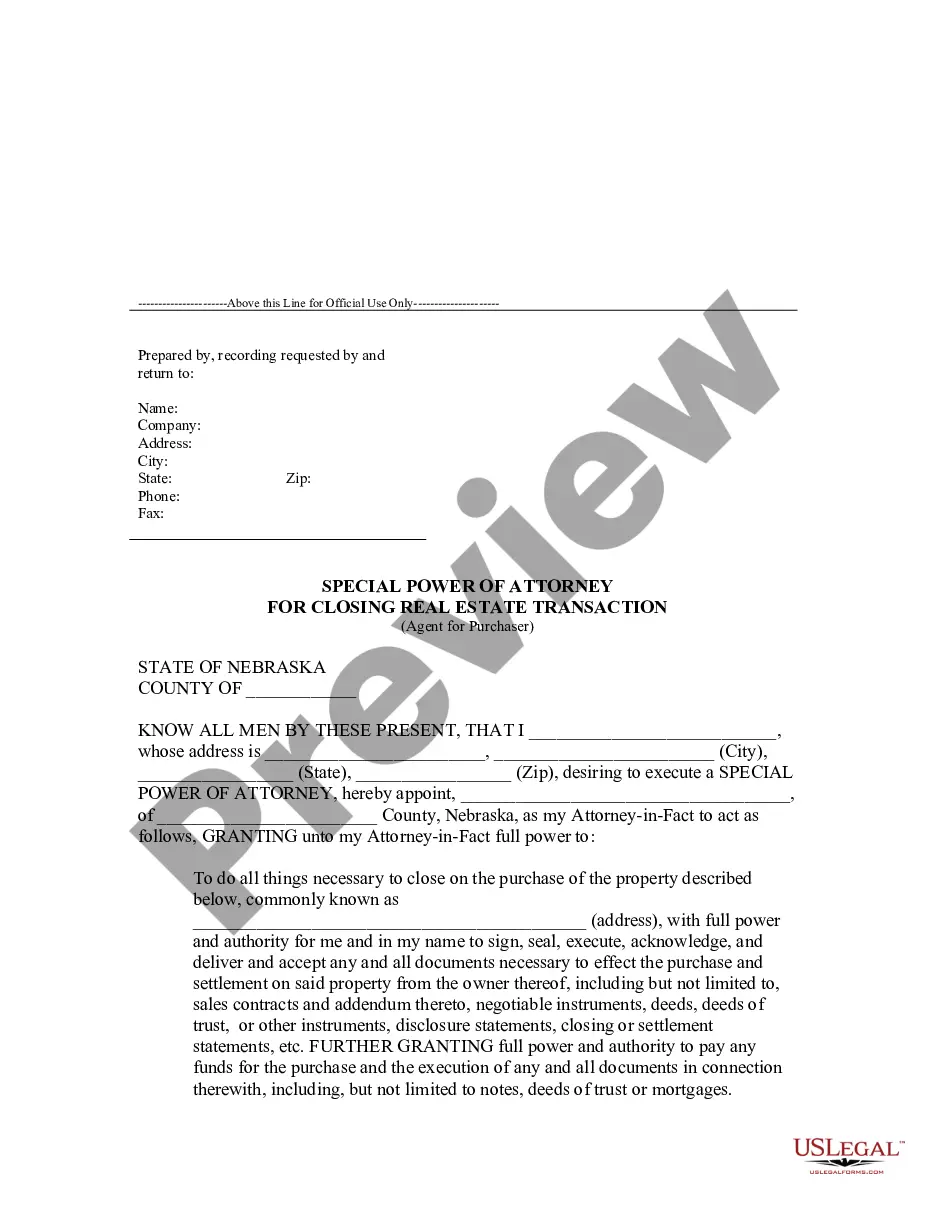

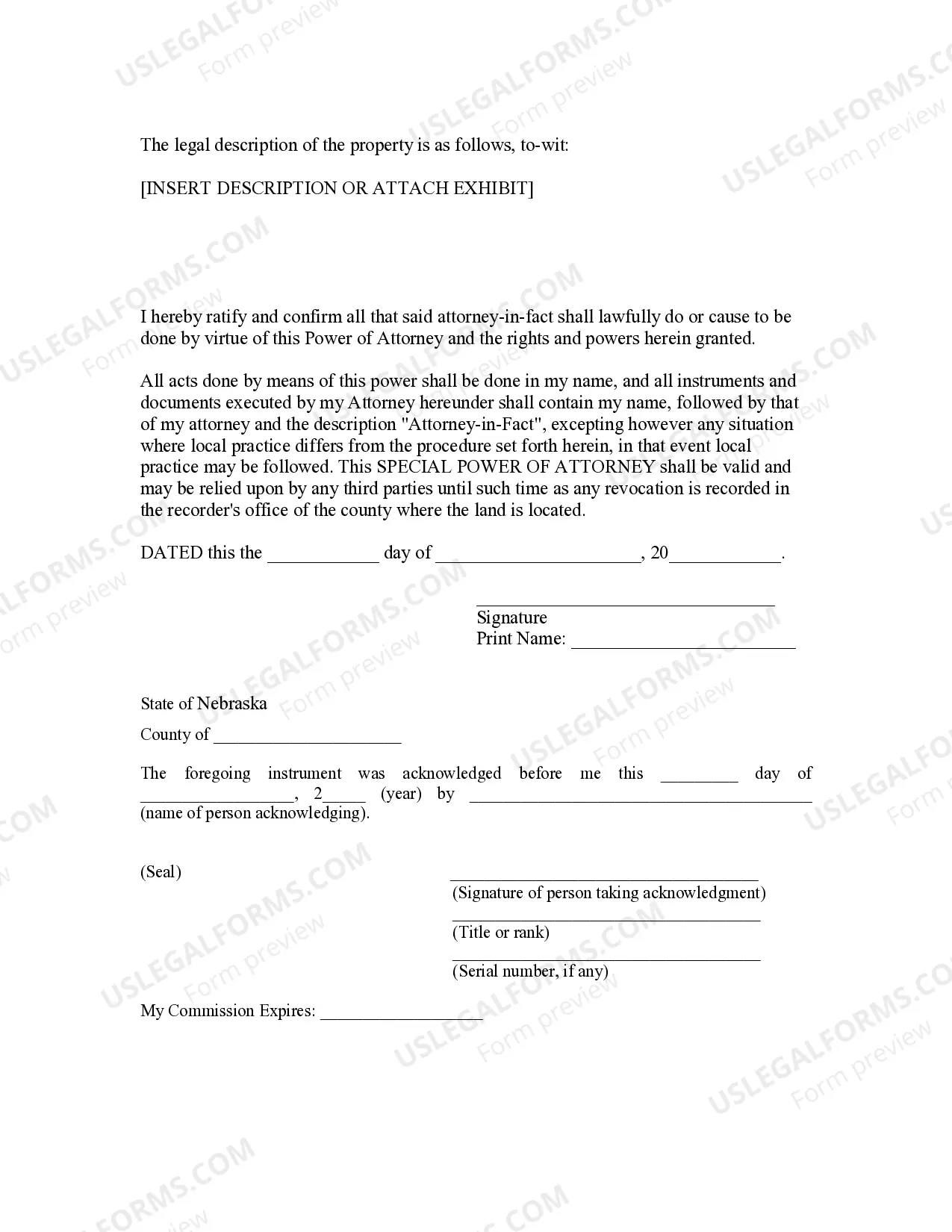

This Power of Attorney for Real Estate Transaction form is for a Purchaser to authorize an attorney-in-fact to execute all documents and do all things necessary to purchase a particular parcel of real estate for purchaser, including loan documents. This form must be signed and notarized.

Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is a legal document that authorizes an individual (the purchaser) to act on behalf of another person or entity in a specific real estate purchase transaction in Omaha, Nebraska. This power of attorney grants a limited scope of authority to the purchaser, allowing them to only make decisions and perform actions related to the specified real estate purchase. The Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is designed to provide flexibility and convenience when the principal (the person or entity granting the power) is unable to personally attend or participate in the real estate purchase transaction. It allows them to appoint a trusted representative to act on their behalf, ensuring that the transaction proceeds smoothly and efficiently. The specific types of Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser may vary depending on the needs and preferences of the parties involved. Some common types include: 1. Limited Power of Attorney for Purchase Agreement: This type of power of attorney grants the purchaser authority to enter into a purchase agreement on behalf of the principal. It enables them to negotiate terms, sign contracts, make earnest money deposits, and perform other actions necessary to initiate the purchase. 2. Limited Power of Attorney for Property Inspections: With this type of power of attorney, the purchaser is authorized to conduct property inspections, coordinate with inspectors, receive inspection reports, and make decisions based on the findings. This is especially useful when the principal cannot physically be present for inspections. 3. Limited Power of Attorney for Closing Documents: This power of attorney empowers the purchaser to sign closing documents, including loan agreements, title documents, and other necessary paperwork on behalf of the principal. It ensures a smooth and timely closing process. 4. Limited Power of Attorney for Financial Transactions: In some cases, the purchaser may need the authority to execute financial transactions related to the real estate purchase, such as wire transfers, paying closing costs, or obtaining mortgage financing. This type of power of attorney grants the necessary authorization for such actions. It's important to note that these are just a few examples of the possible types of Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser. Depending on the specific circumstances and requirements of the transaction, the power of attorney can be customized and tailored to meet the parties' needs. It is advisable to consult with a qualified attorney to draft and execute the appropriate power of attorney document.

Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is a legal document that authorizes an individual (the purchaser) to act on behalf of another person or entity in a specific real estate purchase transaction in Omaha, Nebraska. This power of attorney grants a limited scope of authority to the purchaser, allowing them to only make decisions and perform actions related to the specified real estate purchase. The Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is designed to provide flexibility and convenience when the principal (the person or entity granting the power) is unable to personally attend or participate in the real estate purchase transaction. It allows them to appoint a trusted representative to act on their behalf, ensuring that the transaction proceeds smoothly and efficiently. The specific types of Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser may vary depending on the needs and preferences of the parties involved. Some common types include: 1. Limited Power of Attorney for Purchase Agreement: This type of power of attorney grants the purchaser authority to enter into a purchase agreement on behalf of the principal. It enables them to negotiate terms, sign contracts, make earnest money deposits, and perform other actions necessary to initiate the purchase. 2. Limited Power of Attorney for Property Inspections: With this type of power of attorney, the purchaser is authorized to conduct property inspections, coordinate with inspectors, receive inspection reports, and make decisions based on the findings. This is especially useful when the principal cannot physically be present for inspections. 3. Limited Power of Attorney for Closing Documents: This power of attorney empowers the purchaser to sign closing documents, including loan agreements, title documents, and other necessary paperwork on behalf of the principal. It ensures a smooth and timely closing process. 4. Limited Power of Attorney for Financial Transactions: In some cases, the purchaser may need the authority to execute financial transactions related to the real estate purchase, such as wire transfers, paying closing costs, or obtaining mortgage financing. This type of power of attorney grants the necessary authorization for such actions. It's important to note that these are just a few examples of the possible types of Omaha Nebraska Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser. Depending on the specific circumstances and requirements of the transaction, the power of attorney can be customized and tailored to meet the parties' needs. It is advisable to consult with a qualified attorney to draft and execute the appropriate power of attorney document.