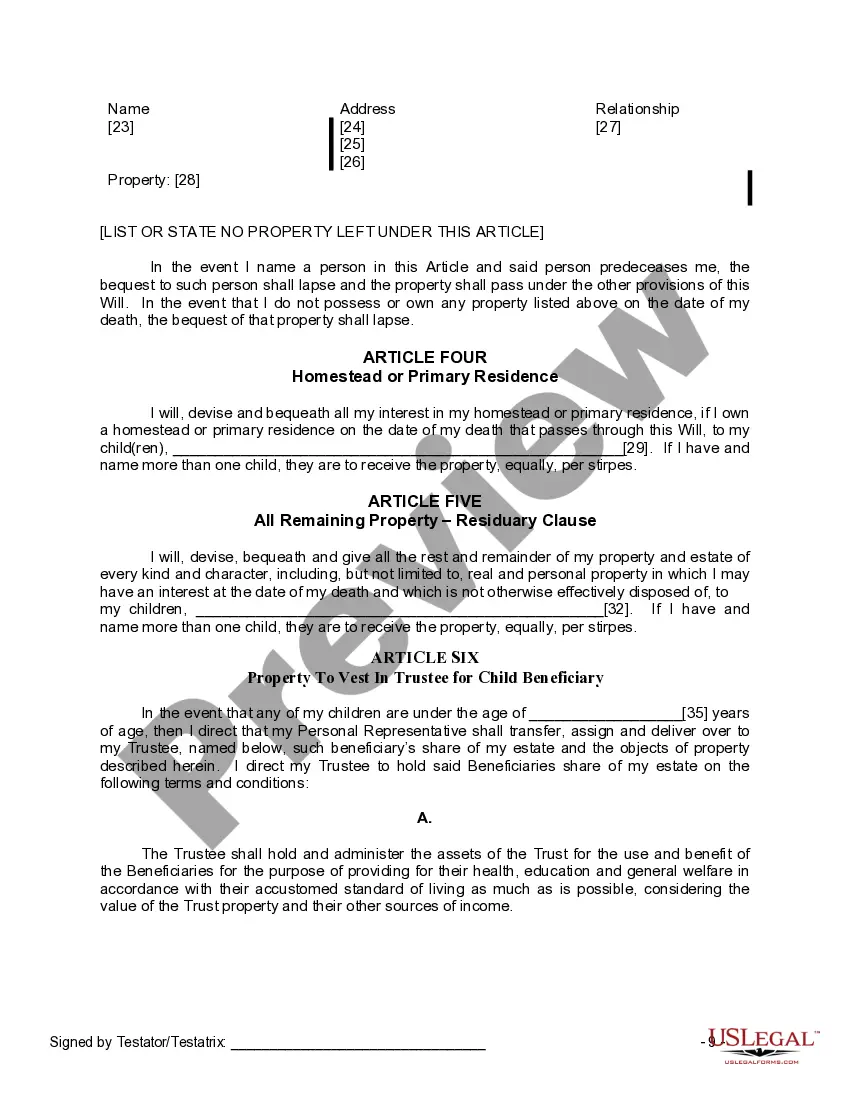

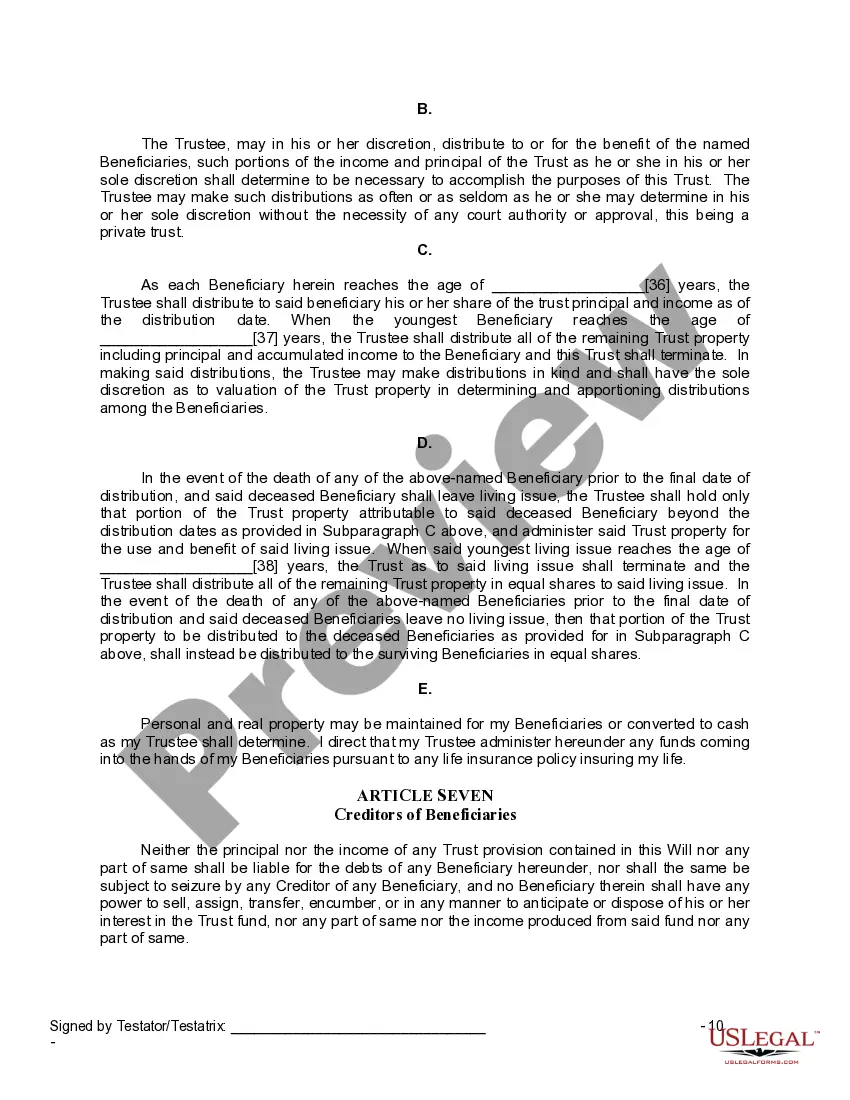

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals in the state of North Dakota who have lost their spouse and have minor children to declare their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that your loved ones and assets are protected according to your specific instructions. Key elements of the Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children include: 1. Executor or Personal Representative: In this form, you can appoint an individual to be the executor or personal representative of your estate. This person will be responsible for overseeing the distribution of your assets and handling any outstanding debts or taxes. 2. Beneficiaries: You can specify who will receive your assets, such as property, bank accounts, investments, and personal belongings. It is crucial to name your minor children as beneficiaries and designate a guardian to ensure their well-being in the event of your death. 3. Guardian Designation: This form provides you with the opportunity to appoint a guardian for your minor children. The designated guardian will be responsible for their personal care, education, and upbringing until they reach the age of adulthood. 4. Trusts: If desired, you can establish a trust for your minor children's inheritance. This allows you to allocate assets specifically for their benefit, ensuring their financial security until they reach a designated age or milestone. 5. Alternate Beneficiaries and Guardians: To account for unforeseen circumstances, it is recommended to name alternate beneficiaries and guardians to ensure that your children's best interests are protected if your initial choices are unavailable or unable to fulfill their responsibilities. There may be variations of this kind of Fargo North Dakota Legal Last Will and Testament Form, depending on the specific needs and preferences of the Widow or Widower. For instance, there might be versions that cater to individuals with unique circumstances, such as those who already have existing trusts established or blended families with step-children. By utilizing the Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children, individuals can have peace of mind knowing that their wishes for their assets and minor children's well-being are legally stated and will be honored upon their passing.

