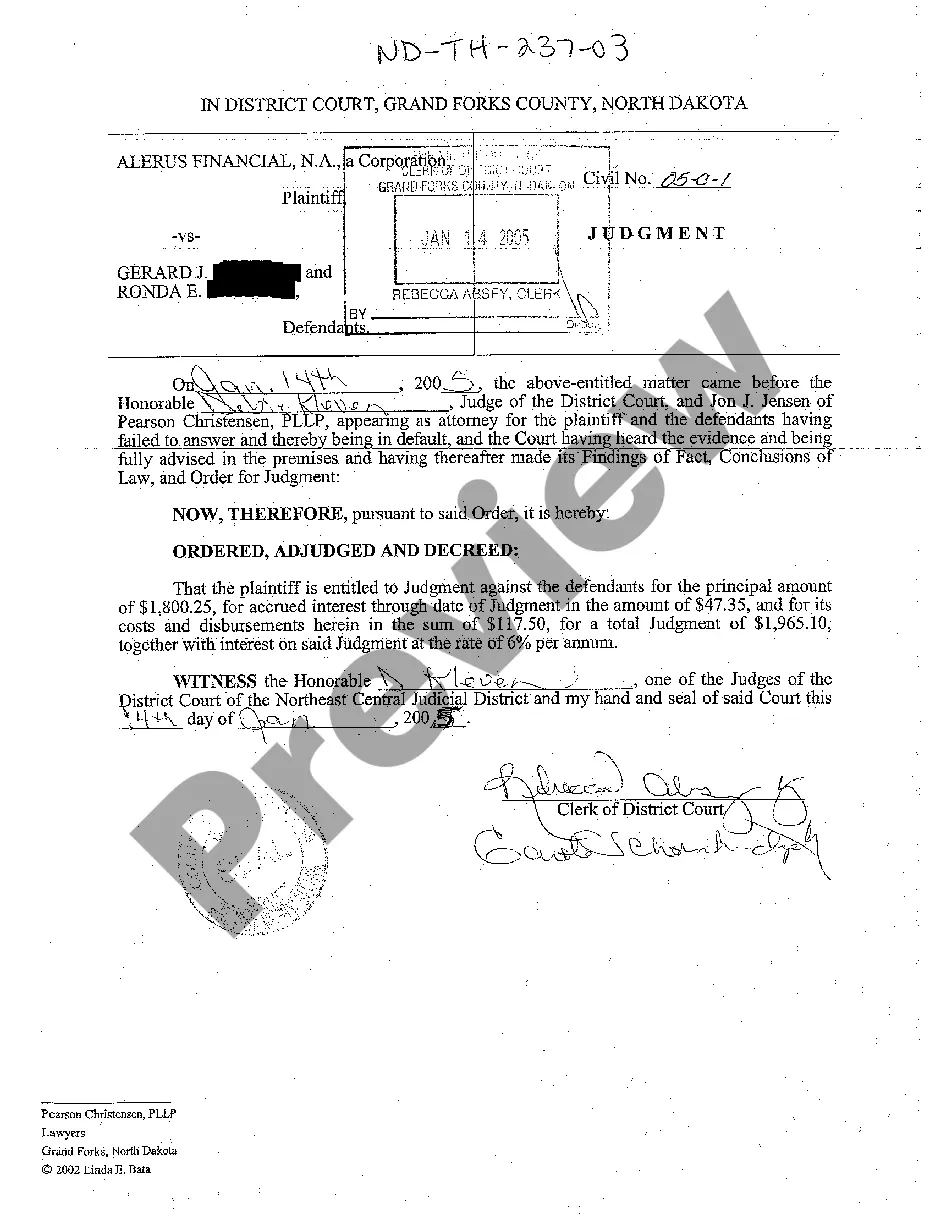

Fargo, North Dakota Judgment Granting Plaintiff Past Due Loan Payments: A Comprehensive Overview In Fargo, North Dakota, a Judgment Granting Plaintiff Past Due Loan Payments is a legally binding court decision that orders a defendant to pay a creditor the outstanding loan payments that have become past due. This judgment is typically obtained after a legal proceeding during which the creditor, referred to as the plaintiff, proves that the defendant failed to honor their loan repayment obligations. Keywords: Fargo, North Dakota, judgment, granting, plaintiff, past due loan payments. Different Types of Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments: 1. Installment Loan Judgment: This type of judgment typically applies to loans with regular monthly payments. If the defendant fails to make these scheduled installments and the creditor files a lawsuit, a judge may grant a judgment ordering the defendant to pay the past due amounts. 2. Mortgage Loan Judgment: In the case of a mortgage loan, this judgment applies when a homeowner fails to make monthly mortgage payments as agreed upon in the loan agreement. The judgment aims to enforce the repayment of missed payments and potentially even initiate foreclosure proceedings if necessary. 3. Personal Loan Judgment: Personal loans, such as those for education, medical expenses, or other personal needs, can also lead to judgment granting past due loan payments. If the borrower defaults on these loans by failing to make timely payments, a judgment may be sought by the lender to collect the outstanding debt. 4. Business Loan Judgment: For loans taken out by businesses, a judgment can be obtained when the borrower becomes delinquent on loan payments. This can occur when businesses face financial hardships, leading to missed payments and potential legal action by the lender. 5. Auto Loan Judgment: Auto loans, used for purchasing vehicles, can also result in a judgment if the borrower fails to make the required payments. A creditor can seek a judgment to regain the unpaid amounts and potentially repossess the vehicle as collateral. It's important to note that each judgment scenario can vary based on specific loan agreements, the amount owed, and the court's decision. Judgment granting past due loan payments serves to protect creditors' rights and provide a legal framework for collecting the outstanding debt. In Fargo, North Dakota, creditors must initiate legal action by filing a lawsuit against the debtor. Subsequently, the court will evaluate the evidence, including the loan agreement and payment history, to determine if a judgment is warranted. If the judgment is granted, the court will provide a detailed order outlining the required payment amount, the deadline for payment, and any potential consequences for non-compliance. Creditors can then use the court-ordered judgment to pursue various collection methods to recover the past due loan payments. These may include wage garnishment, bank account levies, property liens, or other legally permissible means to satisfy the debt. In summary, a Fargo, North Dakota Judgment Granting Plaintiff Past Due Loan Payments is a legal measure taken by creditors to recoup unpaid loan amounts. Various types of loans, such as installment loans, mortgage loans, personal loans, business loans, and auto loans, can lead to such judgments if the borrowers default on their payment obligations.

Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments

Description

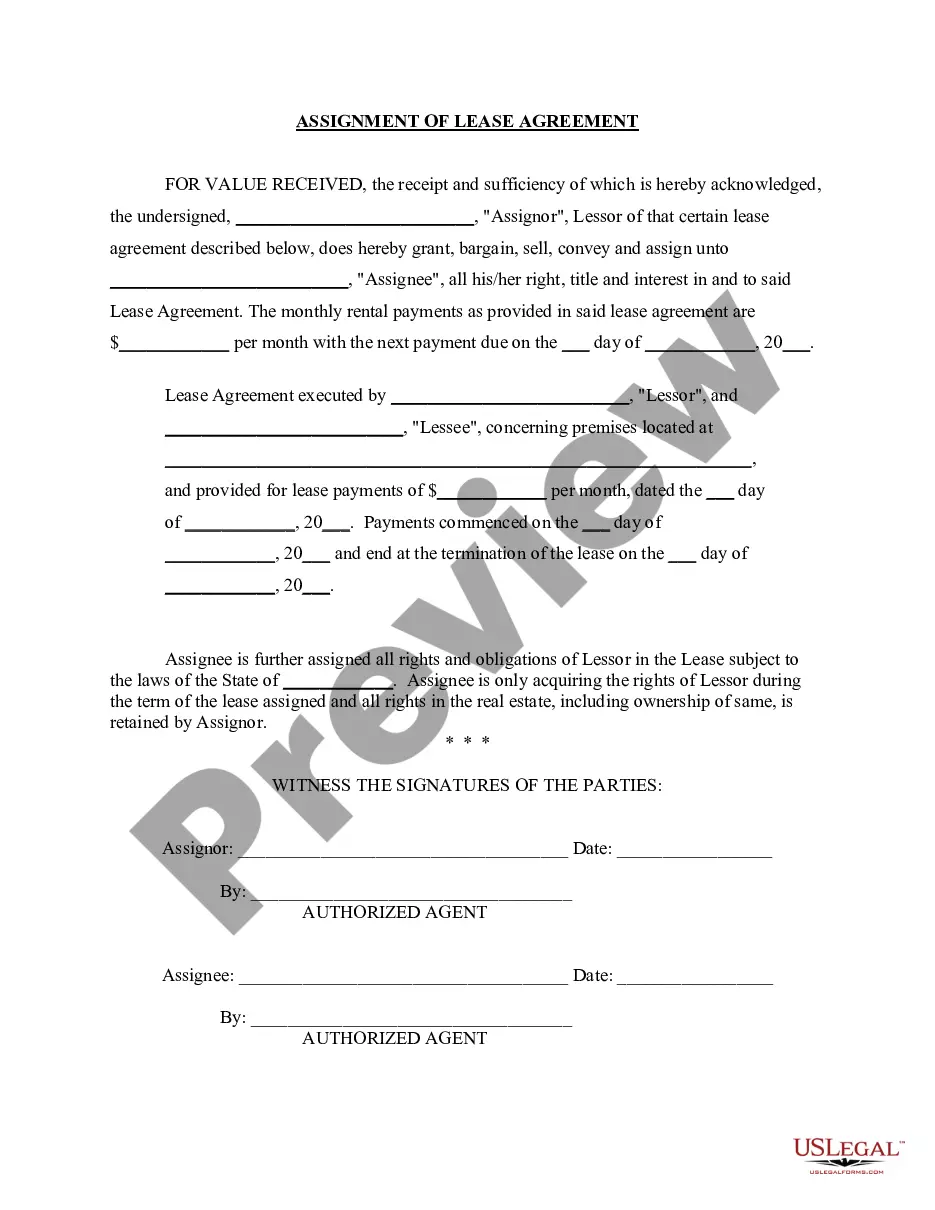

How to fill out Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments?

Benefit from the US Legal Forms and have immediate access to any form sample you want. Our useful platform with thousands of document templates makes it simple to find and obtain almost any document sample you will need. You are able to download, complete, and certify the Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments in a matter of minutes instead of surfing the Net for many hours searching for the right template.

Using our catalog is a wonderful strategy to increase the safety of your record filing. Our experienced lawyers on a regular basis review all the documents to ensure that the forms are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. In addition, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Open the page with the template you need. Ensure that it is the form you were hoping to find: check its title and description, and make use of the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Choose the format to obtain the Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy document libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Fargo North Dakota Judgment Granting Plaintiff Past Due Loan Payments.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!

Form popularity

FAQ

File an Exemption in North Dakota You must file a wage garnishment exemption form to request this relief. You can also try to use an example letter to stop wage garnishment if you have income that is protected from debt wage garnishments such as social security income.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Overview: In general, a North Dakota small claims or state district court judgment expires ten years from the date the judgment was first docketed. However, the judgment may be renewed one time.

A Small Claims judgment is final ? it cannot be appealed. The debtor must pay the judgment within ten (10) days of receiving notice.

Overview: In general, a North Dakota small claims or state district court judgment expires ten years from the date the judgment was first docketed. However, the judgment may be renewed one time.

The statute of limitations for actions on notes and contracts, including credit card debt, is six years. N.D.

If the judge requests the defendant to pay, you will need to pay within 14 days. If you decide not to pay because you cannot afford the payment along with essential living costs, the claimants may first try to gather information about your personal finances. This will tell them if you can afford to pay or not.

North Dakota follows federal law in terms of how much of your disposable income can be garnished by a creditor. Creditors can garnish whichever is less: 25% of your weekly disposable income, or. The amount by which your weekly income exceeds 40 times the federal minimum wage.

Once the writ has been issued, its terms must be carried out immediately or as soon as possible. The sheriff of the relevant court, in the absence of specific instructions from the judgment creditor, goes to the home, place of employment or place of business of the debtor.