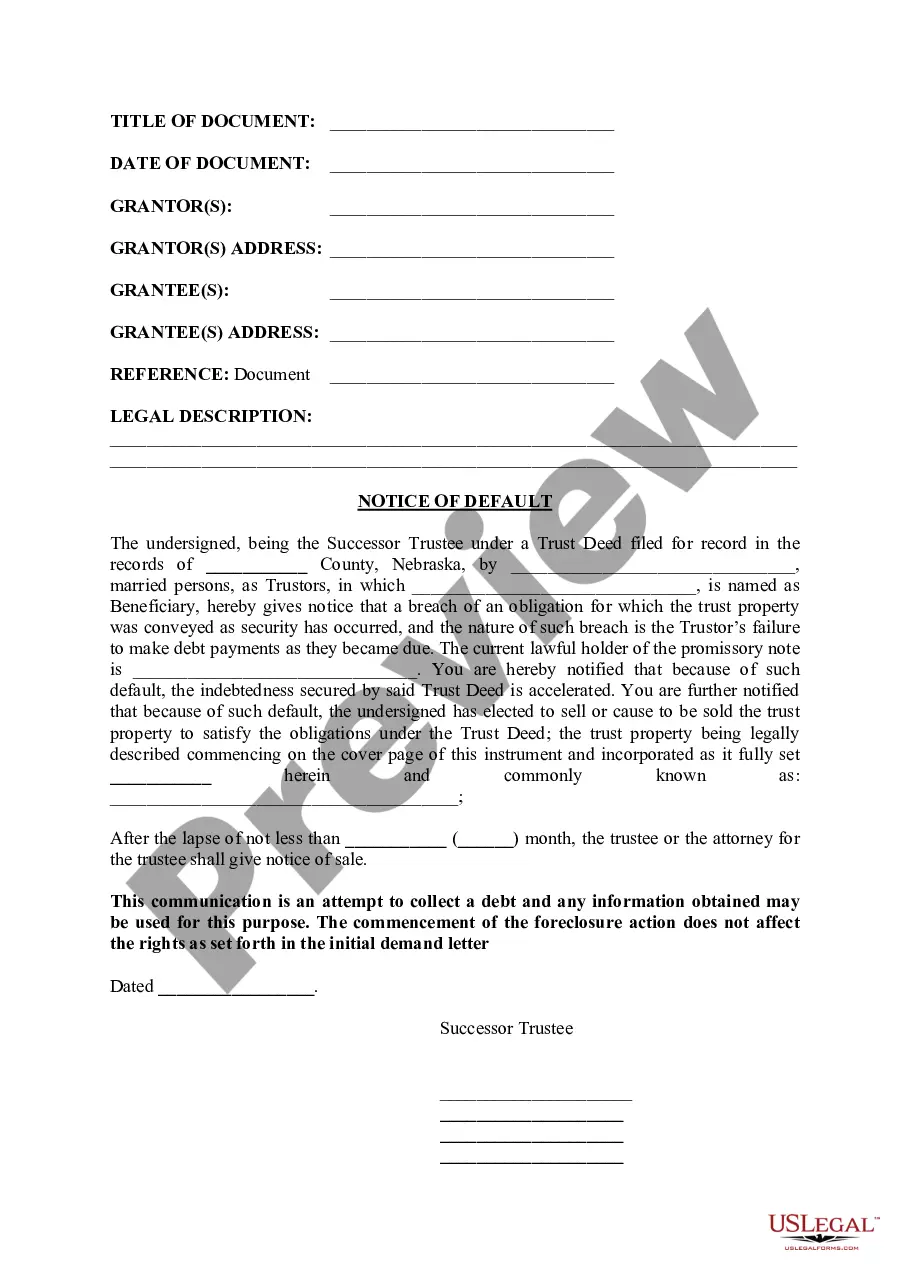

Omaha Nebraska Notice of Default is a legal document issued when a borrower fails to make timely mortgage payments. It serves as a formal notice to inform the borrower about their default status and warns them about potential consequences if the default is not resolved. The Notice of Default in Omaha, Nebraska, is typically sent by the mortgage lender or their authorized representative. It outlines important details regarding the borrower's mortgage loan, such as the loan amount, outstanding balance, interest rate, and payment history. This document also includes essential deadlines and instructions to rectify the default. In Omaha, there are two primary types of Notice of Default: 1. Preliminary Notice of Default: This initial notice is sent to the borrower after they miss one or more mortgage payments, indicating the beginning stages of their default. It serves as a reminder and a wake-up call to the borrower about resolving their financial obligations promptly. 2. Final Notice of Default: If the borrower remains delinquent on their mortgage payments after the preliminary notice, the lender proceeds to send a Final Notice of Default. This notice emphasizes the impending foreclosure process if the borrower fails to cure the default within a specific timeframe stated in the notice. Additionally, it's important to note that the Omaha Nebraska Notice of Default is a legally mandated step in the foreclosure process. It acts as a formal warning to borrowers and provides them with an opportunity to rectify their default before further legal actions are taken, such as initiating foreclosure proceedings. Keywords: Omaha Nebraska Notice of Default, foreclosure, mortgage payments, borrower, default status, legal document, mortgage lender, loan amount, outstanding balance, interest rate, payment history, preliminary notice of default, final notice of default, delinquent, foreclosure process, legal actions, cure the default, formal warning, opportunity to rectify.

Omaha Nebraska Notice of Default

Description

How to fill out Omaha Nebraska Notice Of Default?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal background to draft such paperwork from scratch, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform offers a massive library with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Omaha Nebraska Notice of Default or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Omaha Nebraska Notice of Default quickly employing our trustworthy platform. If you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

However, if you are new to our platform, ensure that you follow these steps prior to obtaining the Omaha Nebraska Notice of Default:

- Be sure the form you have chosen is specific to your location since the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief description (if available) of scenarios the document can be used for.

- In case the form you selected doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Omaha Nebraska Notice of Default once the payment is through.

You’re all set! Now you can go ahead and print the document or complete it online. Should you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.