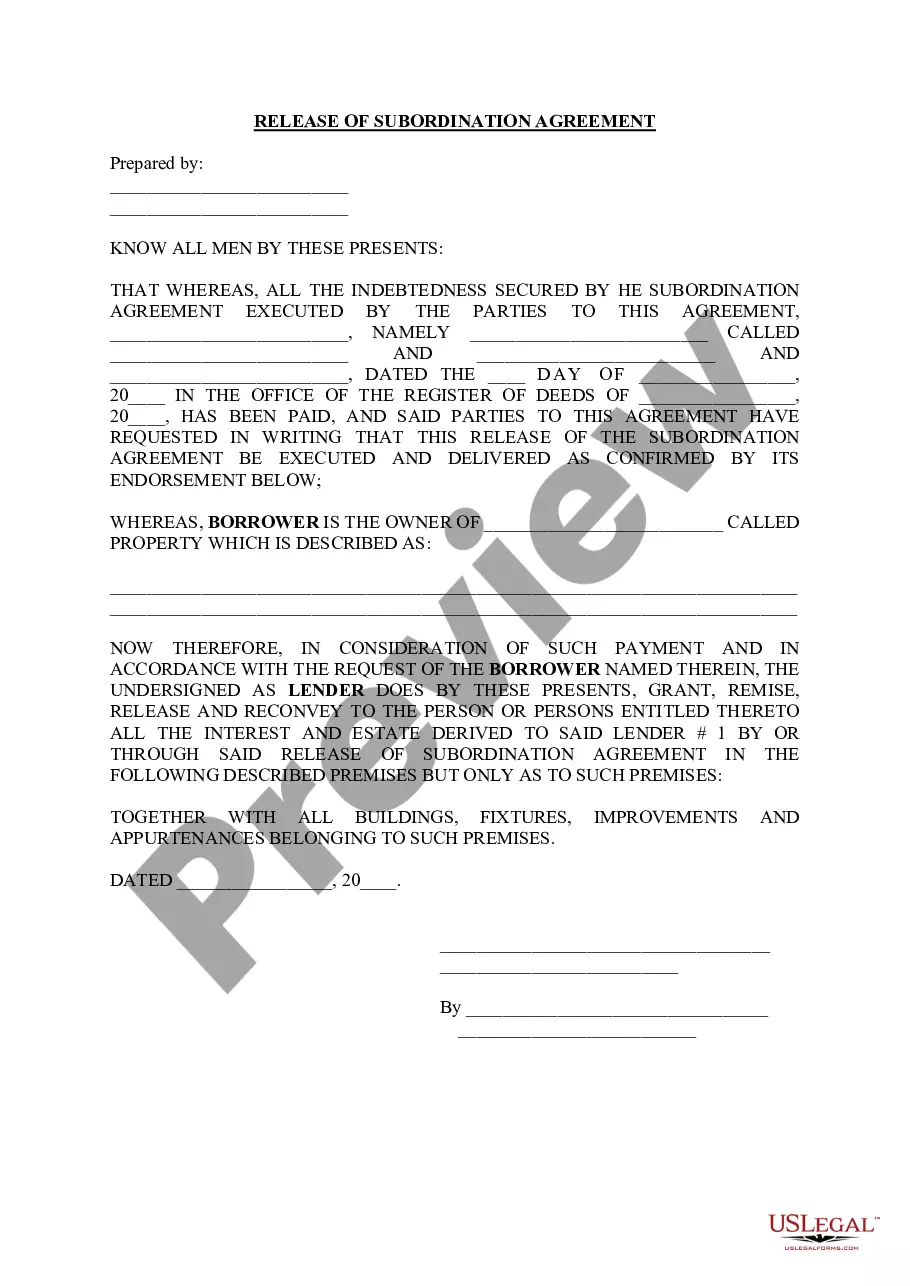

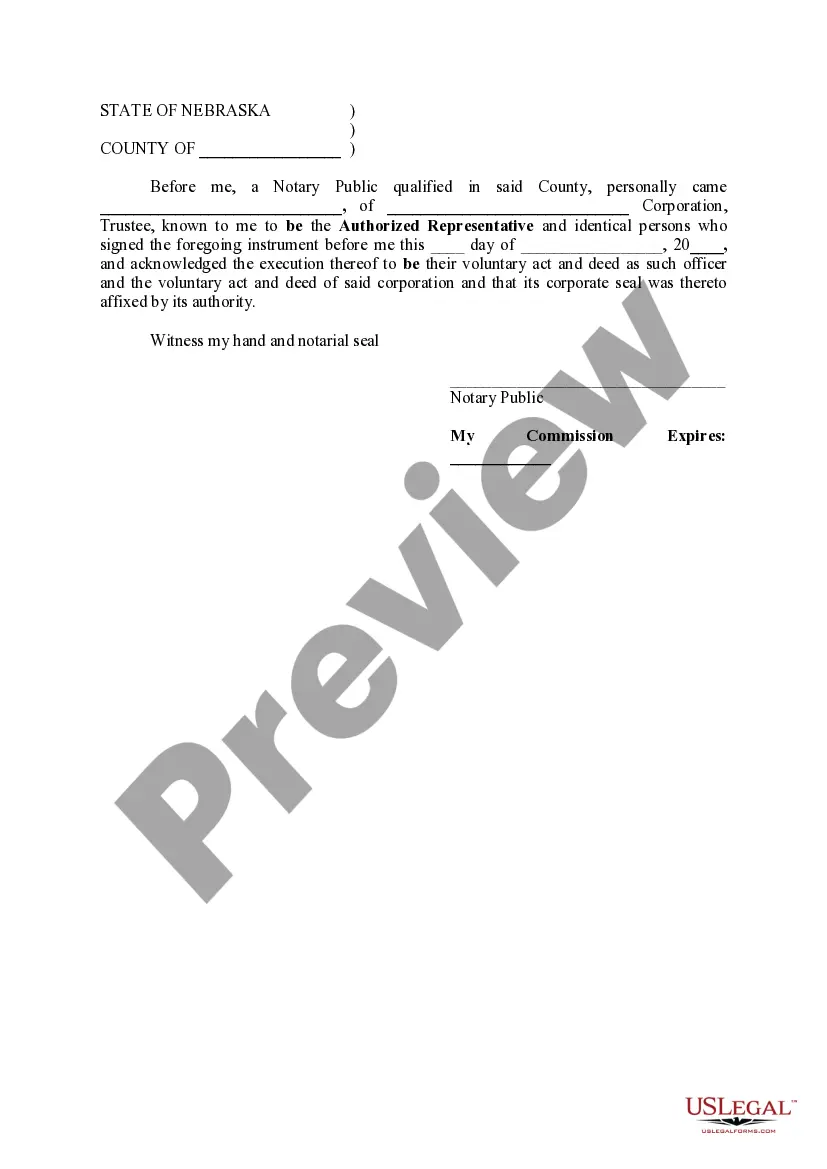

A Release of Subordination Agreement is an important legal document used in Omaha, Nebraska, that allows a party to release or waive their subordinated interest in a property or asset, often in relation to a mortgage or lien. This agreement helps to clarify the priority of claims on the property or asset, allowing for smoother transactions and potential refinancing options. Omaha, Nebraska, being a bustling metropolitan area with a robust real estate market, witnesses various types of Release of Subordination Agreements. Some common types include: 1. Mortgage Release of Subordination Agreement: This type of agreement is commonly used when a property owner wants to refinance their mortgage. By signing this agreement, the lender agrees to release their subordinated interest, allowing the property owner to proceed with the refinancing process without any obstacles. 2. Lien Release of Subordination Agreement: In cases where a property or asset has a lien against it, this agreement allows the lien holder to release their subordinated interest. It is often utilized in scenarios where the property owner intends to sell the property, and the release of the lien facilitates the smooth transfer of ownership to the buyer. 3. Judgment Release of Subordination Agreement: When judgments have been made against a property or asset, this type of agreement enables the judgment holder to release their subordinated interest. This agreement can be vital for property owners who want to clear their title and address any outstanding legal claims against the property. 4. Tax Lien Release of Subordination Agreement: In situations where a property or asset is subject to a tax lien, this agreement allows the tax authority to release their subordinated interest. By doing so, it opens up the possibility for the property owner to address their tax obligations and resolve any issues surrounding the property's title. Overall, a Release of Subordination Agreement in Omaha, Nebraska, serves as a crucial legal tool to clarify and adjust the priority of claims on a property or asset. It helps property owners, lenders, lien holders, judgment holders, or tax authorities to navigate various transactions smoothly, ensuring the efficient transfer of property rights and assets.