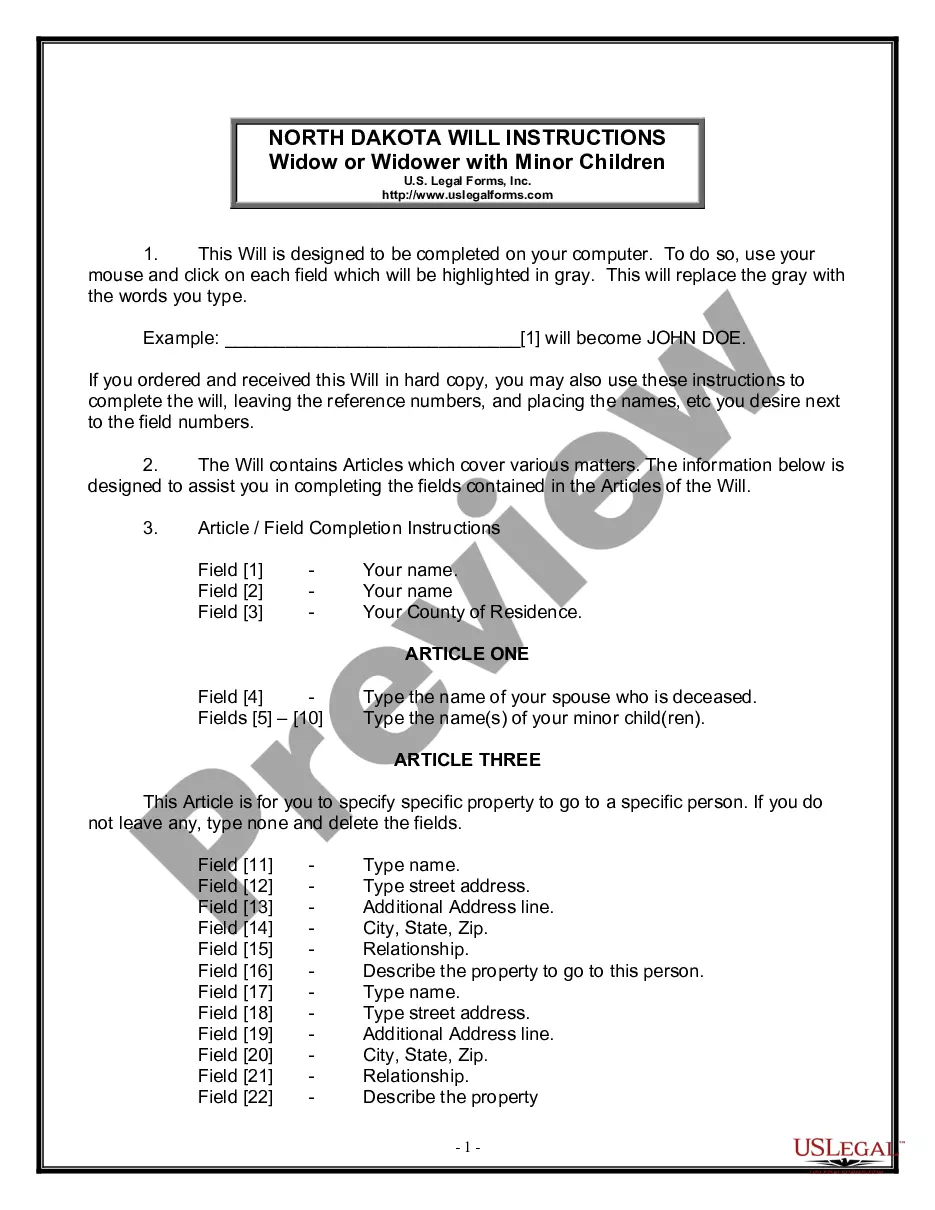

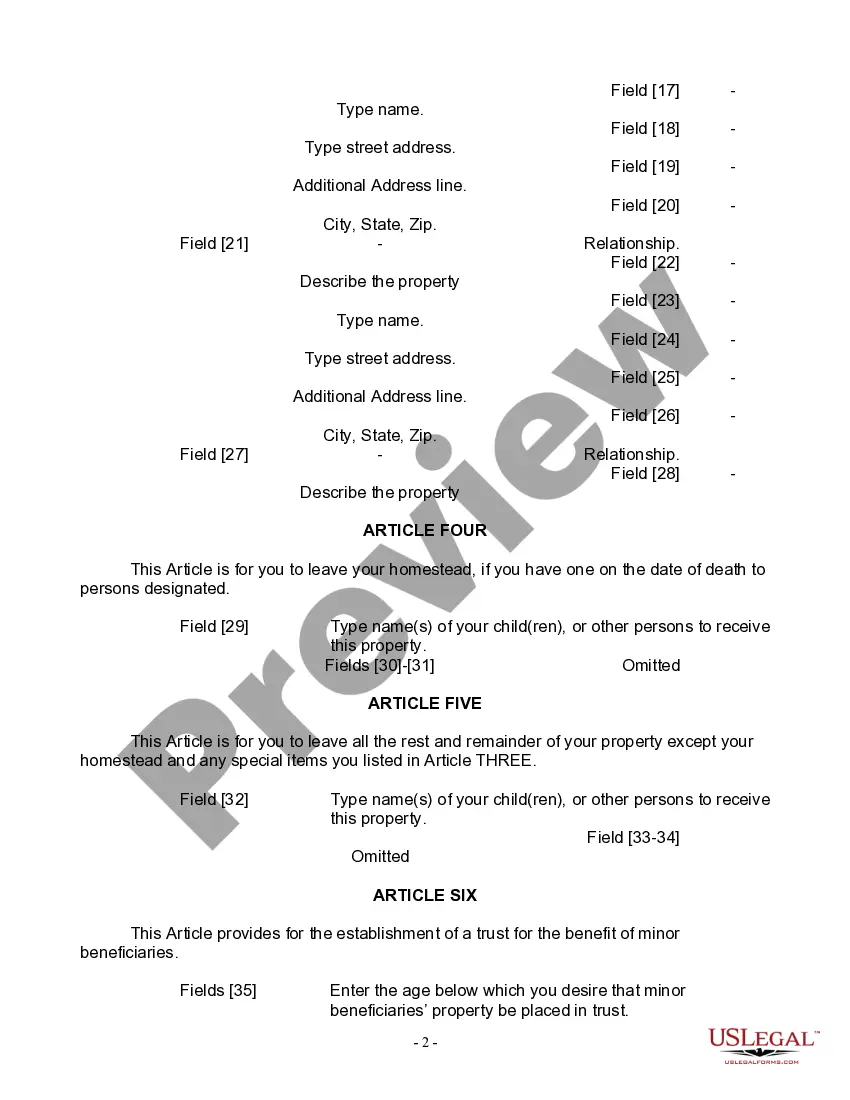

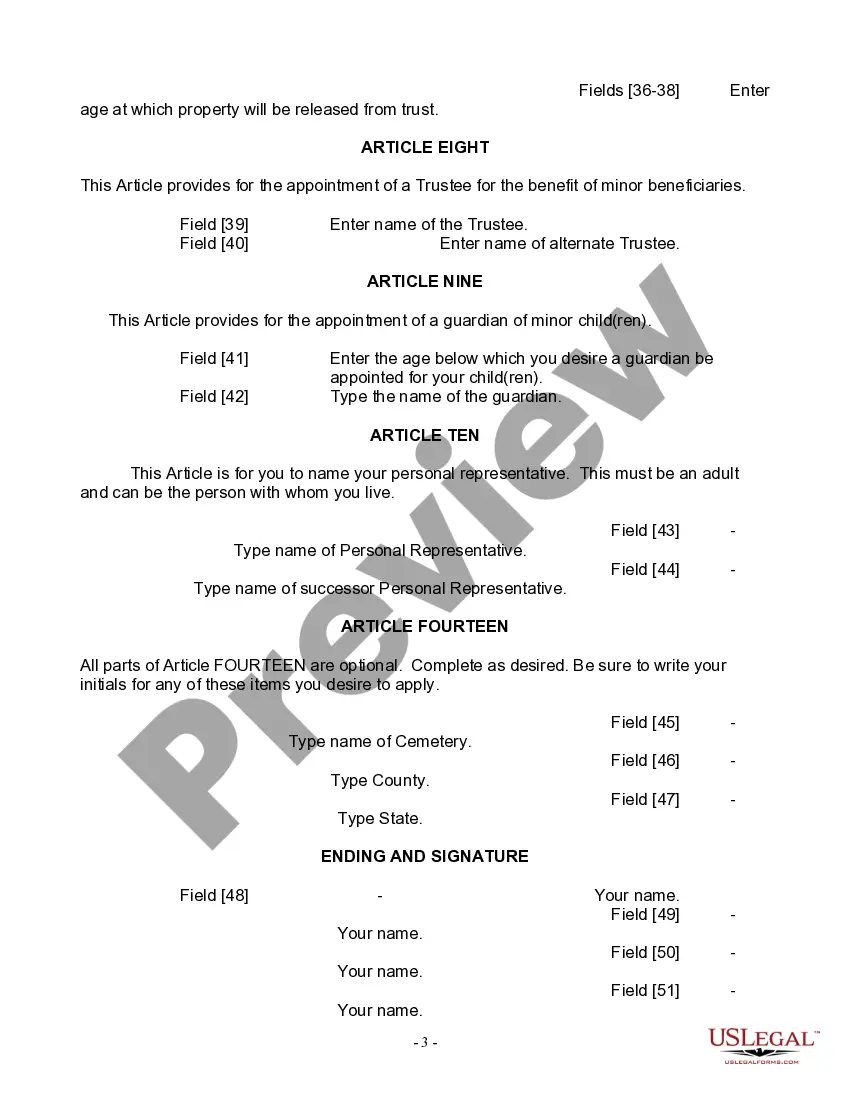

A Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals in the state of North Dakota who have lost their spouse and have minor children to declare their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that your loved ones and assets are protected according to your specific instructions. Key elements of the Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children include: 1. Executor or Personal Representative: In this form, you can appoint an individual to be the executor or personal representative of your estate. This person will be responsible for overseeing the distribution of your assets and handling any outstanding debts or taxes. 2. Beneficiaries: You can specify who will receive your assets, such as property, bank accounts, investments, and personal belongings. It is crucial to name your minor children as beneficiaries and designate a guardian to ensure their well-being in the event of your death. 3. Guardian Designation: This form provides you with the opportunity to appoint a guardian for your minor children. The designated guardian will be responsible for their personal care, education, and upbringing until they reach the age of adulthood. 4. Trusts: If desired, you can establish a trust for your minor children's inheritance. This allows you to allocate assets specifically for their benefit, ensuring their financial security until they reach a designated age or milestone. 5. Alternate Beneficiaries and Guardians: To account for unforeseen circumstances, it is recommended to name alternate beneficiaries and guardians to ensure that your children's best interests are protected if your initial choices are unavailable or unable to fulfill their responsibilities. There may be variations of this kind of Fargo North Dakota Legal Last Will and Testament Form, depending on the specific needs and preferences of the Widow or Widower. For instance, there might be versions that cater to individuals with unique circumstances, such as those who already have existing trusts established or blended families with step-children. By utilizing the Fargo North Dakota Legal Last Will and Testament Form for Widow or Widower with Minor Children, individuals can have peace of mind knowing that their wishes for their assets and minor children's well-being are legally stated and will be honored upon their passing.