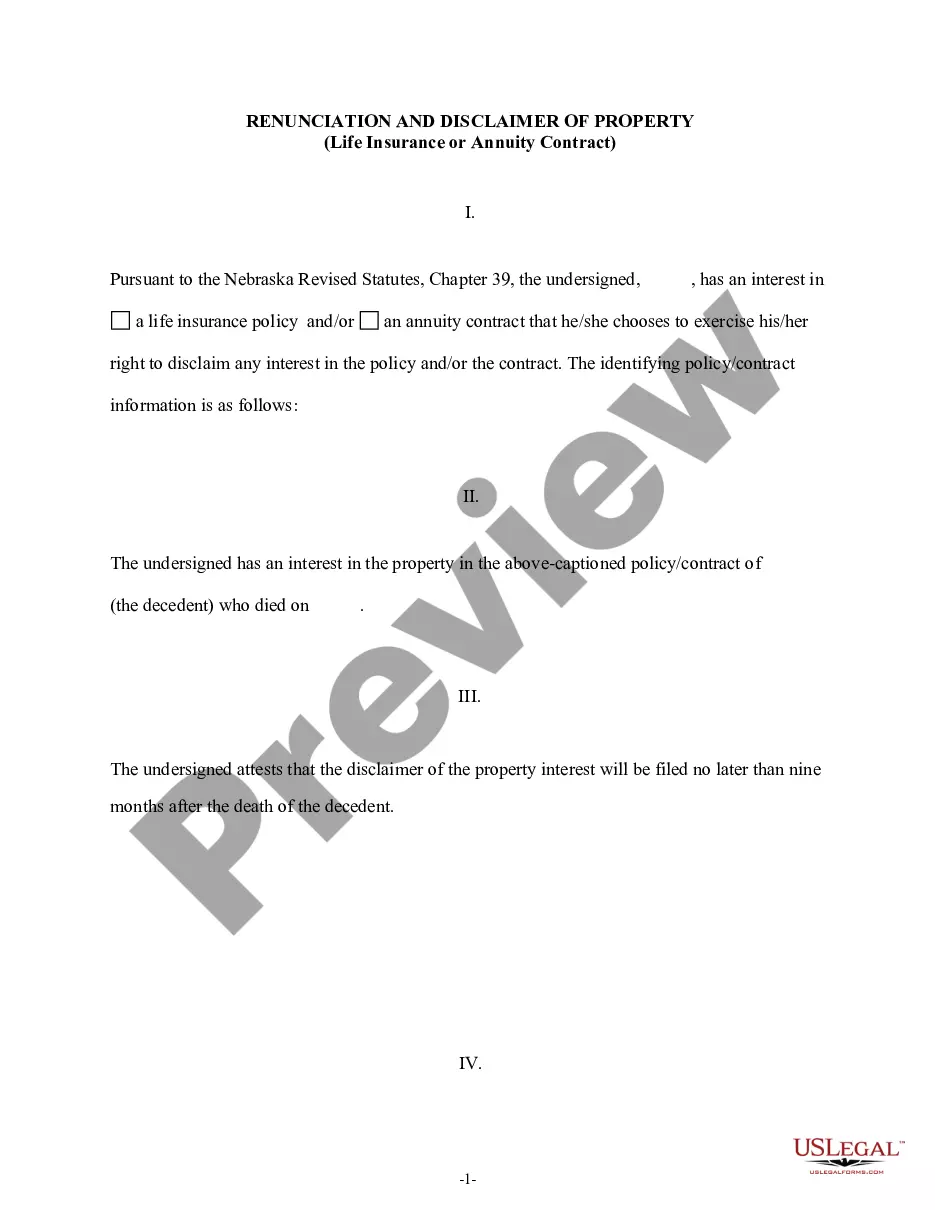

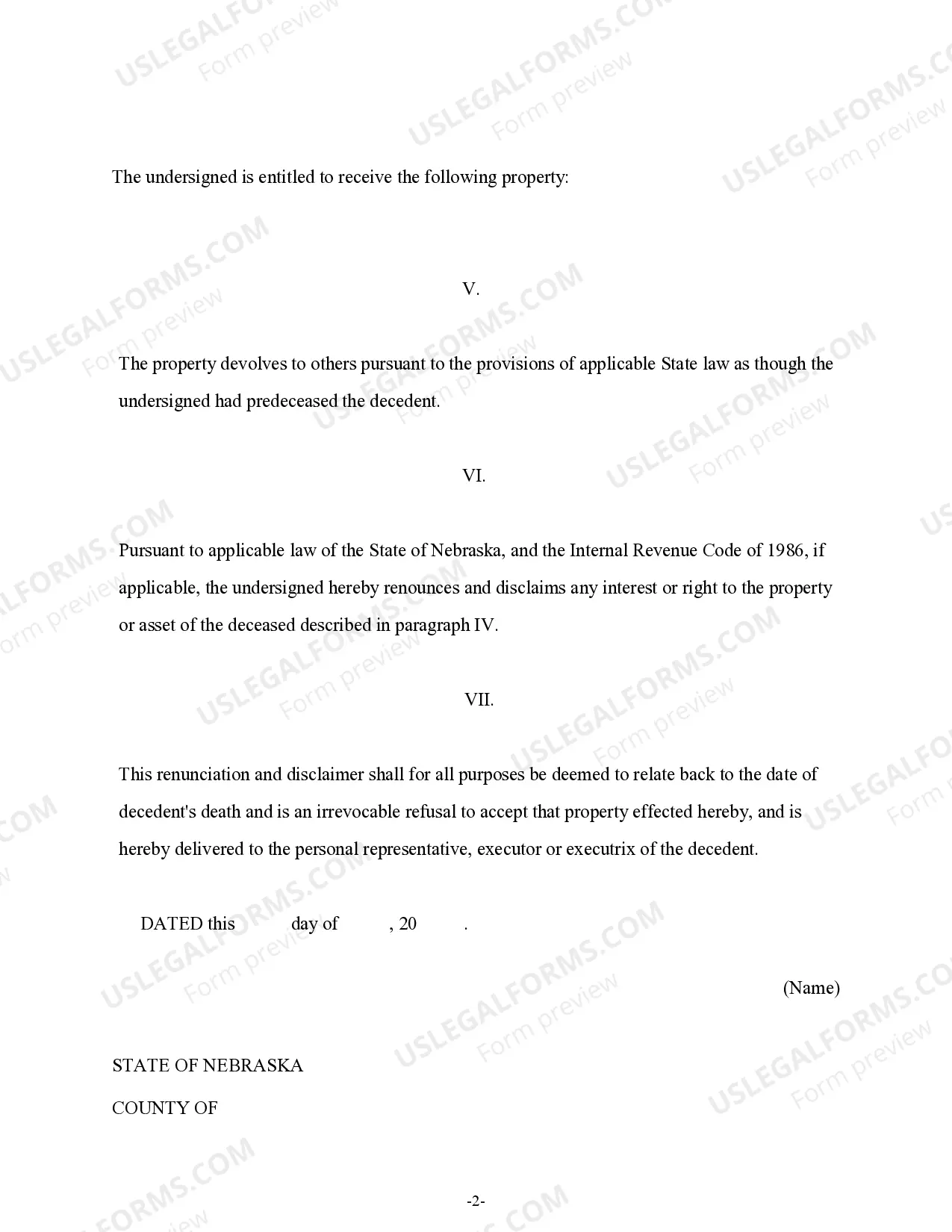

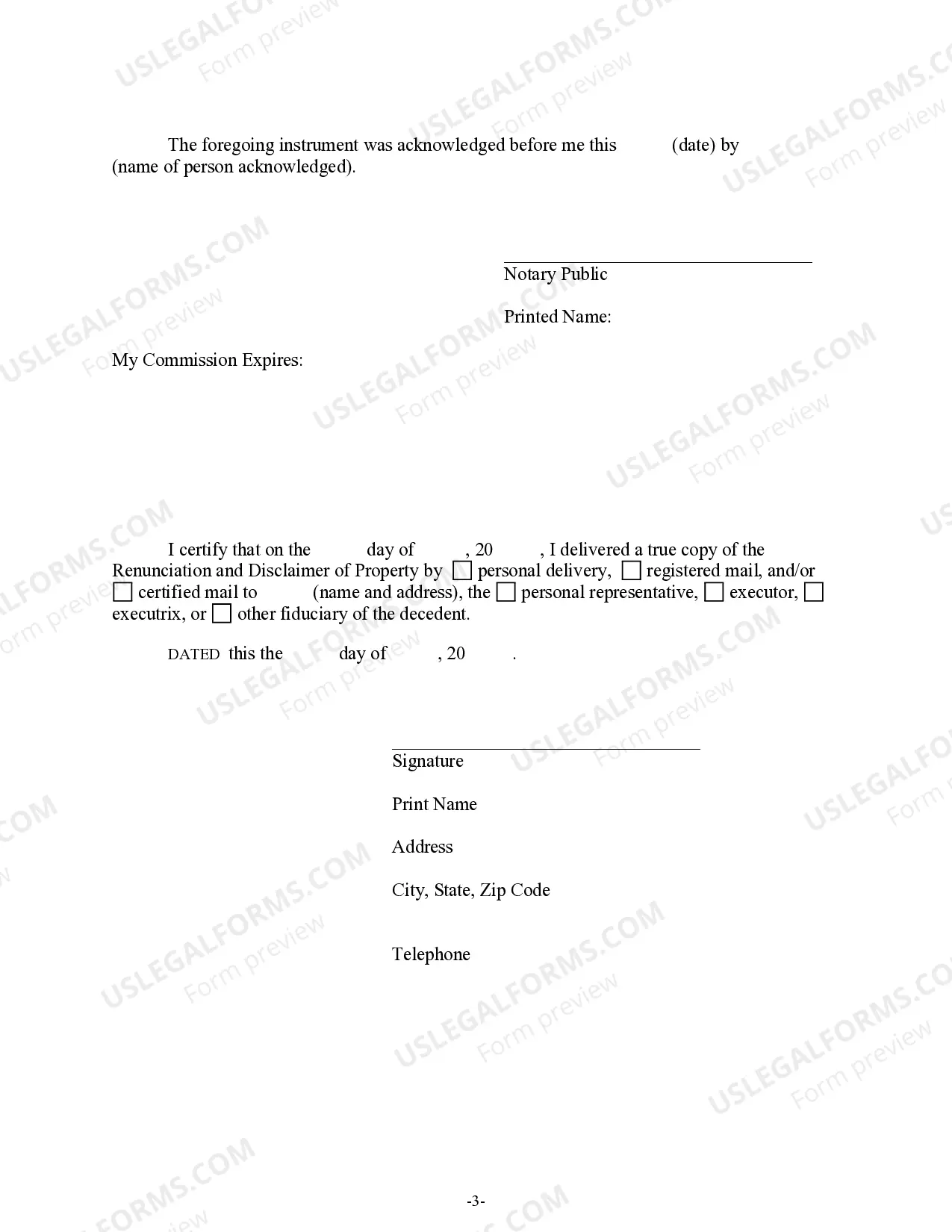

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, chooses to disclaim his/her interest in the property pursuant to the Nebraska Revised Statutes, Chapter 39. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to relinquish their rights and claims to property, specifically life insurance or annuity contracts, in the state of Omaha, Nebraska. This process is crucial when beneficiaries or recipients of such contracts decide to disclaim their rights to the designated property. There are different types of Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, depending on the specific circumstances and nature of the property being renounced or disclaimed. 1. Life Insurance Renunciation: This type of renunciation occurs when the intended beneficiary of a life insurance policy decides to relinquish their rights to the proceeds or benefits of the policy. This may be done for various reasons, such as if the beneficiary wishes to avoid tax obligations associated with the policy or if they believe the proceeds would be better distributed to other beneficiaries. 2. Annuity Contract Renunciation: An annuity contract renunciation, on the other hand, relates to individuals disclaiming their rights to annuity payments or benefits. This might occur when an individual receives an annuity contract as a result of inheritance but chooses not to accept or receive the scheduled payments. It could be due to personal financial considerations, tax implications, or other personal circumstances. The Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract process typically involves several important steps. Firstly, the renounced must provide a written renunciation declaration, explicitly stating their intention to disclaim the property. This declaration should clearly identify the life insurance or annuity contract being