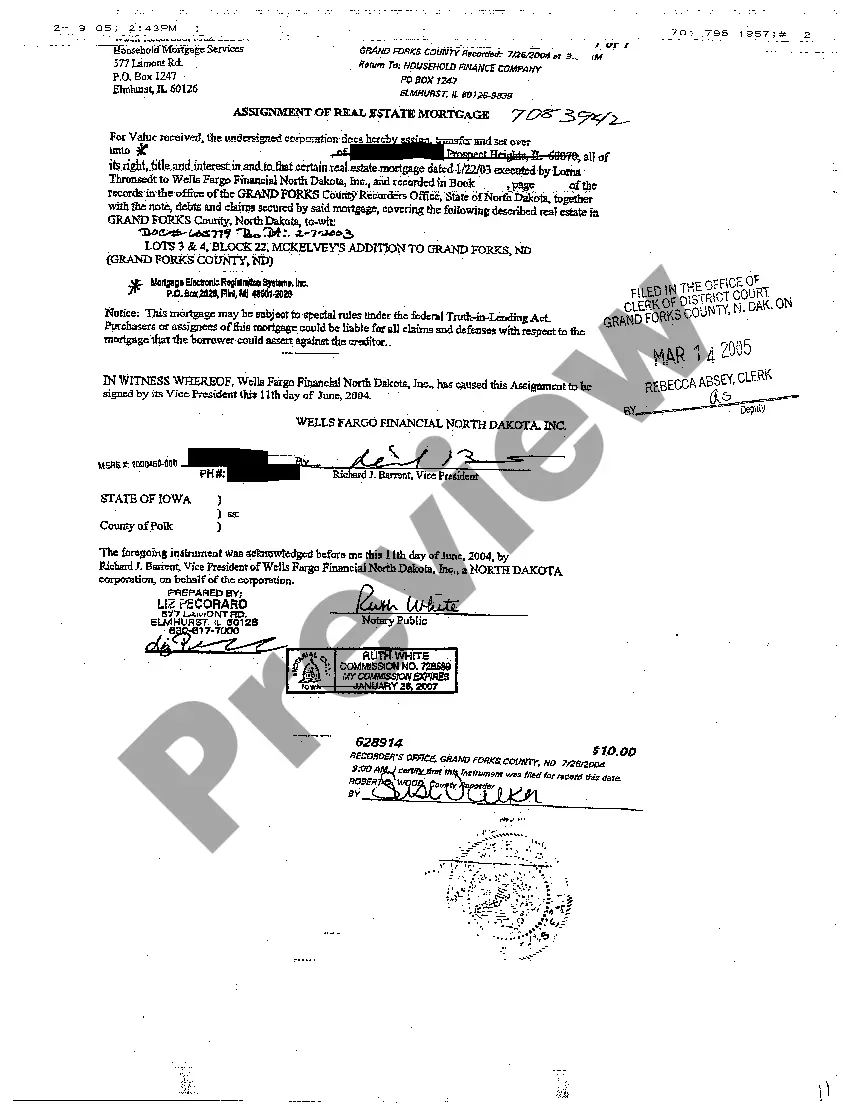

Free preview

How to fill out Fargo North Dakota Notice Before Foreclosure?

If you’ve already utilized our service before, log in to your account and download the Fargo North Dakota Notice Before Foreclosure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Fargo North Dakota Notice Before Foreclosure. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!