Omaha Nebraska Release of Subordination Agreement

Description

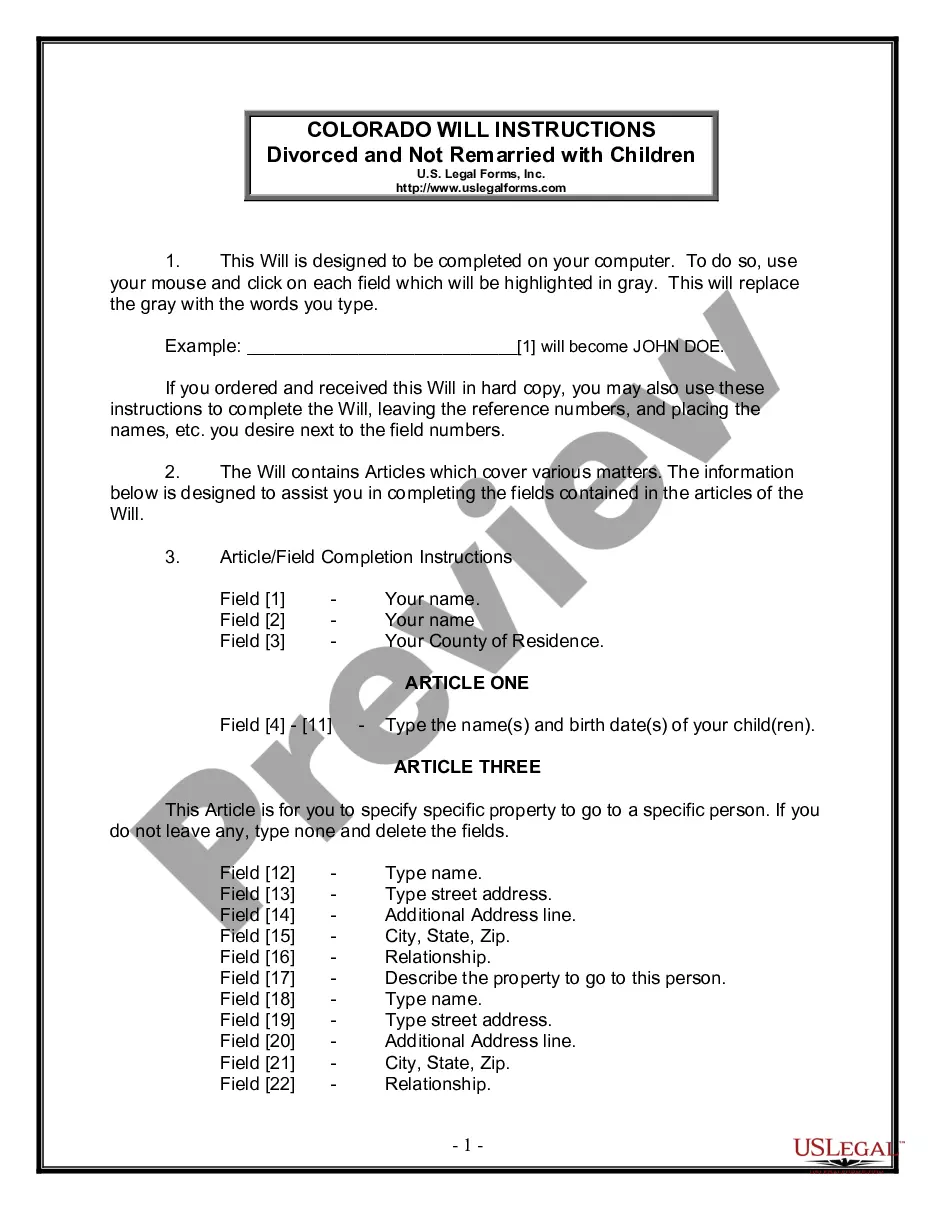