renounced, including policy numbers and relevant details. Moreover, the renunciation declaration should be signed by the renounced and notarized to ensure its legality and authenticity. The renounced must also ensure the declaration is delivered to the appropriate parties, such as the insurance company or annuity provider, within a specified timeline as prescribed by Nebraska state law. It is important to note that renunciation and disclaimer of property should be done in compliance with Omaha, Nebraska's legal requirements. Seeking legal advice or consulting with an attorney who specializes in estate planning and insurance matters is highly recommended ensuring the renouncement is executed correctly and legally binding. In conclusion, Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with a mechanism to surrender their rights and claims to life insurance policies or annuity contracts within the state. This process offers flexibility for beneficiaries or recipients who may have various reasons for not accepting or receiving such property, allowing for alternative distribution or financial planning.Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to relinquish their rights and claims to property, specifically life insurance or annuity contracts, in the state of Omaha, Nebraska. This process is crucial when beneficiaries or recipients of such contracts decide to disclaim their rights to the designated property. There are different types of Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, depending on the specific circumstances and nature of the property being renounced or disclaimed. 1. Life Insurance Renunciation: This type of renunciation occurs when the intended beneficiary of a life insurance policy decides to relinquish their rights to the proceeds or benefits of the policy. This may be done for various reasons, such as if the beneficiary wishes to avoid tax obligations associated with the policy or if they believe the proceeds would be better distributed to other beneficiaries. 