Fargo North Dakota Commitment for Title Insurance

Description

How to fill out North Dakota Commitment For Title Insurance?

If you have previously availed yourself of our service, sign in to your account and download the Fargo North Dakota Commitment for Title Insurance to your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment arrangement.

If this is your inaugural experience with our service, follow these straightforward steps to obtain your document.

You have uninterrupted access to all documents you’ve acquired: you can locate it in your profile under the My documents section whenever you wish to reuse it. Make the most of the US Legal Forms service to quickly find and store any template for your personal or business requirements!

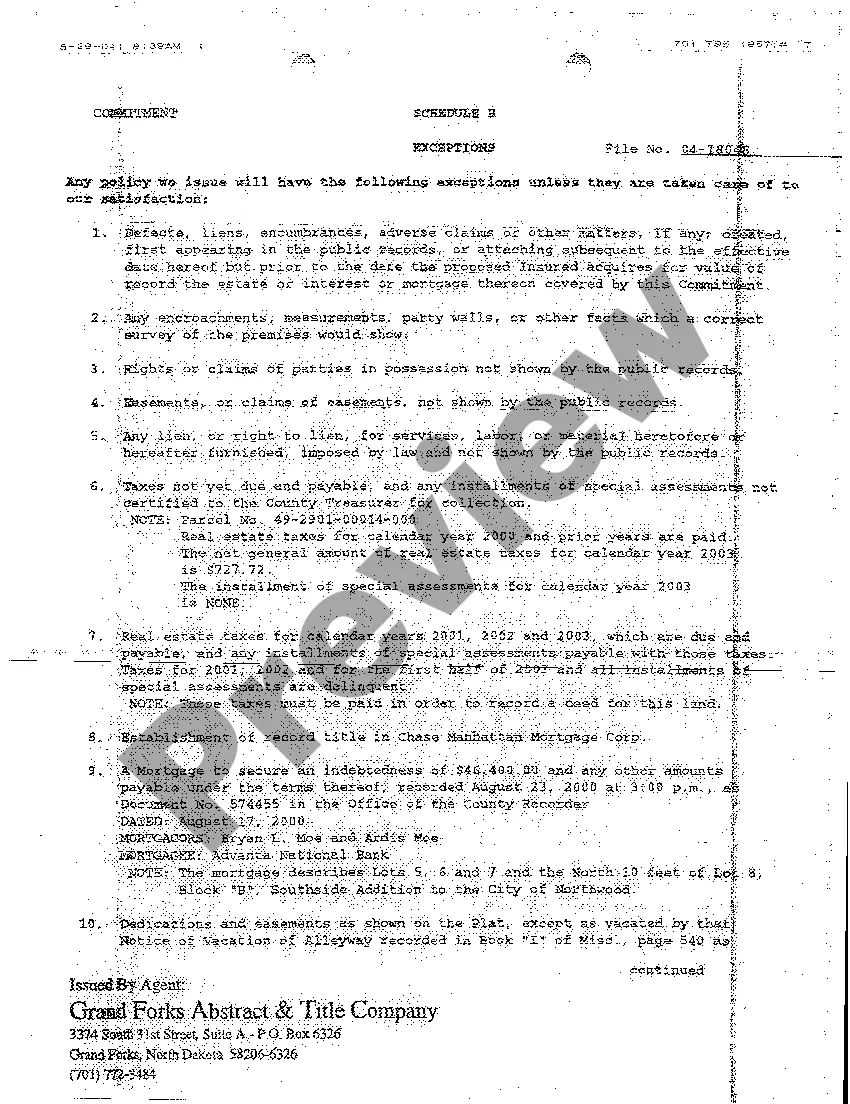

- Verify that you’ve located a suitable document. Browse through the description and use the Preview feature, if available, to see if it aligns with your requirements. If it doesn't meet your expectations, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Fargo North Dakota Commitment for Title Insurance. Select the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and electronically sign it.

Form popularity

FAQ

You can obtain a title commitment through a title company in Fargo, North Dakota. It's essential to choose a reputable provider to ensure accuracy and thoroughness. Online resources, such as uslegalforms, can help you locate and select a reliable title company tailored to your needs. This approach saves you time and ensures you receive quality service.

