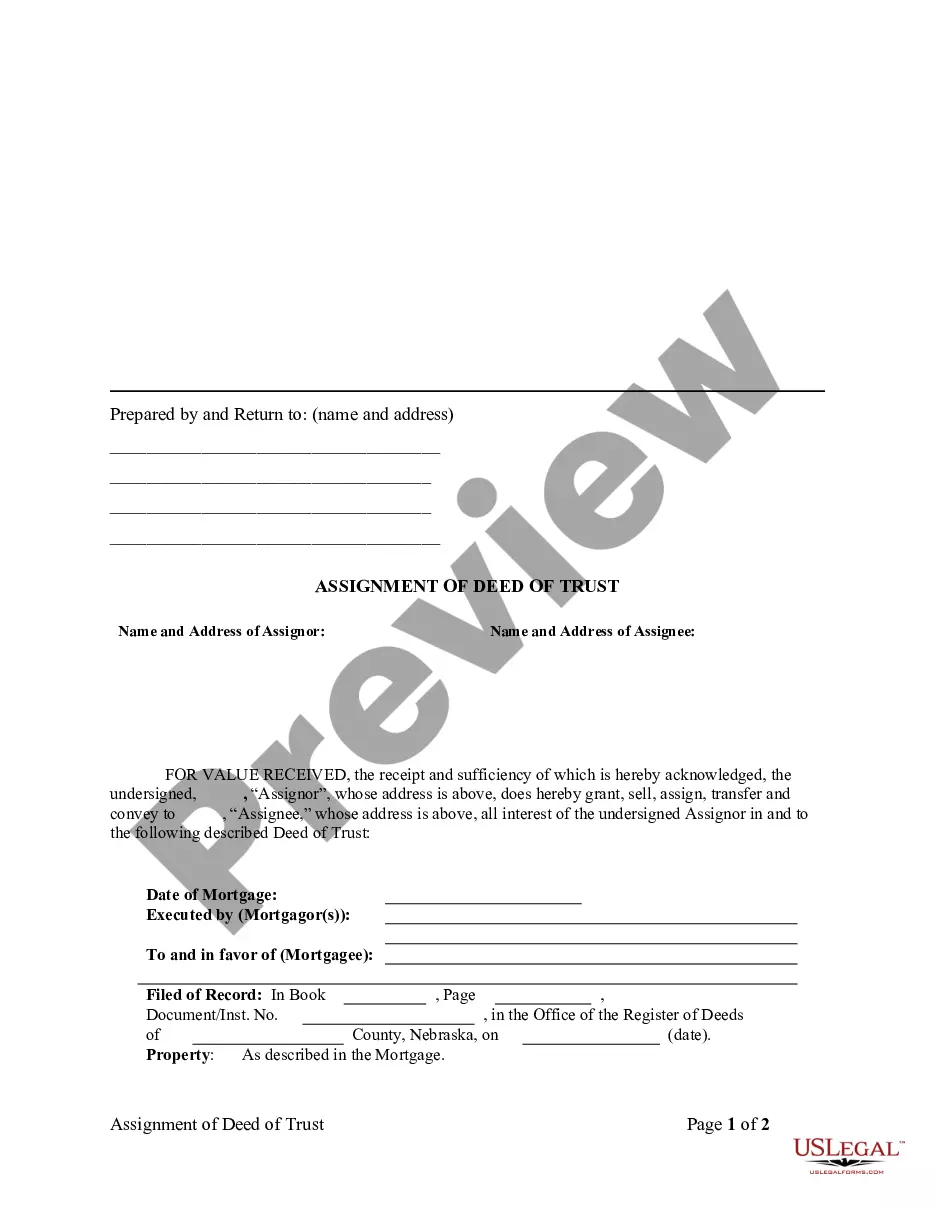

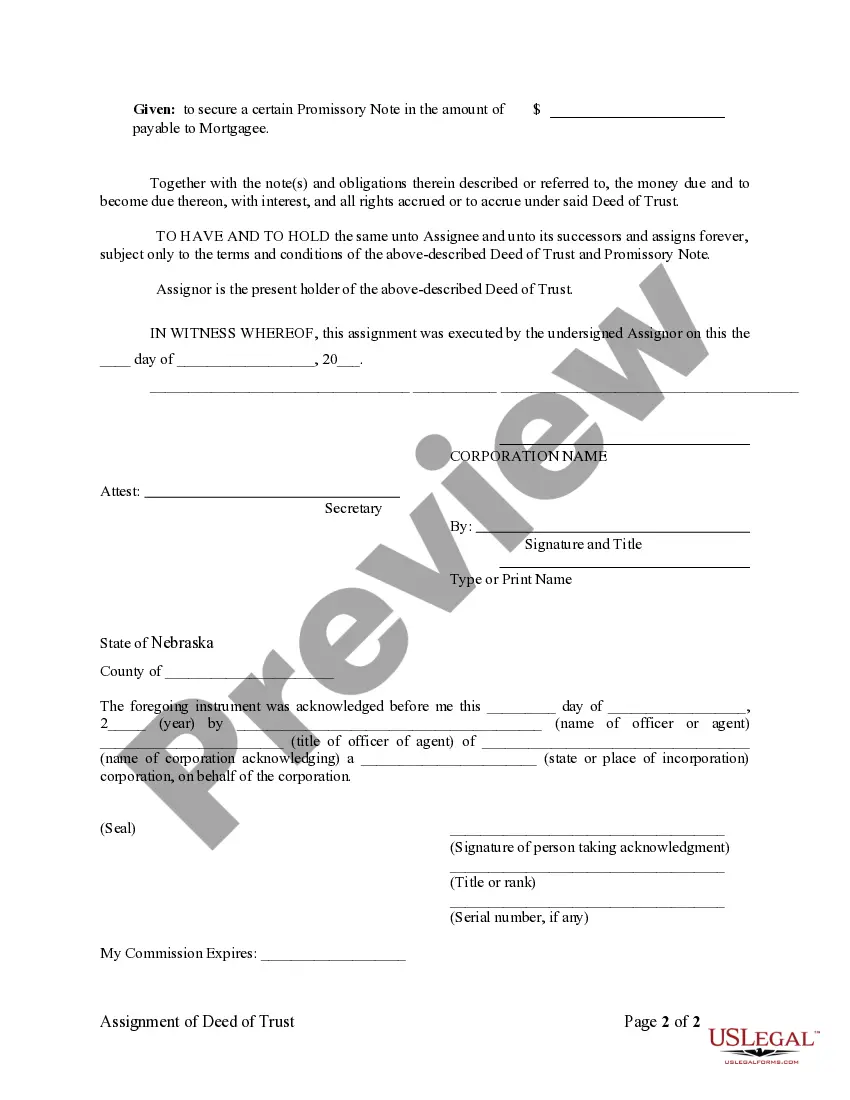

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder: A Comprehensive Guide In the realm of real estate transactions in Omaha, Nebraska, the Assignment of Deed of Trust by Corporate Mortgage Holder plays a critical role. This legal document transfers the rights and interests of a corporate mortgage holder to another party, ensuring a smooth transition of ownership and ensuring the continuity of mortgage responsibilities. To understand this process better, let's delve into the details, different types, and key terms related to the Omaha Nebraska Assignment of Deed of Trust. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust is a document that allows a corporate mortgage holder (usually a financial institution or corporation) to transfer the rights, title, and interest in a mortgage loan to another entity or individual. This assignment effectively transfers payment obligations and other mortgage terms from the original lender to the new assignee (mortgagee). Key stakeholders involved in an Assignment of Deed of Trust: 1. Assignor (Corporate Mortgage Holder): The present mortgage holder who is transferring the rights and interests. 2. Assignee (New Mortgagee): The new entity or individual who is acquiring the rights, responsibilities, and benefits of the mortgage. Types of Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type of assignment, only a part of the mortgage loan is transferred to the assignee. The original corporate mortgage holder retains partial interest in the mortgage, while the assignee assumes partial responsibility. This type of assignment can occur when multiple entities invest in a single loan or when diversifying the risk exposure of the mortgage. 2. Full Assignment: Here, the complete mortgage loan is transferred from the corporate mortgage holder to the assignee. The assignee becomes the new mortgagee, assuming all legal rights, interests, and obligations associated with the mortgage. Full assignments often occur when the corporate mortgage holder wishes to sell the mortgage to a different entity or when the debt is satisfied by a third party, such as an investor or financial institution. 