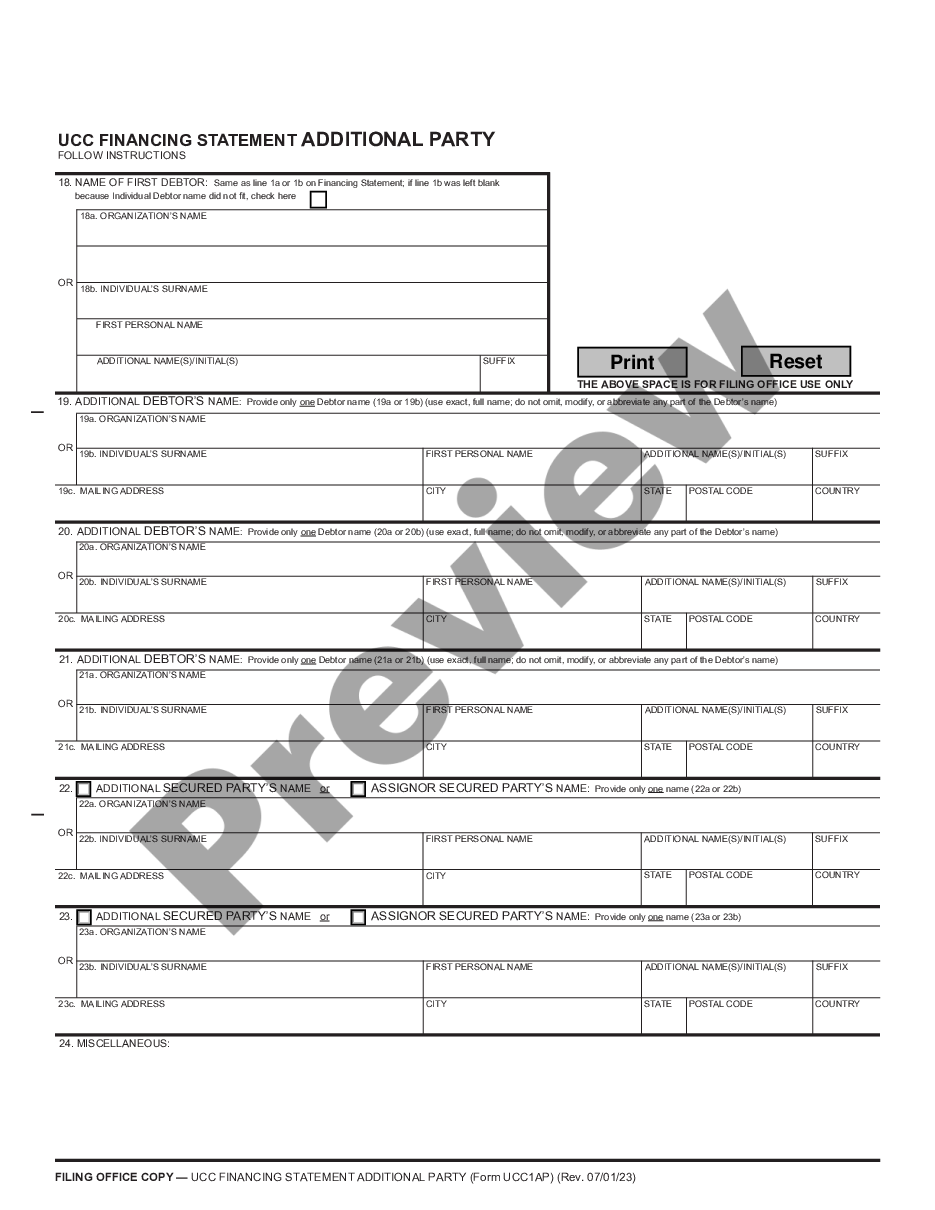

Financing Statement Additional Party form for adding additional Debtors or Secured Parties to Financing Statements (Form UCC1) filed with the Nebraska filing office.

