Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

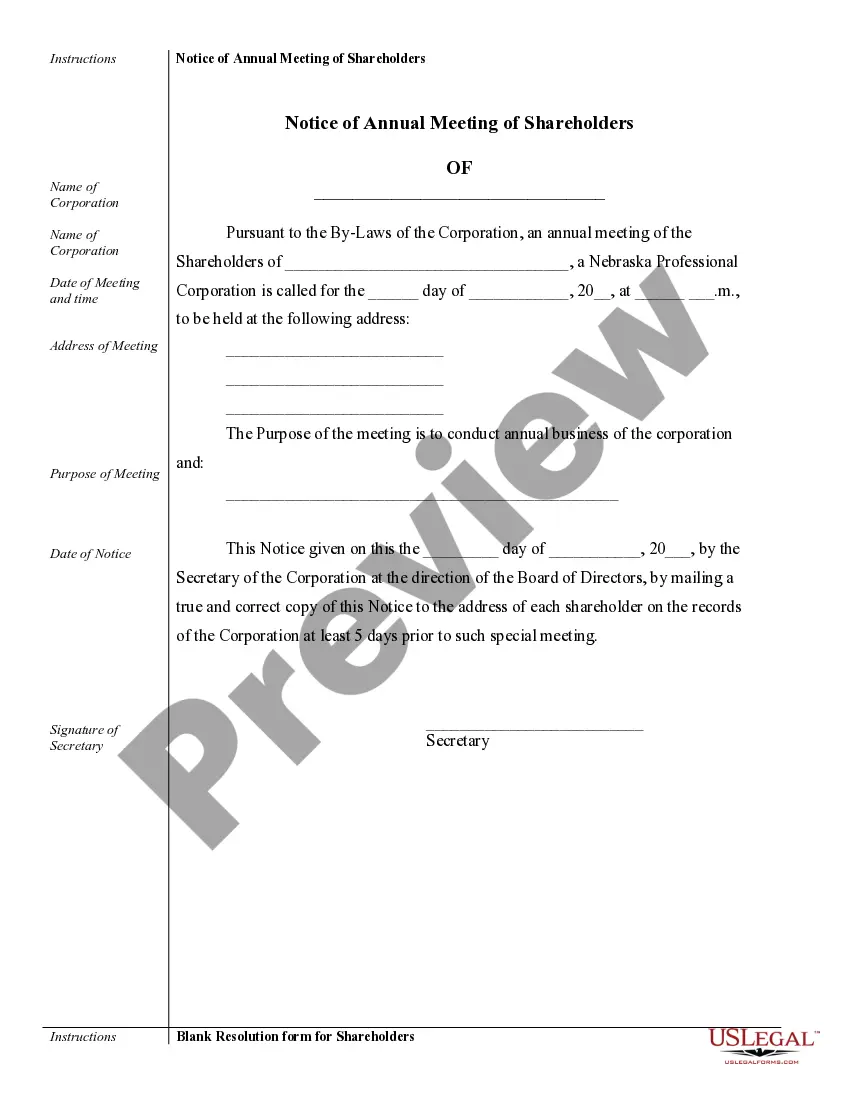

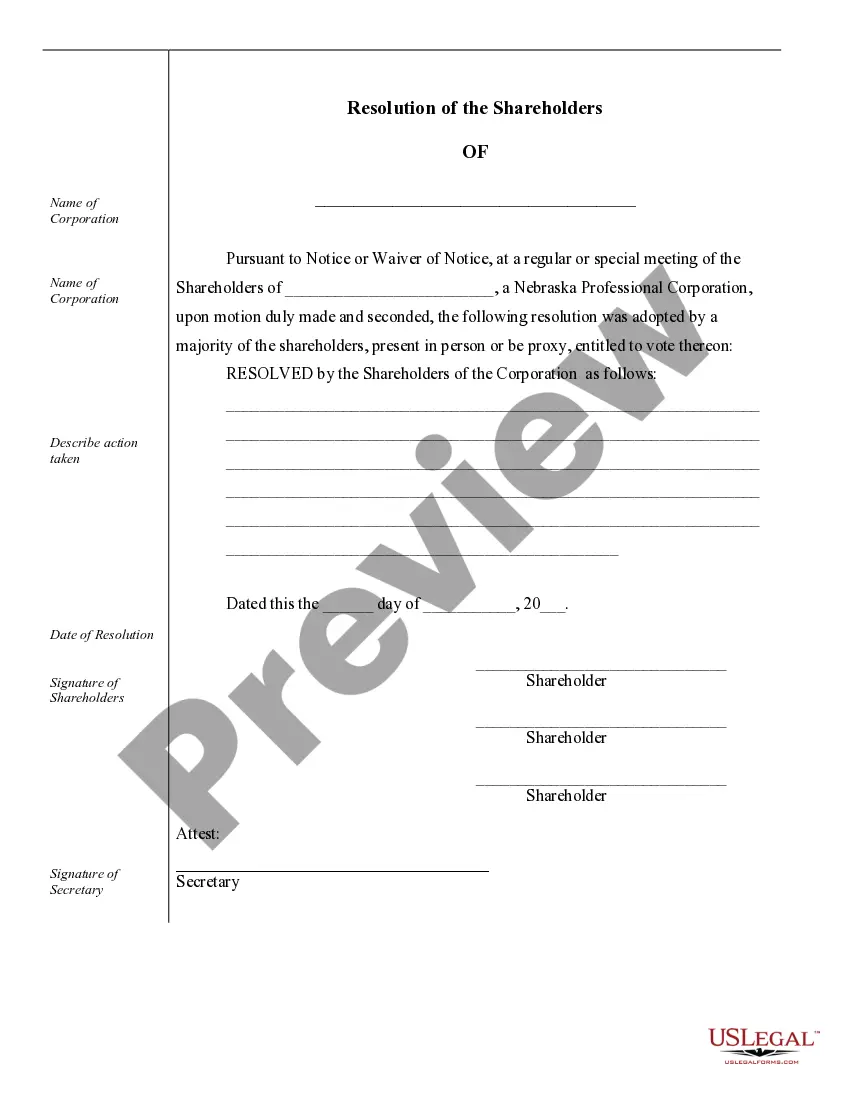

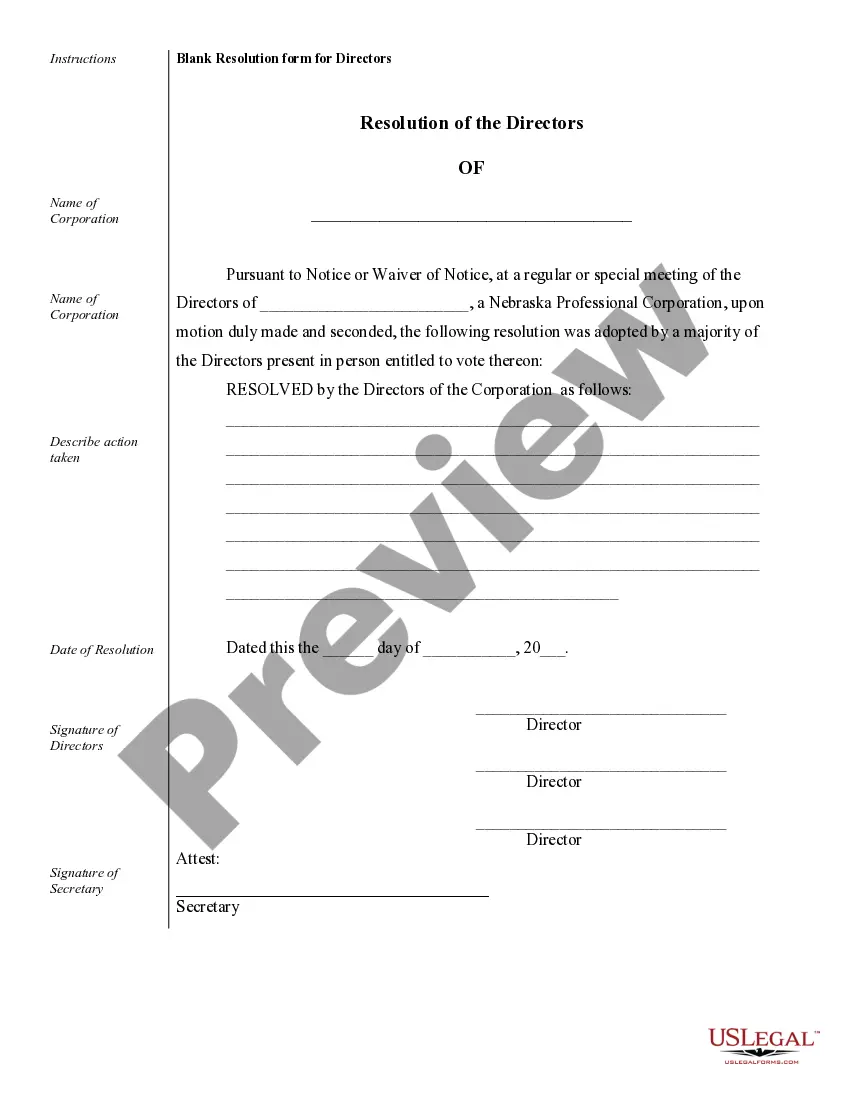

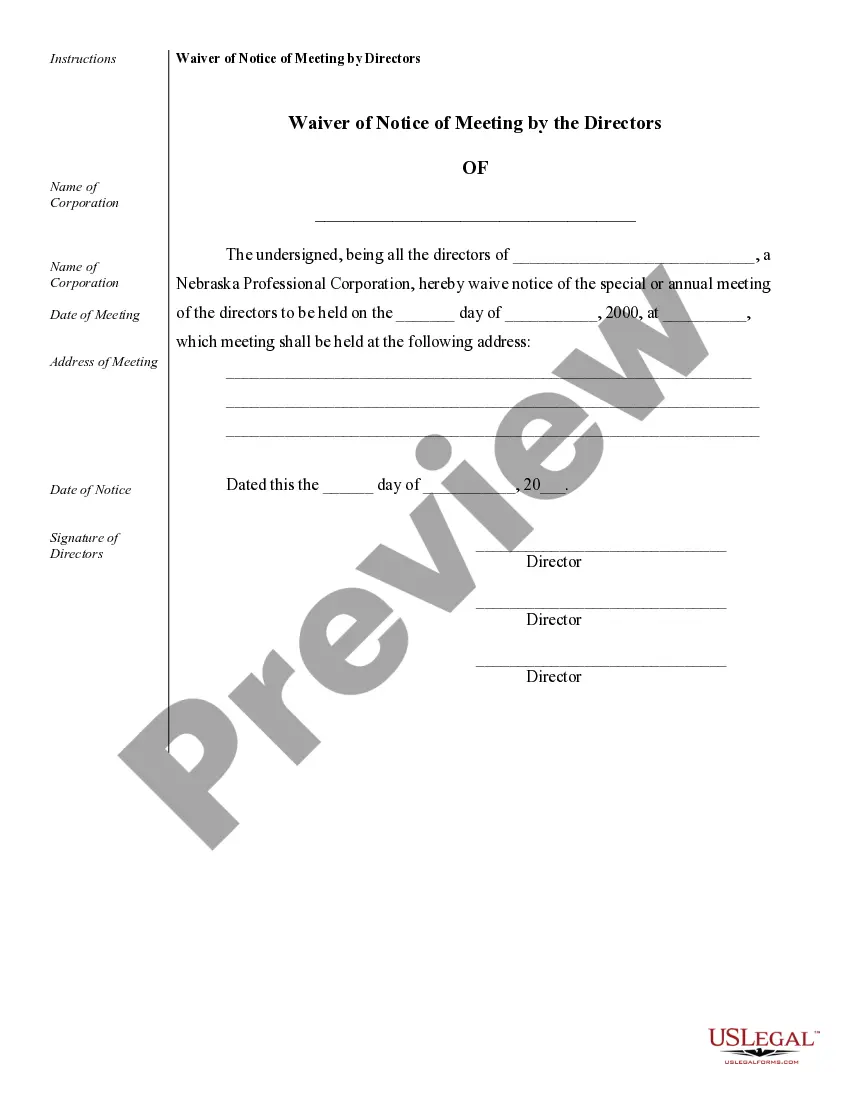

Omaha Sample Corporate Records for a Nebraska Professional Corporation serve as crucial documentation and evidence of a company's activities, transactions, and legal compliance. These records play a pivotal role in providing transparency, maintaining corporate governance, and facilitating efficient decision-making processes. They also ensure compliance with state regulations and guarantee the protection of shareholder interests. The different types of Omaha Sample Corporate Records for a Nebraska Professional Corporation include: 1. Articles of Incorporation: This document establishes the creation of the corporation and includes essential information such as the company's name, purpose, duration, registered agent, and board of directors. 