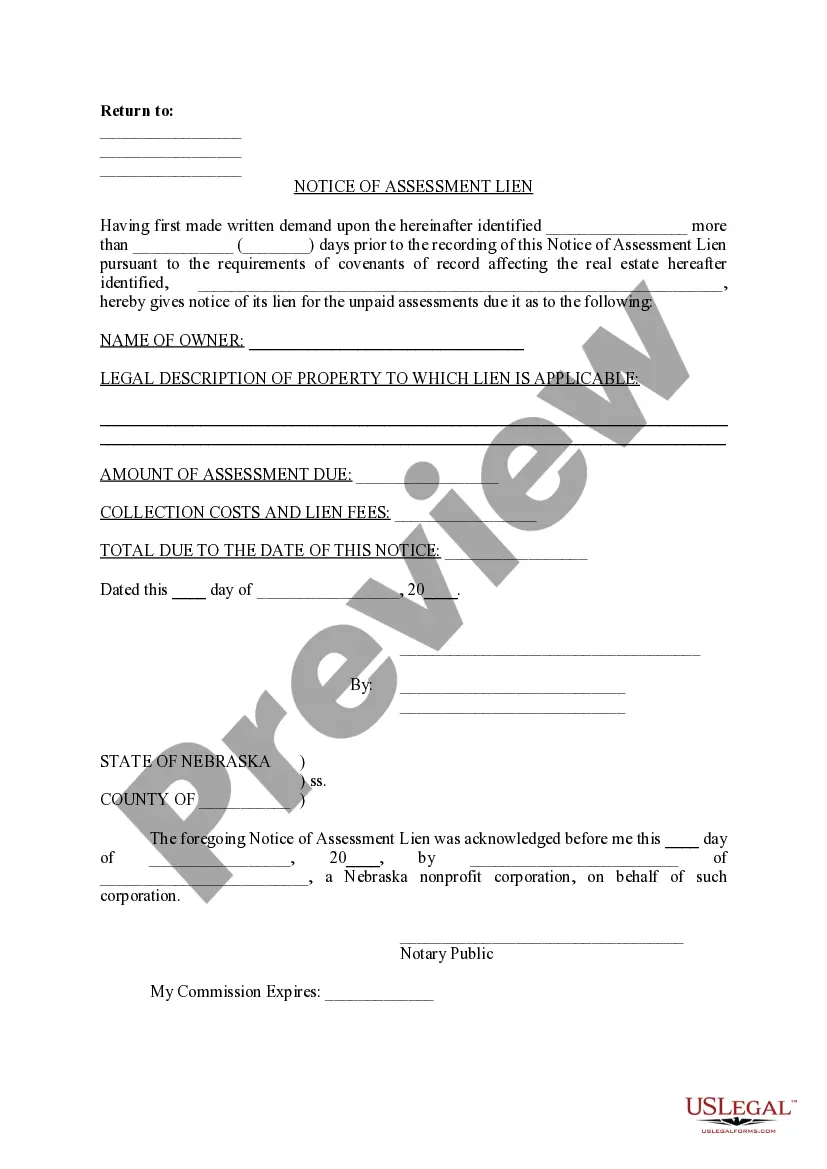

The Omaha Nebraska Notice of Assessment Lien is a legal document filed by the local government to notify property owners of any outstanding tax liabilities and the resulting lien on their property. This lien serves as a legal claim against the property until the owed taxes are paid in full. The Notice of Assessment Lien is an important tool utilized by the Omaha Department of Revenue to enforce tax collection and ensure compliance with local tax laws. It provides transparency to property owners by notifying them of any outstanding tax debts and the consequences if not resolved. There are several types of Omaha Nebraska Notice of Assessment Liens that can be filed, depending on the specific circumstances. These include: 1. Property Tax Lien: This type of lien is filed when property owners fail to pay their property taxes as assessed. It signifies the government's claim over the property until the taxes are paid. 2. Special Assessment Lien: This lien is imposed when property owners fail to pay special assessments for public improvements, such as road repairs, sewer system upgrades, or sidewalk constructions. It ensures that property owners contribute their fair share towards the costs of these improvements. 3. Personal Property Tax Lien: If a business or individual fails to pay taxes on their personal property, such as vehicles, machinery, or equipment, the Omaha Department of Revenue can file a personal property tax lien. The lien secures the government's interest in the personal property until the taxes are paid. 4. Income Tax Lien: If a taxpayer in Omaha fails to pay their state income taxes, the Nebraska Department of Revenue can file an income tax lien on their property. This lien protects the government's ability to collect the outstanding income tax debts. It's important for property owners in Omaha, Nebraska, to understand the ramifications of receiving a Notice of Assessment Lien. Ignoring the lien or failing to address the outstanding tax liabilities promptly may result in further legal consequences, such as foreclosure or garnishment of wages. In conclusion, the Omaha Nebraska Notice of Assessment Lien is a legal instrument employed by the local government to notify property owners of outstanding tax debts. There are various types of liens that can be filed, including property tax liens, special assessment liens, personal property tax liens, and income tax liens. Property owners should prioritize resolving these liens to avoid potential legal repercussions.

Omaha Nebraska Notice of Assessment Lien

Description

How to fill out Omaha Nebraska Notice Of Assessment Lien?

If you are looking for a valid form, it’s extremely hard to find a more convenient platform than the US Legal Forms website – one of the most considerable libraries on the web. Here you can get a huge number of templates for organization and individual purposes by categories and states, or key phrases. With our advanced search option, discovering the most up-to-date Omaha Nebraska Notice of Assessment Lien is as easy as 1-2-3. Additionally, the relevance of every file is verified by a team of expert attorneys that regularly check the templates on our platform and revise them based on the newest state and county regulations.

If you already know about our system and have an account, all you need to receive the Omaha Nebraska Notice of Assessment Lien is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you require. Look at its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the appropriate document.

- Affirm your selection. Choose the Buy now button. Following that, select your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the received Omaha Nebraska Notice of Assessment Lien.

Every template you add to your profile has no expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to receive an extra copy for modifying or printing, feel free to return and save it once more whenever you want.

Take advantage of the US Legal Forms professional catalogue to gain access to the Omaha Nebraska Notice of Assessment Lien you were looking for and a huge number of other professional and state-specific templates on a single platform!