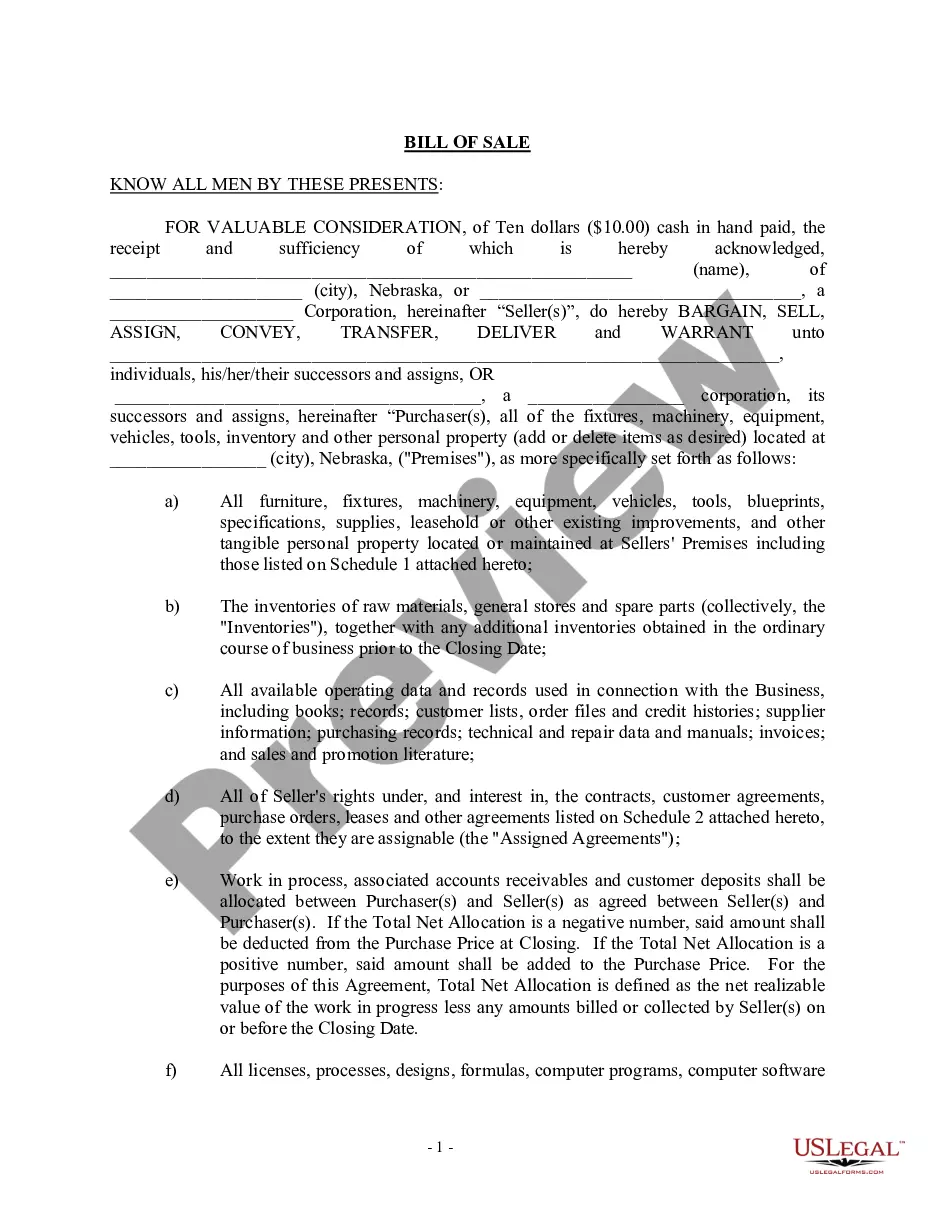

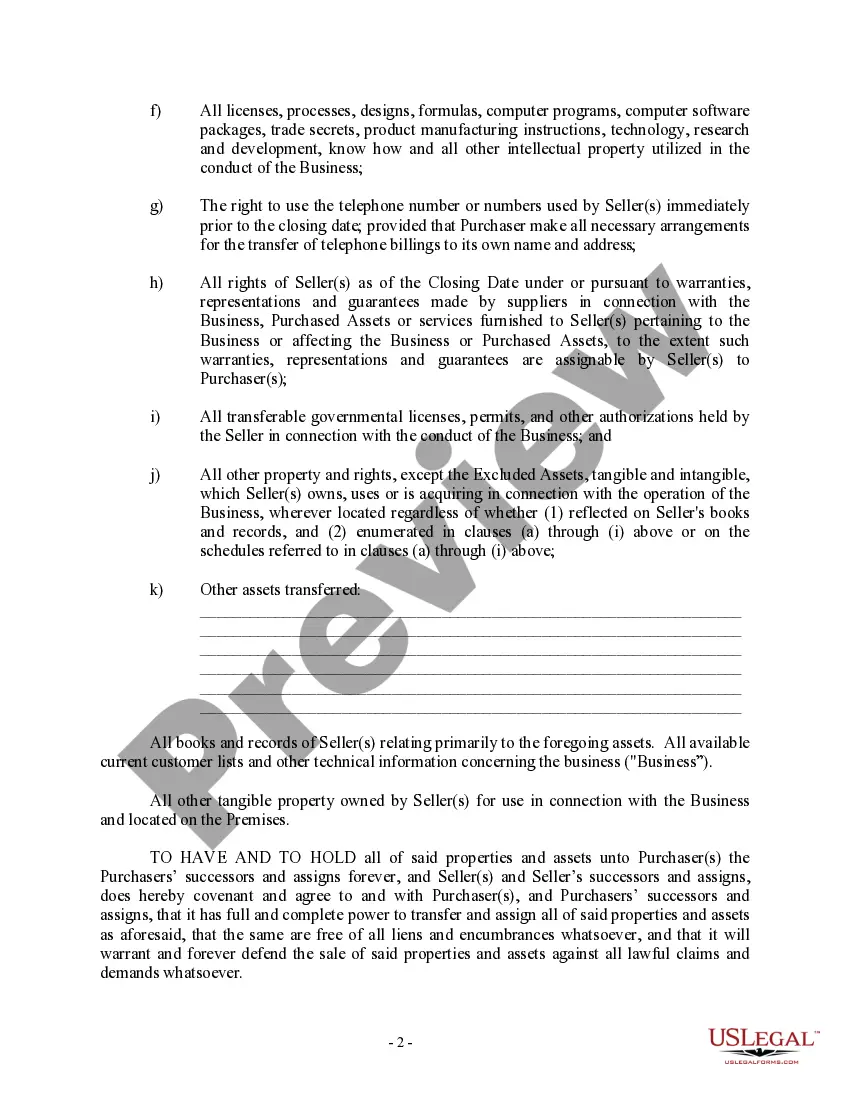

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

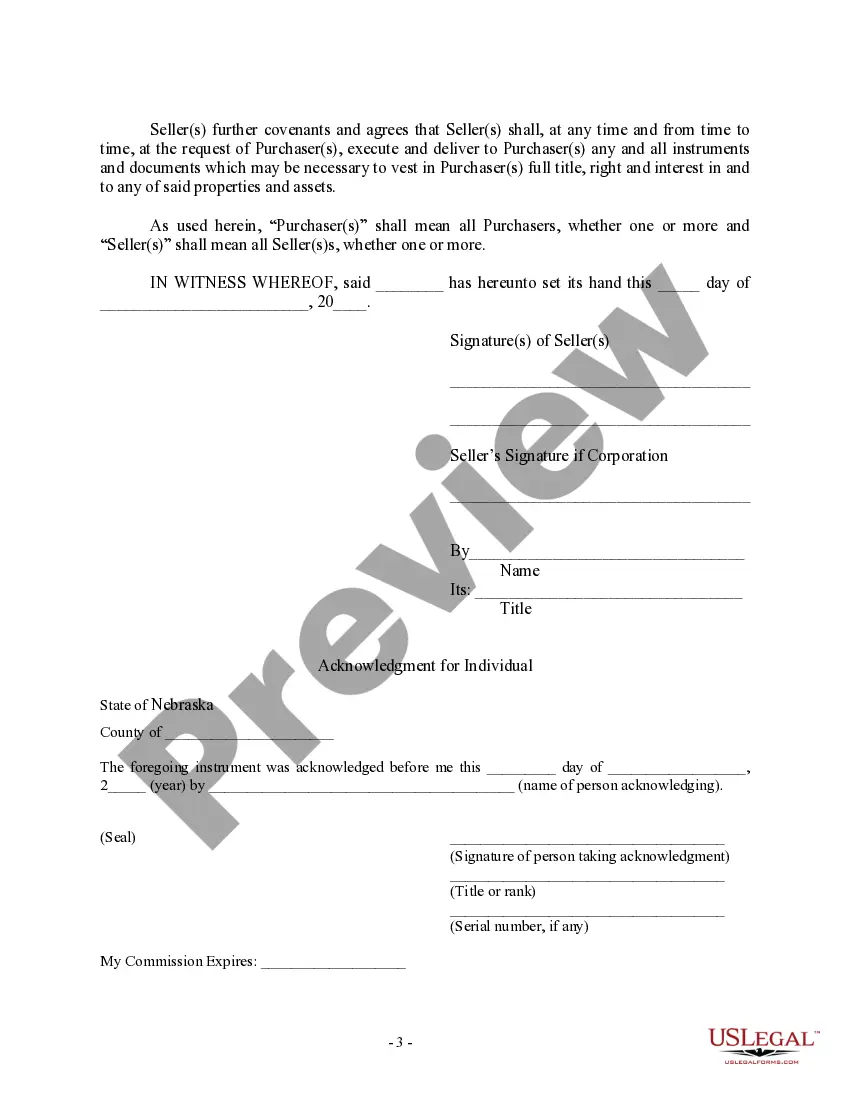

Title: Understanding the Omaha Nebraska Bill of Sale for the Sale of Business by Individual or Corporate Seller Introduction: In Omaha, Nebraska, the Bill of Sale serves as a crucial legal document when selling a business, whether it is by an individual or a corporate seller. It provides an official record of the transaction and outlines the terms and conditions agreed upon by both parties. This article explores the details of the Omaha Nebraska Bill of Sale in connection with the sale of a business, highlighting its significance and shedding light on the different types available. 1. General Omaha Nebraska Bill of Sale for the Sale of Business: The general bill of sale for the sale of a business in Omaha, Nebraska, encompasses the essential elements of the transaction. These include the effective date of the sale, the names and addresses of the buyer(s) and seller(s), a complete description of the business being sold (including assets, inventory, and liabilities), purchase price and payment method, warranties, representations, and any additional terms agreed upon. 2. Omaha Nebraska Bill of Sale for Business Assets Only: This specific type of Bill of Sale focuses solely on the transfer of business assets rather than the entire business. It allows individual or corporate sellers in Omaha, Nebraska, to sell specific assets, such as equipment, vehicles, machinery, intellectual property, or real estate associated with the business. 3. Omaha Nebraska Bill of Sale for Stock or Ownership Interests: In cases where the seller wishes to sell only stock or ownership interests in a business, a specialized Bill of Sale becomes essential. This document outlines the transfer of ownership of the company's stocks or shares, including vital details such as total shares, shareholder names, and purchase price, thus conveying control of the business to the buyer. 