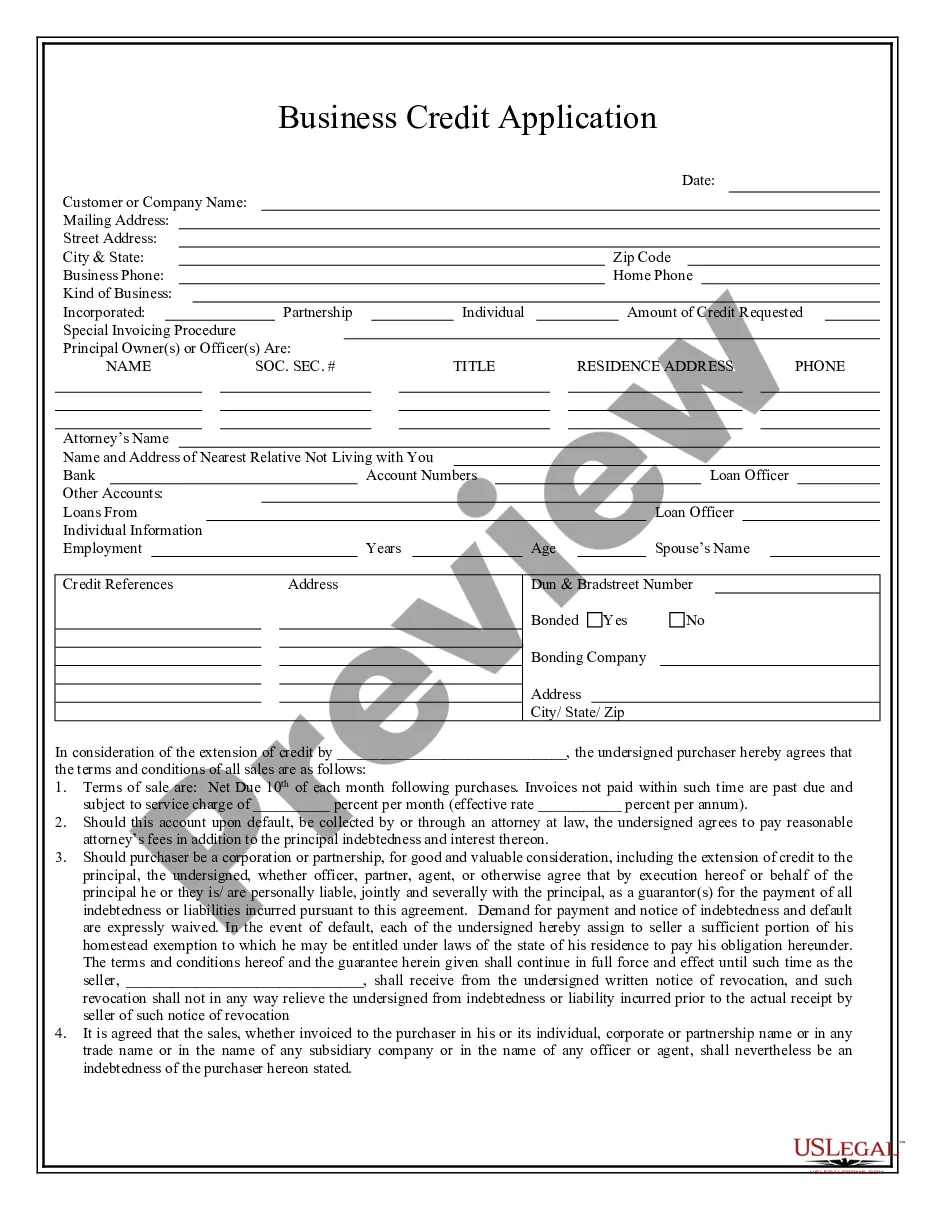

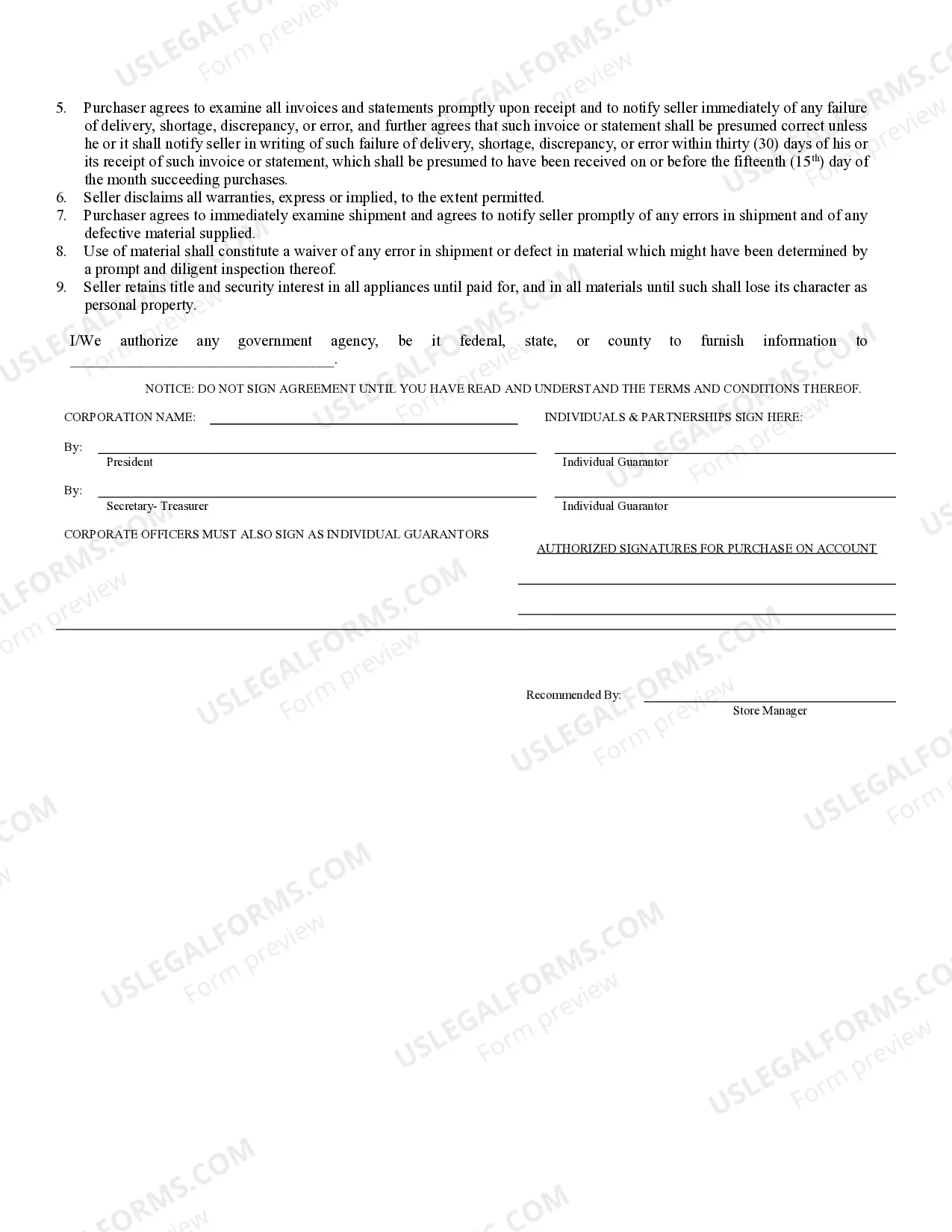

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Omaha Nebraska Business Credit Application is a document used by businesses and entrepreneurs in Omaha, Nebraska to apply for credit facilities from financial institutions or lenders. This application is a crucial step in obtaining business financing and plays a vital role in evaluating the creditworthiness of the applicant. The Omaha Nebraska Business Credit Application typically requires detailed information about the business, its owners or principals, and financial history. It serves as a formal request outlining the desired credit amount and the purpose for which the credit will be used. Lenders use this information to assess the applicant's ability to repay the loan or credit facility, their creditworthiness, and their risk profile. The credit application will usually require the following information: 1. Business Information: This includes the legal name of the business, its physical address, contact information, and the type of business entity (e.g., sole proprietorship, partnership, or corporation). 2. Owner Information: Details about the business owner(s) or principal(s), including their names, contact information, social security numbers, and percentage ownership in the business. 3. Financial Information: This section requires to be detailed financial statements, such as income statements, balance sheets, and cash flow statements. These financial documents help lenders assess the financial health of the business, its ability to generate profits, and its capacity to repay the credit. 4. Business Plan: Some credit applications may require a business plan outlining the company's goals, market analysis, sales projections, and future plans. A solid business plan demonstrates the applicant's commitment and understanding of their business. 