3. Equitable Assignment: In certain cases, a mortgage may not be officially assigned through a written document. An equitable assignment occurs when the transfer of interest happens without a formal assignment, typically through an agreement between the corporate mortgage holder and the assignee. Although not legally required, this type of assignment can still be enforceable in Omaha, Nebraska. Key Terms Associated with Omaha Nebraska Assignment of Deed of Trust: 1. Trust or: The borrower or property owner who pledges the property as security for the mortgage loan. 2. Beneficiary: The lender or corporate mortgage holder who holds the mortgage and is entitled to receive repayment from the borrower. 3. Collateral: The property or assets pledged as security for the mortgage loan. In case of default, the assignee may claim these assets to recover any unpaid debts. 4. Foreclosure: The legal process initiated by a mortgagee in case of default, resulting in the sale of the pledged property to recover the debt owed. Conclusion: Understanding the intricacies of Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for property owners, lenders, and potential assignees. Whether it is a partial or full assignment, the transfer of rights and obligations must adhere to legal requirements to ensure a smooth transition. By comprehending the key terms and types associated with this process, stakeholders can navigate real estate transactions more effectively and make informed decisions.Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder: A Comprehensive Guide In the realm of real estate transactions in Omaha, Nebraska, the Assignment of Deed of Trust by Corporate Mortgage Holder plays a critical role. This legal document transfers the rights and interests of a corporate mortgage holder to another party, ensuring a smooth transition of ownership and ensuring the continuity of mortgage responsibilities. To understand this process better, let's delve into the details, different types, and key terms related to the Omaha Nebraska Assignment of Deed of Trust. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust is a document that allows a corporate mortgage holder (usually a financial institution or corporation) to transfer the rights, title, and interest in a mortgage loan to another entity or individual. This assignment effectively transfers payment obligations and other mortgage terms from the original lender to the new assignee (mortgagee). Key stakeholders involved in an Assignment of Deed of Trust: 1. Assignor (Corporate Mortgage Holder): The present mortgage holder who is transferring the rights and interests. 