Title: Understanding Omaha Nebraska UCC1 Financing Statement Additional Party: A Detailed Overview Introduction: Omaha, Nebraska, follows the Uniform Commercial Code (UCC) guidelines to govern commercial transactions and secure creditors' rights. One crucial element in this process is the UCC1 Financing Statement, which helps establish a creditor's priority in secured transactions. To enhance the understanding of this topic, this article will provide a detailed description of what an Omaha Nebraska UCC1 Financing Statement Additional Party is and its different types. 1. Definition of Omaha Nebraska UCC1 Financing Statement Additional Party: The Omaha Nebraska UCC1 Financing Statement Additional Party refers to any party that is not the primary debtor but has a sufficient interest in the transaction to be included in the UCC1 Financing Statement. The inclusion of additional parties enhances the security interests of creditors, providing them legal protection in case of default or insolvency. 2. Types of Omaha Nebraska UCC1 Financing Statement Additional Party: a. Guarantor or Co-debtor: In some cases, a person or entity may voluntarily join the transaction as a guarantor or co-debtor, accepting liability for the debt if the primary debtor fails to fulfill their obligations. Including such parties in the UCC1 Financing Statement safeguards the creditor's rights and improves the chances of debt recovery. b. Buyer of Accounts Receivable: If the secured party sells its accounts receivables to a third party, the buyer can be considered an additional party. By including them in the UCC1 Financing Statement, the buyer's interest is protected, granting them priority in the event of the debtor's default or bankruptcy. c. Assignee of Promissory Note: When a debtor assigns their promissory note to a third party, the assignee becomes an additional party. Including them in the UCC1 Financing Statement ensures their rights and interest in the assigned promissory note, allowing them potential recovery options in case of non-payment. d. Subsequent Creditor: If a creditor gains an interest in a debtor's collateral after the initial filing of a UCC1 Financing Statement, they can become an additional party. By filing the updated statement, the subsequent creditor secures their rights and priority over other creditors in case of default or insolvency. Conclusion: Omaha Nebraska UCC1 Financing Statement Additional Parties play a vital role in securing creditors' interests, protecting their rights, and ensuring efficient commercial transactions. Whether it involves a guarantor, a buyer of accounts receivable, an assignee of promissory note, or subsequent creditors, including these additional parties in the UCC1 Financing Statement is essential for a robust and enforceable security interest. Adhering to the regulations outlined by the Uniform Commercial Code helps create a transparent, fair, and predictable business environment in Omaha, Nebraska.

Title: Understanding Omaha Nebraska UCC1 Financing Statement Additional Party: A Detailed Overview Introduction: Omaha, Nebraska, follows the Uniform Commercial Code (UCC) guidelines to govern commercial transactions and secure creditors' rights. One crucial element in this process is the UCC1 Financing Statement, which helps establish a creditor's priority in secured transactions. To enhance the understanding of this topic, this article will provide a detailed description of what an Omaha Nebraska UCC1 Financing Statement Additional Party is and its different types. 1. Definition of Omaha Nebraska UCC1 Financing Statement Additional Party: The Omaha Nebraska UCC1 Financing Statement Additional Party refers to any party that is not the primary debtor but has a sufficient interest in the transaction to be included in the UCC1 Financing Statement. The inclusion of additional parties enhances the security interests of creditors, providing them legal protection in case of default or insolvency. 2. Types of Omaha Nebraska UCC1 Financing Statement Additional Party: a. Guarantor or Co-debtor: In some cases, a person or entity may voluntarily join the transaction as a guarantor or co-debtor, accepting liability for the debt if the primary debtor fails to fulfill their obligations. Including such parties in the UCC1 Financing Statement safeguards the creditor's rights and improves the chances of debt recovery. b. Buyer of Accounts Receivable: If the secured party sells its accounts receivables to a third party, the buyer can be considered an additional party. By including them in the UCC1 Financing Statement, the buyer's interest is protected, granting them priority in the event of the debtor's default or bankruptcy. c. Assignee of Promissory Note: When a debtor assigns their promissory note to a third party, the assignee becomes an additional party. Including them in the UCC1 Financing Statement ensures their rights and interest in the assigned promissory note, allowing them potential recovery options in case of non-payment. d. Subsequent Creditor: If a creditor gains an interest in a debtor's collateral after the initial filing of a UCC1 Financing Statement, they can become an additional party. By filing the updated statement, the subsequent creditor secures their rights and priority over other creditors in case of default or insolvency. Conclusion: Omaha Nebraska UCC1 Financing Statement Additional Parties play a vital role in securing creditors' interests, protecting their rights, and ensuring efficient commercial transactions. Whether it involves a guarantor, a buyer of accounts receivable, an assignee of promissory note, or subsequent creditors, including these additional parties in the UCC1 Financing Statement is essential for a robust and enforceable security interest. Adhering to the regulations outlined by the Uniform Commercial Code helps create a transparent, fair, and predictable business environment in Omaha, Nebraska.