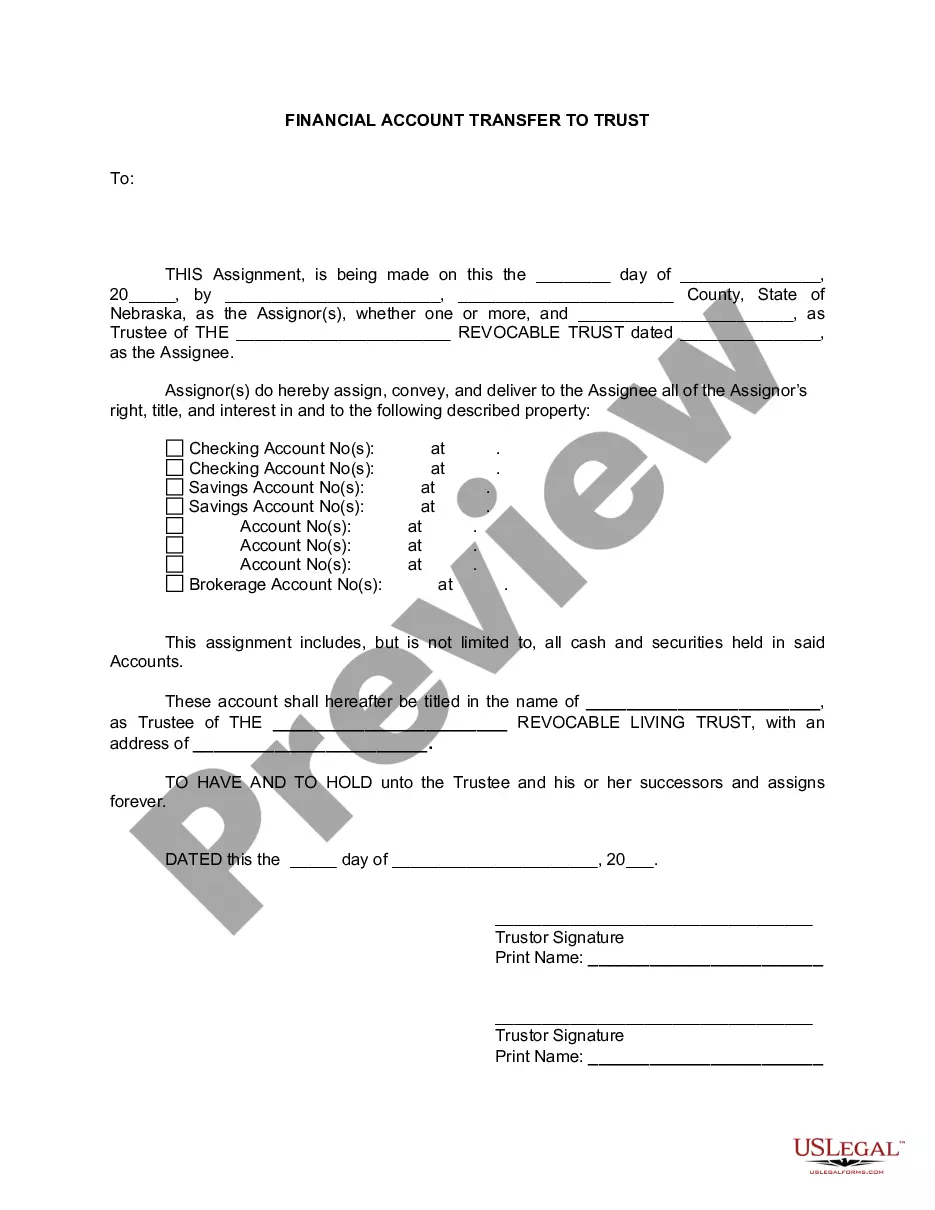

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

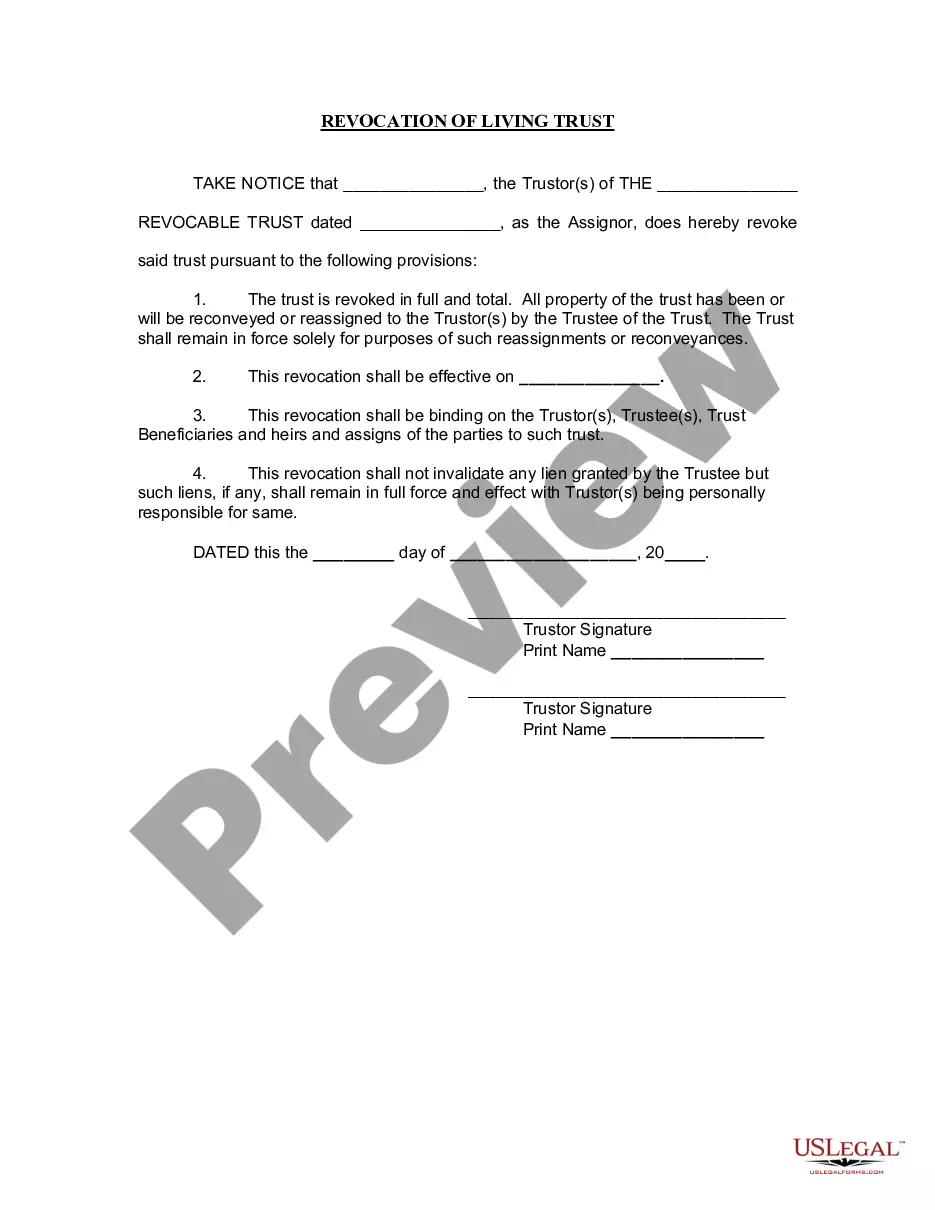

Omaha Nebraska Financial Account Transfer to Living Trust: A Comprehensive Guide In Omaha, Nebraska, Financial Account Transfer to Living Trust involves a legal and seamless process of transferring ownership of various financial accounts, assets, and investments into a designated living trust structure. This strategy ensures a streamlined and efficient transition of assets upon the account holder's incapacity or demise, eliminating the need for probate. 1. Living Trust: Also known as a revocable trust or inter vivos trust, a living trust is a legal entity created by an individual (the granter) to hold, manage, and distribute their assets during their lifetime and after their passing. This trust structure allows for the seamless transfer of accounts to designated beneficiaries, while providing flexibility to modify or revoke it as per the granter's wishes. 2. Financial Accounts: Financial accounts that can be transferred to a living trust include bank accounts, certificates of deposit (CDs), retirement accounts (e.g., IRAs, 401(k)s), brokerage accounts, stocks, bonds, mutual funds, and even real estate properties. 3. Avoiding Probate: The primary benefit of transferring financial accounts to a living trust in Omaha, Nebraska, is bypassing the probate process. Probate can be time-consuming, costly, and subject to public scrutiny. By utilizing a living trust, assets are transferred directly to beneficiaries, avoiding probate and ensuring a smoother transfer process. 4. Privacy and Asset Protection: Transferring accounts to a living trust offers enhanced privacy, as the trust agreement is not publicly filed, unlike a will. Moreover, a living trust can provide asset protection from creditors or potential lawsuits, safeguarding the granter's wealth for the benefit of their beneficiaries. 