Title: Understanding the Fargo North Dakota Complaint for Breach of Loan Agreement: Types and Key Points Introduction: A Fargo North Dakota Complaint for Breach of Loan Agreement refers to a legal document filed by a creditor against a borrower who has failed to adhere to the terms of a loan agreement. This detailed description will shed light on the various types of Fargo North Dakota Complaints for Breach of Loan Agreement and provide key insights into this legal process. Types of Fargo North Dakota Complaint for Breach of Loan Agreement: 1. Residential Mortgage Breach of Loan Agreement: This type of complaint arises when a borrower fails to fulfill their obligations under a residential mortgage loan agreement. It could involve non-payment, late payments, or any other violation mentioned in the loan agreement. 2. Commercial Loan Breach of Loan Agreement: In the case of commercial loans, a complaint can be filed against a borrower who fails to repay the loan amount or meet other specified terms stated in the commercial loan agreement. This complaint could pertain to a breach such as non-payment, insufficient collateral, or any violation specified in the agreement. Key Points to Consider: 1. Loan Agreement Terms: The loan agreement is a legally binding contract that outlines the specific terms and conditions agreed upon by both the lender and borrower. It typically covers aspects such as loan repayment schedule, interest rates, penalties for default, and other relevant clauses. 2. Breach of Agreement: A breach occurs when the borrower fails to fulfill one or more obligations stated in the loan agreement. Violations can include non-payment, late payments, insolvency, misrepresentation, failure to provide collateral, or any other clause breach mentioned in the agreement. 3. Pre-litigation Resolution: Before filing a complaint, lenders are encouraged to engage in pre-litigation negotiations with the borrower to explore possible resolution options. This can involve discussions, notifications, and attempts to rectify any breaches in order to avoid legal action. 4. Legal Representation: Both parties involved in the loan agreement are advised to seek legal representation. A qualified attorney experienced in breach of loan agreement cases in Fargo, North Dakota, can provide invaluable guidance throughout the process and ensure that their client's rights and interests are protected. 5. Possible Remedies: If the court finds in favor of the lender for a Fargo North Dakota Complaint for Breach of Loan Agreement, potential remedies could include monetary compensation, repossession of collateral (if stated in the agreement), specific performance, or other appropriate legal measures as determined by the court. Conclusion: Filing a Fargo North Dakota Complaint for Breach of Loan Agreement is a significant step towards resolving disputes between creditors and borrowers. Understanding the different types of complaints and key aspects of this legal process can help both parties navigate the complexities involved and seek appropriate solutions to protect their rights and interests.

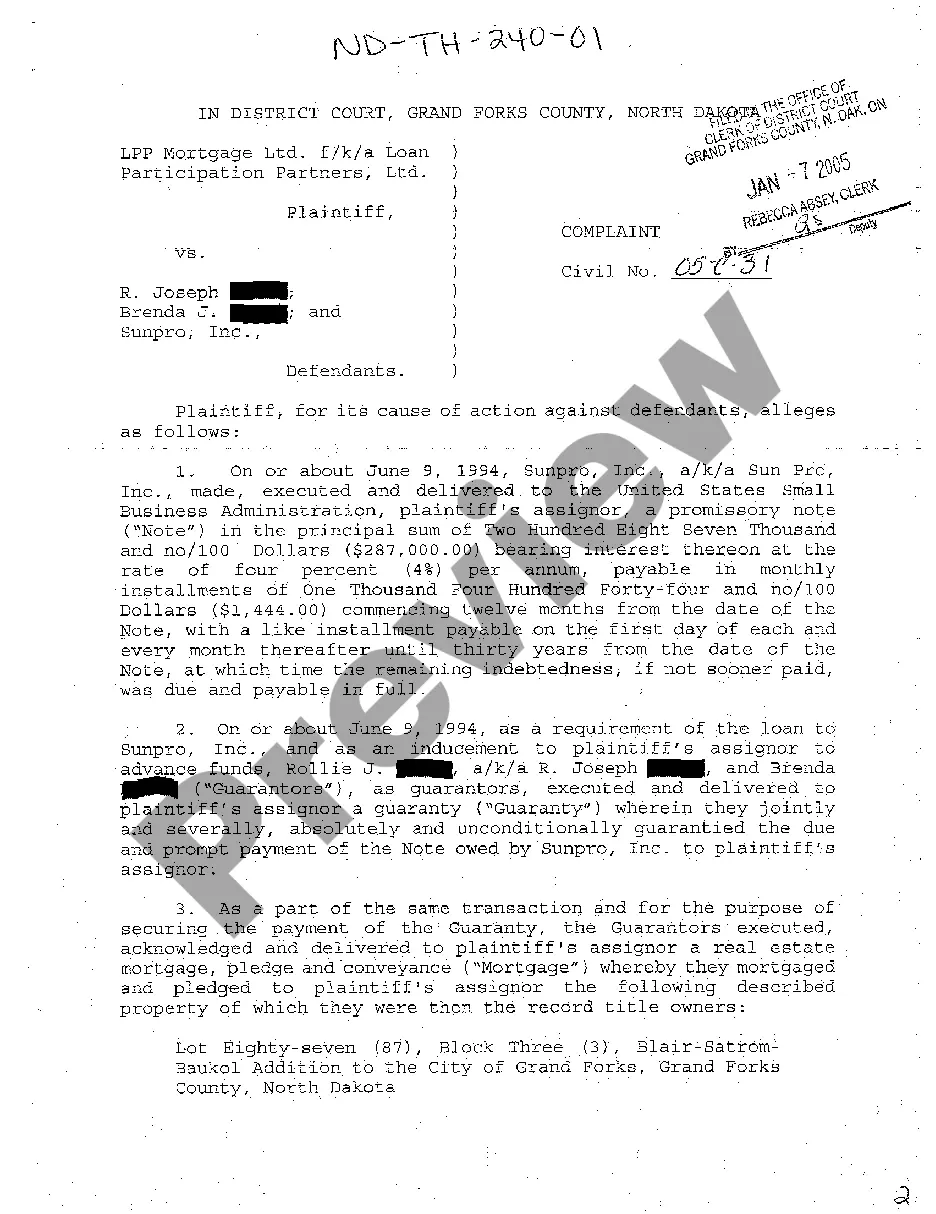

Fargo North Dakota Complaint for Breach of Loan Agreement

Description

How to fill out Fargo North Dakota Complaint For Breach Of Loan Agreement?

Do you need a trustworthy and affordable legal forms provider to get the Fargo North Dakota Complaint for Breach of Loan Agreement? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed in accordance with the requirements of particular state and area.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Fargo North Dakota Complaint for Breach of Loan Agreement conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Fargo North Dakota Complaint for Breach of Loan Agreement in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online for good.