2. Annuity Contract Renunciation: An annuity contract renunciation, on the other hand, relates to individuals disclaiming their rights to annuity payments or benefits. This might occur when an individual receives an annuity contract as a result of inheritance but chooses not to accept or receive the scheduled payments. It could be due to personal financial considerations, tax implications, or other personal circumstances. The Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract process typically involves several important steps. Firstly, the renounced must provide a written renunciation declaration, explicitly stating their intention to disclaim the property. This declaration should clearly identify the life insurance or annuity contract being renounced, including policy numbers and relevant details. Moreover, the renunciation declaration should be signed by the renounced and notarized to ensure its legality and authenticity. The renounced must also ensure the declaration is delivered to the appropriate parties, such as the insurance company or annuity provider, within a specified timeline as prescribed by Nebraska state law. It is important to note that renunciation and disclaimer of property should be done in compliance with Omaha, Nebraska's legal requirements. Seeking legal advice or consulting with an attorney who specializes in estate planning and insurance matters is highly recommended ensuring the renouncement is executed correctly and legally binding. In conclusion, Omaha Nebraska Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with a mechanism to surrender their rights and claims to life insurance policies or annuity contracts within the state. This process offers flexibility for beneficiaries or recipients who may have various reasons for not accepting or receiving such property, allowing for alternative distribution or financial planning.