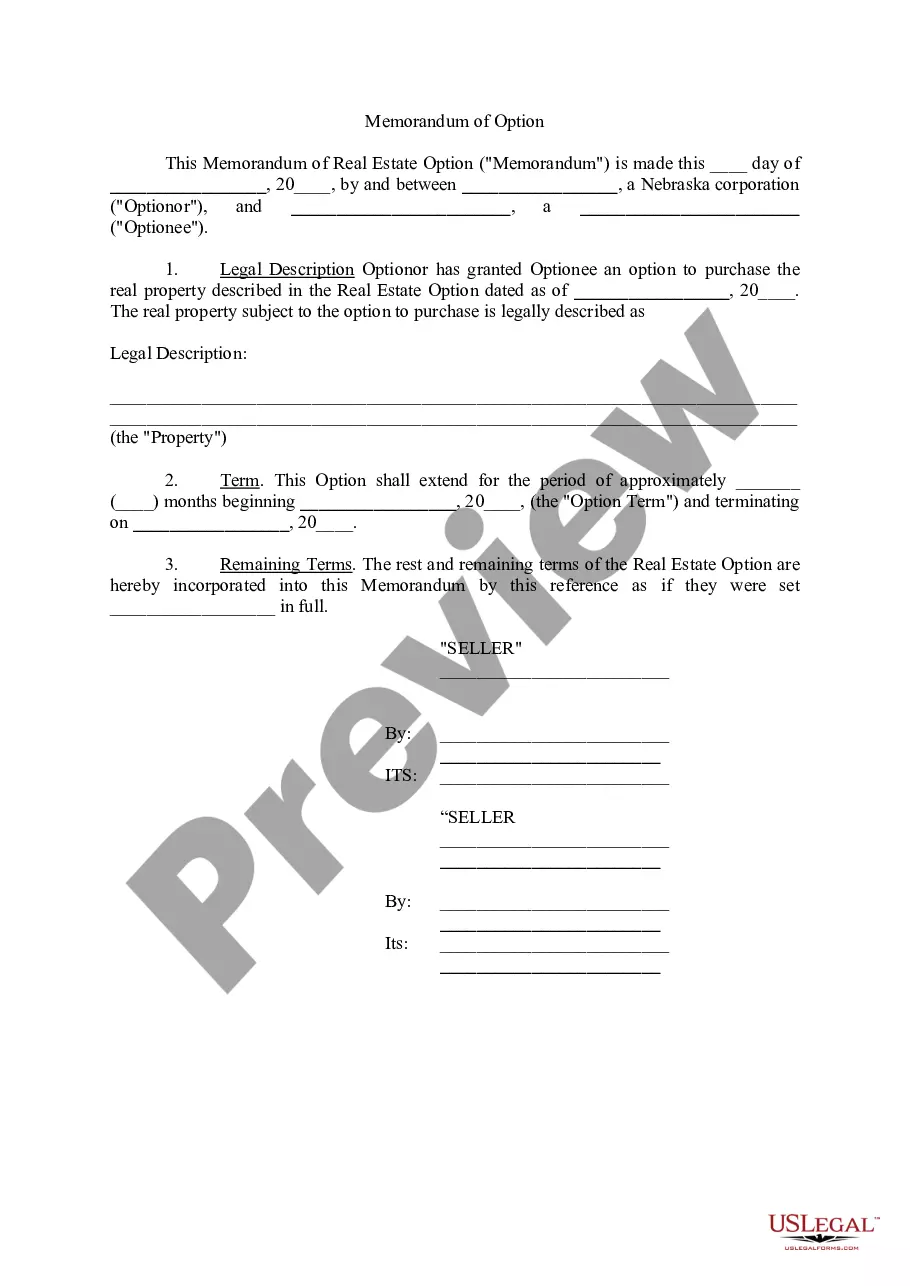

Omaha Nebraska Memorandum of Option

Description

How to fill out Nebraska Memorandum Of Option?

If you have previously made use of our service, sign in to your account and obtain the Omaha Nebraska Memorandum of Option on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment schedule.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have permanent access to all of the documents you have purchased: you can find them in your profile under the My documents section when you wish to use them again. Make use of the US Legal Forms service to effortlessly discover and save any template for your personal or professional requirements!

- Confirm that you've found the correct document. Review the description and utilize the Preview feature, if accessible, to verify if it satisfies your needs. If it doesn't work for you, use the Search tab above to locate the appropriate one.

