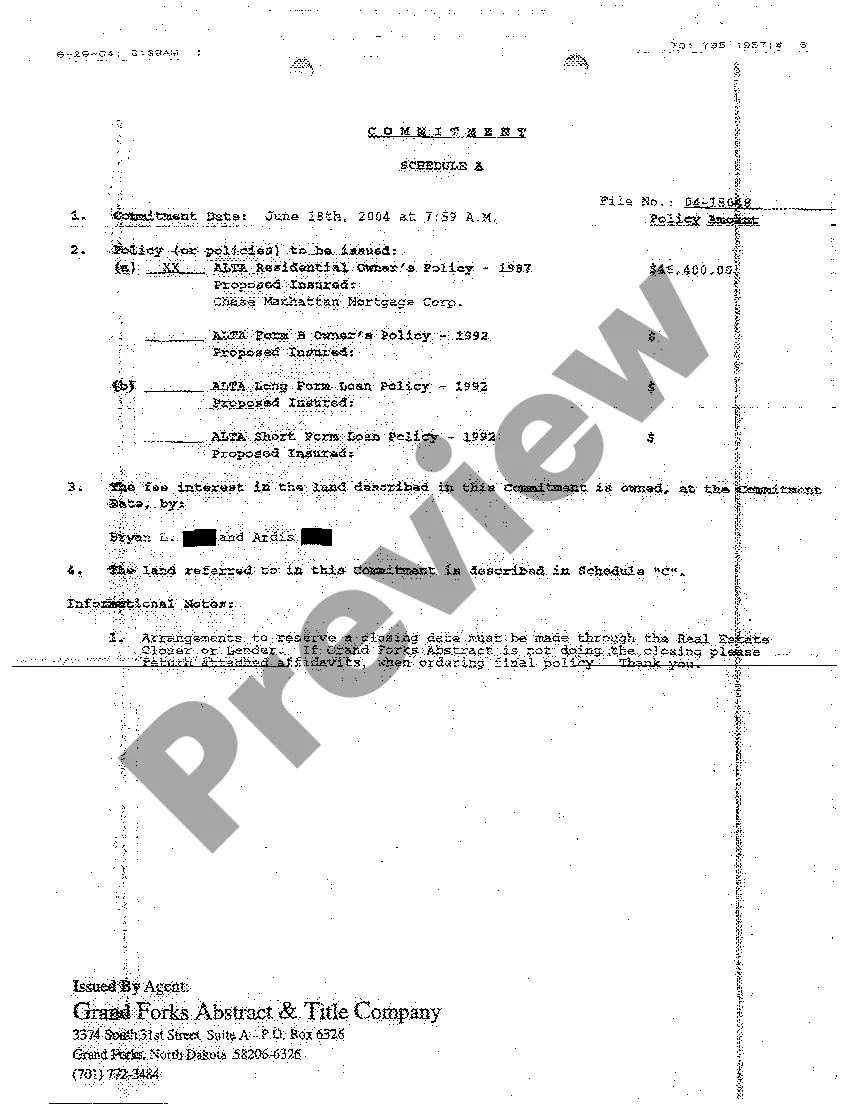

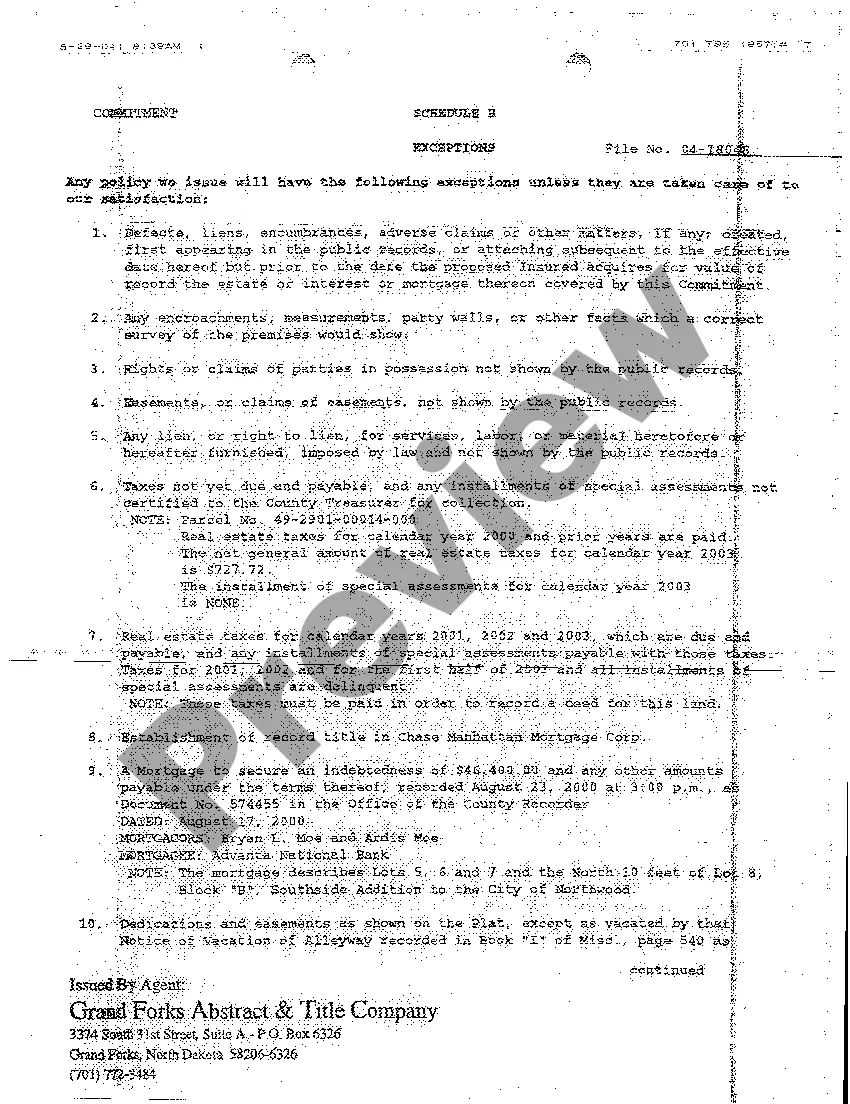

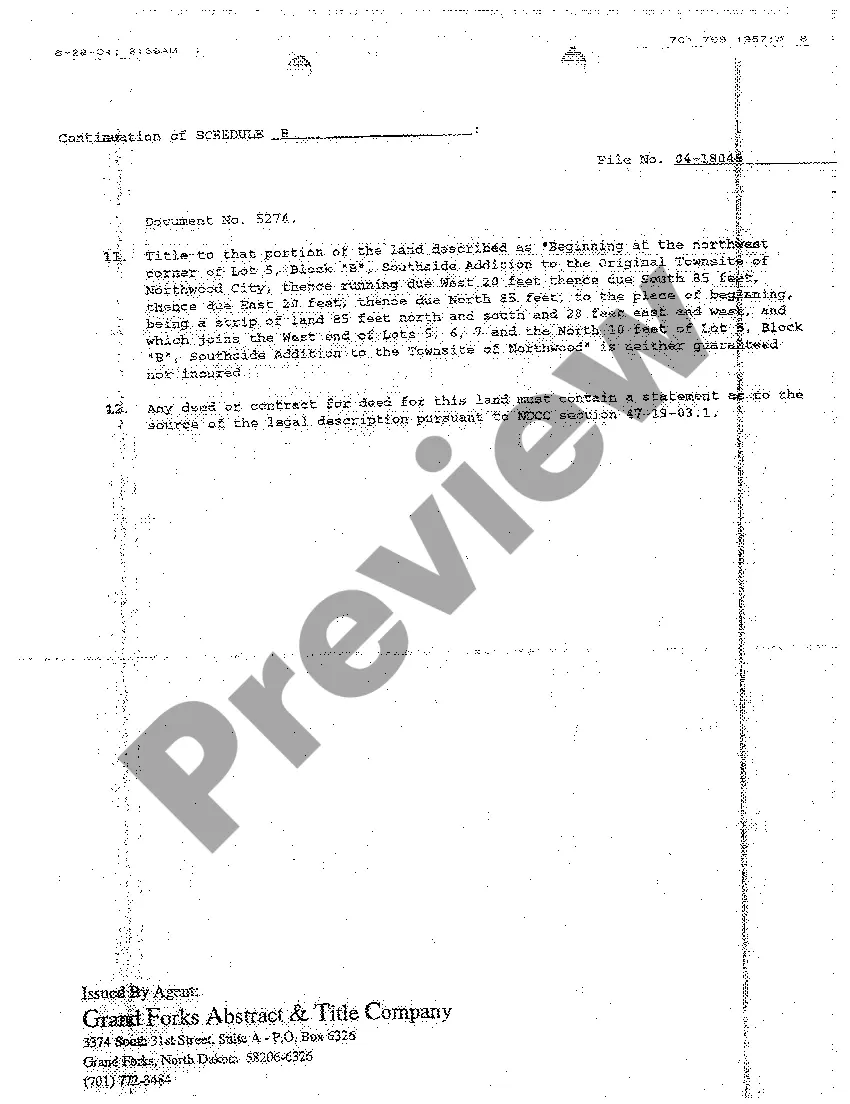

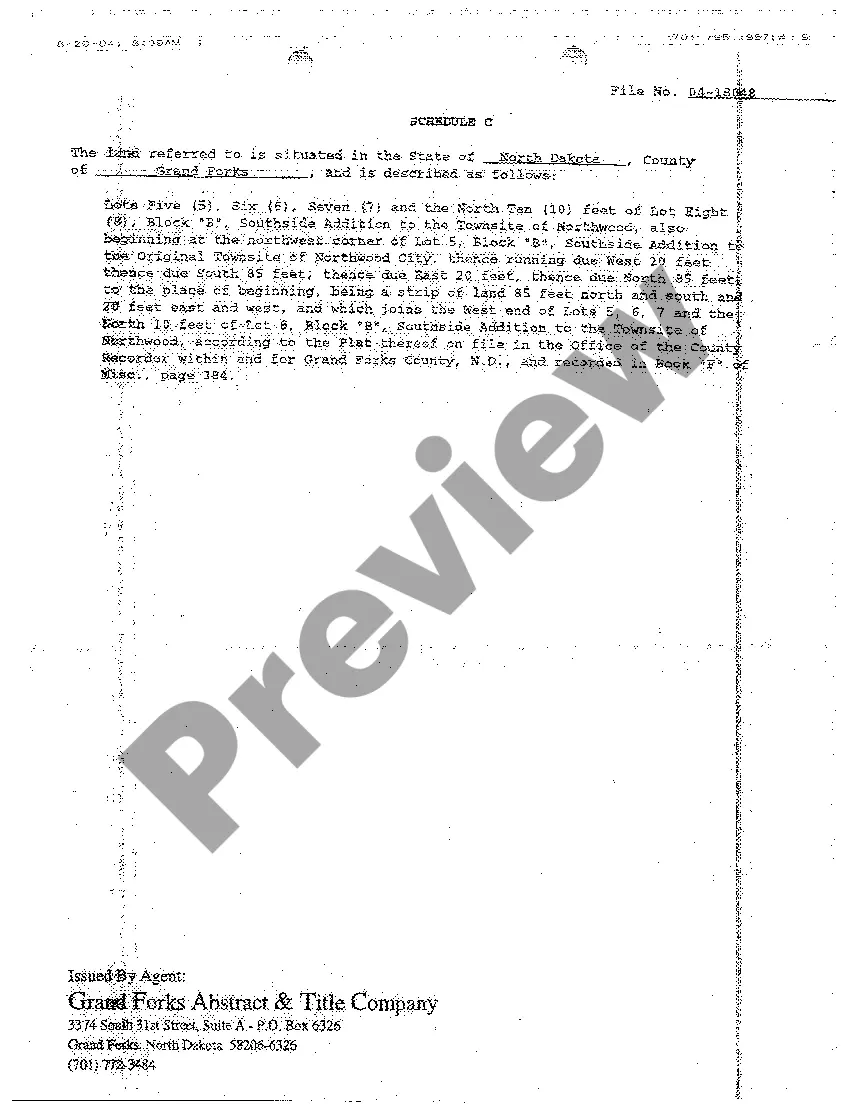

Fargo North Dakota Commitment for Title Insurance is an essential document that outlines the details and assurances provided by a title insurance company regarding the ownership and rights associated with a particular property in Fargo, North Dakota. This commitment offers protection, both financially and legally, to property owners and lenders involved in real estate transactions. The Fargo North Dakota Commitment for Title Insurance guarantees the integrity of the property title, ensuring that there are no existing claims, liens, or encumbrances that could jeopardize the buyer's ownership rights. This commitment serves as a promise from the title insurance company to conduct a thorough investigation and research the property's history to uncover any potential issues before issuing a title insurance policy. Fargo North Dakota Commitment for Title Insurance consists of multiple components, each addressing different aspects of the property's title. These may include: 1. Schedule A: This section provides a detailed summary of the property, including its legal description, address, and purchase price. It also lists the proposed insured parties, such as the buyer and lender. 2. Schedule B: This part of the commitment outlines any exceptions or exclusions to the coverage provided by the title insurance policy. It identifies outstanding liens, easements, or other encumbrances that may affect the property's title. 