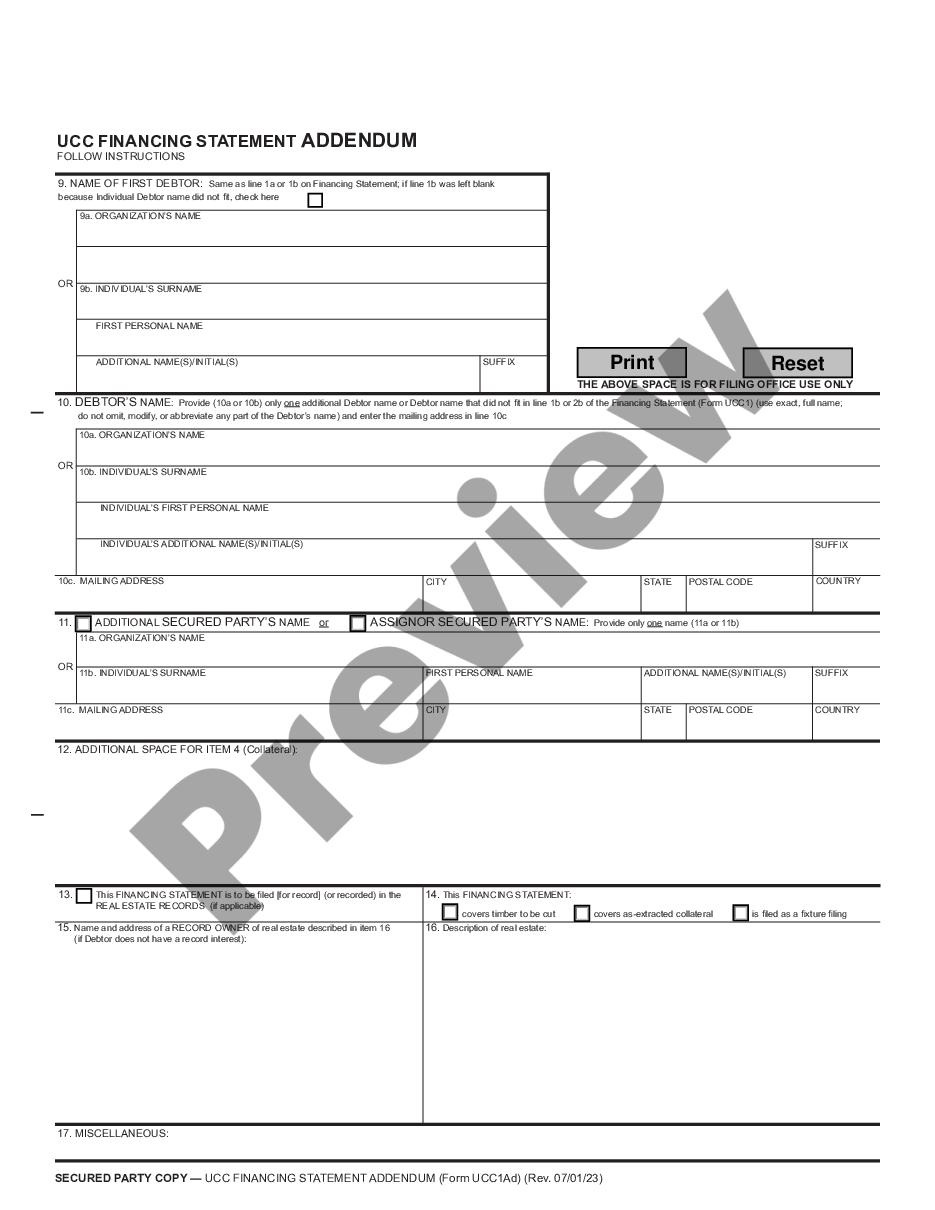

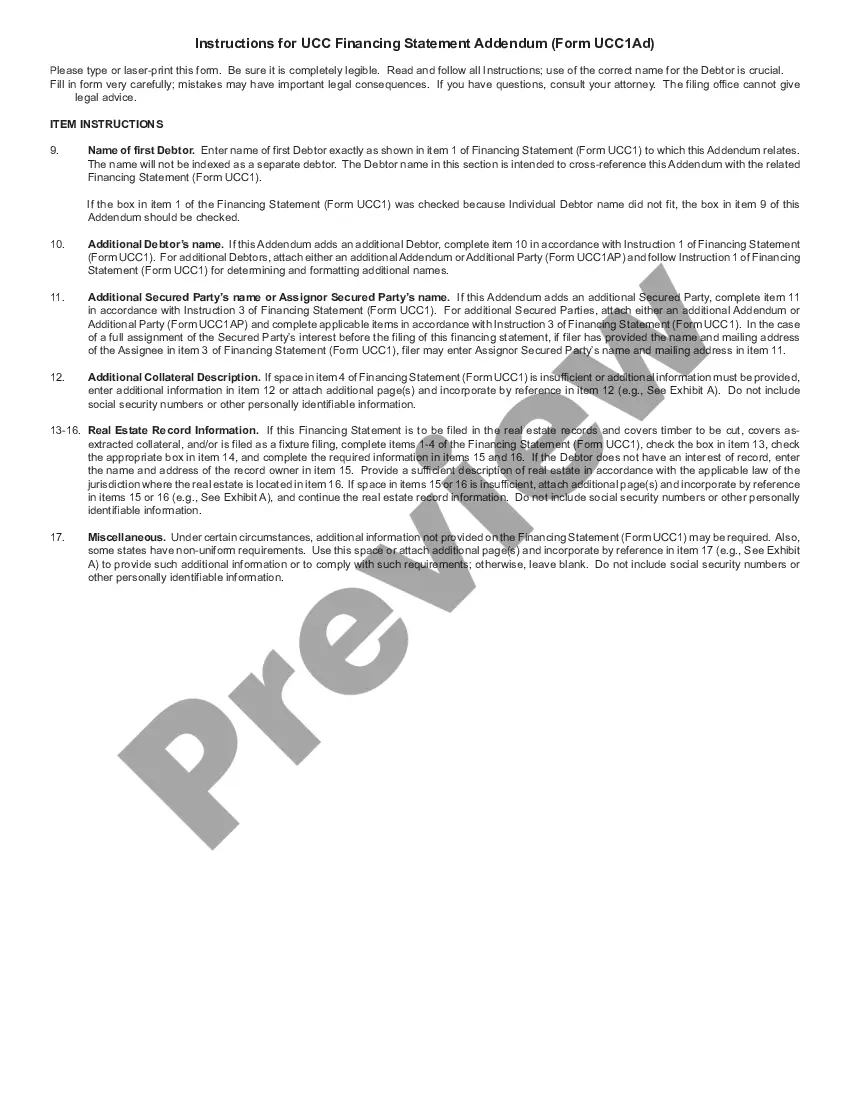

UCC1 - Financing Statement Addendum - Nebraska - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Omaha Nebraska UCC1 Financing Statement Addendum

Description

How to fill out Nebraska UCC1 Financing Statement Addendum?

If you are in search of a legitimate template, it’s challenging to select a more suitable service than the US Legal Forms website – one of the most extensive repositories available online.

Here you can acquire numerous form samples for corporate and personal use categorized by types and states, or keywords.

With the efficient search function, obtaining the latest Omaha Nebraska UCC1 Financing Statement Addendum is as simple as 1-2-3.

Confirm your choice. Click the Buy now button. Then, select the desired pricing plan and provide your details to create an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Additionally, the accuracy of each document is validated by a team of experienced attorneys who routinely review the templates on our site and update them according to the most recent state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Omaha Nebraska UCC1 Financing Statement Addendum is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have located the sample you need. Review its details and utilize the Preview function (if available) to examine its content.

- If it doesn’t satisfy your needs, make use of the Search feature located at the top of the screen to find the right document.

Form popularity

FAQ

To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

Additionally, a UCC filing does not natively impact your credit score. But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

How Does a UCC Filing Affect My Credit? A UCC filing won't impact your business credit scores directly because it doesn't indicate anything about your ability to repay your debts. However, it can affect your ability to get credit again in the future.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

If you have not filed a UCC-1, then you are considered unsecured, and as such, you are placed in the ?back of the line,? behind the secured creditors. Secured creditors are taken care of first in the division of assets.