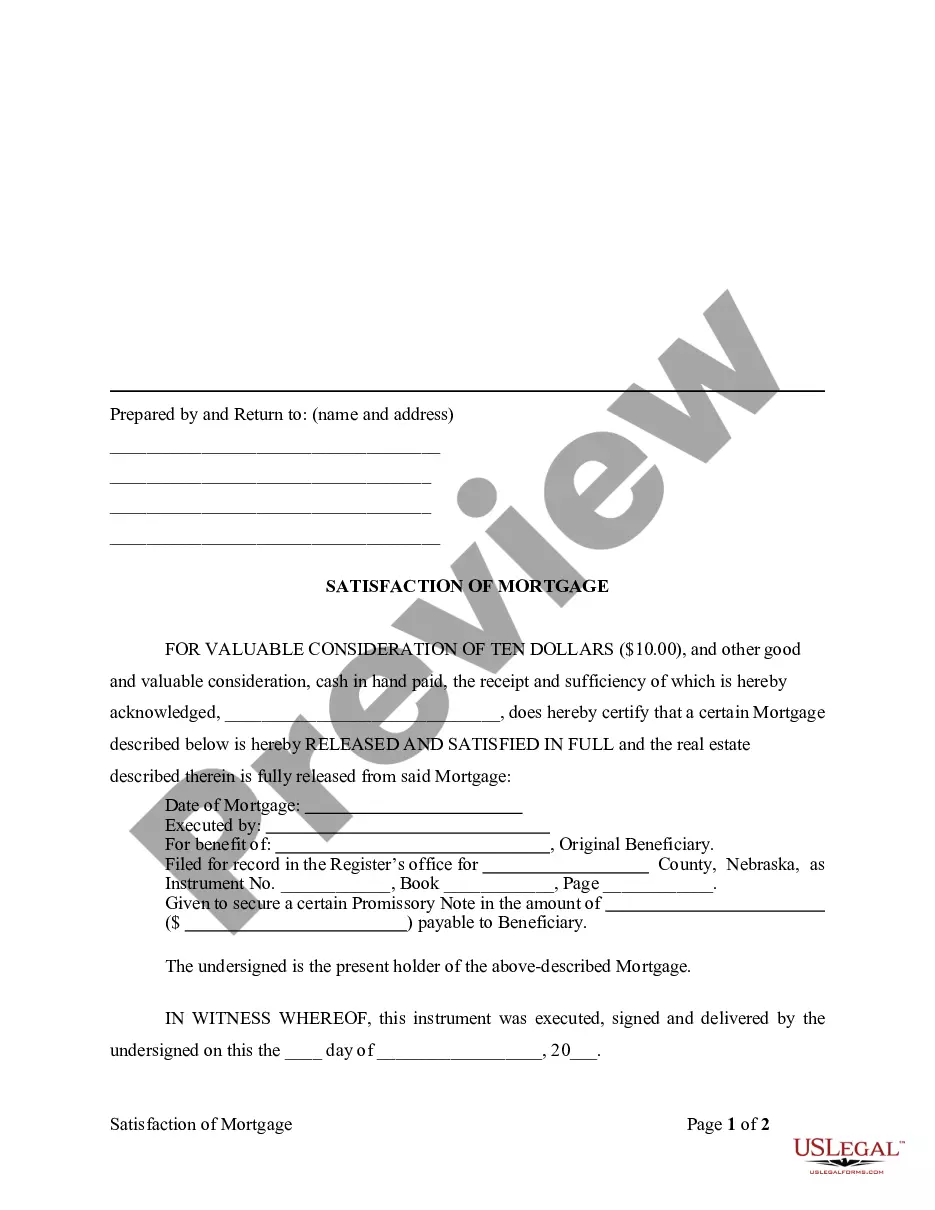

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Release of Mortgage - Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. You can adapt the language to fit your circumstances. This form is available for download now in standard format(s).

Omaha Nebraska Release of Mortgage by Corporation is a legal document that signifies the complete payment and satisfaction of a mortgage loan issued to a corporation in the Omaha area. It acts as evidence that the mortgage has been fully paid off, the loan is discharged, and the corporation's property is no longer encumbered by a mortgage lien. The process of executing a Release of Mortgage by Corporation in Omaha involves several key steps. First, the corporation must ensure they have fulfilled all their mortgage obligations, including repaying the principal loan amount, interest, and any other specified terms. Once this has been accomplished, the corporation can request a Release of Mortgage from the lending institution or the mortgage holder. Upon receiving the request, the lender or mortgage holder will review the corporation's payment history and ensure that all outstanding mortgage payments have been made. They will verify the financial records and assess if there are any other outstanding obligations associated with the mortgage. If everything is in order, the lender or mortgage holder will prepare the Release of Mortgage document. This document will contain details such as the corporation's name, the property description, the original mortgage deed reference, and the loan identification number. It will also state that the mortgage is officially released and discharged, freeing the corporation's property from any mortgage claims or liens. Omaha Nebraska offers various types of Release of Mortgage by Corporation, depending on the specific circumstances. Some common types include: 1. Full Release: This is the most common type, signifying that the corporation has repaid the mortgage loan in full, including principal, interest, and other charges. The property is fully released from the mortgage claim. 2. Partial Release: In situations where multiple properties are pledged as security for a mortgage loan, a corporation may request a partial release for a specific property after paying off a portion of the loan. This allows the property to be removed from the mortgage while the remaining properties remain bound by the mortgage. 3. Subordination Agreement: Sometimes, a corporation may request a release of mortgage on a property while maintaining the mortgage lien for another loan or purpose. In this case, the lender and the corporation can enter into a subordination agreement, which allows the release of a specific property while preserving the mortgage on others. It is crucial for corporations in Omaha, Nebraska, to promptly execute a Release of Mortgage to ensure their property is free from any encumbrances and to establish a clear title. The release serves as proof that all obligations have been met, providing security and peace of mind to the corporation and potential buyers or lenders. Failure to obtain a Release of Mortgage could complicate future property transactions and hinder the corporation's financial flexibility. Therefore, it is essential to consult legal professionals well-versed in Omaha's real estate laws to ensure a smooth Release of Mortgage process.