2. Assignee (New Mortgagee): The new entity or individual who is acquiring the rights, responsibilities, and benefits of the mortgage. Types of Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type of assignment, only a part of the mortgage loan is transferred to the assignee. The original corporate mortgage holder retains partial interest in the mortgage, while the assignee assumes partial responsibility. This type of assignment can occur when multiple entities invest in a single loan or when diversifying the risk exposure of the mortgage. 2. Full Assignment: Here, the complete mortgage loan is transferred from the corporate mortgage holder to the assignee. The assignee becomes the new mortgagee, assuming all legal rights, interests, and obligations associated with the mortgage. Full assignments often occur when the corporate mortgage holder wishes to sell the mortgage to a different entity or when the debt is satisfied by a third party, such as an investor or financial institution. 3. Equitable Assignment: In certain cases, a mortgage may not be officially assigned through a written document. An equitable assignment occurs when the transfer of interest happens without a formal assignment, typically through an agreement between the corporate mortgage holder and the assignee. Although not legally required, this type of assignment can still be enforceable in Omaha, Nebraska. Key Terms Associated with Omaha Nebraska Assignment of Deed of Trust: 1. Trust or: The borrower or property owner who pledges the property as security for the mortgage loan. 2. Beneficiary: The lender or corporate mortgage holder who holds the mortgage and is entitled to receive repayment from the borrower. 3. Collateral: The property or assets pledged as security for the mortgage loan. In case of default, the assignee may claim these assets to recover any unpaid debts. 4. Foreclosure: The legal process initiated by a mortgagee in case of default, resulting in the sale of the pledged property to recover the debt owed. Conclusion: Understanding the intricacies of Omaha Nebraska Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for property owners, lenders, and potential assignees. Whether it is a partial or full assignment, the transfer of rights and obligations must adhere to legal requirements to ensure a smooth transition. By comprehending the key terms and types associated with this process, stakeholders can navigate real estate transactions more effectively and make informed decisions.