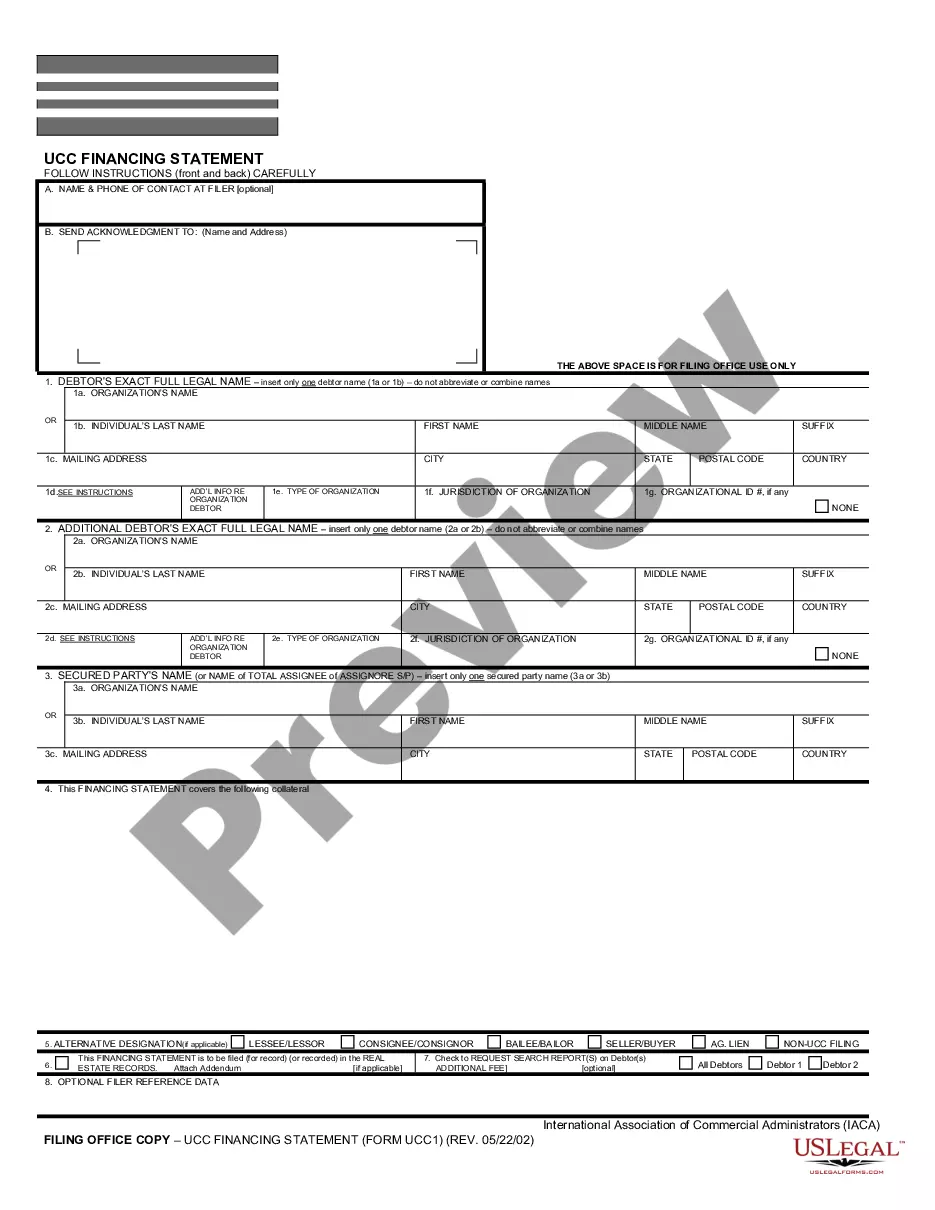

Fargo North Dakota UCC1 Financing Statement

Description

How to fill out North Dakota UCC1 Financing Statement?

We consistently aim to minimize or evade legal repercussions when navigating intricate legal or financial matters.

To achieve this, we engage legal services that are typically quite costly.

Nevertheless, not every legal issue is equally complex.

Many can be handled independently.

Take advantage of US Legal Forms whenever you require to locate and download the Fargo North Dakota UCC1 Financing Statement or any other form swiftly and securely.

- US Legal Forms is an online directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library empowers you to manage your own affairs without needing an attorney.

- We provide access to legal form templates that are not always accessible to the public.

- Our templates are tailored to specific states and areas, which greatly eases the search process.