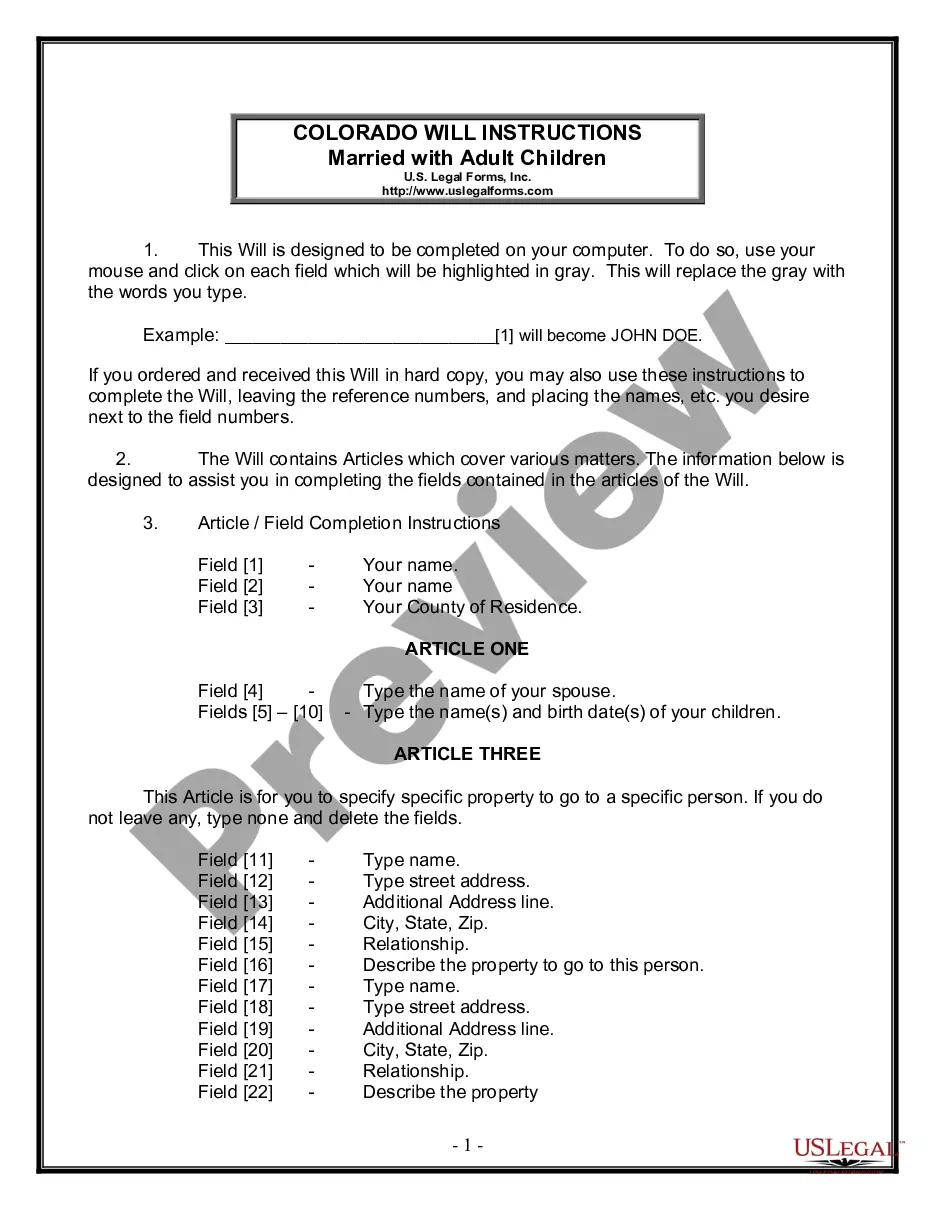

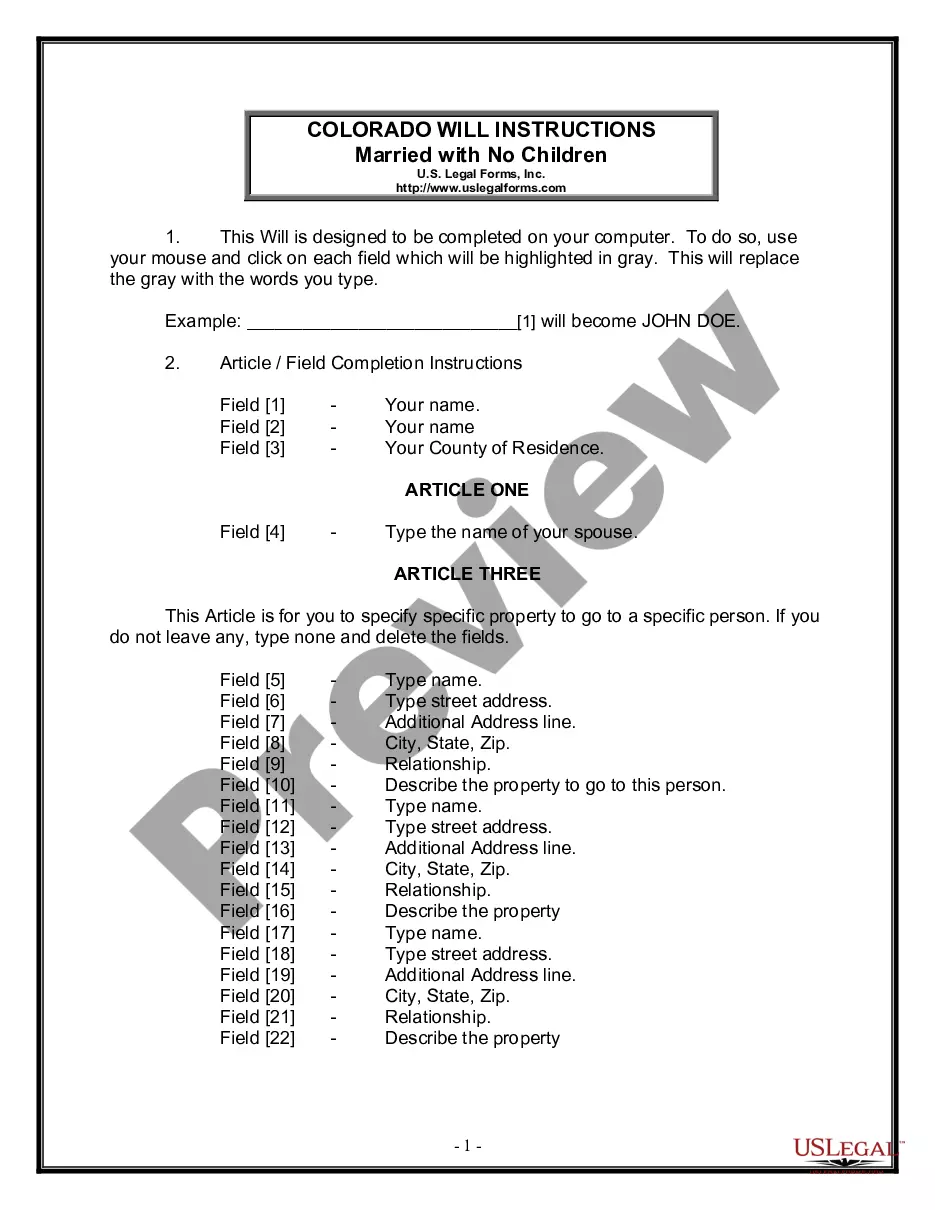

How to fill out Omaha Nebraska Release Of Subordination Agreement?