5. Purpose of Credit: Applicants must clearly state the intended use of the credit facility, such as purchasing equipment, expanding operations, or financing working capital. This information allows lenders to assess the viability and potential risks associated with the loan. In Omaha, Nebraska, there may be different types of business credit applications based on the specific needs of the applicant. Examples may include: 1. Small Business Credit Application: Designed for small businesses seeking credit or loans to finance day-to-day operations, expansion, or investment projects. 2. Startup Business Credit Application: Tailored for new businesses without an established credit history, requiring alternative methods to assess creditworthiness, such as personal guarantees or collateral. 3. Commercial Real Estate Credit Application: Geared towards businesses or developers seeking credit for real estate investment, development, or acquisition purposes. 4. Equipment Financing Credit Application: Designed for businesses requiring credit or loans to purchase machinery, vehicles, or other types of equipment. Remember, when completing an Omaha Nebraska Business Credit Application, accuracy and transparency are of utmost importance. Providing comprehensive and reliable information will increase the likelihood of securing the desired credit facility for your business.Omaha Nebraska Business Credit Application is a document used by businesses and entrepreneurs in Omaha, Nebraska to apply for credit facilities from financial institutions or lenders. This application is a crucial step in obtaining business financing and plays a vital role in evaluating the creditworthiness of the applicant. The Omaha Nebraska Business Credit Application typically requires detailed information about the business, its owners or principals, and financial history. It serves as a formal request outlining the desired credit amount and the purpose for which the credit will be used. Lenders use this information to assess the applicant's ability to repay the loan or credit facility, their creditworthiness, and their risk profile. The credit application will usually require the following information: 1. Business Information: This includes the legal name of the business, its physical address, contact information, and the type of business entity (e.g., sole proprietorship, partnership, or corporation). 