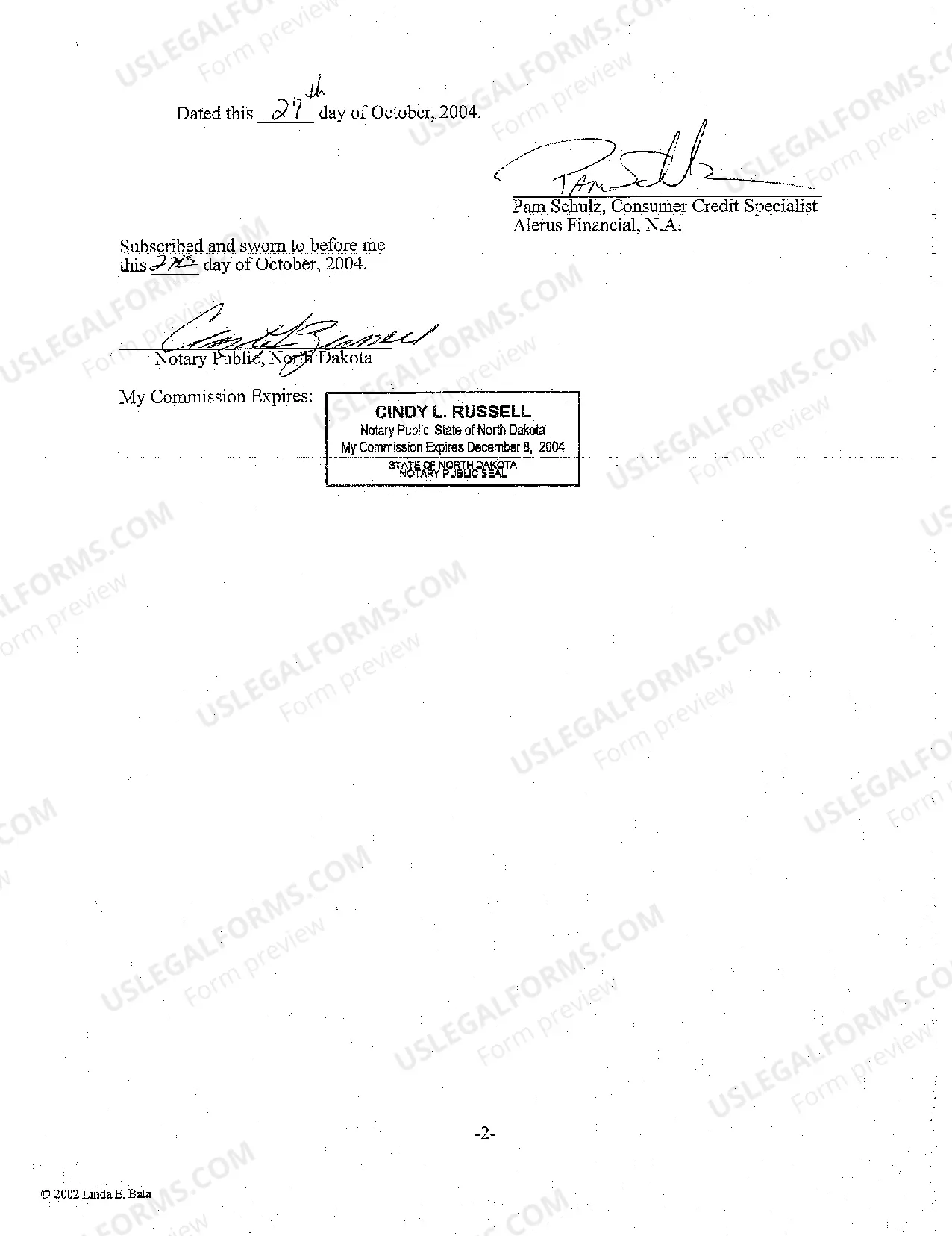

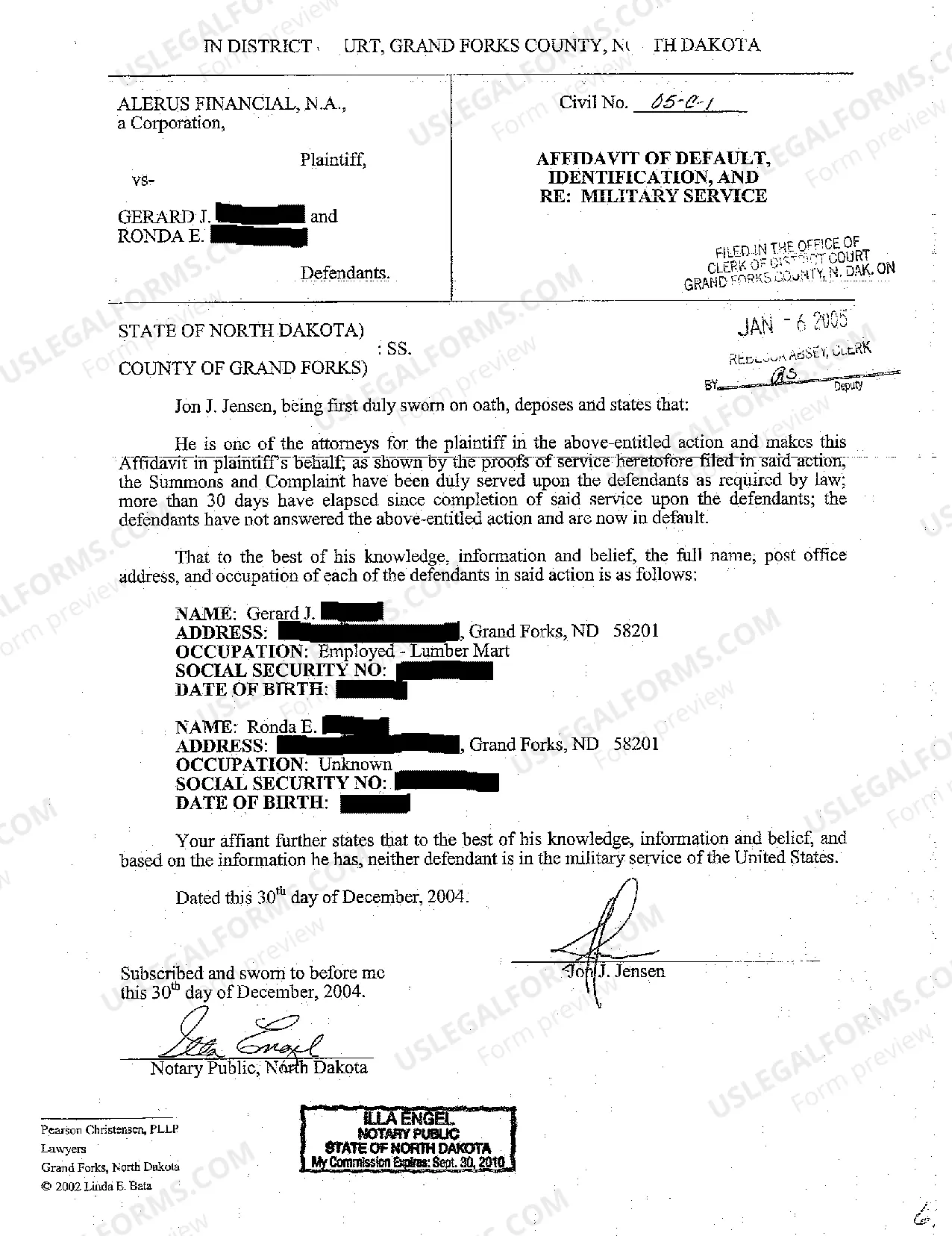

Keywords: Fargo North Dakota, Complaint, Breach of Loan Agreement, types Fargo North Dakota Complaint for Breach of Loan Agreement is a legal document filed by a lender against a borrower for violating the terms and conditions of a loan agreement in Fargo, North Dakota. This complaint seeks to resolve the breach of the loan agreement by taking legal action against the delinquent borrower. There are several types of Fargo North Dakota Complaint for Breach of Loan Agreement, including: 1. Personal Loan Breach Complaint: This type of complaint is filed when an individual borrower fails to meet their repayment obligations under a personal loan agreement. The lender can pursue legal action to recover the outstanding loan amount and any associated damages. 2. Mortgage Loan Breach Complaint: When a borrower defaults on their mortgage loan obligations, the lender may file a complaint to initiate foreclosure proceedings. This legal action allows the lender to sell the property mortgaged to recover the outstanding balance on the loan. 3. Business Loan Breach Complaint: In cases where a borrower, typically a business entity, fails to make timely payments or violates the terms of a business loan agreement, the lender can file a complaint to demand repayment or seek legal remedies. 4. Student Loan Breach Complaint: If a borrower fails to repay their educational loans, the student loan lender can file a complaint to initiate legal proceedings. This type of complaint aims to recover the outstanding student loan balance and may result in wage garnishment or other legal actions. Fargo North Dakota Complaint for Breach of Loan Agreement typically includes the following elements: 1. Parties Involved: The complaint identifies the plaintiff (the lender) and the defendant (the borrower) by their legal names and addresses. 2. Loan Agreement Details: The complaint includes a copy or references the loan agreement, stating the terms and conditions agreed upon by both parties, including the repayment schedule, interest rate, and any penalties for default. 