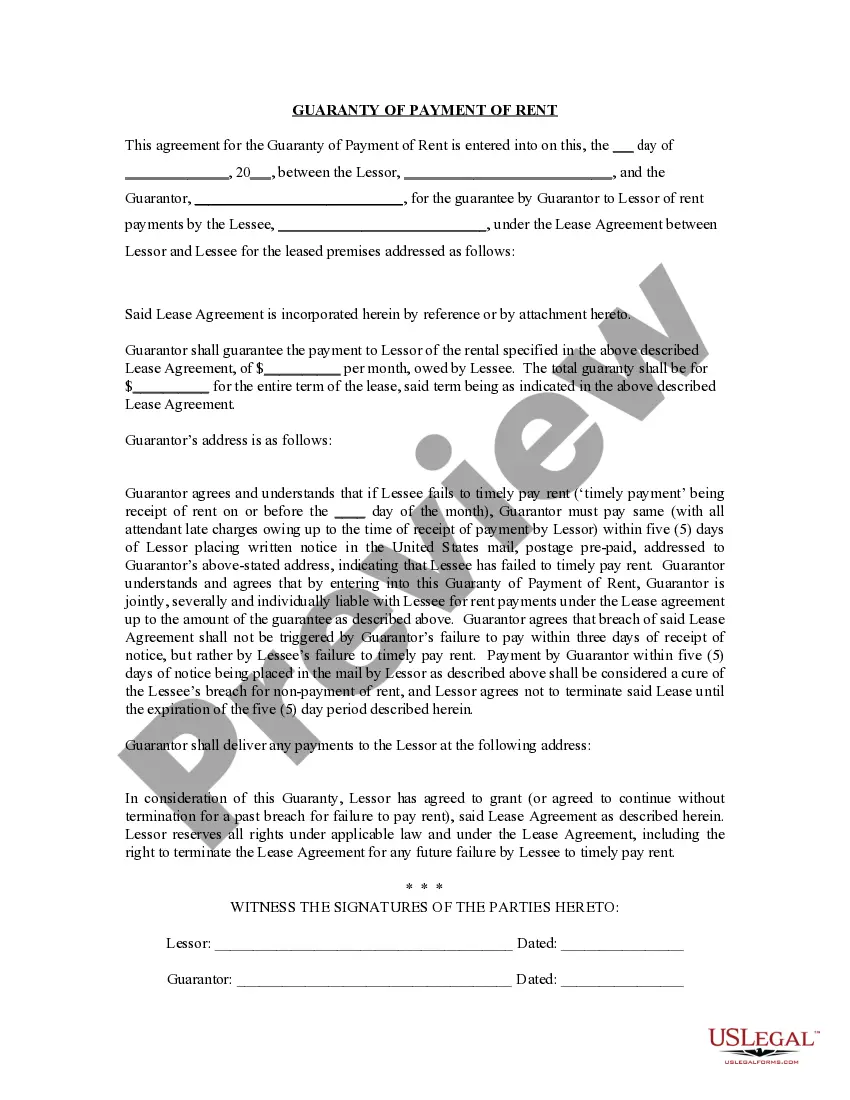

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Omaha Nebraska Guaranty or Guarantee of Payment of Rent is a legal agreement that provides security to landlords in Omaha, Nebraska, ensuring that rent payments will be made even if the tenant defaults. This guarantee acts as a financial safeguard for property owners and helps mitigate the risk associated with renting out their properties. Landlords often require this guarantee to protect their rental income and property investment. The Omaha Nebraska Guaranty or Guarantee of Payment of Rent can take various forms, catering to different situations and preferences. Some common types include: 1. Individual Guarantor: This type of guarantee involves a third party, typically a close friend or family member of the tenant, who agrees to assume responsibility for rent payments if the tenant fails to do so. The individual guarantor typically undergoes a thorough credit check to ensure their financial stability. 2. Corporate Guarantor: In some cases, a corporation or business entity may act as the guarantor, guaranteeing the rent payment on behalf of the tenant. This type of arrangement is commonly seen when businesses lease commercial properties in Omaha. 3. Security Deposit Guaranty: Instead of a separate guarantor, the landlord may permit the tenant to provide an increased security deposit as a guarantee of payment. This deposit acts as a protection against defaulting on rent and can be used to cover unpaid rent or damages to the property. 4. Rental Guarantee Insurance: Landlords may opt to acquire rental guarantee insurance, which ensures they receive rent payments even if the tenant defaults. This insurance policy generally covers a specified amount of rent for a specific period. Omaha Nebraska Guaranty or Guarantee of Payment of Rent is crucial for both landlords and tenants. It provides peace of mind to the landlord by reducing financial risks and ensures uninterrupted rental income. For tenants, having a guarantor allows them to secure a rental property even if they have less-than-ideal credit or financial standing. It is essential for both landlords and tenants to thoroughly understand the terms and conditions of the guarantee before entering into an agreement. Seeking professional legal advice is highly recommended ensuring compliance with local laws and to fully protect the interests of all parties involved. In conclusion, Omaha Nebraska Guaranty or Guarantee of Payment of Rent offers landlords a valuable layer of financial security by assuring prompt and complete rental payments. This guarantee can take various forms, including individual or corporate guarantors, security deposit guarantees, or rental guarantee insurance.Omaha Nebraska Guaranty or Guarantee of Payment of Rent is a legal agreement that provides security to landlords in Omaha, Nebraska, ensuring that rent payments will be made even if the tenant defaults. This guarantee acts as a financial safeguard for property owners and helps mitigate the risk associated with renting out their properties. Landlords often require this guarantee to protect their rental income and property investment. The Omaha Nebraska Guaranty or Guarantee of Payment of Rent can take various forms, catering to different situations and preferences. Some common types include: 1. Individual Guarantor: This type of guarantee involves a third party, typically a close friend or family member of the tenant, who agrees to assume responsibility for rent payments if the tenant fails to do so. The individual guarantor typically undergoes a thorough credit check to ensure their financial stability. 2. Corporate Guarantor: In some cases, a corporation or business entity may act as the guarantor, guaranteeing the rent payment on behalf of the tenant. This type of arrangement is commonly seen when businesses lease commercial properties in Omaha. 3. Security Deposit Guaranty: Instead of a separate guarantor, the landlord may permit the tenant to provide an increased security deposit as a guarantee of payment. This deposit acts as a protection against defaulting on rent and can be used to cover unpaid rent or damages to the property. 4. Rental Guarantee Insurance: Landlords may opt to acquire rental guarantee insurance, which ensures they receive rent payments even if the tenant defaults. This insurance policy generally covers a specified amount of rent for a specific period. Omaha Nebraska Guaranty or Guarantee of Payment of Rent is crucial for both landlords and tenants. It provides peace of mind to the landlord by reducing financial risks and ensures uninterrupted rental income. For tenants, having a guarantor allows them to secure a rental property even if they have less-than-ideal credit or financial standing. It is essential for both landlords and tenants to thoroughly understand the terms and conditions of the guarantee before entering into an agreement. Seeking professional legal advice is highly recommended ensuring compliance with local laws and to fully protect the interests of all parties involved. In conclusion, Omaha Nebraska Guaranty or Guarantee of Payment of Rent offers landlords a valuable layer of financial security by assuring prompt and complete rental payments. This guarantee can take various forms, including individual or corporate guarantors, security deposit guarantees, or rental guarantee insurance.