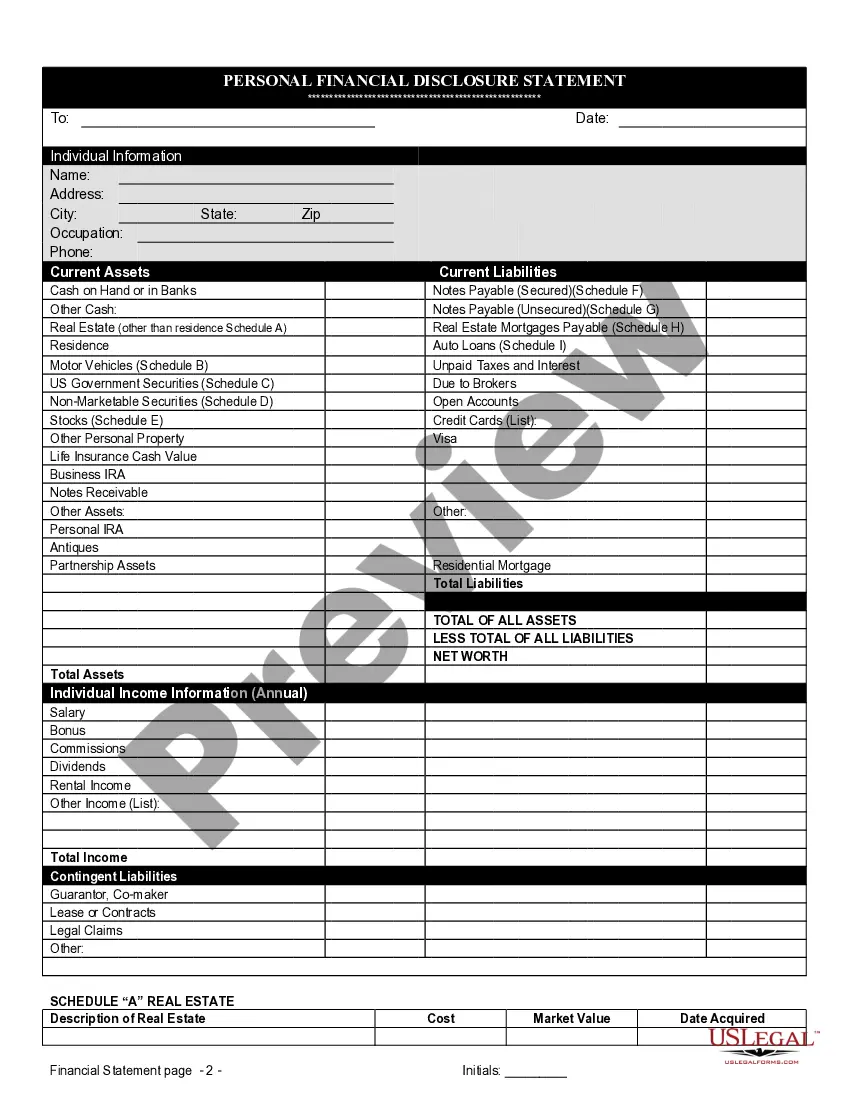

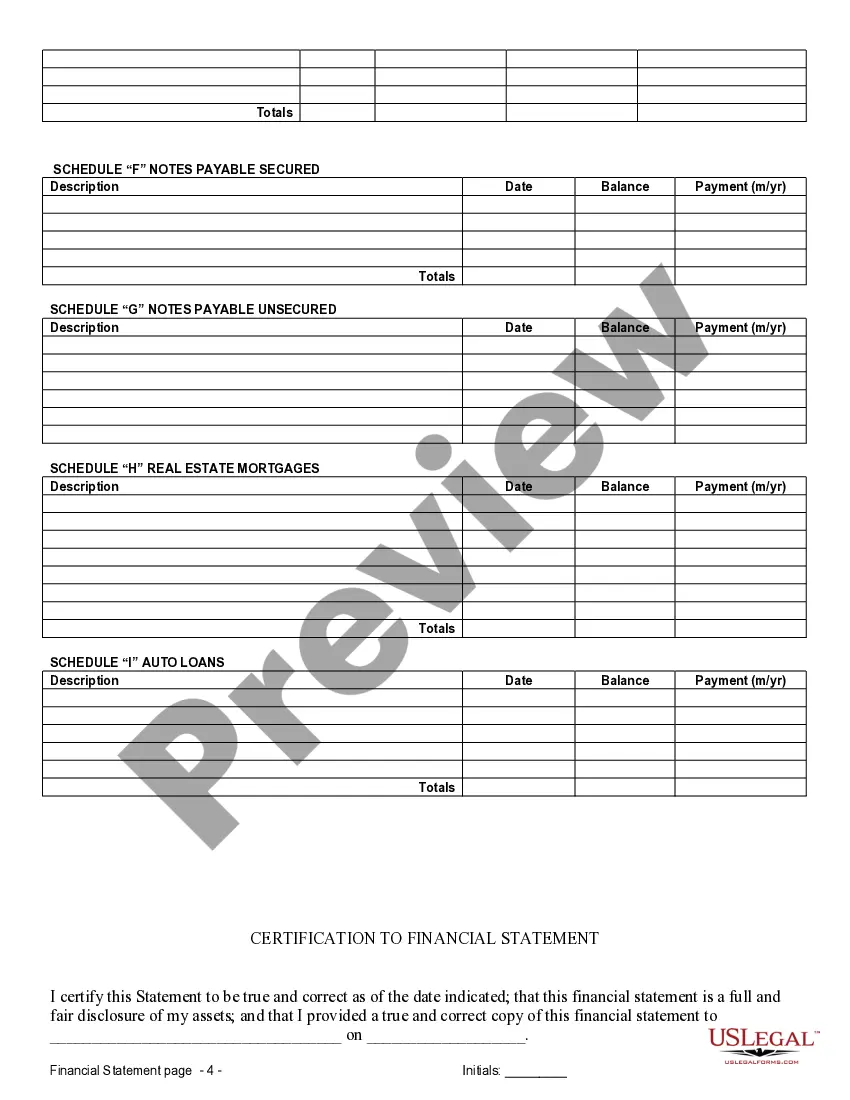

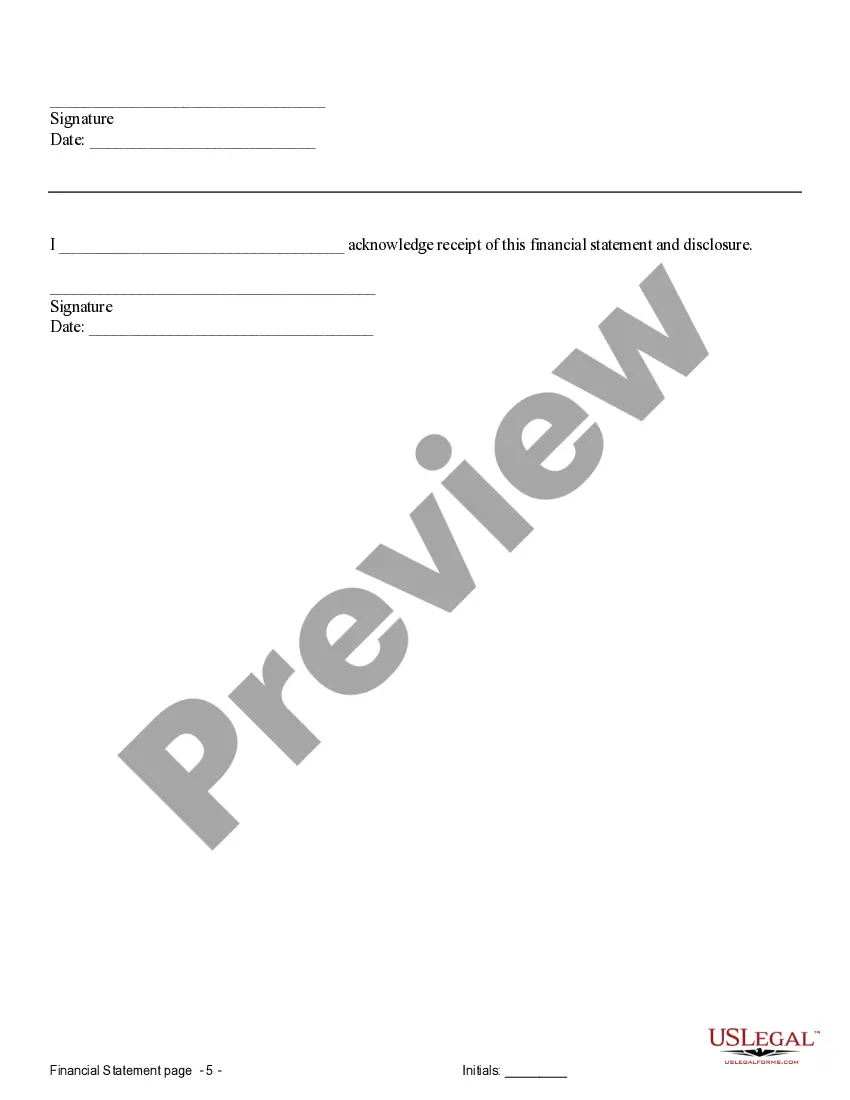

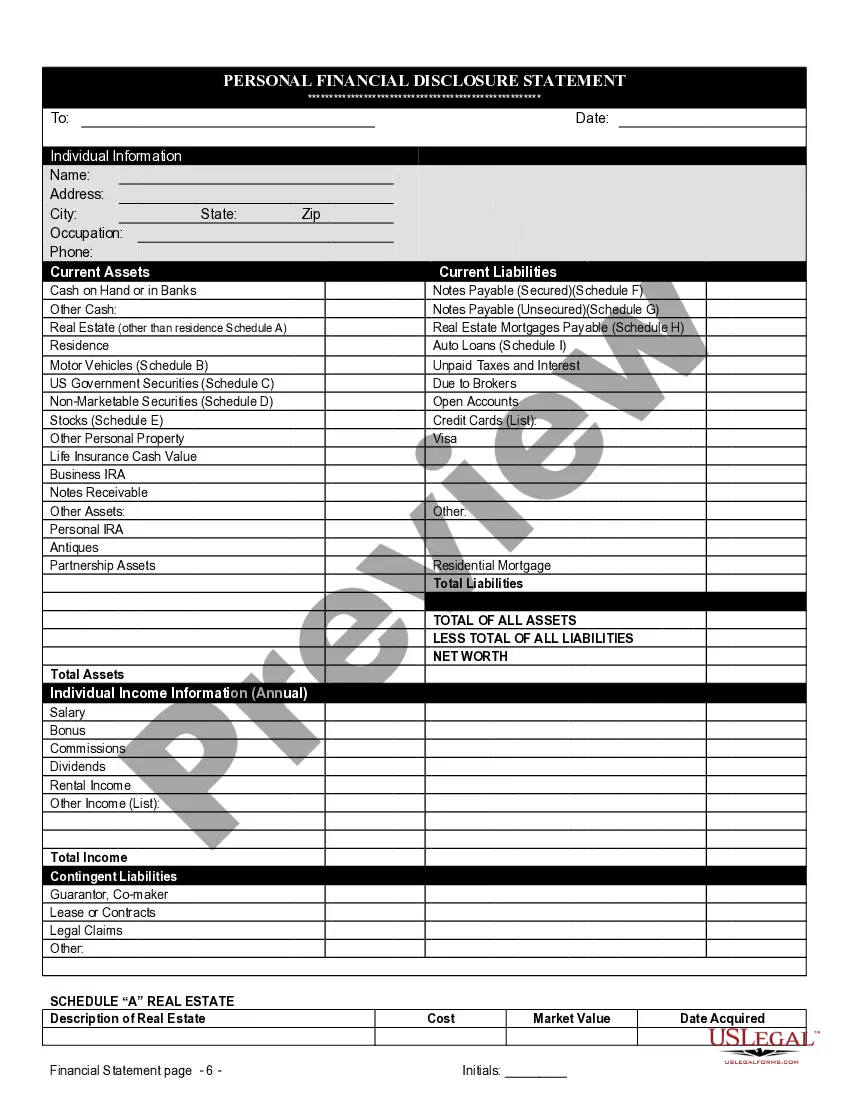

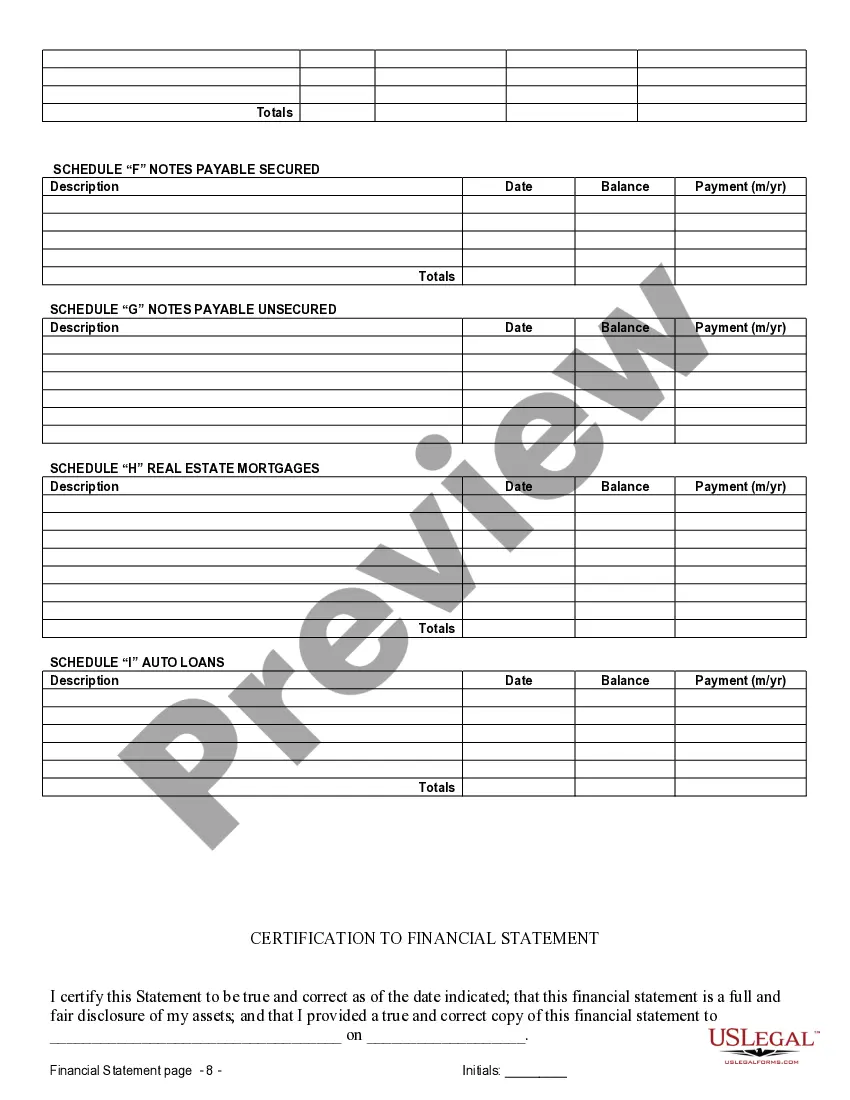

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

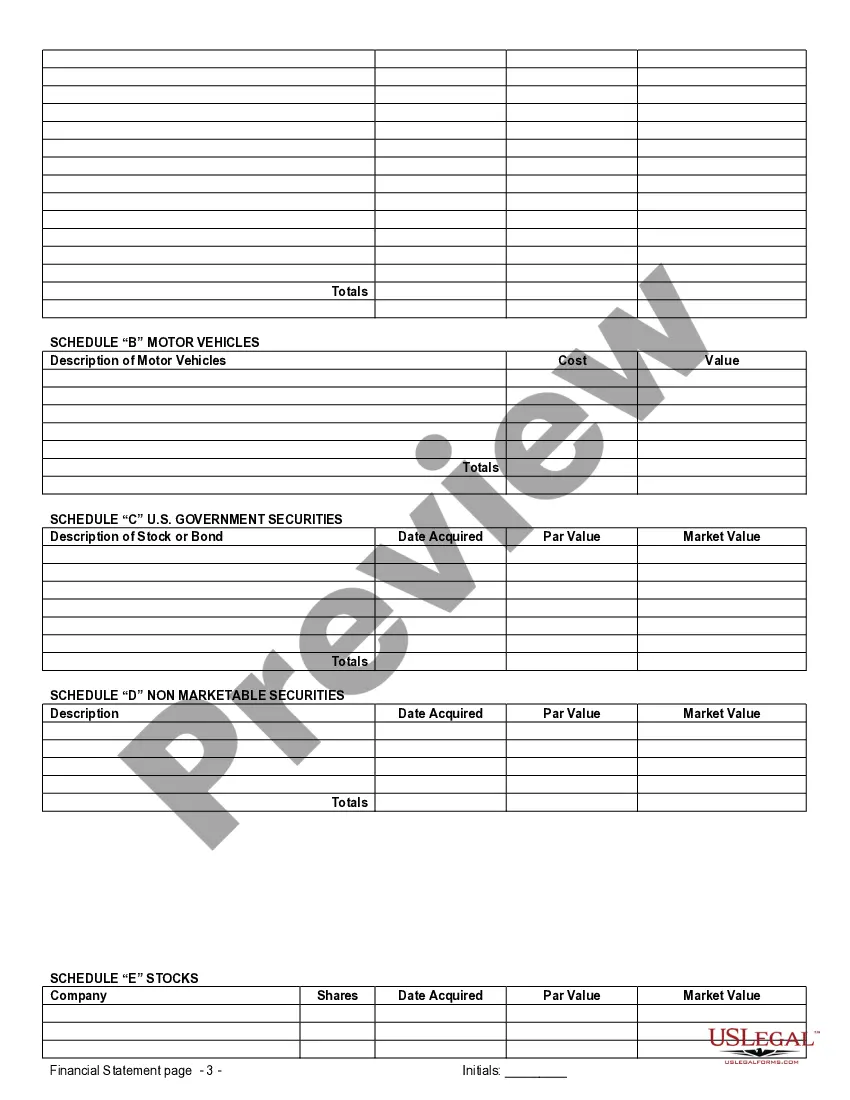

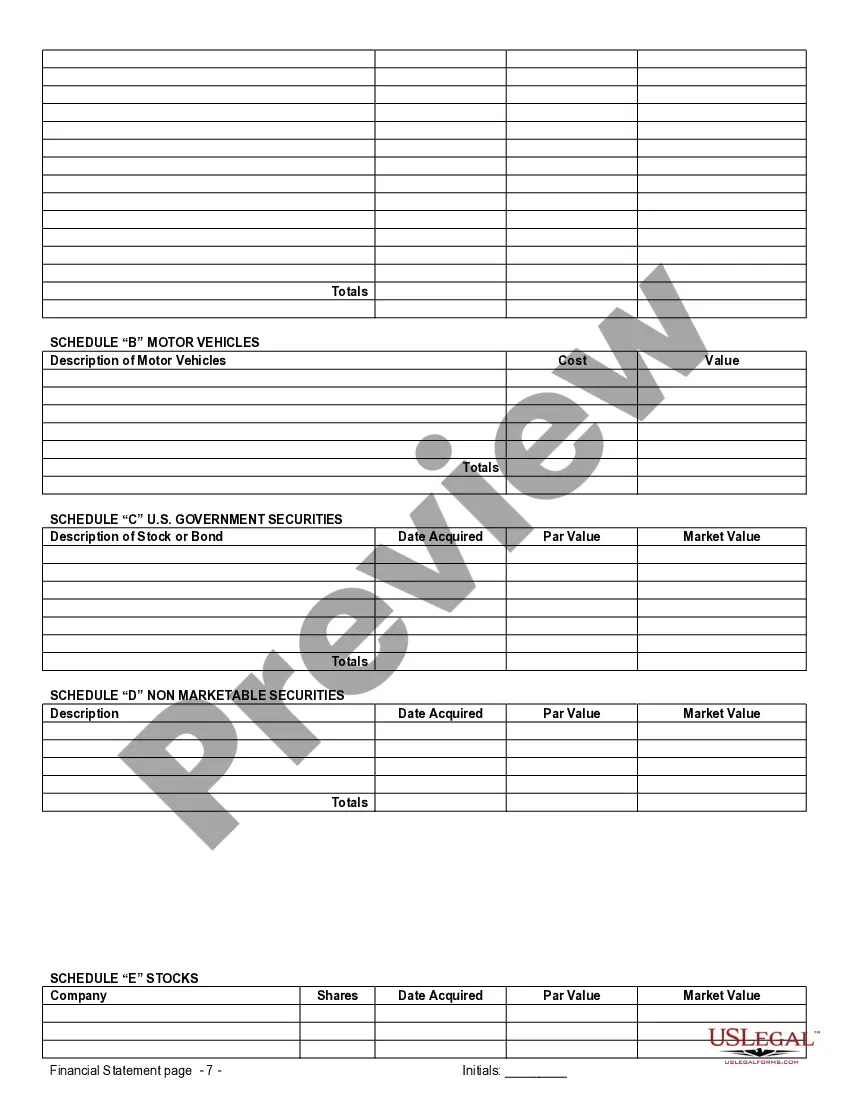

Omaha Nebraska Financial Statements in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role when it comes to prenuptial or premarital agreements in Omaha, Nebraska. These statements provide an overview of the couple's financial standing and help establish a fair distribution of