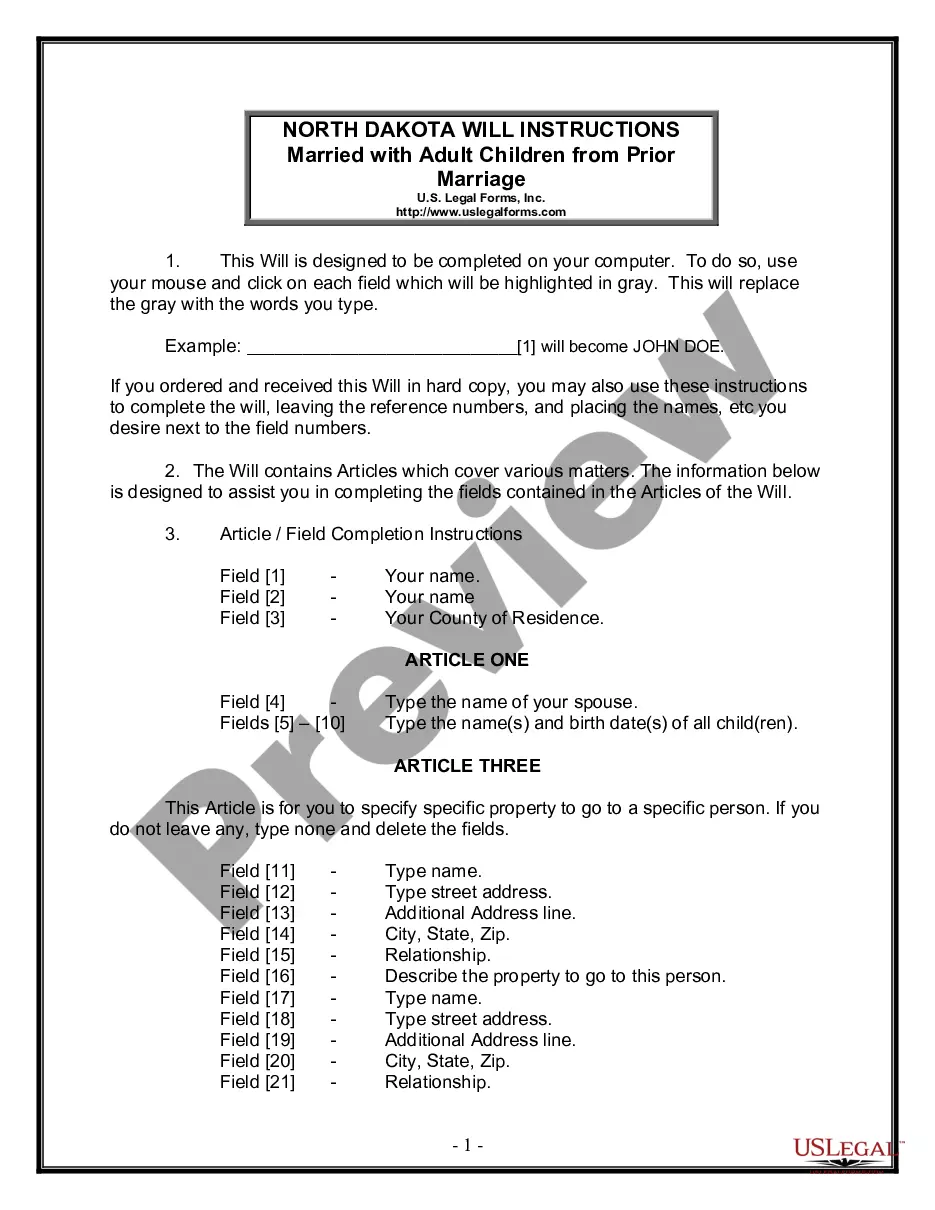

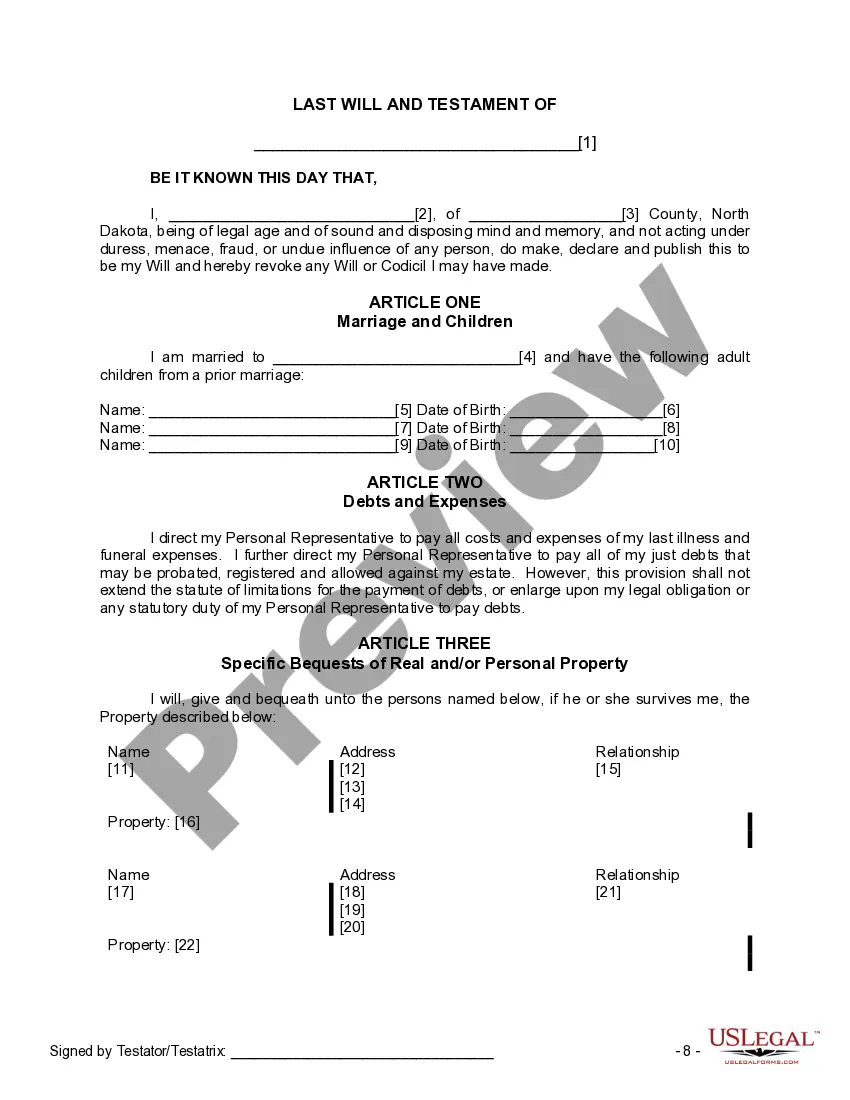

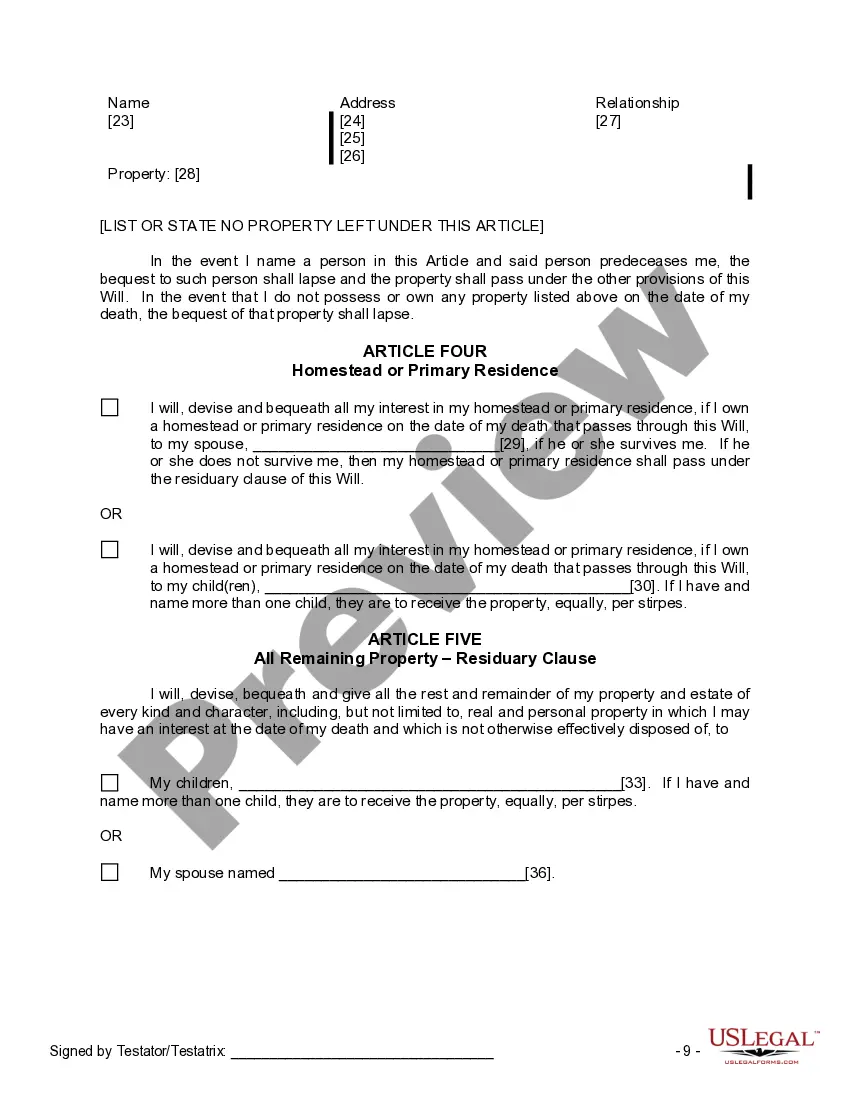

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Fargo North Dakota Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage is a legal document that allows individuals residing in Fargo, North Dakota, who are married and have adult children from a previous marriage, to create a comprehensive plan for the distribution of their assets, debts, and personal belongings upon their death. This will form ensures that the testator's wishes are accurately carried out and helps minimize any potential family disputes or legal conflicts that may arise after their passing. Keywords: Fargo North Dakota, legal, last will and testament, form, married person, adult children, prior marriage, assets, debts, personal belongings, death, testator, family disputes, legal conflicts. In Fargo, North Dakota, there may be different variations or versions of the Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage, catering to specific circumstances and preferences. Some possible types of Fargo North Dakota Legal Last Will and Testament Forms for Married persons with Adult Children from Prior Marriage include: 1. Standard Last Will and Testament: This form outlines the distribution of assets, such as real estate, bank accounts, investments, and personal property, among the surviving spouse and adult children from a previous marriage. It may also address any outstanding debts or specific bequests to other beneficiaries. 2. Living Will: In addition to addressing asset distribution, a Living Will allows individuals to express their wishes regarding medical treatment and end-of-life decisions, providing guidance to family members and healthcare providers in case of incapacitation. 