4. Omaha Nebraska Bill of Sale for Goodwill: Goodwill is an intangible asset that represents the value of a business's reputation, customer base, and brand image. Omaha Nebraska provides a specific Bill of Sale for the transfer of goodwill associated with a business. This document ensures the smooth transfer of intangible assets, protecting both the seller and the buyer. 5. Omaha Nebraska Bill of Sale — Non-Competition Agreement: In some cases, the seller may be required to sign a non-competition agreement, preventing them from competing with the business they have sold for a specified period within a defined geographical area. The Omaha Nebraska Bill of Sale includes provisions to document this agreement and protects the buyer's interests after the sale. Conclusion: The Omaha Nebraska Bill of Sale plays a significant role when it comes to the sale of a business, providing legal security for both buyers and sellers. Whether it is a general bill of sale, a business assets transfer, a stock transfer, a goodwill transfer, or a non-competition agreement, having the appropriate document customized to the specific type of sale is crucial for a successful transaction. Ensure that the Bill of Sale is carefully drafted, reviewed, and signed by all involved parties, seeking legal advice if necessary, to ensure a smooth transfer of ownership.Title: Understanding the Omaha Nebraska Bill of Sale for the Sale of Business by Individual or Corporate Seller Introduction: In Omaha, Nebraska, the Bill of Sale serves as a crucial legal document when selling a business, whether it is by an individual or a corporate seller. It provides an official record of the transaction and outlines the terms and conditions agreed upon by both parties. This article explores the details of the Omaha Nebraska Bill of Sale in connection with the sale of a business, highlighting its significance and shedding light on the different types available. 1. General Omaha Nebraska Bill of Sale for the Sale of Business: The general bill of sale for the sale of a business in Omaha, Nebraska, encompasses the essential elements of the transaction. These include the effective date of the sale, the names and addresses of the buyer(s) and seller(s), a complete description of the business being sold (including assets, inventory, and liabilities), purchase price and payment