assets and liabilities in the event of a divorce or legal separation. When drafting a prenuptial agreement, it is essential to have accurate and detailed financial statements specific to Omaha, Nebraska. There are several types of financial statements involved in a prenuptial agreement in Omaha, including: 1. Income Statements: These statements provide a comprehensive breakdown of the couple's income from various sources, such as employment salaries, investments, rental properties, or business ownership. Income statements highlight each party's earning capacity and potential future financial contributions to the marriage. 2. Balance Sheets: Balance sheets offer a snapshot of the couple's overall financial position, showcasing their assets (e.g., real estate, vehicles, investments, savings accounts, retirement funds) and liabilities (e.g., mortgages, loans, credit card debt). Balance sheets assist in determining the division of property and debt in case of divorce or separation. 3. Bank Statements: Bank statements reveal a couple's financial transactions, including deposits, withdrawals, and transfers, providing evidence of income and expenditures. These statements help assess each party's spending habits, saving patterns, and overall financial stability. 4. Tax Returns: Tax returns provide an in-depth understanding of each individual's income, deductions, and overall financial situation. By examining tax returns, it becomes easier to assess the potential income and tax implications during the marriage and in the event of divorce. 5. Retirement Account Statements: These statements detail the couple's retirement savings, including individual retirement accounts (IRAs), 401(k) plans, pensions, or any other retirement investment. Retirement account statements are vital in determining how these assets would be divided or protected in the case of a divorce. 6. Investment Account Statements: Investment account statements outline any stocks, bonds, mutual funds, or other investment portfolios owned by the couple individually or jointly. These statements help to identify the value and growth potential of the investments, which may impact the distribution of assets during divorce proceedings. 7. Business Financial Statements: If either party owns a business, business financial statements, including income statements, balance sheets, cash flow statements, and profit and loss statements, are necessary to understand the value and financial health of the company. These statements ensure fair treatment of business-related assets and liabilities during a divorce. When addressing prenuptial agreements in Omaha, Nebraska, it is crucial to compile these financial statements accurately, completely, and transparently. It is advised to consult with experienced family law attorneys or financial professionals who specialize in prenuptial agreements to ensure full compliance with state laws and regulations. By having thorough financial statements specific to Omaha, Nebraska, couples can create fair and comprehensive prenuptial agreements that protect their financial interests and provide stability in uncertain circumstances.