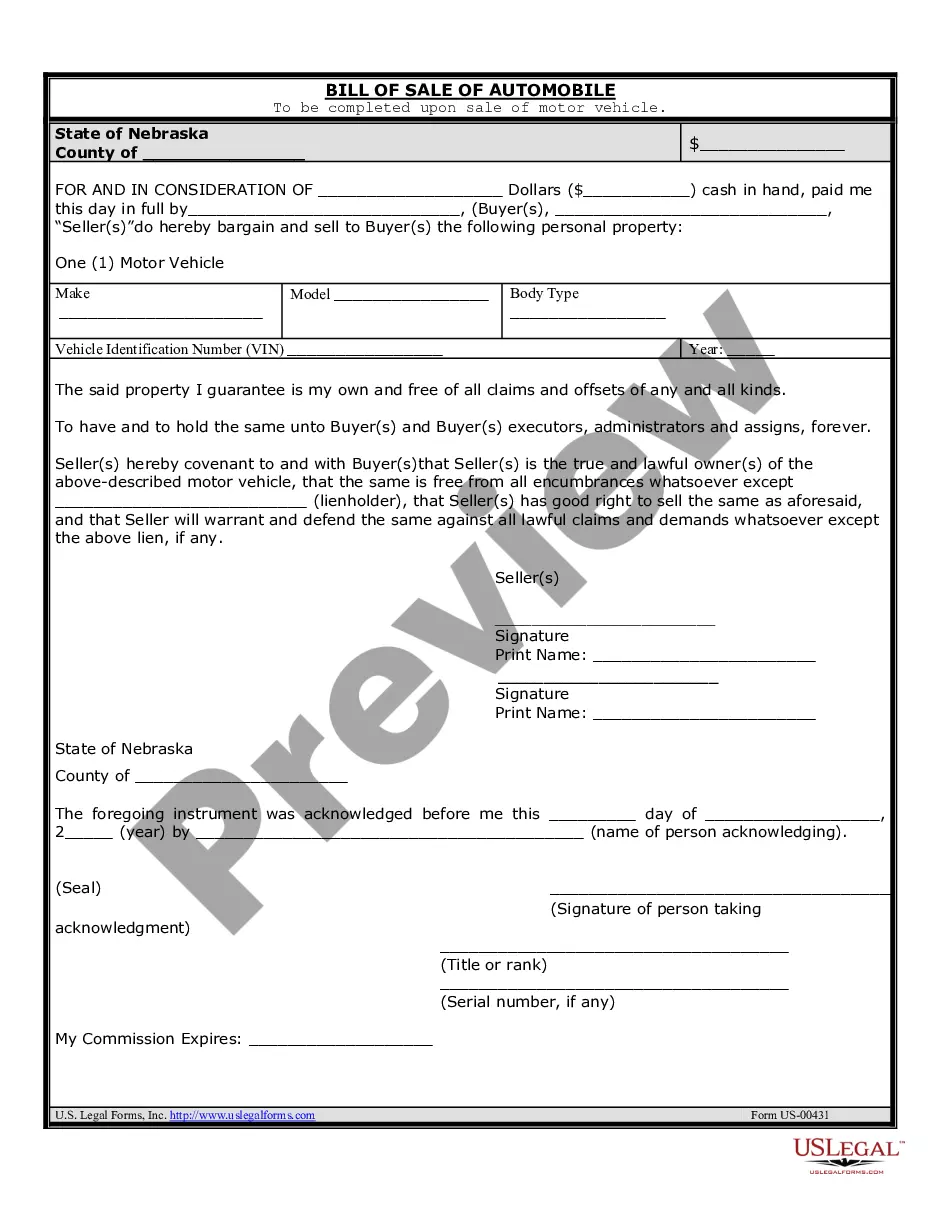

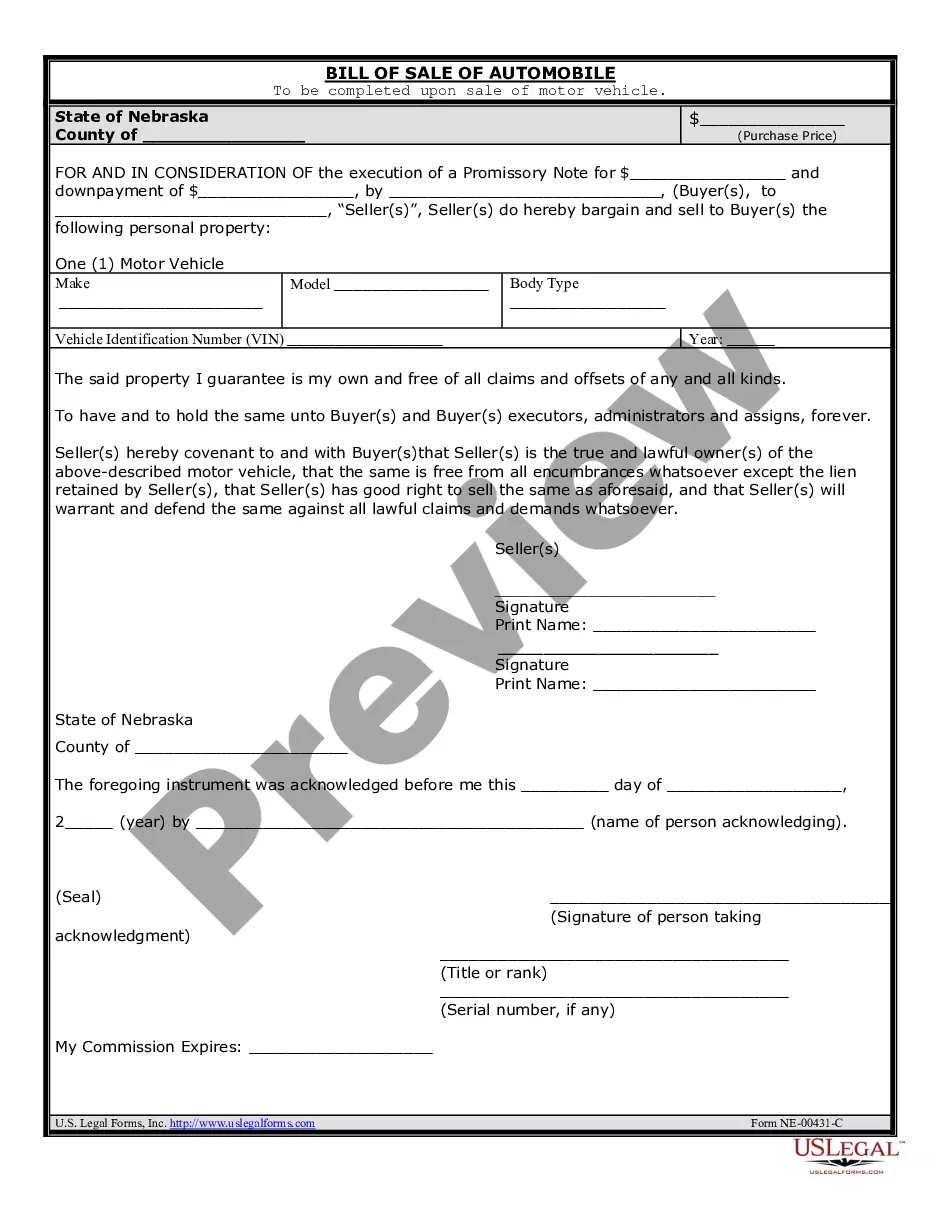

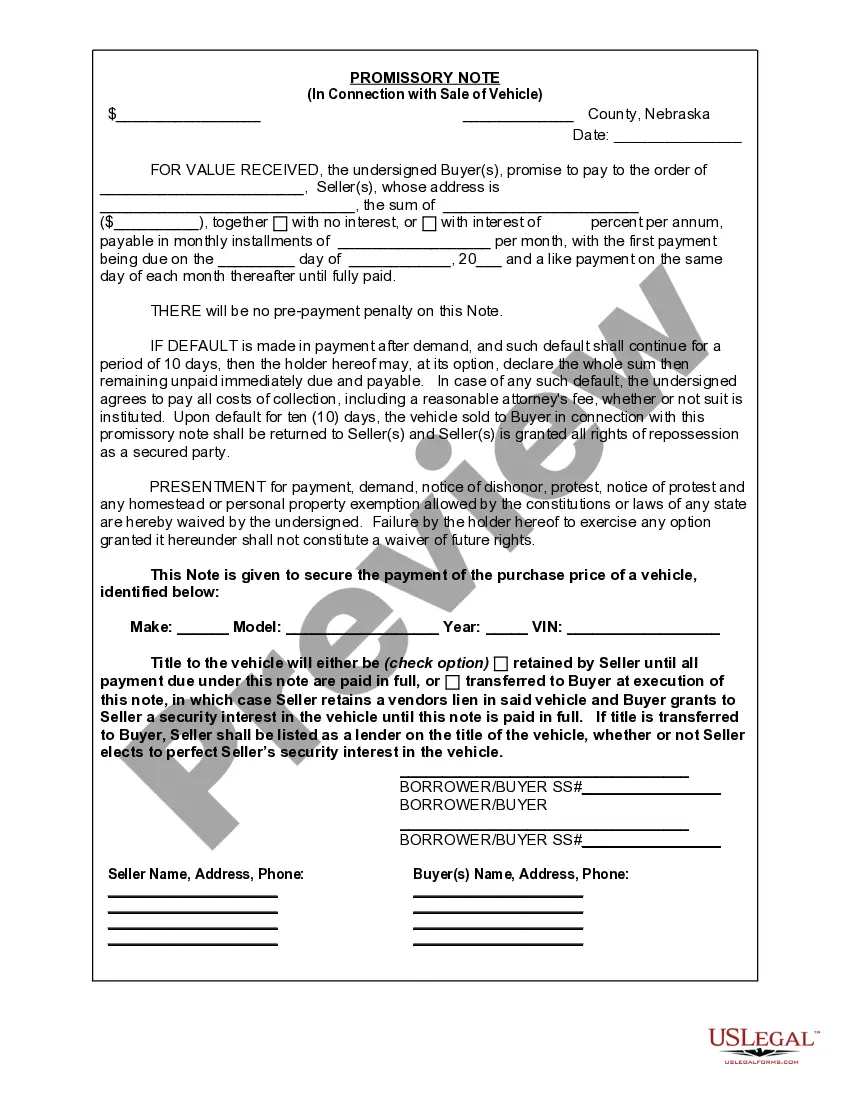

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Omaha, Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile: All You Need to Know In Omaha, Nebraska, a promissory note is commonly used as a legal document in connection with the sale of vehicles or automobiles. This legally binding agreement outlines the terms and conditions agreed upon by the buyer and seller, ensuring clarity and protection for both parties involved. By signing this document, parties can establish a repayment plan for the purchase price of the vehicle, including any interest or additional fees, if applicable. Keywords: Omaha, Nebraska, promissory note, sale of vehicle, automobile, legal document, terms and conditions, buyer, seller, repayment plan, purchase price, interest, additional fees. Types of Omaha, Nebraska Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Fixed-Term Promissory Note: This type of promissory note establishes a specific duration and number of payments for the buyer to repay the purchase amount. The duration and payment structure are pre-determined, providing clarity on the repayment schedule. 2. Interest-Bearing Promissory Note: In certain cases, the seller may charge interest on the amount of the loan. This interest rate is typically determined during the negotiation process and added to the principal loan amount. An interest-bearing promissory note ensures that the buyer is aware of the additional cost of borrowing. 3. Balloon Promissory Note: A balloon promissory note offers the buyer lower monthly repayments for a specified period. However, at the end of this period, a larger "balloon" payment covers the remaining balance. This type of note is useful for buyers who anticipate having the necessary funds to make a lump sum payment in the future. 