method, warranties, representations, and any additional terms agreed upon. 2. Omaha Nebraska Bill of Sale for Business Assets Only: This specific type of Bill of Sale focuses solely on the transfer of business assets rather than the entire business. It allows individual or corporate sellers in Omaha, Nebraska, to sell specific assets, such as equipment, vehicles, machinery, intellectual property, or real estate associated with the business. 3. Omaha Nebraska Bill of Sale for Stock or Ownership Interests: In cases where the seller wishes to sell only stock or ownership interests in a business, a specialized Bill of Sale becomes essential. This document outlines the transfer of ownership of the company's stocks or shares, including vital details such as total shares, shareholder names, and purchase price, thus conveying control of the business to the buyer. 4. Omaha Nebraska Bill of Sale for Goodwill: Goodwill is an intangible asset that represents the value of a business's reputation, customer base, and brand image. Omaha Nebraska provides a specific Bill of Sale for the transfer of goodwill associated with a business. This document ensures the smooth transfer of intangible assets, protecting both the seller and the buyer. 5. Omaha Nebraska Bill of Sale — Non-Competition Agreement: In some cases, the seller may be required to sign a non-competition agreement, preventing them from competing with the business they have sold for a specified period within a defined geographical area. The Omaha Nebraska Bill of Sale includes provisions to document this agreement and protects the buyer's interests after the sale. Conclusion: The Omaha Nebraska Bill of Sale plays a significant role when it comes to the sale of a business, providing legal security for both buyers and sellers. Whether it is a general bill of sale, a business assets transfer, a stock transfer, a goodwill transfer, or a non-competition agreement, having the appropriate document customized to the specific type of sale is crucial for a successful transaction. Ensure that the Bill of Sale is carefully drafted, reviewed, and signed by all involved parties, seeking legal advice if necessary, to ensure a smooth transfer of ownership.