Form popularity

FAQ

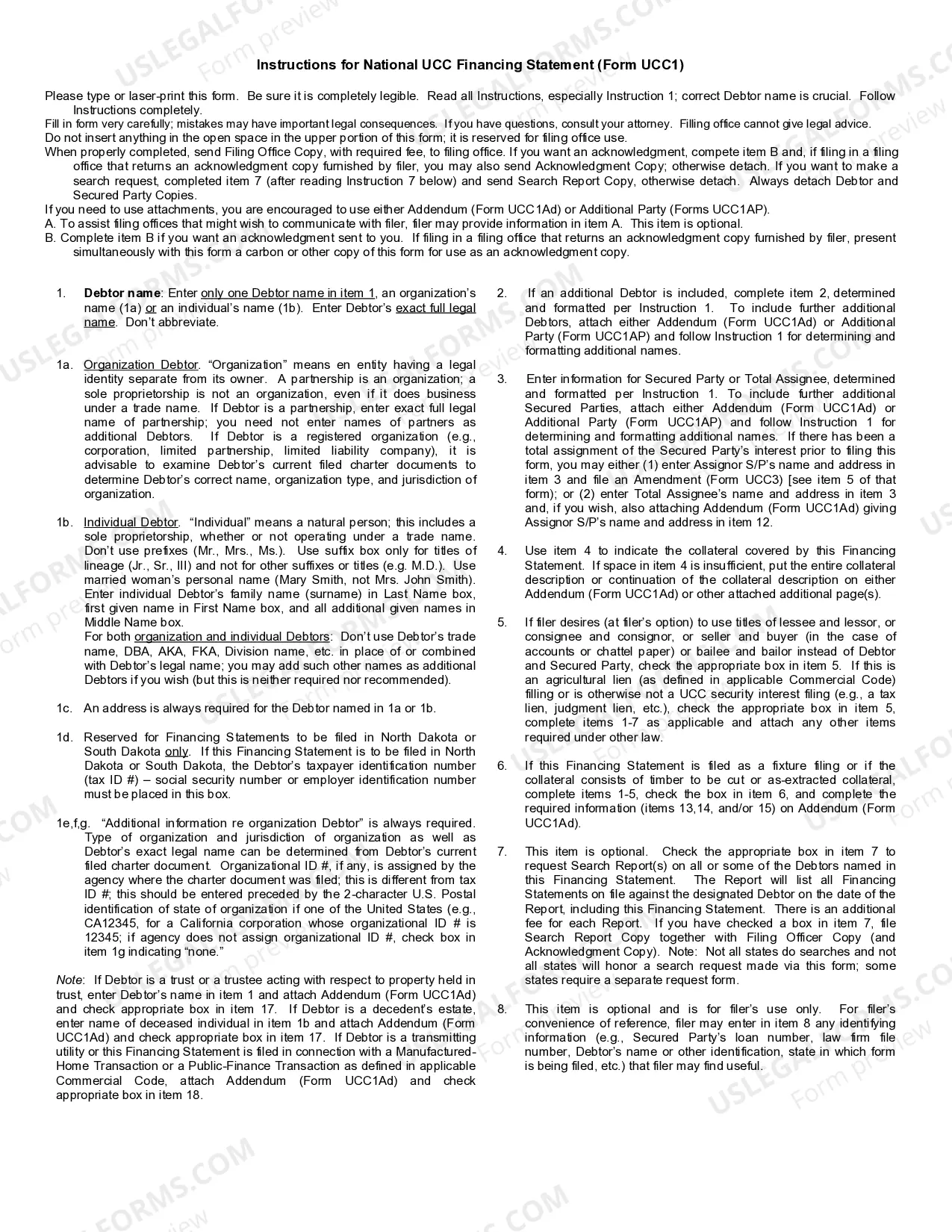

Properly filling out a Fargo North Dakota UCC1 Financing Statement requires attention to detail. Begin by correctly entering all required information, including names and addresses of both the debtor and secured party. Make sure to provide a clear and concise description of the collateral in question to avoid any potential confusion or future disputes.

To assign a Fargo North Dakota UCC1 Financing Statement, you need to complete an assignment form. This process involves providing the necessary information about the original secured party and the new assignee. Once the assignment is finalized, you must file it with the state to update the public record, ensuring transparency and clarity of ownership.

You should file your Fargo North Dakota UCC1 Financing Statement in North Dakota, where the debtor is located or where the collateral is physically situated. This ensures that the filing is effective and properly registered under state laws. It’s essential to choose the correct state to maintain your security interest.

Filling out a Fargo North Dakota UCC1 Financing Statement involves several clear steps. First, gather the necessary information about the debtor and the secured party. After that, accurately complete the form, ensuring you include a detailed description of the collateral, and finally, file the form with the appropriate state office to make it effective.

To file a Fargo North Dakota UCC1 Financing Statement, you must identify the parties involved and describe the collateral. The debtor's name and address, as well as the secured party's name and address, are mandatory. Additionally, you need to ensure that your collateral description is sufficiently detailed to identify what is covered under the financing statement.

You can access your UCC filings through the North Dakota Secretary of State's online portal. In Fargo, North Dakota, this portal provides an efficient way to check the status or retrieve copies of your UCC1 Financing Statement. If you’re looking for a streamlined approach to filing and managing your documents, consider using the USLegalForms platform for ease and confidence.

Yes, UCC financing statements are officially recorded with the Secretary of State, creating a public record of the secured party's interest. In Fargo, North Dakota, it is vital to file your UCC1 Financing Statement to protect your interests and alert other creditors about your lien. Recording this statement not only provides notice but also strengthens your legal position.

UCC liens are recorded with the Secretary of State in the state where the debtor resides. In Fargo, North Dakota, these filings are essential for giving notice of the lien to potential lenders. By filing correctly, you ensure that your claim remains perfect and enforceable against the debtor's assets.

Yes, a UCC lien can show up on a credit report. When a UCC1 Financing Statement is filed, it may appear in the public records section of a credit report, affecting the creditworthiness of the debtor. Keeping track of any UCC liens is important for businesses and individuals in Fargo, North Dakota, as it provides transparency about existing obligations.

A recorded financing statement is a legal document that establishes a lender's interest in a borrower's assets. This document, once filed in Fargo, North Dakota, serves as public notice of the secured party's claim against the assets listed. It is essential for protecting the lender's rights in case of default.