2. Bylaws: Bylaws dictate the internal operating rules and regulations of the corporation and outline the responsibilities of the directors, officers, and shareholders. They cover topics such as board meetings, officer appointments, voting procedures, and the amendment process. 3. Shareholder Agreements: These agreements define the rights and obligations of the corporation's shareholders, including preemptive rights, restrictions on transfer, voting rights, and dividend policies. They help ensure a fair and equitable relationship among shareholders. 4. Stock Certificates and Ledgers: Stock certificates serve as legal proof of ownership for shareholders. They represent the shares held by each shareholder and contain information such as the owner's name, issue date, and the number of shares issued. Stock ledgers maintain an updated record of all issued and transferred stock certificates. 5. Meeting Minutes: Meeting minutes document the discussions, decisions, and actions taken during board of directors and shareholder meetings. They provide a historical record of key decisions made by the corporation, including the appointment of officers, changes to the company's structure, and the approval of major transactions. 6. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial performance. These records enable stakeholders to assess the company's profitability, liquidity, and overall financial health. 7. Annual Reports: Annual reports summarize a corporation's activities, financial statements, and achievements for a specific period. They are typically shared with shareholders and regulatory authorities to ensure transparency and compliance. 8. Contracts and Agreements: These records include copies of contracts, agreements, and leases entered into by the corporation, such as vendor agreements, client contracts, and employment agreements. These documents outline the terms and conditions of the various business relationships entered into by the corporation. In summary, Omaha Sample Corporate Records for a Nebraska Professional Corporation encompass a wide range of documentation that ensures legal compliance, strengthens corporate governance, and enhances transparency in the company's operations. These records are indispensable for the smooth functioning and long-term success of a professional corporation.