4. Secured Promissory Note: This type of promissory note includes a collateral agreement, wherein the buyer pledges an asset (usually the vehicle itself) as security for the loan. In case of default or non-payment, the seller retains the right to repossess the collateral. 5. Unsecured Promissory Note: An unsecured promissory note does not require collateral. Instead, it relies solely on the buyer's promise to repay the outstanding amount, usually backed by their creditworthiness and reputation. It is essential for both parties involved in the sale of a vehicle or automobile in Omaha, Nebraska, to carefully consider the terms and conditions when drafting and signing a promissory note. This document protects the rights, responsibilities, and obligations of both the buyer and seller, ensuring a transparent and fair transaction. Overall, a promissory note provides a legal framework for the financing of a vehicle purchase, allowing for smooth and secure transactions between buyers and sellers in Omaha, Nebraska.Omaha, Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile: All You Need to Know In Omaha, Nebraska, a promissory note is commonly used as a legal document in connection with the sale of vehicles or automobiles. This legally binding agreement outlines the terms and conditions agreed upon by the buyer and seller, ensuring clarity and protection for both parties involved. By signing this document, parties can establish a repayment plan for the purchase price of the vehicle, including any interest or additional fees, if applicable. Keywords: Omaha, Nebraska, promissory note, sale of vehicle, automobile, legal document, terms and conditions, buyer, seller, repayment plan, purchase price, interest, additional fees. Types of Omaha, Nebraska Promissory Notes in Connection with Sale of Vehicle or Automobile: 1. Fixed-Term Promissory Note: This type of promissory note establishes a specific duration and number of payments for the buyer to repay the purchase amount. The duration and payment structure are pre-determined, providing clarity on the repayment schedule. 