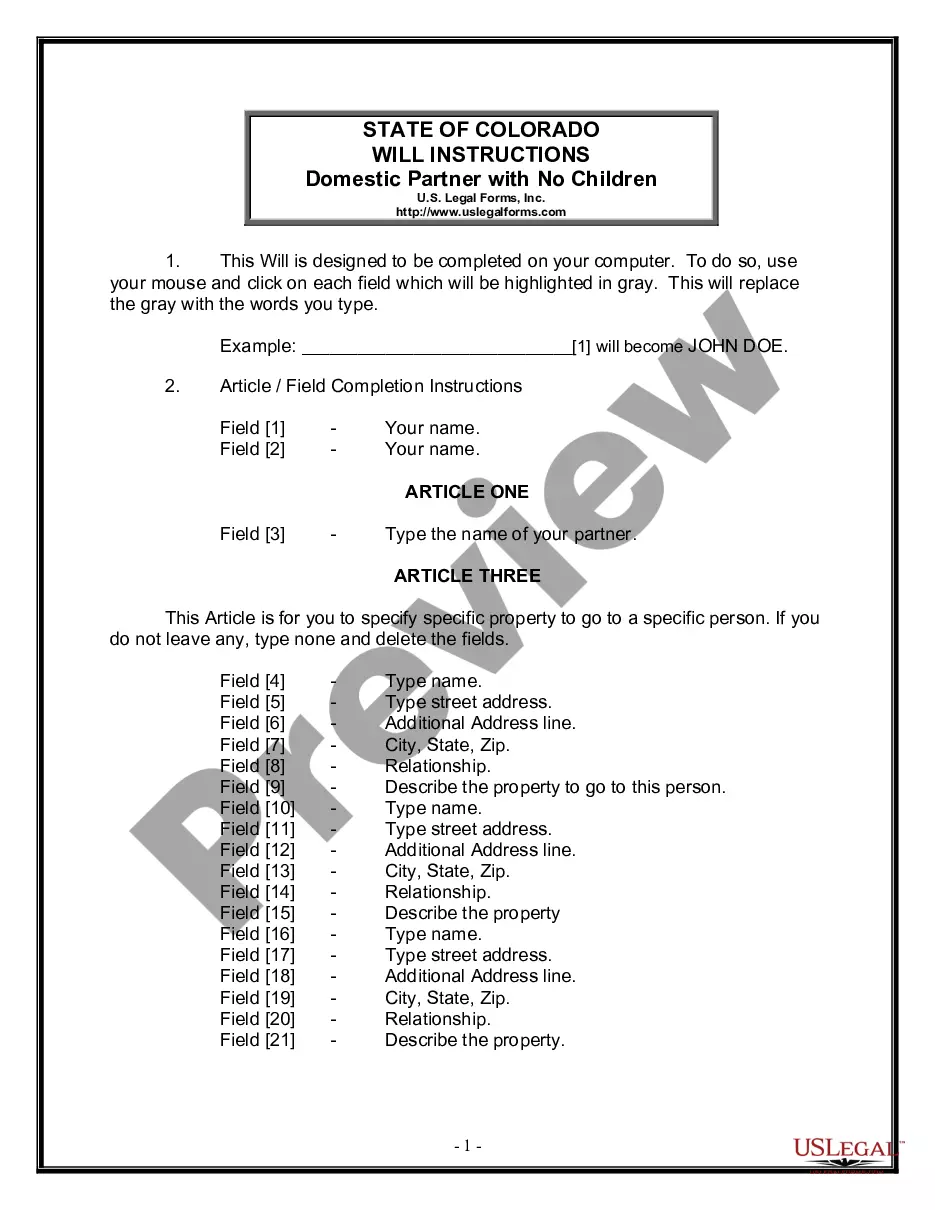

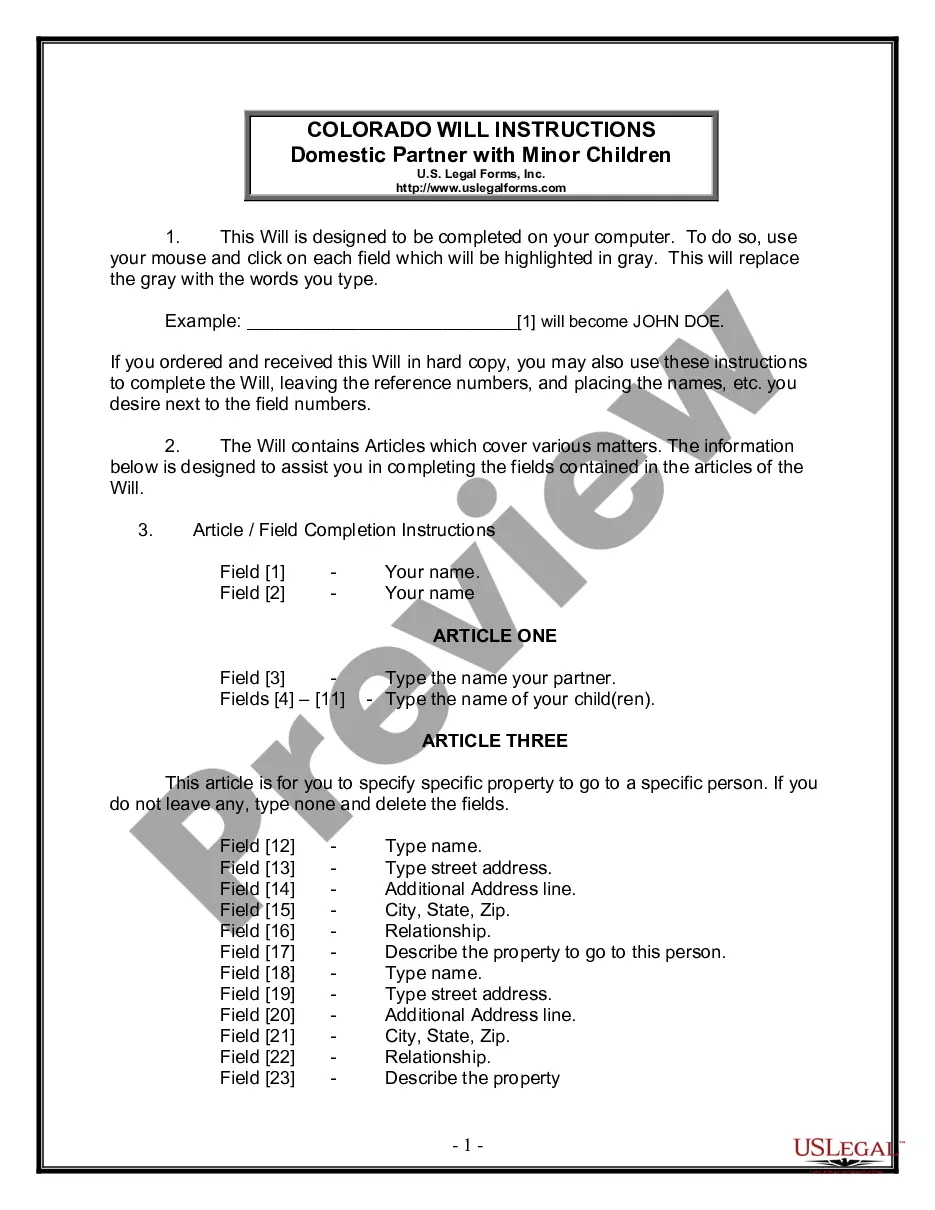

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal education to create such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Omaha Nebraska Release of Subordination Agreement or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Omaha Nebraska Release of Subordination Agreement in minutes using our trustworthy service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Omaha Nebraska Release of Subordination Agreement:

- Ensure the template you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Preview the document and read a brief outline (if available) of scenarios the document can be used for.

- If the form you picked doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Omaha Nebraska Release of Subordination Agreement as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the document or complete it online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.