2. Owner Information: Details about the business owner(s) or principal(s), including their names, contact information, social security numbers, and percentage ownership in the business. 3. Financial Information: This section requires to be detailed financial statements, such as income statements, balance sheets, and cash flow statements. These financial documents help lenders assess the financial health of the business, its ability to generate profits, and its capacity to repay the credit. 4. Business Plan: Some credit applications may require a business plan outlining the company's goals, market analysis, sales projections, and future plans. A solid business plan demonstrates the applicant's commitment and understanding of their business. 5. Purpose of Credit: Applicants must clearly state the intended use of the credit facility, such as purchasing equipment, expanding operations, or financing working capital. This information allows lenders to assess the viability and potential risks associated with the loan. In Omaha, Nebraska, there may be different types of business credit applications based on the specific needs of the applicant. Examples may include: 1. Small Business Credit Application: Designed for small businesses seeking credit or loans to finance day-to-day operations, expansion, or investment projects. 2. Startup Business Credit Application: Tailored for new businesses without an established credit history, requiring alternative methods to assess creditworthiness, such as personal guarantees or collateral. 3. Commercial Real Estate Credit Application: Geared towards businesses or developers seeking credit for real estate investment, development, or acquisition purposes. 4. Equipment Financing Credit Application: Designed for businesses requiring credit or loans to purchase machinery, vehicles, or other types of equipment. Remember, when completing an Omaha Nebraska Business Credit Application, accuracy and transparency are of utmost importance. Providing comprehensive and reliable information will increase the likelihood of securing the desired credit facility for your business.