2. Interest-Bearing Promissory Note: In certain cases, the seller may charge interest on the amount of the loan. This interest rate is typically determined during the negotiation process and added to the principal loan amount. An interest-bearing promissory note ensures that the buyer is aware of the additional cost of borrowing. 3. Balloon Promissory Note: A balloon promissory note offers the buyer lower monthly repayments for a specified period. However, at the end of this period, a larger "balloon" payment covers the remaining balance. This type of note is useful for buyers who anticipate having the necessary funds to make a lump sum payment in the future. 4. Secured Promissory Note: This type of promissory note includes a collateral agreement, wherein the buyer pledges an asset (usually the vehicle itself) as security for the loan. In case of default or non-payment, the seller retains the right to repossess the collateral. 5. Unsecured Promissory Note: An unsecured promissory note does not require collateral. Instead, it relies solely on the buyer's promise to repay the outstanding amount, usually backed by their creditworthiness and reputation. It is essential for both parties involved in the sale of a vehicle or automobile in Omaha, Nebraska, to carefully consider the terms and conditions when drafting and signing a promissory note. This document protects the rights, responsibilities, and obligations of both the buyer and seller, ensuring a transparent and fair transaction. Overall, a promissory note provides a legal framework for the financing of a vehicle purchase, allowing for smooth and secure transactions between buyers and sellers in Omaha, Nebraska.