5. Revocable vs. Irrevocable Trust: While a revocable living trust is the most common type, allowing the granter to modify or revoke it at any time, an irrevocable living trust can also be established. An irrevocable trust, once created, cannot be easily modified or revoked but offers additional protection against estate taxes and potential creditors. 6. Transfer Process: To transfer financial accounts to a living trust, the account holder (granter) must consult with an estate planning attorney to create the trust agreement. Once established, the granter needs to update the account ownership information, designating the trust as the new owner. This typically involves submitting the necessary forms and documentation to each financial institution. The attorney will guide the process to ensure all legal requirements are met and the transfer is executed accurately. In summary, Omaha, Nebraska Financial Account Transfer to Living Trust is a strategic estate planning approach designed to facilitate the efficient transfer of financial accounts, assets, and investments to a living trust structure. By avoiding probate, ensuring privacy, and potentially protecting assets, this practice offers individuals and families a comprehensive and seamless solution to secure their financial future.Omaha Nebraska Financial Account Transfer to Living Trust: A Comprehensive Guide In Omaha, Nebraska, Financial Account Transfer to Living Trust involves a legal and seamless process of transferring ownership of various financial accounts, assets, and investments into a designated living trust structure. This strategy ensures a streamlined and efficient transition of assets upon the account holder's incapacity or demise, eliminating the need for probate. 1. Living Trust: Also known as a revocable trust or inter vivos trust, a living trust is a legal entity created by an individual (the granter) to hold, manage, and distribute their assets during their lifetime and after their passing. This trust structure allows for the seamless transfer of accounts to designated beneficiaries, while providing flexibility to modify or revoke it as per the granter's wishes. 