Typically, the title company or title agent delivers the title commitment to you directly. This document is essential in the property transaction process. Ensuring clear communication with your title company helps streamline delivery. With the resources available through uslegalforms, you can easily connect with experts who will guide you through delivery.

A title commitment is a preliminary document indicating the intention to issue a title policy. It details terms and conditions before the closing. In contrast, the title policy provides actual insurance coverage, protecting against specific losses after closing. Understanding both is crucial for making informed decisions, and uslegalforms can help clarify any remaining questions.

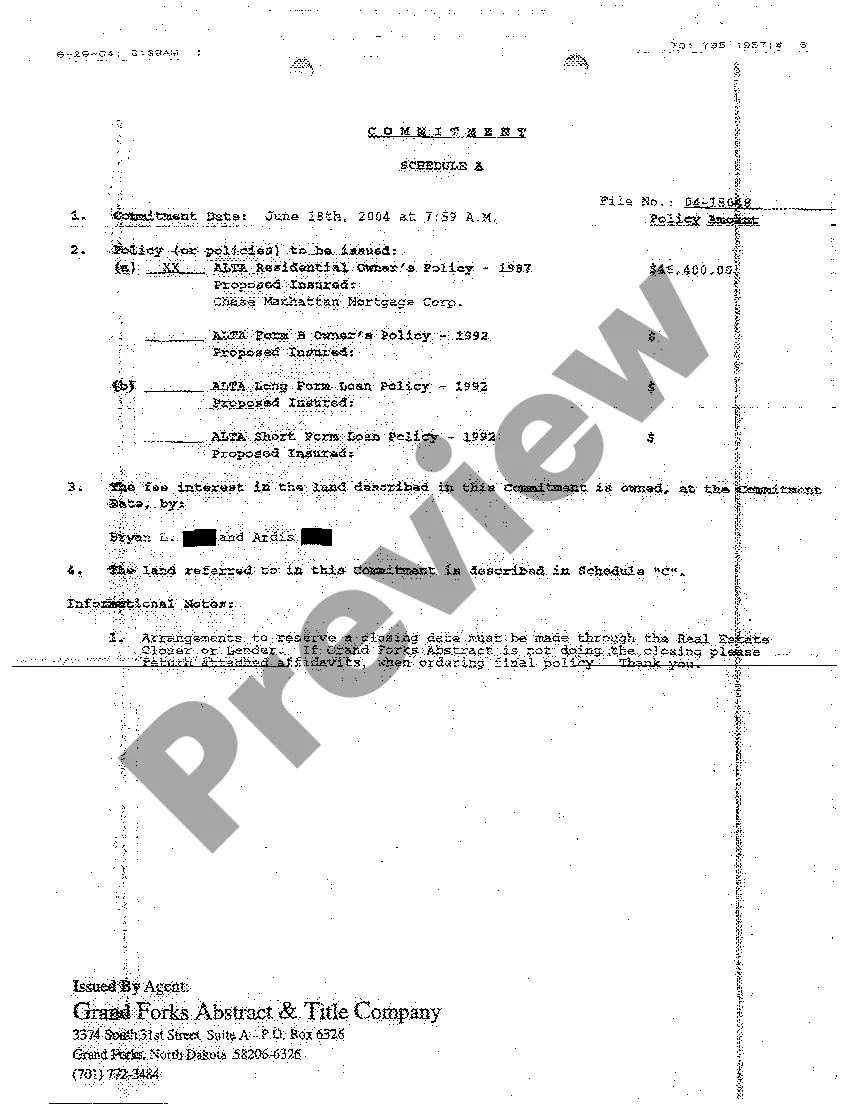

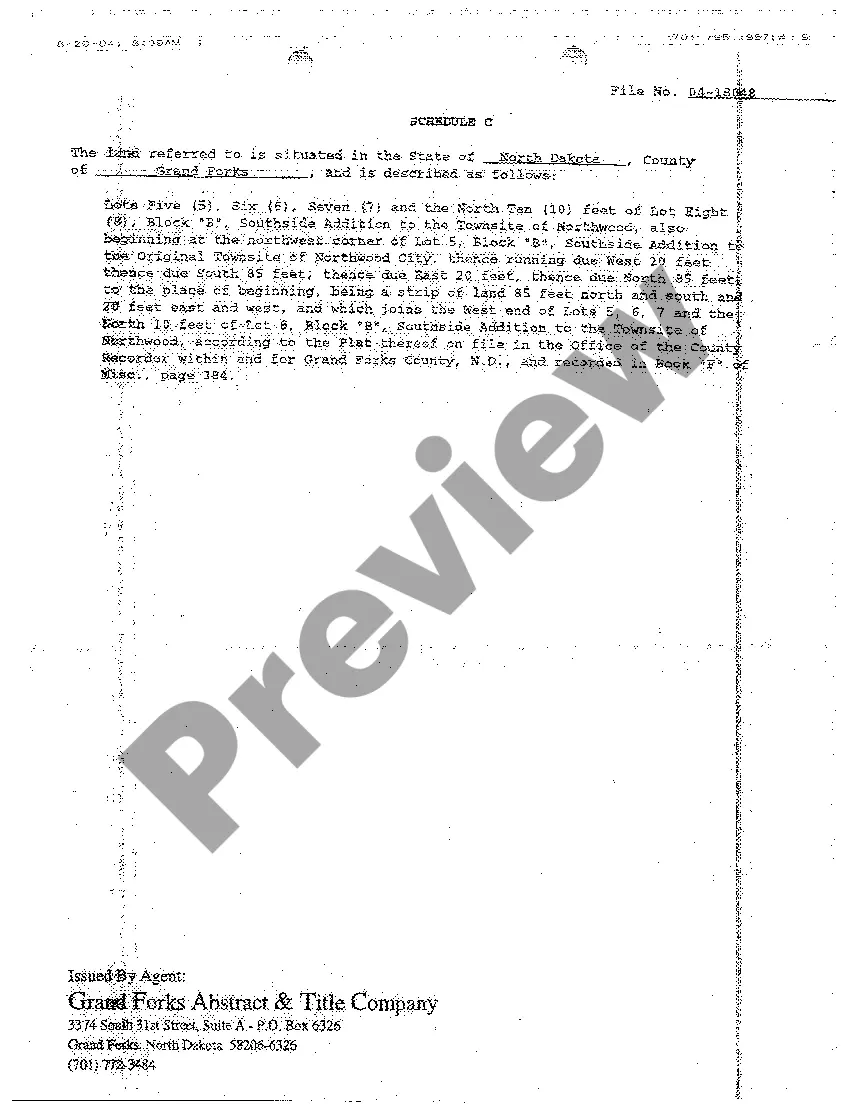

The title commitment process involves several key steps. Initially, the title company reviews public records for any issues related to the property. Following this, they issue the Fargo North Dakota Commitment for Title Insurance, which outlines the necessary steps to finalize the title transfer. Engaging with uslegalforms can simplify this process and provide clarity about your obligations.

The title commitment is prepared by a title company or a title agent in Fargo. Their responsibility encompasses examining public records, verifying ownership, and ensuring that there are no outstanding claims against the property. This preparation is crucial to protect your investment. Platforms like uslegalforms can connect you with trusted professionals in your region.