- Acquire the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Omaha Nebraska Memorandum of Option. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

The gross receipts from the lease or rental of motor vehicles in this state are subject to Nebraska and any applicable local sales tax.

An individual or business that has been issued a common or contract carrier certificate of exemption may only use it to purchase those items described above prior to the expiration date on the certificate. The certificate of exemption expires every 5 years.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

How to Write a Nebraska Quitclaim Deed Preparer's name and address. Name and mailing address of the party to whom the recorded deed should be sent. County where the real property is located. The consideration paid to the grantor (dollar amount should be written in words and numbers) Grantor's name and address.

(b)(1) A transfer on death deed shall contain the following warnings: WARNING: The property transferred remains subject to inheritance taxation in Nebraska to the same extent as if owned by the transferor at death. Failure to timely pay inheritance taxes is subject to interest and penalties as provided by law.

Stat. §§ 76-3401-76-3423 (the ?Act?). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

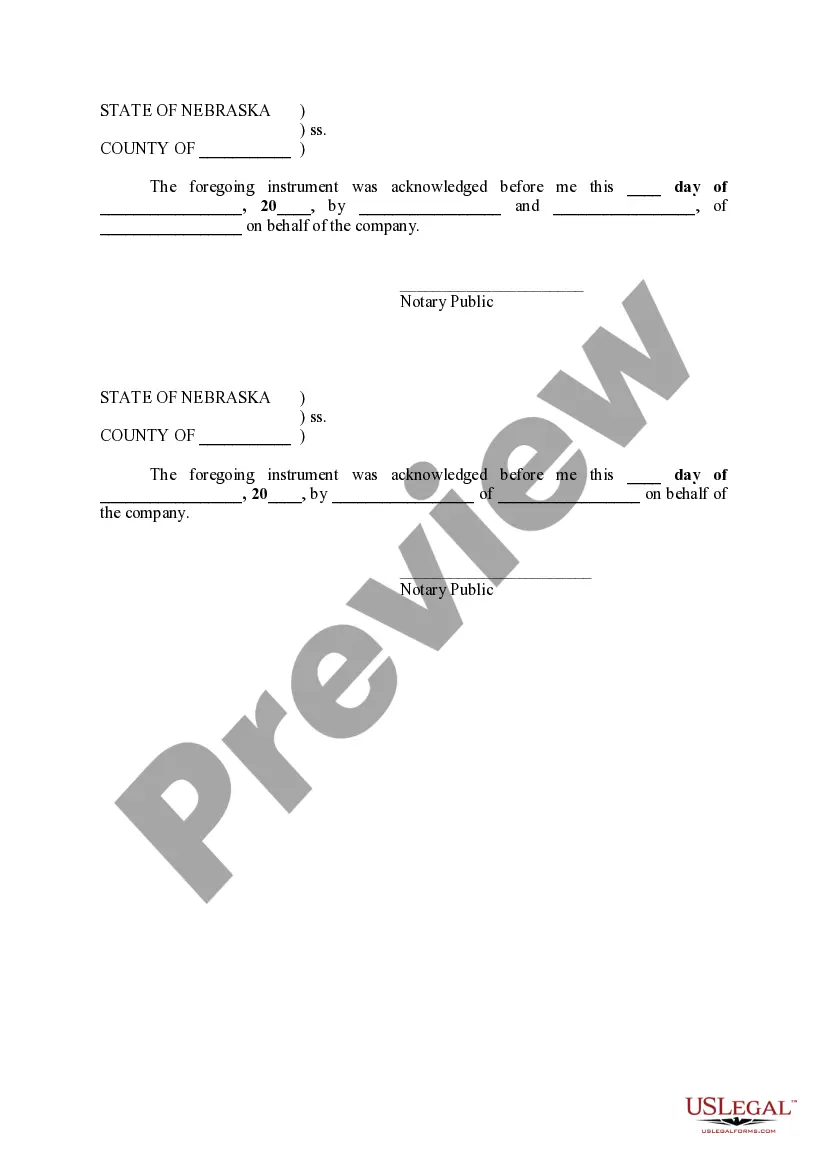

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

001.01 The documentary stamp tax is a tax upon the grantor for the privilege of transferring beneficial interest in or legal title to real property located in the state of Nebraska based upon the value of the real property transferred. The tax is due when a deed is offered for recording, unless it is exempt.

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed Form 521, which are not subject to the documentary stamp tax until the deed is presented for recording.