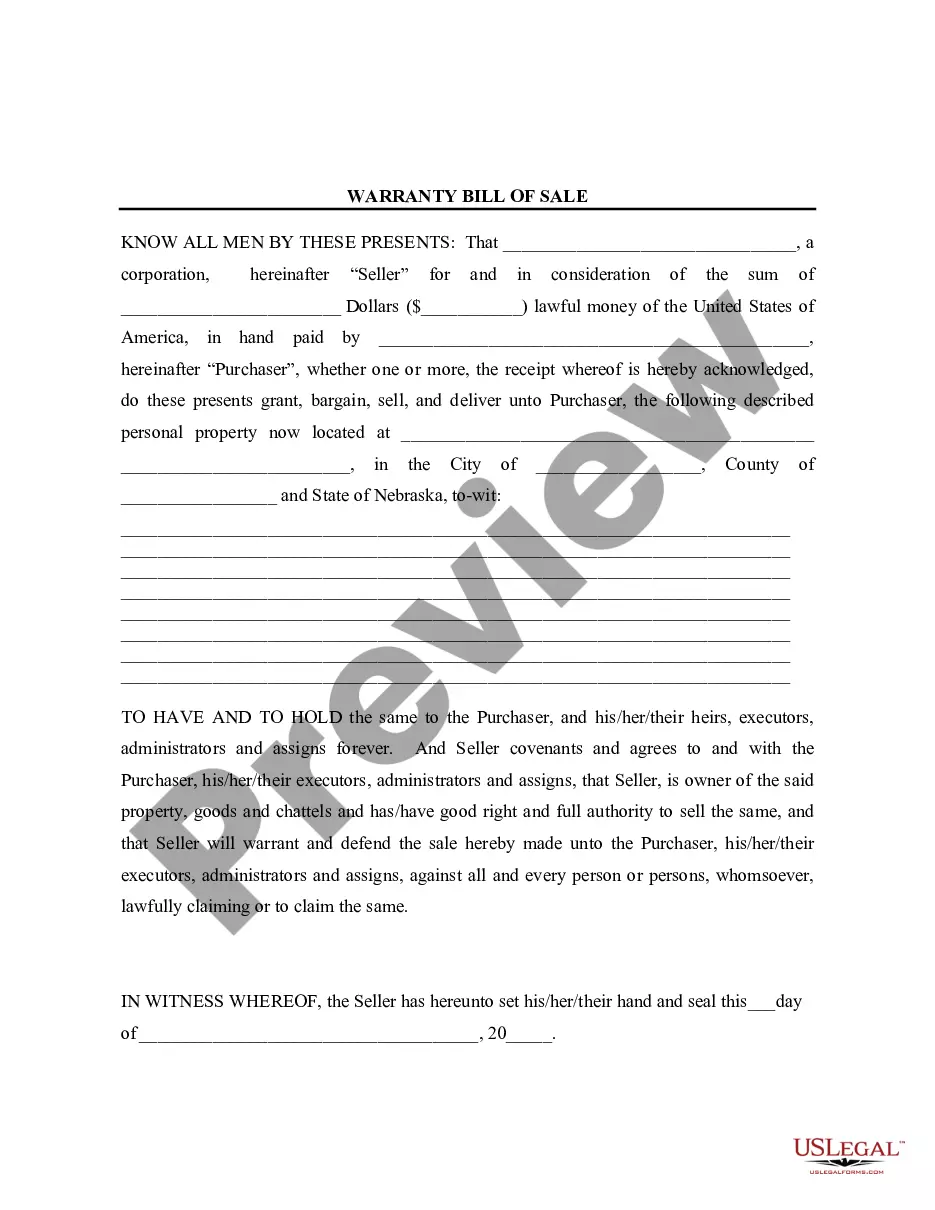

This Bill of Sale with Warranty for Corporate Seller is a Bill of Sale with an appropriate state specific Acknowledgment by Corporate Seller.This is a Warranty Conveyance as opposed to a Quitclaim Conveyance. This form complies with all applicable state statutory laws.

Omaha Nebraska Bill of Sale with Warranty for Corporate Seller

Description

How to fill out Nebraska Bill Of Sale With Warranty For Corporate Seller?

We consistently strive to minimize or evade legal complications when navigating intricate legal or financial matters.

To achieve this, we seek legal remedies that, as a general rule, tend to be quite costly.

Nevertheless, not all legal issues are that complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to locate and download the Omaha Nebraska Bill of Sale with Warranty for Corporate Seller or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our repository enables you to take control of your matters without needing to consult a lawyer.

- We offer access to legal form templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, making the search procedure significantly easier.

Form popularity

FAQ

For motor vehicles, you can use the form that the state of California provides (Form Reg-135) or you can draft an original document. California does not provide an official Bill of Sale for livestock.

Does a bill of sale have to be notarized in Nebraska? Yes. Both the buyer and the seller need to sign the bill of sale in the presence of a notary.

The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 ? Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales. (NOTE: Nebraska Department of Revenue Form 6 is not available for download from the Department of Motor Vehicles website.

Private Sales Any consumer who transfers ownership of a motor vehicle must first obtain a certificate of title in his or her name, register the vehicle and pay sales tax.

Nebraska Bill of Sale Requirements You can use the form the state of Nebraska provides, or you can draft your own.

The seller is responsible for completing the Odometer Certification section of the title. The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 ? Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales.

Buyers have 30 days to title and register their new vehicles in Nebraska. To complete the registration process, buyers must provide a: Vehicle title. Bill of sale.

Both you and the seller must sign the bill of sale. You'll need to show an original bill of sale as proof of sales price. The county assessor (DMV) or the Idaho Transportation Department (ITD) will collect sales tax when you apply for an Idaho title.

Does a bill of sale have to be notarized in Nebraska? Yes. Both the buyer and the seller need to sign the bill of sale in the presence of a notary.

State of Nebraska. Department of Motor Vehicles. BILL OF SALE DATE OF SALE. (MO/DAY/YEAR) I, in consideration of the payment of the sum of $ Transferor (Seller) PLEASE PRINT.Transferor Information. Full Name. Address.Transferor's (Seller) Signature. Transferee's (Buyer) Signature.