A title company provides a commitment letter, specifically detailing the terms of the Fargo North Dakota Commitment for Title Insurance. This document outlines the conditions under which the insurance will be issued. By working with a reputable title company, you ensure clarity and security regarding your property transaction. Using uslegalforms can help you find reliable options in your area.

The process to obtain a Fargo North Dakota Commitment for Title Insurance typically takes a few days. Factors influencing this timeline include the complexity of the property and the responsiveness of various parties involved. It's essential to communicate with your title company for updates. With efficient systems, like those offered by uslegalforms, you can streamline your request.

A commitment for title insurance is a formal offer from a title company to provide a title insurance policy once certain conditions are met. This commitment outlines the details of the title search, any outstanding issues, and the terms of coverage. By securing a Fargo North Dakota Commitment for Title Insurance, you can protect yourself from potential legal issues related to property ownership.

The title commitment date refers to the specific date when the title commitment document is issued. This date is crucial, as it establishes the timeline for completing the property transaction. Understanding the title commitment date helps you and your real estate agents stay organized during the process and ensures a smoother closing.

The time frame for receiving a title commitment in Fargo, North Dakota, generally takes between five to ten business days. Factors such as the title search's depth and any necessary document retrieval can influence this duration. To minimize waiting time, consider utilizing UsLegalForms for smoother processing and efficient service.