3. Trust-based Last Will and Testament: This form establishes a trust to manage and distribute assets upon the testator's death, ensuring continued financial stability for the surviving spouse and adult children. It may offer tax benefits, enhanced asset protection, and the ability to delay distributions under certain circumstances. 4. Pour-over Will: This document is used in conjunction with a Revocable Living Trust, enabling individuals to pass any assets not held within the trust at the time of their death into the trust, ensuring comprehensive management and distribution of their estate. It is crucial to consult with an attorney or legal professional in Fargo, North Dakota, to ensure the selected Last Will and Testament form aligns with individual circumstances, complies with local laws and regulations, and effectively addresses the unique needs of married individuals with adult children from a previous marriage.

Fargo North Dakota Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage is a legal document that allows individuals residing in Fargo, North Dakota, who are married and have adult children from a previous marriage, to create a comprehensive plan for the distribution of their assets, debts, and personal belongings upon their death. This will form ensures that the testator's wishes are accurately carried out and helps minimize any potential family disputes or legal conflicts that may arise after their passing. Keywords: Fargo North Dakota, legal, last will and testament, form, married person, adult children, prior marriage, assets, debts, personal belongings, death, testator, family disputes, legal conflicts. In Fargo, North Dakota, there may be different variations or versions of the Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage, catering to specific circumstances and preferences. Some possible types of Fargo North Dakota Legal Last Will and Testament Forms for Married persons with Adult Children from Prior Marriage include: 1. Standard Last Will and Testament: This form outlines the distribution of assets, such as real estate, bank accounts, investments, and personal property, among the surviving spouse and adult children from a previous marriage. It may also address any outstanding debts or specific bequests to other beneficiaries. 2. Living Will: In addition to addressing asset distribution, a Living Will allows individuals to express their wishes regarding medical treatment and end-of-life decisions, providing guidance to family members and healthcare providers in case of incapacitation. 3. Trust-based Last Will and Testament: This form establishes a trust to manage and distribute assets upon the testator's death, ensuring continued financial stability for the surviving spouse and adult children. It may offer tax benefits, enhanced asset protection, and the ability to delay distributions under certain circumstances. 4. Pour-over Will: This document is used in conjunction with a Revocable Living Trust, enabling individuals to pass any assets not held within the trust at the time of their death into the trust, ensuring comprehensive management and distribution of their estate. It is crucial to consult with an attorney or legal professional in Fargo, North Dakota, to ensure the selected Last Will and Testament form aligns with individual circumstances, complies with local laws and regulations, and effectively addresses the unique needs of married individuals with adult children from a previous marriage.