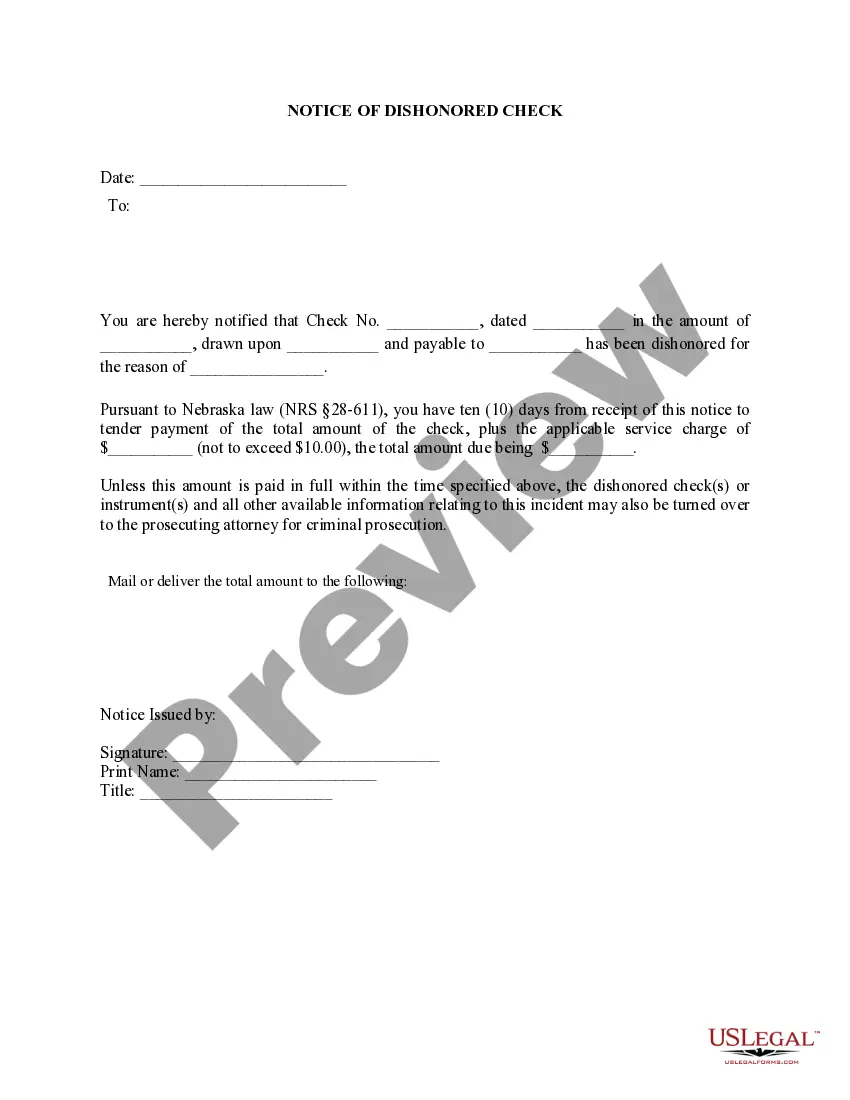

This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Omaha Nebraska Notice of Dishonored Check — Criminal A bad check or a bounced check refers to a check that cannot be processed due to insufficient funds or other issues. In Omaha, Nebraska, the Legal Code Section 28-611 clearly defines and addresses the consequences and actions associated with dishonored checks. When a check is returned unpaid, the recipient has the right to take legal action against the issuer. Types of Dishonored Checks: 1. Insufficient Funds: This type of dishonored check occurs when the issuer's bank account does not have enough funds to cover the amount written on the check. It commonly happens if the check issuer spends or withdraws more money than is available in their account. 2. Closed Account: If an account has been closed by the issuer before the recipient attempts to cash the check, it will be considered a dishonored check. This situation could arise if the account holder has switched banks or closed their account due to unforeseen circumstances. 3. Stop Payment: When the issuer arranges a "stop payment" on a check, it signifies the intention to prevent the recipient from depositing or cashing the check. This can occur if the issuer realizes a mistake or wants to cancel the transaction altogether. Omaha Nebraska Notice of Dishonored Check Procedure: If you have received a bad check in Omaha, Nebraska, you have legal remedies available to you under the Nebraska Statutes. To initiate the process, you must first send a Notice of Dishonored Check to the issuer. This written notice serves as a formal warning and informs the issuer about the dishonored check. The Notice of Dishonored Check must contain essential details such as the check number, date, and the amount of the bounced check. It is crucial to include your contact information, the recipient's name, and address. Moreover, emphasize the legal consequences associated with dishonored checks to inform the issuer of the seriousness of the situation. Upon receiving the Notice of Dishonored Check, the issuer is provided with a certain period to make the necessary payment, typically within ten (10) days. If the issuer fails to pay within the given time frame, the recipient can pursue legal action against them. Consequences of Dishonored Checks: Under Nebraska law, intentionally issuing a dishonored check is considered a criminal offense. Below are some potential consequences for the issuer: 1. Criminal Charges: The issuer may face criminal charges for passing a bad check, as it is deemed fraud. Depending on the amount of the dishonored check, the offense can fall within different classifications, ranging from a misdemeanor to a felony. The penalties can include fines, restitution, probation, or even imprisonment. 2. Additional Costs: In addition to the potential legal ramifications, dishonored check issuers may also be liable to pay additional costs associated with the check, such as bank fees, collection agency charges, and attorney fees. 3. Damage to Credit Score: Dishonored checks can negatively impact the issuer's credit score, making it harder for them to obtain credit in the future. It can affect their ability to secure loans, mortgages, or even open new bank accounts. In conclusion, Omaha, Nebraska takes dishonored checks seriously, imposing penalties on those who knowingly issue them. If you encounter a dishonored or bad check, it is vital to follow the appropriate legal procedures, including sending a Notice of Dishonored Check, to