3. Breach of Loan Agreement: The complaint outlines the specific provisions of the loan agreement that the defendant has violated, such as non-payment, late payments, or failure to provide collateral, among others. 4. Damages Incurred: The lender states the financial harm suffered due to the borrower's breach, including the outstanding loan balance, accrued interest, late fees, and any additional costs incurred because of the breach. 5. Remedies Sought: The complaint seeks appropriate remedies, which may include repayment of the outstanding balance, payment of accrued interest and penalties, or foreclosure in the case of mortgage loans. 6. Legal Grounds: The complaint cites relevant state and federal laws that support the lender's right to file a breach of loan agreement complaint and recover damages. In conclusion, Fargo North Dakota Complaint for Breach of Loan Agreement is a legal document filed by a lender against a borrower who has violated the terms and conditions of a loan agreement in Fargo, North Dakota. Different types of complaints may include personal loan breach, mortgage loan breach, business loan breach, and student loan breach. The complaint seeks to resolve the breach and recover the outstanding balance and associated damages.

Fargo North Dakota Complaint for Breach of Loan Agreement

Description

How to fill out Fargo North Dakota Complaint For Breach Of Loan Agreement?

Are you looking for a reliable and inexpensive legal forms provider to buy the Fargo North Dakota Complaint for Breach of Loan Agreement? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Fargo North Dakota Complaint for Breach of Loan Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is good for.

- Start the search over in case the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Fargo North Dakota Complaint for Breach of Loan Agreement in any available file format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online once and for all.