2. Financial Accounts: Financial accounts that can be transferred to a living trust include bank accounts, certificates of deposit (CDs), retirement accounts (e.g., IRAs, 401(k)s), brokerage accounts, stocks, bonds, mutual funds, and even real estate properties. 3. Avoiding Probate: The primary benefit of transferring financial accounts to a living trust in Omaha, Nebraska, is bypassing the probate process. Probate can be time-consuming, costly, and subject to public scrutiny. By utilizing a living trust, assets are transferred directly to beneficiaries, avoiding probate and ensuring a smoother transfer process. 4. Privacy and Asset Protection: Transferring accounts to a living trust offers enhanced privacy, as the trust agreement is not publicly filed, unlike a will. Moreover, a living trust can provide asset protection from creditors or potential lawsuits, safeguarding the granter's wealth for the benefit of their beneficiaries. 5. Revocable vs. Irrevocable Trust: While a revocable living trust is the most common type, allowing the granter to modify or revoke it at any time, an irrevocable living trust can also be established. An irrevocable trust, once created, cannot be easily modified or revoked but offers additional protection against estate taxes and potential creditors. 6. Transfer Process: To transfer financial accounts to a living trust, the account holder (granter) must consult with an estate planning attorney to create the trust agreement. Once established, the granter needs to update the account ownership information, designating the trust as the new owner. This typically involves submitting the necessary forms and documentation to each financial institution. The attorney will guide the process to ensure all legal requirements are met and the transfer is executed accurately. In summary, Omaha, Nebraska Financial Account Transfer to Living Trust is a strategic estate planning approach designed to facilitate the efficient transfer of financial accounts, assets, and investments to a living trust structure. By avoiding probate, ensuring privacy, and potentially protecting assets, this practice offers individuals and families a comprehensive and seamless solution to secure their financial future.