seek resolution or pursue legal action if necessary.Omaha Nebraska Notice of Dishonored Check — Criminal A bad check or a bounced check refers to a check that cannot be processed due to insufficient funds or other issues. In Omaha, Nebraska, the Legal Code Section 28-611 clearly defines and addresses the consequences and actions associated with dishonored checks. When a check is returned unpaid, the recipient has the right to take legal action against the issuer. Types of Dishonored Checks: 1. Insufficient Funds: This type of dishonored check occurs when the issuer's bank account does not have enough funds to cover the amount written on the check. It commonly happens if the check issuer spends or withdraws more money than is available in their account. 2. Closed Account: If an account has been closed by the issuer before the recipient attempts to cash the check, it will be considered a dishonored check. This situation could arise if the account holder has switched banks or closed their account due to unforeseen circumstances. 3. Stop Payment: When the issuer arranges a "stop payment" on a check, it signifies the intention to prevent the recipient from depositing or cashing the check. This can occur if the issuer realizes a mistake or wants to cancel the transaction altogether. Omaha Nebraska Notice of Dishonored Check Procedure: If you have received a bad check in Omaha, Nebraska, you have legal remedies available to you under the Nebraska Statutes. To initiate the process, you must first send a Notice of Dishonored Check to the issuer. This written notice serves as a formal warning and informs the issuer about the dishonored check. The Notice of Dishonored Check must contain essential details such as the check number, date, and the amount of the bounced check. It is crucial to include your contact information, the recipient's name, and address. Moreover, emphasize the legal consequences associated with dishonored checks to inform the issuer of the seriousness of the situation. Upon receiving the Notice of Dishonored Check, the issuer is provided with a certain period to make the necessary payment, typically within ten (10) days. If the issuer fails to pay within the given time frame, the recipient can pursue legal action against them. Consequences of Dishonored Checks: Under Nebraska law, intentionally issuing a dishonored check is considered a criminal offense. Below are some potential consequences for the issuer: 1. Criminal Charges: The issuer may face criminal charges for passing a bad check, as it is deemed fraud. Depending on the amount of the dishonored check, the offense can fall within different classifications, ranging from a misdemeanor to a felony. The penalties can include fines, restitution, probation, or even imprisonment. 2. Additional Costs: In addition to the potential legal ramifications, dishonored check issuers may also be liable to pay additional costs associated with the check, such as bank fees, collection agency charges, and attorney fees. 3. Damage to Credit Score: Dishonored checks can negatively impact the issuer's credit score, making it harder for them to obtain credit in the future. It can affect their ability to secure loans, mortgages, or even open new bank accounts. In conclusion, Omaha, Nebraska takes dishonored checks seriously, imposing penalties on those who knowingly issue them. If you encounter a dishonored or bad check, it is vital to follow the appropriate legal procedures, including sending a Notice of Dishonored Check, to seek resolution or pursue legal action if necessary.