3. Conditions and Stipulations: These are the terms and requirements that the buyer and lender must fulfill to obtain the title insurance policy. They may include satisfactory completion of the purchase agreement, payment of the premiums, and adherence to any specific conditions imposed by the title insurance company. 4. Commitment Expiration Date: This indicates the deadline by which the buyer must close the transaction and acquire the title insurance policy. It serves as a reminder for all parties involved to complete the necessary steps to ensure a clear and marketable title. There might be variations of Fargo North Dakota Commitment for Title Insurance based on the type of transaction or the parties involved. For instance: 1. Residential Commitment for Title Insurance: Specifically designed for residential properties, this commitment focuses on addressing potential issues that commonly occur in residential real estate transactions. It may also include additional protections related to homeowners' associations or private covenants. 2. Commercial Commitment for Title Insurance: Tailored for commercial properties, this commitment accounts for unique considerations in commercial transactions such as zoning, environmental concerns, or leasehold interests. By offering financial security and peace of mind to both buyers and lenders, Fargo North Dakota Commitment for Title Insurance plays a vital role in ensuring a seamless and protected real estate transfer process. It is crucial for all parties involved in Fargo, North Dakota property transactions to understand the commitment and its various components as they form a crucial part of a successful closing.

Fargo North Dakota Commitment for Title Insurance is an essential document that outlines the details and assurances provided by a title insurance company regarding the ownership and rights associated with a particular property in Fargo, North Dakota. This commitment offers protection, both financially and legally, to property owners and lenders involved in real estate transactions. The Fargo North Dakota Commitment for Title Insurance guarantees the integrity of the property title, ensuring that there are no existing claims, liens, or encumbrances that could jeopardize the buyer's ownership rights. This commitment serves as a promise from the title insurance company to conduct a thorough investigation and research the property's history to uncover any potential issues before issuing a title insurance policy. Fargo North Dakota Commitment for Title Insurance consists of multiple components, each addressing different aspects of the property's title. These may include: 1. Schedule A: This section provides a detailed summary of the property, including its legal description, address, and purchase price. It also lists the proposed insured parties, such as the buyer and lender. 2. Schedule B: This part of the commitment outlines any exceptions or exclusions to the coverage provided by the title insurance policy. It identifies outstanding liens, easements, or other encumbrances that may affect the property's title. 3. Conditions and Stipulations: These are the terms and requirements that the buyer and lender must fulfill to obtain the title insurance policy. They may include satisfactory completion of the purchase agreement, payment of the premiums, and adherence to any specific conditions imposed by the title insurance company. 4. Commitment Expiration Date: This indicates the deadline by which the buyer must close the transaction and acquire the title insurance policy. It serves as a reminder for all parties involved to complete the necessary steps to ensure a clear and marketable title. There might be variations of Fargo North Dakota Commitment for Title Insurance based on the type of transaction or the parties involved. For instance: 1. Residential Commitment for Title Insurance: Specifically designed for residential properties, this commitment focuses on addressing potential issues that commonly occur in residential real estate transactions. It may also include additional protections related to homeowners' associations or private covenants. 2. Commercial Commitment for Title Insurance: Tailored for commercial properties, this commitment accounts for unique considerations in commercial transactions such as zoning, environmental concerns, or leasehold interests. By offering financial security and peace of mind to both buyers and lenders, Fargo North Dakota Commitment for Title Insurance plays a vital role in ensuring a seamless and protected real estate transfer process. It is crucial for all parties involved in Fargo, North Dakota property transactions to understand the commitment and its various components as they form a crucial part of a successful closing.